What is a Convenience Fee and How to Avoid It

Published on: 08/18/2022

Convenience fees often catch consumers by surprise. For example, have you ever tried to purchase concert tickets online only to be shocked by the additional charges at checkout? You probably got hit with a convenience fee. This post explains what convenience fees are, why they get charged and whether you can avoid them.

Table of contents

- What is a convenience fee?

- Convenience fee vs. surcharge

- Why do merchants charge convenience fees?

- How to avoid paying convenience fees

- Credit card company rules for convenience fees

What is a convenience fee?

Convenience fees are additional charges that merchants may apply whenever you use a “non-standard” payment method, such as using a credit or debit card in lieu of cash, check or ACH transfer. Some merchants may use convenience fees to offset the cost of merchant fees on credit card or debit cards transactions. However, they must disclose that they’re charging a convenience fee.

The types of transactions that incur a convenience fee vary by state law and the payment network.

Some merchants consider online credit card payments to be a non-standard method of payment. These merchants may charge a convenience fee when paying online by credit or debit card, but not when you pay in person using a debit or credit. Other merchants may charge you a convenience fee for making a payment over the phone.

Common transactions that may include a convenience fee are:

- Tuition

- Taxes

- Utility payments

- Payments to the government

- Mortgage payments[1]

Credit card vs. debit card convenience fees

Convenience fees for credit cards and debit cards may be different due, in part, to credit card processing fees typically being higher than debit card processing fees.

The average credit card processing fee is between 1.5% and 3.5%.[2] According to the Federal Reserve, the average debit card interchange fee was 0.51% for all covered transactions in 2020.[3]

You can see an example of credit card and debit card convenience fees if you pay your taxes online. The payment processor payUSAtax charges a flat $2.55 for debit card payments, but 1.96% of the transaction for credit card payments with a $2.69 minimum. That means if you’re paying $1,000 in taxes, the convenience fee for a credit card payment will be $19.60.[4]

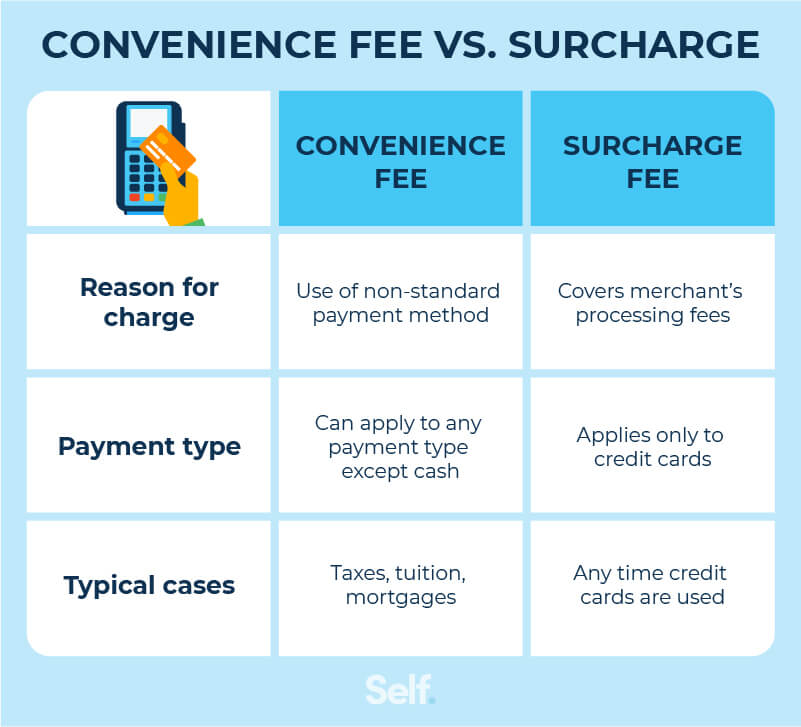

Convenience fee vs. surcharge

It can be easy to confuse a convenience fee with a credit card surcharge. While a convenience fee is charged for the convenience of using non-standard methods of payment, a surcharge may be imposed for every transaction made with a credit card. Debit cards differ from credit cards in that they cannot accrue a surcharge when used as payment.[5],[6]

Why do merchants charge convenience fees?

Convenience fees are designed to incentivize merchants and retailers to accept credit and debit card payments by helping them recover some of the processing fees associated with credit and debit card transactions.[1]

Are convenience fees legal?

