Credit Card Refinancing vs. Debt Consolidation: What’s the Difference?

Published on: 02/07/2022

If you have high-interest credit card debt, you may be looking for a way to lower your interest rate and allocate more funds to paying down your principal.

Two popular options are credit card refinancing and debt consolidation. The question is which one, if either, will best help you reduce your debt and improve your personal finances in a reasonable period of time. Here is some information you can use to help you make that decision.

What is credit card refinancing?

Credit card refinancing is the process of transferring credit card debt to a new credit card with lower APR.[1]

You may want to look for credit cards with introductory 0% APR offers. However, to qualify you’ll need good credit.

Credit card refinancing may help you save money on interest and repay your balances faster, but before deciding if this option is right for you make sure to take into account any fees that may be associated with transferring your debt.

What is debt consolidation?

Perhaps you have several different kinds of debt: credit card debt, student loans, medical bills, home equity loans, etc. Debt consolidation is the process of transferring and combining all your debts into a single loan that is paid off by a debt management plan or a debt consolidation loan from a lender.[2]

People use this method if they want to reorganize multiple debt accounts and make loan payments through one single account instead. A consolidation loan comes with fixed loan terms.

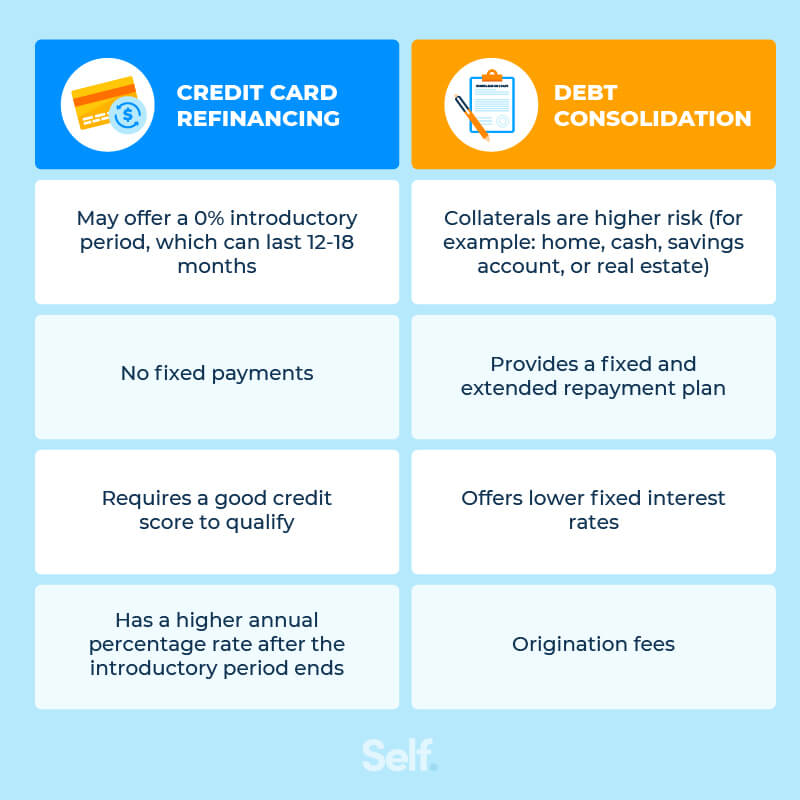

Credit card refinancing vs. debt consolidation

Credit cards and personal loans are both used for refinancing or consolidation. There is some overlap between credit card refinancing and debt consolidation, which can create confusion when making comparisons. Both:

- Offer lower interest rates.

- Are personal loans.

- Require taking out a new loan to pay off debt.

- Lower the cost of paying off your debt by reducing the interest rate.

But key differences between these two options are how your interest rate is lowered, for how long, and the terms of your repayment. The types of loans that can be combined also differ.

Debt consolidation combines multiple loans or several lines of credit into one big single loan. It is essentially a new loan.

- A consolidation loan has a fixed interest rate and payment plan.

Credit card refinancing moves your credit card debt onto a card with lower interest. This often requires using a balance transfer credit card.

- Most balance transfer cards have a 0% introductory APR offer and no fixed payments.

Both these actions will be reflected on your credit report, will impact your credit score, and will hurt your credit history.

The pros and cons of credit card refinancing

If you feel like you have the ability to pay down your debt quickly if you’re given a lower interest rate, credit card refinancing is an option worth exploring.

This option requires discipline, and you should be sure it’s feasible. Why? Because you will have a limited introductory period during which to pay off your balance before the interest rate goes up. Here are some of the pros and cons of credit card refinancing.

