TransUnion vs. Equifax: Major Differences Explained

Published on: 01/24/2022

If you are interested in knowing your credit history, you can find out from one of the three major credit bureaus: Transunion, Equifax, and Experian. However, you may be surprised to find that the information varies from one bureau to the next.

The three major credit bureaus calculate credit scores using slightly different credit scoring models.[1] We’ll cover the difference between TransUnion and Equifax in this article.

What do the credit bureaus do?

Credit bureaus, or credit reporting agencies, collect information from a variety of sources (lenders, utility companies and others) using your Social Security number, credit file, and other identifying information. They use this information to compile credit reports and calculate credit scores, which are different.

- Credit report: Your credit report contains information about when credit accounts were opened, their balances, credit limits, and payment history, as well as information on bankruptcies and debt collections. Credit scores are calculated from the information in your credit reports.

- Credit score: Credit bureaus each calculate their own credit score. This can be confusing because most lenders use credit scores compiled by one of two outside companies — FICO® and VantageScore — which come up with different credit scores using their own models based on the credit bureaus’ reports. (FICO, an abbreviation for Fair Isaac Corporation, is the most commonly used.)

Generally speaking, credit scores are calculated using five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. However, these are defined and weighted somewhat differently depending on the company that’s compiling your score.

It’s helpful to know the difference between how TransUnion and Equifax calculate credit scores, in order to better understand the numbers that appear on their credit reports.

TransUnion credit score calculation

TransUnion is a Chicago-based company founded in 1968. It has information on more than a billion customers in 30-plus countries, including 200 million in the U.S.[2]

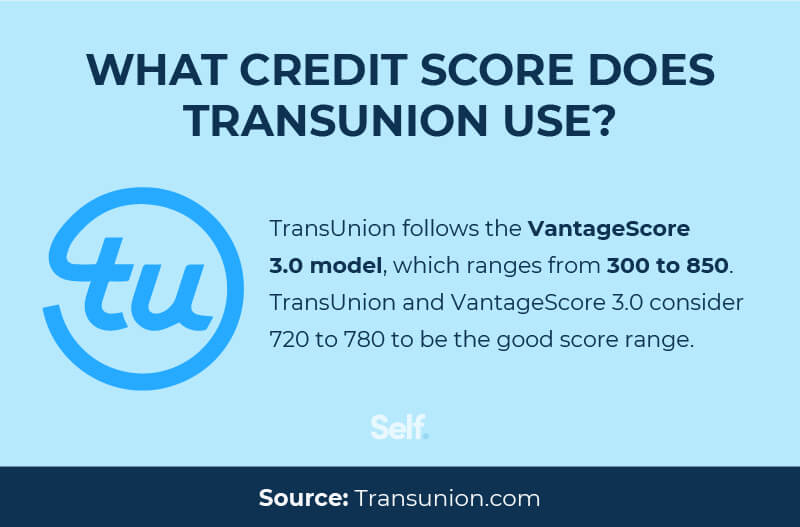

TransUnion uses the VantageScore 3.0 model in compiling its credit score, which ranges from 300 to 850. A good credit score under the TransUnion model ranges from 720 to 780.[3]

For TransUnion, your payment history is even more important than it is under the FICO system, accounting for 40% of the total score. Your credit history accounts for 21% of this total score.[4]

Credit utilization accounts for a smaller percentage of the TransUnion score than the FICO credit score, at 20%. New credit accounts (5%) are also less important for TransUnion than for FICO, and your available credit counts for 3%. Additionally, your latest reported balance totals account for 11%.

Equifax credit score calculation

Atlanta-based Equifax was founded in 1899. It operates in 11 countries, including the United States, where it monitors data on more than 222 million consumers.[2]

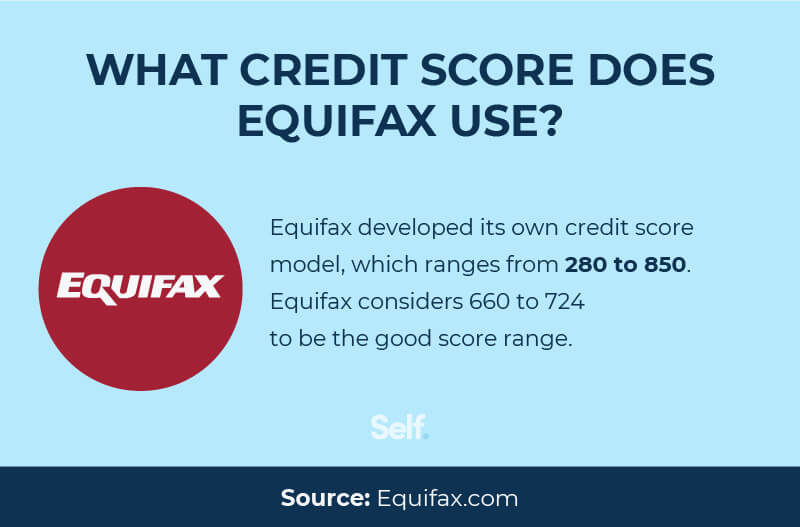

It uses a proprietary credit scoring formula, which is similar to FICO’s. However, its scoring range is slightly different from FICO’s range, starting at 280 and topping out at the same 850 figure.[5] Under the Equifax model, a good credit score ranges between 660 and 724.[6]

Another difference is that Equifax classifies your accounts as either “open” or “closed,” instead of grouping all accounts together as other credit bureaus do, so an open account may be weighted differently than an account you closed three years ago. It also employs an 81-month credit history instead of the standard seven-year (84-month) history the others use.[7]

Comparing TransUnion vs. Equifax: why are my credit scores different?