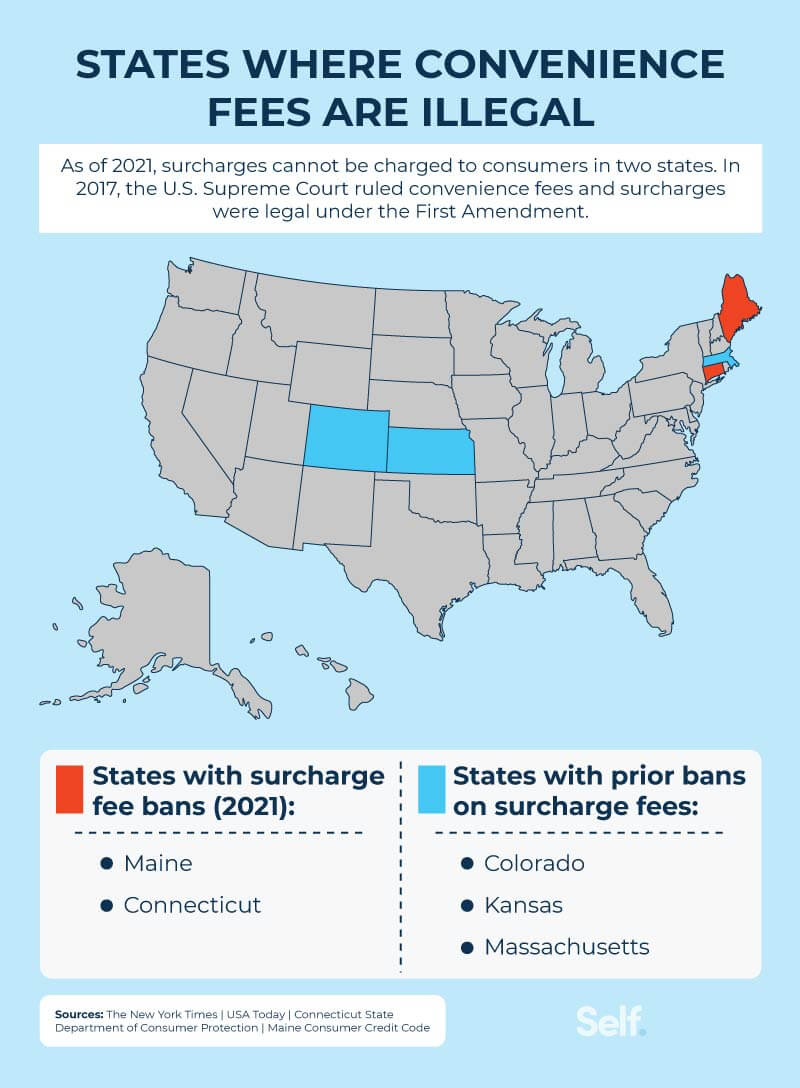

In most cases, it’s perfectly legal for merchants to impose convenience fees or surcharges, but it all depends on where the transaction occurs.

Processing fees, such as surcharge fees and convenience fees, were banned in Colorado, Massachusetts and Kansas before 2021, but now merchants can charge them there.[7] In Maine, it is still legal for government entities to levy surcharge fees to offset their own processing costs. And as of 2021, Maine and Connecticut are the only two states to have laws banning credit card surcharge fees.

Even where these fees are legal, though, the amount that may be charged per transaction is rigorously controlled by state and federal law. In most states, surcharges can’t exceed 4% of the total cost of the transaction.[8]

These legal statutes do face opposition. Critics argue, for instance, that denying merchants and service providers the opportunity to impose these fees is unconstitutional, a violation of their right to manage their property (i.e., their business) as they see fit. In California and New York, opposition to the potential regulation or prohibition of processing fees has gone all the way to the U.S. Supreme Court.[7],[9]

How to avoid paying convenience fees

When it comes to avoiding convenience fees and surcharges, you may not have a whole lot of options. In most cases, your best bet would be to switch to a different form of payment, such as cash or check, if possible.[1]

It is important to note that even if the merchant doesn’t explicitly charge a transaction fee, you might still be paying a higher rate than you would if you paid with cash or check. It’s perfectly legal in all states for merchants to offer discounts and other incentives for those who don’t use credit or debit for their purchases.

So do your homework, and just because you do not see a fee on your statement, don’t assume that you’re not paying more by using your credit or debit card.

