Credit

How to Begin the Process of Combining Finances

How to Begin the Process of Combining FinancesJuly 12, 2022

We reached out to three relationship and money experts to gather tips on the best ways to combine finances with someone you love.

Read more.

How to Manage Your Finances, According to Your Zodiac Sign

How to Manage Your Finances, According to Your Zodiac SignJuly 8, 2022

Astrologer Valerie Mesa breaks down what the stars have in store for each Zodiac sign. Read more.

How Much Debt Is Too Much? Understanding Debt-to-Income Ratio

How Much Debt Is Too Much? Understanding Debt-to-Income RatioJuly 1, 2022

Learn how to calculate your debt-to-income ratio (DTI) to help you understand if you have too much debt. Your DTI should be less than 36%. Read more.

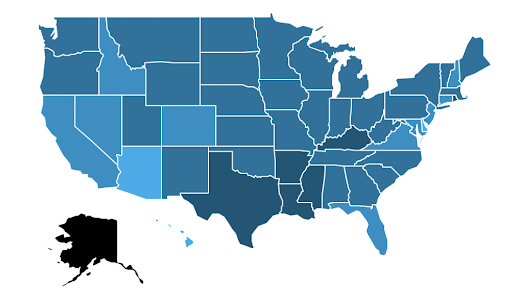

U.S. Cities Where Residents Earn the Most From Alternative Income Streams

U.S. Cities Where Residents Earn the Most From Alternative Income StreamsJune 29, 2022

According to data from the U.S. Census Bureau, more than 75% of households report receiving wages and salaries. But alternative income streams are common in a large number of households as well. Read more.

How Can Piggybacking Credit Impact Your Credit Score?

How Can Piggybacking Credit Impact Your Credit Score?June 21, 2022

Piggybacking credit is a strategy that allows you to become an authorized user on someone’s credit card and “piggyback” on their established credit history. Read more.

Rent to Own A Home When You Have Bad Credit

Rent to Own A Home When You Have Bad CreditApril 21, 2022

Rent to own programs are one path to owning a home. But there are pros and cons, especially if you have bad credit. Find out more here so you can make an informed decision. Read more.

APR vs. APY: What Are The Differences?

APR vs. APY: What Are The Differences?April 19, 2022

APR is the amount of interest you owe, while APY is the amount of interest you earn. We'll explain the key differences and how they are used and calculated. Read more.

Credit Report Example: How To Read and Understand Yours

Credit Report Example: How To Read and Understand YoursApril 11, 2022

This article will show you a credit report example, so you know what to look for and understand the information presented there. Read more.