The Difference Between Debit and Credit Cards

Published on: 02/09/2022

Credit and debit cards are both cards that can be used to make purchases. But the similarities end there.

Credit and debit are two entirely different concepts. The simplest way to put it is that a credit is something you are given, and a debit is something that’s taken from you. When you use a credit card, you take on debt to make a purchase; when you use a debit card, money is withdrawn from your account to pay for something.

In its simplest form, the main difference between a credit card and a debit card lies in the old saying, “You can pay me now, or you can pay me later.” You pay now with a debit card. With a credit card, you pay later. Of course, there is more to it than that. We’ll explore the details in the remainder of this article.

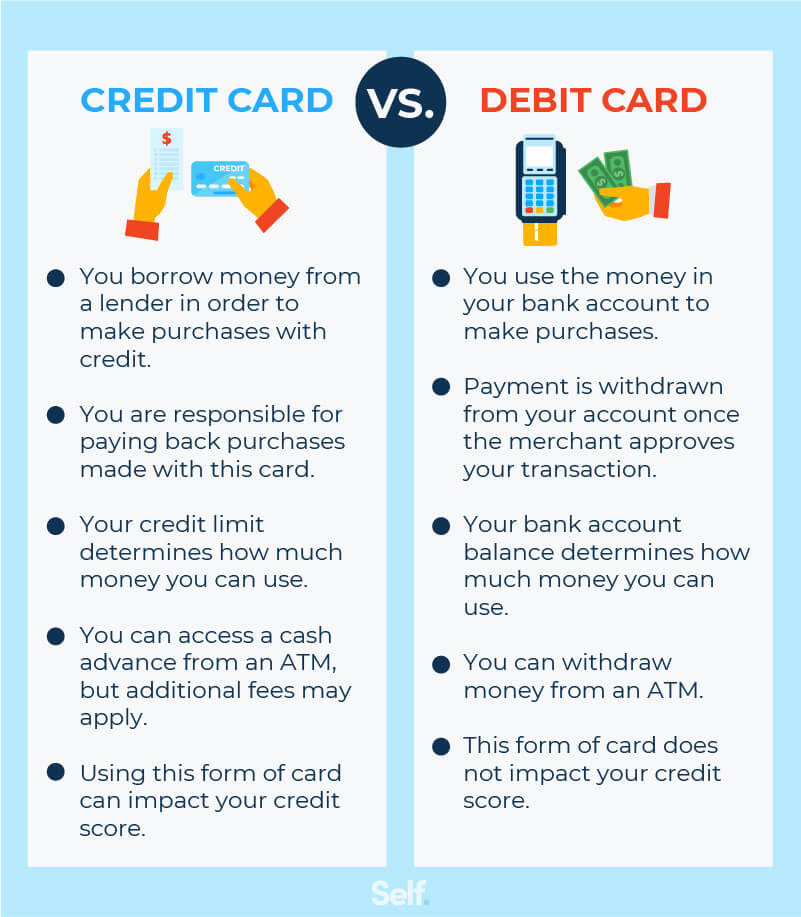

Credit card vs. debit card

A debit card is linked directly to your checking account, and how much you can spend is limited only by your account balance. You can use as much or as little of your available funds as you want. A credit card is not linked to your checking account. You don’t pay anything upfront, and how much you can spend is dictated by your credit limit minus your balance.

What is credit?

Credit is something a lender extends to a customer that allows the person to make a purchase (or purchases).

Revolving credit allows you to borrow money as often as you want, up to an approved level known as your credit limit. Most credit cards and branded store cards fall into this category. Instead of making a fixed payment, you have to pay the credit card company a minimum amount each month. As long as you have available credit, you can continue to borrow until you reach your credit limit.

Installment credit allows you to borrow a sum of money and pay it back in a series of fixed payments, at a specific interest rate, over a specific period of time. Car loans and mortgages are two examples.

By using your credit card responsibly and making your monthly payments on time, you can build a strong credit history and improve your credit score. The two biggest factors in your credit score, as calculated by FICO®, are your payment history (consistently making payments on time) and your credit utilization ratio (the total balance as a percentage of your combined credit limit on all your cards). Together, these two things account for 65% of your FICO® score.

