Budgeting

What Is a Billing Cycle and Can You Change It?

What Is a Billing Cycle and Can You Change It? August 16, 2022

A billing cycle is the period of time between the last billing statement and the current statement. We'll explain how it works and how it impacts you. Read more.

4 Ways to Protect Your Credit and Finances During a Divorce

4 Ways to Protect Your Credit and Finances During a Divorce August 9, 2022

Divorce can be a stressful experience for some, but there are actions you can take that may help when you decide to part ways. Below are four expert tips to protect your credit and finances during a divorce. Read more.

How Long Do ACH Transfers Take to Process?

How Long Do ACH Transfers Take to Process?July 19, 2022

For those sending money, ACH transfers offer the choice of processing payments on the same-day, next-day, or a two-day timeframe. Read more.

How to Avoid Paying Interest on Credit Cards

How to Avoid Paying Interest on Credit CardsJuly 14, 2022

Paying off your balances in full each month is the best way to avoid credit card interest. Here are a few ways to prevent interest from accumulating. Read more.

How to Begin the Process of Combining Finances

How to Begin the Process of Combining FinancesJuly 12, 2022

We reached out to three relationship and money experts to gather tips on the best ways to combine finances with someone you love.

Read more.

How to Manage Your Finances, According to Your Zodiac Sign

How to Manage Your Finances, According to Your Zodiac SignJuly 8, 2022

Astrologer Valerie Mesa breaks down what the stars have in store for each Zodiac sign. Read more.

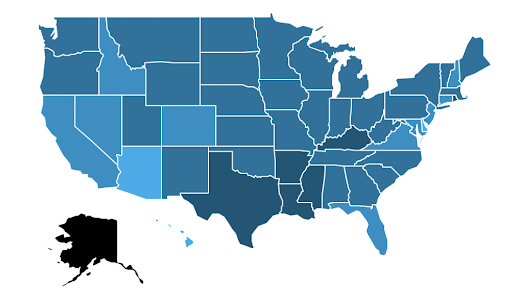

U.S. Cities Where Residents Earn the Most From Alternative Income Streams

U.S. Cities Where Residents Earn the Most From Alternative Income StreamsJune 29, 2022

According to data from the U.S. Census Bureau, more than 75% of households report receiving wages and salaries. But alternative income streams are common in a large number of households as well. Read more.

DIY Credit Repair: 11 Steps to Help Fix Your Credit

DIY Credit Repair: 11 Steps to Help Fix Your CreditJune 21, 2022

Repair your credit report yourself with these actionable steps. Learn how to fix errors, address negative marks, and lift your credit score effectively. Read more.