Personal Finance Blog

Rocket Money (Truebill) vs. Mint: Which Budgeting App Is Best?

Rocket Money (Truebill) vs. Mint: Which Budgeting App Is Best?January 3, 2023

Mint focuses on budgeting and creating savings goals, while Truebill focuses on lowering your bills or canceling unused subscriptions. We'll explain more below. Read more.

What to Do If You’re Denied a Secured Credit Card?

What to Do If You’re Denied a Secured Credit Card?December 28, 2022

Getting rejected from a secured credit card can be confusing. We'll explain what to do if you were denied a secured credit card and the reasons why it happened. Read more.

Do Debit Cards Build Credit?

Do Debit Cards Build Credit?December 22, 2022

Curious if a debit card can build your credit? Discover how debit cards work, their impact on your credit score, and how to establish good credit habits. Read more.

Does Paying Phone Bills Help Build Your Credit?

Does Paying Phone Bills Help Build Your Credit?December 19, 2022

Phone bills are typically not reported to the major credit bureaus since they are not considered credit accounts. We'll explain how they can affect you. Read more.

Do Credit Unions Help Build Credit?

Do Credit Unions Help Build Credit?December 14, 2022

This post will help you understand how credit unions work, how they differ from commercial banks, and how credit unions can help you build credit. Read more.

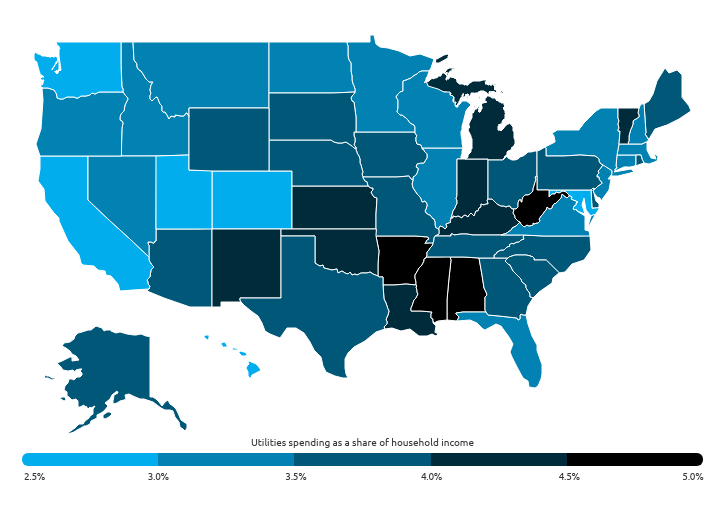

Cities With the Highest Utility Bills

Cities With the Highest Utility Bills December 8, 2022

One of the biggest drivers of price increases has been skyrocketing energy costs, which Americans have been feeling both at the gas pump and through higher utility bills. Read more.

Your Budget as Holiday Desserts

Your Budget as Holiday DessertsDecember 6, 2022

For a fun twist, here's your money management style in the form of some of your favorite festive sweet treats. Read more.

Should You Apply for a Loan Online or In Person?

Should You Apply for a Loan Online or In Person?December 6, 2022

In this article, we’ll go over online loans, in-person loans, when each might be the best choice for your situation and how to weigh your options. Read more.