What is debit?

A debit card is a way to pay for something using money you already have. A traditional debit card is linked to your bank account and can be used as an alternative form of payment, instead of cash, a personal check, or a cashier’s check. (Another kind of debit card is a prepaid debit card, which you can use without a checking account: It works like a reloadable gift card, with the funds on the card decreasing as you make purchases. You can add more money by reloading the card when it runs low.)

Debit cards aren’t as immediate as cash but typically allow money to be withdrawn from your account more quickly than if you use a personal check: often within 24 hours instead of days after you write a check.[1] They’re also more widely accepted than personal checks, which many merchants will not take.

In addition, you can use a debit card to withdraw cash from your bank’s automated teller machine, or ATM. Some ATM cards, however, are not debit cards: They can only be used to withdraw money from ATM terminals and not to make purchases from merchants.

Because debit card transactions draw directly from your bank account, there are no interest charges or monthly bills. However, that does not mean they are free from costs. Spending more than what you have in your account may result in an overdraft fee.

If you make cash withdrawals at an ATM outside of your financial institution’s network, you are likely to be charged two fees for each transaction: one from your own bank or credit union, and the other from the company providing the ATM. For instance, you could end up paying a $3 transaction fee to your bank and another $3 transaction fee to the machine owner.[2]

The main differences between debit and credit

Debit cards and credit cards can both be used to make purchases, but a debit card uses your money to do so, while a credit card uses a lender’s money. The amount of money you can spend using a debit card is dictated by your account balance, while the amount of money you can access using a credit card is determined by your credit limit minus your balance.

You can use a debit card to withdraw money from an ATM. You can use a credit card to get cash, too, via a cash advance, but you will have to pay interest on it just as you would a credit card purchase. In fact, cash advance interest rates often come with a higher APR than purchases or balance transfers and may include a fee, often 3% to 5% of the amount of the advance.[3]

Using a credit card responsibly can increase your credit score, while missing payments, carrying a high balance, or applying for too much credit can hurt your score. Using a debit card, on the other hand, does not affect your credit score either way. Debit card activity merely accesses your own money, which isn’t a form of credit, so it is not reported to the major credit bureaus.[4]

Credit card uses

Using a credit card responsibly can help you boost your credit score and, depending on the card, may earn you cash back or rewards on things like dining, travel, gas and supermarket purchases.[5]

They can be used to make purchases that you don’t have enough money to pay for, but which you can afford making smaller payments over time. However if you don’t pay your balance in full each month or make only the minimum payment, you will be paying interest, which will also eat into your available credit.

Pros of a credit card

- The opportunity to build credit.

- More security since it doesn’t draw from your checking account and you have the right to dispute a charge you didn’t make.[6]

- The ability to earn cash back and other rewards with certain cards.

Cons of a credit card

- Accrual of interest if you don’t pay your balance in full every month. Interest rates typically range from around 12% to about 24%, depending on your credit, although they can go a little lower or higher for different cards.[7]

- Missed payments or high credit utilization can damage your credit and make it difficult to gain approval for credit you may need in the future.

Debit card uses

Debit cards are widely accepted by merchants and can be used to make purchases at point-of-sale terminals at gas pumps, supermarket checkout stands, sales counters, and online. Debit cards are like having instant cash that’s limited only by what’s in your bank account.

Pros of a debit card

- Access to cash at ATMs.

- Doesn’t accrue interest.

- Reduces overspending since it doesn’t allow you to borrow money that you don’t have.

Cons of a debit card

- More vulnerable to fraud and identity theft.

- Limited by the amount of money you have in your account.

- Doesn’t allow you to build credit.

FAQs about credit and debit cards

You may have a number of questions about credit and debit cards. We’ve compiled a list of some of the most common ones and come up with some answers.

Should I have a credit and a debit card?

Having different ways to pay can be a good idea, giving you different options to fit different situations. Carrying a credit card with a low balance can help you increase your credit score and give you access to credit for larger purchases when you need it.

