25 Facts About Credit and Credit Scores

Published on: 01/31/2022

Credit can seem like a mystery at times. What’s the difference between a credit score and a credit report? Between a joint user and an authorized user? Is your income part of your credit report? What about your marital status?

What constitutes “good credit,” and how do you obtain it? And what role does it play in your overall personal finances?

These are just some of the questions that may come to mind as you’re seeking to qualify for a loan or credit card and get the best interest rate possible. We’ll look at 25 facts about credit and credit scores to clarify any misconceptions.

1. Good credit doesn’t guarantee your credit application will be approved.

Lenders want to make sure all their bases are covered before they extend you credit. That means they may look at factors other than your credit score to determine whether to lend you money. Your employment status also can play a role: If your income is too low or you haven’t been at your current workplace long, those factors could weigh against you.

Your financial status apart from your credit score also matters. You might also be denied if you have high account balances or a high debt-to-income ratio.

2. You have different types of credit scores.

“Your credit score” is a misleading phrase, because you actually have more than one. Two main credit scoring companies — FICO® and VantageScore — use different models to determine their version of your credit score, although both use a scale that ranges from 300 to 850. Different lenders may use custom scoring models to compile their own credit scores.

You can’t account for every possible variation, but you can home in on the most important factors, and there is a good deal of commonality between the two systems. If you want to focus on one, FICO is the better bet because it’s the one the majority of lenders use in deciding whether to extend you new credit.

3. A credit score is calculated by five factors.

Your credit score is determined using five factors, which are weighted according to their importance under the scoring system being used.

Under the FICO system, the most important element is your payment history, which accounts for 35% of the total.

That’s followed by the amount you owe, which is a bit more complicated than a single figure. What’s really being evaluated is your credit utilization ratio, which is the total amount you owe on your credit cards divided by your credit limit total for those cards. This accounts for 30% of your FICO score.

Other factors weigh less heavily. The length of your credit history counts for 15% of your total score with FICO, while the amount of new credit you have and your credit mix each count for 10%.

VantageScore defines and weighs these factors a little differently. The most important factor under this system, which is seen as “extremely influential,” combines your total credit usage, balance, and available credit. That’s followed by your credit mix and experience (“highly influential”). Then comes your payment history, which is “moderately influential.”

The age of your credit history and new accounts are “less influential.”

4. You can dispute items on your credit reports.

If you see an error or something you don’t recognize on your credit report, you can dispute it with either the lender or the credit bureaus. (There are three major credit bureaus that track your credit history: Equifax, Experian and TransUnion.)

Errors can come in a variety of forms. You may not have been credited for a payment you made, or you may have been charged for a purchase you didn’t make. A debt might be listed more than once, or your balance might be wrong.

Identity issues can occur because of problems like sharing a similar name or Social Security number with someone else. Or they might be the result of fraud. It’s useful to check your credit report once a year to look for issues, such as an incorrect address listed.

If you find an error on your credit report, you can contact the credit bureaus online or by mail. More information is available from the Federal Trade Commission and the Consumer Financial Protection Bureau.

5. Credit scoring models differ from country to country.

Lenders in different countries have different ways of assessing creditworthiness. For instance, Australia has four reporting bureaus: Equifax, Experian, Dun and Bradstreet, and the Tasmanian Collection Service, while the Netherlands uses Krediet Registratie.[1]

Scoring systems may be different, too. Germany’s SCHUFA score starts with a score of 100 that goes down as you build a financial record. Canada uses a slightly broader scoring range (300 to 900) than what’s used in the U.S. (300 to 850). In France, each bank operates on its own and labels new credit applications as “yes,” “maybe” or “no.”[2]

6. Keeping old credit cards open can positively impact your credit score.

As long as you make your payments on time, there’s not really a downside to keeping an old credit card open. You can build credit by lengthening and improving your credit history.

Keeping a card with a low or no balance can also help your credit by improving your credit utilization ratio (CUR). If you close a card with a low balance, that may hurt your CUR — especially if you have high balances on your other cards. For example, if you have a $50 balance on a $1,000 card, that’s a 5% utilization ratio that can bring down your overall CUR.

Experts say it’s important to keep it under 30%, and that under 10% is optimal.[3]

7. Potential employers are allowed to check your credit.

Employers are allowed to look at your credit history by running a credit check — with your permission. The rationale? They may see your ability to manage your credit responsibly as a reflection on your overall management skills.