Your scores might be different on your Equifax and TransUnion credit reports. They might also be different at Experian. There are a few reasons you might see such discrepancies:

The credit bureaus don’t have identical information

Different credit bureaus won’t always have exactly the same information. One reason is that a lender may report credit activity for inclusion in the Equifax credit report but not to TransUnion, or vice versa. Your credit card activity, car loan payments, or student loan status may be reported to one credit bureau and not the other. As a result, your scores may differ.

You didn’t check each report during the same time period

Credit scores are updated on a regular basis, so if you check one credit bureau’s score in April and another’s in August, you’re likely to find they’re different.

It doesn’t even need to be months apart.

Here’s why: Creditors report updated information on your payments, debt, and new applications every 30 to 45 days, but they don’t necessarily send it to those agencies at the same time. As a result, your scores may change from one day to the next (or even from one hour to the next with Experian).

Different credit-scoring models were used

Different credit-scoring models can produce contrasting results because the factors are not weighed the same.

For example, under TransUnion’s model, you’ll be rewarded more if you pay your bills on time and have a long credit history than you will under FICO’s system. On the other hand, (all other things being equal), the FICO model will likely give you a higher score than TransUnion if you have a good credit utilization ratio.

Which credit bureau is more accurate?

Part of the problem in determining accuracy lies in how the word is defined. Credit scores are compiled using different scoring systems, which are subjective by their very nature. Is FICO’s emphasis on payment history as the most important factor in its system more accurate? Or, is VantageScore correct in making that the third-most important factor?

It’s hard to answer these questions because, again, the FICO and VantageScore models are subjective, and so are the “educational” models used by credit bureaus. What we can say is that, if you’re looking for the score lenders are most likely to use in assessing whether to provide you with loans or lines of credit, you’ll likely want to look at FICO.

That said, the scores provided by TransUnion and Equifax are not likely to deviate too much from what you’ll find with FICO, so they can provide you with valuable information if you’re looking for a ballpark figure.[8]

Which credit score do lenders use?

The Consumer Financial Protection Bureau has stated that scores provided by credit bureaus like TransUnion and Equifax are “rarely used by lenders.” Instead, they’re considered “educational credit scores” intended for consumers’ educational use.[9]

Equifax explicitly states on its site that lenders do not use its scores in assessing consumer creditworthiness. Instead, Equifax scores are provided to consumers merely as a way to let them know where they stand.[10]

According to myFICO, 90% of U.S. lenders use FICO Scores when they check consumer credit in making their lending decisions. The FICO 8 model used by credit card companies is the most commonly used model overall, others use VantageScore.

According to myFICO: “You have more than one FICO Score — depending on what type of credit you’re seeking, your lenders may evaluate your credit risk using different FICO Score versions.” Credit card issuers tend to use the FICO Score 8 or FICO Bankcard Scores. On the other hand, lenders are more likely to rely on FICO Auto Scores when you’re applying for an auto loan.[11]

How can I check my credit score?

You can get a free credit score under the Experian VantageScore 3.0 model online, or you can purchase your FICO score. FICO offers a package that includes a three-bureau credit report that’s updated quarterly, 28 FICO scores (including credit, mortgage, and auto versions), and other features for $29.95 a month.[12]

Federal law gives you the right to a free credit report every year at www.annualcreditreport.com. Doing so can not only help you know what you need to work on to improve your credit, but can allow you to spot red flags that could indicate errors, cases of fraud, or identity theft. You can then dispute these errors with the credit bureaus.

Understand your credit scores

Each credit monitoring service uses a unique scoring system and, to some extent, different credit information to make decisions.

Knowing how different credit agencies such as Equifax and TransUnion operate and how they calculate your credit score can help you know where you stand so you can begin to build credit effectively.

Sources

- Forbes. “What You Need to Know About the Three Main Credit Bureaus,” https://www.forbes.com/advisor/credit-score/3-credit-bureaus. Accessed October 8, 2021.

- Business Insider. “3 different agencies collect the information that determines your credit score — viewing each of your credit reports is key to maintaining a good score,” https://www.businessinsider.com/personal-finance/three-major-credit-bureaus-experian-equifax-transunion-differences. Accessed October 8, 2021.

- TransUnion. “What’s Considered a Good Credit Score?” https://www.transunion.com/blog/credit-advice/whats-considered-a-good-credit-score. Accessed October 8, 2021.

- TransUnion. “What is a credit score?” https://www.transunion.com/credit-score. Accessed October 8, 2021.

- Equifax. “What are the Equifax credit score ranges?” https://www.equifax.com/personal/help/equifax-credit-score-ranges. Accessed October 8, 2021.

- Equifax. “What is a Good Credit Score?” https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score. Accessed October 8, 2021.

- PocketSense. “Equifax vs. TransUnion Score,” https://pocketsense.com/equifax-vs-transunion-score-12107.html. Accessed October 8, 2021.

- Forbes. "Which Credit Score Do Lenders Actually Use?" https://www.forbes.com/sites/robertberger/2017/01/06/which-credit-score-do-lenders-actually-use. Accessed October 19, 2021.

- Consumer Financial Protection Bureau. “Consent order in the Matter of “Equifax Inc. and Equifax Consumer Services LLC,” https://files.consumerfinance.gov/f/documents/201701_cfpb_Equifax-consent-order.pdf. Accessed October 8, 2021.

- Equifax. “What is the difference between credit scores from Equifax and credit scores from FICO?” https://www.equifax.com/personal/help/equifax-credit-score-ranges. Accessed October 8, 2021.

- myFICO. “How lenders use FICO® Scores in credit checks,” https://www.myfico.com/credit-education/credit-scores/how-lenders-use-credit-scores. Accessed October 8, 2021.

- FICO. “FICO® Advanced,” https://www.myfico.com/products/ultimate-three-bureau-credit-report. Accessed October 8, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.