Credit cards are also safer when guarding against identity theft and fraud. This is especially true when you’re traveling outside the country: You’ll get better exchange rates, can cancel your card immediately if it’s lost, and can get travel insurance.[8]

Debit cards, meanwhile, are good for everyday purchases and avoiding the interest charges that come from carrying a balance on a credit card. They’re a good substitute for cash, and you won’t have to deal with the monthly bills that go with a credit card.

Can debit be used as credit?

You can’t use a debit card to access money that isn’t in your bank account, so it’s not possible for you to spend more “on credit” than what you have using a debit card.

Which card is safer to use?

It depends on how you are using them. Here, the definition of “safe” is important. If you’re looking for safety from fraud and identity theft, credit cards offer better protection. This is especially true when traveling and when shopping online, where hackers have more opportunities to compromise your accounts.

If you are not disciplined about making purchases you can afford, however, a debit card is safer because it will protect you from running up debt you won’t be able to pay. Debit cards don’t require you to pay interest, make monthly payments (or keep track of due dates), or pay fees to access cash, as you would with cash advances offered by credit cards.

Which card helps me build credit?

Only a credit card can help you build credit directly. Debit card use isn’t reported to the credit bureaus, doesn’t go on your credit report, and does not affect your credit score. However, if you use a debit card for most of your purchases while keeping your credit card balance low, this can help you build credit indirectly by:

- Keeping your credit card payments manageable so you can afford to pay on time.

- Maintaining a low credit utilization ratio.

Which type of card has the most rewards?

Credit cards offer better rewards programs because card issuers want you to use their cards. Unlike debit card issuers, they make money off the interest they collect on goods and services you charge. So the more they get you to use their cards, the more money they make.

This allows them to more than recoup the cost of the rewards they offer. So it’s a good idea to be careful: If you carry a balance from month to month, you might as well end up paying more in interest than you’re earning in rewards (especially if you can’t or don’t use the rewards that are offered). If, however, you pay your balance in full each month, you can take advantage of rewards you wouldn’t get with a debit card.

Final thoughts

Credit and debit cards function differently and allow users different options when making purchases or accessing funds. The biggest difference involves whose money you are using: your own or a lender’s money that must be paid back. But there are other differences, too, such as the level of protection you can get from fraud, whether you will have to pay extra in interest and/or fees, and how or whether your credit is affected.

The bottom line is it’s a good idea to take all these factors into account when deciding whether and when to use a debit card or a credit card.

Sources

- Washington State Department of Financial Institutions. “Debit Cards Frequently Asked Questions,” https://dfi.wa.gov/financial-education/information/debit-cards-frequently-asked-questions. Accessed December 9, 2021.

- Business Insider. “What you can expect to pay in bank ATM fees,” https://www.businessinsider.com/personal-finance/bank-atm-fees. Accessed December 9, 2021.

- CNBC. “What is a cash advance and how do they work?” https://www.cnbc.com/select/what-is-a-cash-advance-and-how-do-they-work/. Accessed December 9, 2021.

- CNBC. “Only having a debit card can actually hurt your credit—here’s how,” https://www.cnbc.com/select/debit-cards-and-credit/. Accessed December 9, 2021.

- The Ascent: a Motley Fool Service. “Best Rewards Credit Cards for December 2021,” https://www.fool.com/the-ascent/credit-cards/best-rewards-credit-cards/. Accessed December 9, 2021.

- Experian. “What Is the Fair Credit Billing Act?” https://www.experian.com/blogs/ask-experian/what-is-the-fair-credit-billing-act/. Accessed December 9, 2021.

- Experian. “Low APR Credit Cards,” https://www.experian.com/credit/credit-cards/low-interest/. Accessed December 9, 2021.

- Money Under 30. “Cash Vs. Credit Vs. Debit---Which Should You Use?” https://www.moneyunder30.com/cash-vs-credit-vs-debit-which-should-you-use. Accessed December 9, 2021.

- Journal of Experimental Psychology: Applied. “Monopoly Money: The Effect of Payment Coupling and Form on Spending Behavior,” https://www.apa.org/pubs/journals/releases/xap143213.pdf. Accessed December 9, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.