And yes, an employer is allowed to reject your job application on the basis of your credit score. They do, however, need to give you time to dispute any errors you discover in the report.[4]

The good news is that a credit check run by a potential employer won’t affect your credit. It counts as a soft inquiry or “soft pull” on your credit, which isn’t reflected in your credit score. A hard inquiry you make yourself (by applying for credit, such as a new credit card) may shave a few points off your score.

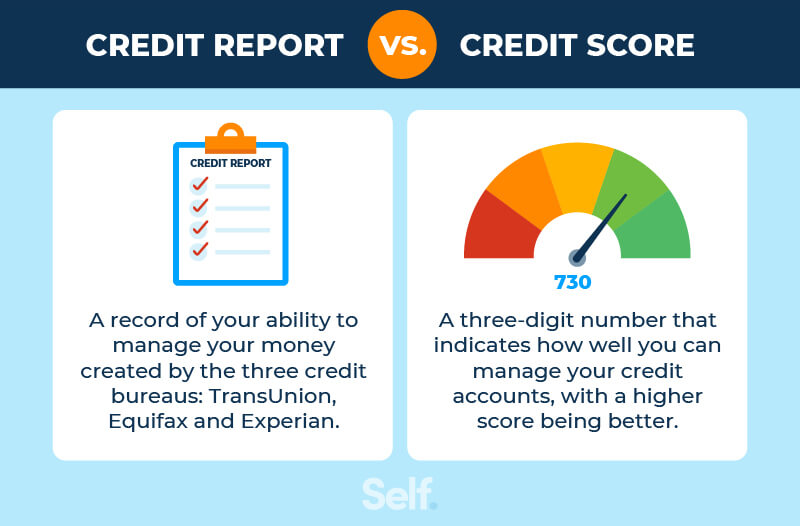

8. Credit reports and credit scores are not the same thing.

Your credit report is a record of your credit history, your activity in seeking and using credit, and the current status of your accounts. Credit reports are compiled by reporting bureaus. Credit scores, on the other hand, are numerical values calculated based on the information in your credit report.[5]

9. You need a credit report before a credit score is determined.

You don’t get assigned a credit score when you’re born or when you turn 18. Your credit score is based on what’s in your credit report, so you don’t have one until you start to build credit. You can do so by establishing a line of credit with a credit card company, getting a loan, or even renting your own place and paying utility bills: Utility bills appear on your credit report if they are delinquent and referred to a collection agency.

10. Having a higher credit score may result in lower interest rates.

A good credit score shows a lender you are responsible with your credit, and specifically about paying your bills on time. It means you don’t have a lot of missed payments.

FICO divides credit scores into five score ranges: Exceptional (800 or more), Very Good (740 to 799), Good (670 to 739), Fair (580 to 669) and Poor (anything below 580).

The higher your score, the more likely lenders will be to take a chance on extending you credit and the lower your interest rate will likely be.

Interest rates vary from one lender to another, but you can save thousands of dollars over a period of years in saved interest — especially on a high-dollar loan like a home loan — with good or excellent credit.

11. Exceeding your credit limit can impact your credit score.

Credit utilization is an important factor in determining your credit score, so going over your credit limit can hurt your credit score. (If one of your cards is maxed out at 100%, that’s likely to hurt your CUR, which you are better off keeping under 30%). On top of that, your lender may reduce your line of credit for fear that you’re unable to stay on top of your payments, or might decide to charge you a higher interest rate.[6]

Over-the-limit fees can be another negative consequence of going over your credit limit. These fees can’t be more than the amount you have gone over your limit, and they are typically capped at $35. So, if you’re $10 over the limit, you can’t be charged a fee of more than $10. In addition, under the CARD Act of 2009, you have to opt-in to the fees when you sign up for a credit card. If you don’t, the issuer can’t charge them.

You can also opt out of the fees at any time for subsequent overages. If you decline to opt-in on the fees, any purchases that push you over your limit will be declined. But purchases can still be declined even if you do opt-in, so there’s little or no benefit to doing so.[7]

12. Lenders and creditors decide your creditworthiness, not the credit bureaus.

Lenders are under no obligation to approve a loan or line of credit, regardless of what your credit history shows. Credit bureaus’ only role in the process is to provide information. It’s entirely up to prospective lenders to determine your creditworthiness (whether the lender believes you’re at risk of defaulting on your debt).