Pros

Lower interest rate

Many credit card refinancing offers come with 0% APR, which means you literally pay no interest on your balance for a set period of time, typically between six and 21 months.[3] This means that, during this period, each payment you make goes entirely toward paying down your principal. You can make a lot of progress reducing your debt that way, especially if you make more than the minimum payment.

Reduce monthly payments, interest payments

Paying down your principal during the introductory period has a couple of benefits, even if you don’t pay off your full balance during that period. First, you’ll be reducing the amount of your monthly payment. That’s because it’s typically calculated as a percentage of your balance. Second, because your balance will be lower, you’ll also be paying less interest once it kicks in.

Combine credit cards into one loan

You can transfer balances from multiple accounts onto a single new credit card, which will allow you to put all your debt (or as much as the new card’s credit limit allows) in one place. You’ll want to make sure that the new card is from a different issuer than those you already have. If the new card is backed by the same company as one of the old ones, you won’t be able to transfer the balance from one account to another.[4]

0% percent interest rate

This is the big advantage of this approach. As mentioned, the 0% “introductory” period can vary from as little as six to as long as 21 months. That’s the time during which it’s a good idea to pay down as much debt as possible: the time when you won’t be accruing new interest on the balance you transferred.

Easy application process

Credit card borrowers are often approved within minutes of submitting an application.[5] In fact, many credit card companies send out offers in the mail saying you’ve been prequalified or preapproved for a new card. Some card issuers use these terms interchangeably. However, in general, being prequalified means the lender has done a preliminary review of your creditworthiness. Preapproval more likely means you’re receiving an offer of credit.[6]

Cons

Doesn’t actually get rid of debt

A balance transfer doesn’t reduce your debt. It’s a tool to help you do so. Moving debt from one credit card to another doesn’t actually change how much you owe: If you had $7,500 in debt on three cards, you’ll have $7,500 on your one new card. A balance transfer can give you the opportunity to pay down debt by providing lower interest rates, but it does nothing to address the issues that put you in debt. For that, you can find help in the form of credit counseling.

Higher interest rates if you keep making minimum payments

If you’re just making minimum payments, chances are you won’t be able to pay off your balance by the time the introductory period ends. If that happens, the annual percentage rate can get extremely high, and you may find yourself right back where you started. Then doing another balance transfer may not be easy because your credit may have suffered. Plus, each time you apply for a new credit card, it counts as a “hard inquiry” on your credit report, which can hurt your credit score further.

The introductory rate period ends

Once the introductory period ends, the rate will go up — often significantly. It may be as high as or higher than the rate you were paying on your old cards. In addition, with some cards, the introductory rate only applies to the transfer. It isn’t good on any new purchases you make, which may incur an APR of between 14% and 24%.[3] Of course, if you’re trying to pay down your balance, making new purchases may not help you achieve that goal.

Good credit or excellent credit

Balance transfer cards that offer 0% APR tend to require that you have good or excellent credit.[7] This can be a problem if you’re already struggling to control your debt. For instance, you may be close to maxing out the credit cards you have. If so, you will have a poor credit utilization ratio, which is a key factor in determining your credit score. Even if your application is approved, you may not be able to get a high enough credit limit on a new card to consolidate all your debt.

Should I use a balance transfer credit card?

A balance transfer card is just one type of credit card. Whether it’s the best option for you in reducing your debt depends on a number of factors. If you believe you can pay off all or most of your transferred balance within the introductory period, it can be worth considering, as it can save you hundreds of dollars in interest payments.[8]

You’ll want to consider the impact of balance transfer fees and annual fees, as well as how long the introductory period is. Also, if you have other kinds of debt other than credit card debt, you will likely want to take that into account. For instance, if you have a student loan that carries a 6% interest rate, it can be risky to transfer it to a credit card where the 0% APR introductory rate may jump to 24% after 12 months.

The pros and cons of debt consolidation

Debt consolidation involves taking out a single loan to pay off other debt, and it can cover anything from student loans to medical bills. You’re not limited to credit card transfers. You can use the money to pay off whatever debts you like, whether they’re secured by collateral (such as a car loan) or unsecured.

Pros

Lower interest rates

If you have a number of high-interest loans and you have good credit, you may be able to consolidate them into a single loan with a lower interest rate.[9] This can allow you to pay them off faster. If you can get a debt consolidation loan at 9% and you’re paying 17% and 20% on two credit cards you want to pay off, consolidation will save you money and allow you to pay your debt off faster. But if you’re paying 5% on a car loan, it wouldn’t make sense to include that in your consolidated package.