You may also be able to avoid these fees if you find that the merchant isn’t adhering to state and federal laws. For instance, if your merchant tries to impose a fee in states where they’re illegal, or if they try to charge a fee amount higher than that allowed by state law, you have the right to dispute the fee.

Likewise, if the merchant imposes the fee without telling you, then you may also file a complaint with the Consumer Financial Protection Bureau or related agencies. By law, merchants who impose surcharges or convenience fees have to notify the consumer either with a sign posted outside their shop, at the cash register or through a written statement on online transactions.[1],[10]

Credit card company rules for convenience fees

Though merchants can make their own rules about whether they will impose a processing fee on their customers, they’re limited in what they can do.

Not only do merchants have to follow state and federal laws when assessing processing fees, but they also have to be bound by the rules of the credit card issuer. Some payment networks have their own rules and guidelines when it comes to assessing convenience fees and surcharges for the different card brands. For example:

- Visa: To charge a convenience fee “the fee must be a flat fee (not a percentage of the transaction amount), clearly disclosed, and represent payment for the convenience of paying through an alternate payment channel (such as online) that is different than the merchant’s normal payment channel (for example sending a check through the mail or paying in person).”[11]

- Mastercard: A convenience fee can be charged as long as “the fee is imposed on all like transactions regardless of the form of payment used. [12]

Understand additional charges

Transaction fees such as convenience fees and surcharges are fees levied by merchants to help offset the costs associated with credit or debit card transactions.

Fees can vary widely from one merchant or service provider to another and are often based on a range of factors, including location, transaction type, payment channel and credit card issuer. Federal and state laws may severely limit or even prohibit convenience fees and surcharges, however.

To avoid unnecessary fees, it’s important to know your rights as a consumer, including understanding state and federal regulations. Ultimately, it may not be possible to avoid every transaction fee, but being aware of where your money goes is an essential step toward making better decisions on your path to financial freedom and building better credit.

Sources

- Experian. “How to Avoid Credit Card Convenience Fees,” https://www.experian.com/blogs/ask-experian/how-to-avoid-credit-card-convenience-fees/. Accessed January 28, 2022.

- Forbes. “Credit Card Processing Fees (2022 Guide),” https://www.forbes.com/advisor/business/credit-card-processing-fees/. Accessed July 15, 2022.

- Federal Reserve. “Regulation II (Debit Card Interchange Fees and Routing),” https://www.federalreserve.gov/paymentsystems/regii-average-interchange-fee.htm. Accessed July 15, 2022.

- IRS. “Pay Your Taxes by Debit or Credit Card or Digital Wallet,” https://www.irs.gov/payments/pay-your-taxes-by-debit-or-credit-card. Accessed July 15, 2022.

- Visa. “Surcharging Credit Cards-Q&A for Merchants,” https://usa.visa.com/dam/VCOM/download/merchants/surcharging-faq-by-merchants.pdf. Accessed June 28, 2022.

- Business.org. “What’s the Difference Between a Surcharge and a Convenience Fee?” https://www.business.org/finance/payment-processing/surcharge-vs-convenience-fee/ Accessed January 28, 2022.

- USA Today. “It’s illegal to charge credit card processing fees in these 5 states. Here’s what to do,” https://www.usatoday.com/story/money/personalfinance/2021/04/05/its-illegal-to-charge-credit-card-processing-fees-in-these-5-states/43512911/. Accessed June 27, 2022.

- MasterCard. “U.S. Merchant Class Settlement Mastercard Frequently Asked Questions Merchant Surcharge”. https://www.mastercard.us/content/dam/public/mastercardcom/na/us/en/documents/Merchant_Surcharge_FAQ.pdf. Accessed March 29, 2022.

- National Conference of State Legislatures. “Credit or Debit Card Surcharges Statutes,” https://www.ncsl.org/research/financial-services-and-commerce/credit-or-debit-card-surcharges-statutes.aspx Accessed January 28, 2022.

- The Ascent. “Average Credit Card Processing Fees and Costs in 2021,” https://www.fool.com/the-ascent/research/average-credit-card-processing-fees-costs-america/. Accessed January 28, 2022.

- Visa. “Visa Rules and Policy,” https://usa.visa.com/support/consumer/visa-rules.html. July 15, 2022.

- Mastercard. “Mastercard Rules,” https://www.mastercard.us/content/dam/mccom/global/documents/mastercard-rules.pdf. July 15, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.