13. Your relationship status doesn’t impact your credit.

Your marital status isn’t included in your credit reports, and neither is your spouse's identity — as long as accounts are held separately. Joint loans or credit cards will appear on both spouses’ credit reports. It’s not the status of your relationship that affects your credit, but the status of any jointly held accounts.[8]

14. Your income doesn’t impact your credit score.

Your credit score is based only on what’s in your credit report including your record of paying off debts. Your income may well affect your ability to meet your credit obligations, but it has no direct impact on your credit score. If you are making your payments on time, your credit score “doesn’t care” whether you’re doing it while making minimum wage or a six-figure salary.

15. You can become an authorized user on someone’s credit card account to build credit.

Becoming an authorized user on someone else’s credit card means that their account will be listed on your credit report.

A 2018 study showed that someone with fair credit could improve their credit score by 12.5% in six months or 20% in a year by becoming an authorized user on someone else’s card. Someone with poor credit could improve their score by 18.1% in six months and 28% in a year. Impacts were smaller for authorized users with better credit.[9]

Remember that your use of the credit card will go on their credit report, too, so you’ll want to be clear with the cardholder about what their expectations are. Also, FICO and VantageScore weigh an authorized user’s information differently, and not every credit card company reports authorized user accounts to the credit bureaus.

16. You can freeze your credit to prevent identity theft.

You can place a freeze on your credit report for free by contacting the credit bureaus either online, by phone, or by mail. If you put a freeze on your credit report, lenders won’t be able to see it, so they aren’t likely to approve any fraudulent requests for credit.

Once you request a freeze online or by phone, it will take effect the next business day. If you request one by mail, it will take three business days from the time the credit bureau receives your request.[10]

17. Most lenders use FICO scores to make decisions.

FICO is by far the most widely used scoring system. More than 90% of top lenders use it when making decisions about loans.[11] Each lender decides when to upgrade to newer scoring versions, so the scoring system remains the same while the scoring versions may vary. For instance, FICO Scores 8 and 9 are the most commonly used scoring versions among the three credit bureaus. With this in mind, a good rule of thumb is to know your base FICO Score as well as FICO Scores 8 and 9.[12]

18. Late payments remain on your credit report even after paying off the debt.

Payments that are more than 30 days late, like most other negative information, stay on your credit report for seven years. This is true regardless of whether you’ve since paid off the debt. But the more time that passes, the less that late payment will affect lending decisions. A series of repeated late payments will likely affect your credit score more than a single late payment.

If you make consistent on-time payments, those will help your credit score rebound, while the impact of old delinquent payments is reduced.

19. Negative credit items fall off of your credit report after a certain amount of time.

Bad credit isn’t forever, but negative information does stay on your credit report for a period of time. Late payments fall off your credit report after seven years, and so do most other negative marks. Bankruptcies can stay on your credit report for as long as 10 years, depending on the type, and closed accounts can stay there for 10 years, too.[13]

A hard inquiry stays on your credit report for two years and will only affect your credit score for one year.[14]

20. Checking your credit score won’t damage your score.

Checking your credit score or looking at your credit report won’t damage your credit, and your score won’t change. A credit score check is known as a soft inquiry, which doesn’t impact your credit score. On the other hand, if you apply for a credit card or loan, a lender will evaluate your credit, resulting in a hard inquiry. Hard inquiries generally negatively impact your credit score if you open multiple credit accounts around the same time. Lenders see this as risky behavior and may dock your credit score because of it. The good news is that FICO® Scores only review the most recent 12 months of inquiries when calculating your score.[15]

21. Each year, you can check your credit report for free.

Under federal law, you’re entitled to receive a free credit report every 12 months from each of the three credit bureaus. You can order your copy online at annualcreditreport.com. It’s a good idea to check your credit report for accuracy to make sure you don’t see any errors or signs of fraud you may wish to dispute.

22. You can still get a loan with bad credit.

You can get a loan with bad credit, but you’re likely to pay a higher origination fee and a steeper interest rate. Some lenders won’t offer loans to people with bad credit, but other companies make a business of it. It’s a good idea to be cautious about predatory lenders and high-interest businesses such as payday loans and car title loans.

Both are short-term, high-interest loans. With car title loans, the borrower turns over title to the vehicle as collateral — which the lender can keep if you don’t pay.[16]

A less risky option is a secured credit card. There’s collateral involved here, too, but it’s just a few hundred dollars in a linked account, and it isn’t touched as long as you make your payments on time. It’s a good way to build credit.