Fixed repayment plan

The life of the loan is fixed. This means that once you’re done with your payments, you’re done. You can’t accumulate more debt the way you can with a credit card (known as a revolving line of credit). Also, unlike a credit card, the amount you pay doesn’t change from month to month. Under the fixed repayment plan that comes with debt consolidation, you’ll know exactly how much money you need to pay every time.

Easy to manage

Because all your payments are in one place, it’s easier to manage your account. That way, you won’t forget to make a payment, which can harm your credit score if it’s more than 30 days late.

It can improve your credit over time

You can improve your credit score by making consistent on-time payments and lowering your credit utilization rate. Your credit utilization is the amount of debt you have on all your credit cards divided by your total credit limit. So if you remove all your debt from your credit cards and leave them open (but don’t use them), paying down your debt consolidation loan in the meantime can improve your credit utilization ratio.

Cons

Fees

Debt consolidation loans often come with an array of fees, potentially including loan origination fees, balance transfer fees, and annual fees. Origination fees (sometimes called administrative fees) are common for debt consolidation loans. They typically range anywhere from 1% to 6% depending on the lender.[10]

Repayment terms

You may be locked in on the repayment period, and you’ll have to pay a certain amount each month. However, the best debt consolidation loans offer flexible repayment options and don’t charge a prepayment penalty, so you can pay everything off before the discharge date without having to pay a fee.[11]

Creditworthiness

You need to have good or excellent credit to qualify for an unsecured personal loan to consolidate your debt. If you don’t have good credit, you may still get approved, but you will almost certainly wind up paying a higher interest rate, which might even be similar to what you’re already paying. In cases such as these, it’s a good idea to compare your old interest rates with what you’d be paying with a consolidation loan, and add in any fees to estimate your total cost.

Who credit card refinancing may be best for?

Credit card refinancing may be best for:

- People who can pay off their debt in less than two years, or even better, by the time the introductory low APR expires.

- People who prefer a lower APR at the beginning, and are confident they can get out of debt quickly with a little help from lower interest rates.

- People with smaller debts who can use the lower interest rates to pay them off quickly.

Who debt consolidation may be best for?

Debt consolidation may be best for:

- People who have multiple debts and need more time to pay them off.

- People who prefer fixed payment schedules.

- People with large or several kinds of debt, not just credit cards (medical bills, credit card debt, etc.).

Evaluate your financial situation

Deciding which of these loan options — debt consolidation or credit card refinancing — is right for you depends on your goals and your financial situation. These include:

- The size of your debt and the loan amount you’ll be seeking.

- Your ability to pay, and how quickly.

- Your credit history: what’s the lowest rate you can get?

- Whether you prefer revolving or installment credit.

Once you’ve assessed the pros and cons of debt consolidation and credit card refinancing, you can make an informed decision about whether one or the other (or neither) is right for you.

Sources

- Investopedia. “Refinance,” https://www.investopedia.com/terms/r/refinance.asp. Accessed October 19, 2021.

- Investopedia. “Debt Consolidation,” https://www.investopedia.com/terms/d/debtconsolidation.asp#citation-1. Accessed October 19, 2021.

- CNBC. “How do 0% APR credit cards work? 8 things to know before applying,” https://www.cnbc.com/select/how-do-0-apr-credit-cards-work/. Accessed October 19, 2021.

- CNBC. “Can you transfer more than one balance to a 0% APR card?” https://www.cnbc.com/select/how-many-balances-transfer-0-percent-credit-card/. Accessed October 19, 2021.

- Forbes. “What is Revolving Credit?” https://www.forbes.com/advisor/credit-cards/what-is-revolving-credit/. Accessed October 19, 2021.

- Experian. “Prequalified vs. Preapproved: What’s the Difference?” https://www.experian.com/blogs/ask-experian/pre-approved-vs-pre-qualified-whats-the-difference/. Accessed October 19, 2021.

- CNBC. “How to decide between using a personal loan or a 0% APR card to get out of debt,” https://www.cnbc.com/select/how-to-choose-between-loan-and-zero-percent-apr-card-for-debt/. Accessed October 19, 2021.

- CNBC. “How a balance transfer card can save you hundreds of dollars,” https://www.cnbc.com/select/how-to-complete-a-balance-transfer/. Accessed October 19, 2021.

- Experian. “What Is Debt Consolidation?” https://www.experian.com/blogs/ask-experian/what-is-debt-consolidation/#s1. Accessed October 19, 2021.

- Investopedia. “Best Debt Consolidation Loans,” https://www.investopedia.com/best-personal-loans-for-debt-consolidation-4779764. Accessed October 19, 2021.

- Forbes. “Best Debt Consolidation Loans Of October 2021,” https://www.forbes.com/advisor/personal-loans/best-debt-consolidation-loans/. Accessed October 19, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.