23. Credit isn’t the only deciding factor in lending decisions.

While things such as your income and assets don’t affect your credit report, they still can affect a lender’s decision on whether to lend you money. Your employment status and history can be a factor, as well. A mortgage lender, for example, will want to see your savings account balance, total assets, and current income in addition to your credit report in determining whether to approve you for a loan, and if so, for how much.[17]

24. You can spot fraud by periodically checking your credit.

A check of your credit report can reveal red flags that could indicate identity theft. If you see charges you don’t recognize from companies you don’t do business with, you might want to dispute them.

You also might find errors in your Social Security number and other personal information.

These may be simple errors, or they may be an indication of fraud or identity theft.

Regardless, they can affect your credit score. One Federal Trade Commission study found that 1 in 4 consumers had credit report errors that might affect their credit scores, and 1 in 5 had an error that was corrected by a credit bureau after it was disputed.[18]

25. Activity from a joint account impacts your credit score.

It doesn’t matter which cardholder makes charges to a joint account or whose checking account is the source of payments. Both users will have their credit score affected by the charges, payments, and the credit utilization level of the card. A joint user is different from an authorized user in that a joint user is responsible for repaying the debt.

Moving forward

There’s a lot to know about your credit and how it affects your financial life, but you don’t need an army of calculators to know where you stand. With a free copy of your credit report and an understanding of the principles we’ve discussed here, credit won’t be a mystery anymore, but rather an asset you can use to your advantage.

Sources

- CNBC. “Is the U.S. the only country with credit scores?” https://www.cnbc.com/select/is-the-us-the-only-country-with-credit-scores. Accessed October 7, 2021.

- Forbes. “Do Other Countries Have Credit Scores?” https://www.forbes.com/advisor/credit-score/do-other-countries-have-credit-scores. Accessed October 7, 2021.

- Experian. “What Should My Credit Card Utilization Be?” https://www.experian.com/blogs/ask-experian/what-should-my-credit-card-utilization-be. Accessed October 7, 2021.

- Experian. “Do Employers Look at Credit Reports?” https://www.experian.com/blogs/ask-experian/do-employers-look-at-credit-reports. Accessed October 7, 2021.

- Consumer Financial Protection Bureau. “What is the difference between a credit report and a credit score?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-credit-report-and-a-credit-score-en-2069. Accessed October 7, 2021.

- Experian. “Does Going Over My Credit Limit Affect My Credit Score?” https://www.experian.com/blogs/ask-experian/does-going-over-my-credit-limit-affect-my-credit-score. Accessed October 7, 2021.

- CNBC. "What happens if you try to spend more than your credit limit," https://www.cnbc.com/select/exceeding-credit-limit/. Accessed October 21, 2021.

- Experian. “Can My Spouse Ruin My Credit?” https://www.experian.com/blogs/ask-experian/can-my-spouse-ruin-my-credit. Accessed October 7, 2021.

- CNBC. “Does being an authorized user on someone else’s credit card actually build your credit score?” https://www.cnbc.com/select/does-being-an-authorized-user-affect-your-credit-score. Accessed October 7, 2021.

- USA.gov. “Credit Reports and Scores,” https://www.usa.gov/credit-reports. Accessed October 7, 2021.

- MyFico. “What is a FICO® Score?” https://www.myfico.com/credit-education/what-is-a-fico-score. Accessed October 7, 2021.

- MyFico. “FICO® Scores Versions,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed October 21, 2021.

- Equifax. “How Long Does Information Stay on My Equifax Credit Report?” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report. Accessed October 7, 2021.

- Forbes. “How Credit Inquiries Affect Your Credit Score,” https://www.forbes.com/advisor/credit-score/credit-inquiries. Accessed October 7, 2021.

- MyFico. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed October 21, 2021.

- Federal Trade Commission. “What To Know About Payday and Car Title Loans,” https://www.consumer.ftc.gov/articles/what-know-about-payday-and-car-title-loans. Accessed October 7, 2021.

- Consumer Financial Protection Bureau. “How does my credit score affect my ability to get a mortgage loan?” https://www.consumerfinance.gov/ask-cfpb/how-does-my-credit-score-affect-my-ability-to-get-a-mortgage-loan-en-319. Accessed October 7, 2021.

- Federal Trade Commission. “In FTC Study, Five Percent of Consumers Had Errors on Their Credit Reports That Could Result in Less Favorable Terms for Loans,” https://www.ftc.gov/news-events/press-releases/2013/02/ftc-study-five-percent-consumers-had-errors-their-credit-reports. Accessed October 7, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.