How Long Do ACH Transfers Take to Process?

Published on: 07/19/2022

If you’ve ever received a direct deposit or paid for something online, you’ve participated in an ACH transfer.

You may be eager for the payment to process, especially if you’re receiving funds, but transfers don’t happen automatically. They may occur same-day or they can take several business days. Banks like Wells Fargo and Chase state that transfers typically take two to three business days to complete.[1][2]

Table of contents

- What is an ACH transfer?

- How long does an ACH transfer take to process?

- How are ACH transfers processed?

- Can ACH transfers be reversed?

- Pros and cons of ACH transfers

- What are the differences between ACH and wire transfers?

What is an ACH transfer?

An ACH transfer is the electronic transfer of money through the Automated Clearing House Network. The ACH transfer system actually predates the internet, dating back to 1974. It was created and is administered by National Automated Clearing House Association (NACHA).

Payments are funneled either through the U.S. Federal Reserve or The Clearing House, a private company owned by major commercial banks.[3]

ACH credit transactions

ACH credits, or “push” transactions, allow you to receive funds like wages, tax refunds, social security payments, and more. An originator initiates a transaction to the Receiving Depository Financial Institution (RDFI) account, which is then credited.[4]

ACH debit transactions

You can use ACH debits, or “pull” transactions, to make payments or send money, whether it’s to pay a bill, purchase a product or service, send money to family or friends, or make a tax or tuition payment. In a “pull” transaction, the originator pulls funds from the receiving bank account (often a checking account), which is then debited.[4]

How long does an ACH transfer take to process?

Many banks estimate it will take two to three business days for an ACH transfer to process.[1][2]

According to the Consumer Financial Protection Bureau, some ACH payments can take several days to complete because of the way they’re processed and the precautions that are in place against fraud and money laundering.[3]

The FedACH network and NACHA process funds same-day and future dates.[5] They have three submission cutoff times for same-day transactions with corresponding same-day settlement windows. They have five submission cutoff times for future dated transactions, all of which have an 8:30 am ET settlement schedule for the next banking day or the scheduled settlement date.[6][7]

While there are multiple submission and settlement opportunities, banks can choose how many times per day they submit batches of transactions to be processed. Even if they submit transactions that are processed the same day, the receiving bank can hold the funds, meaning that the money won’t be released into your account yet.

While ACH transfers may take multiple business days to process, the speed of ACH processing is continuously improving. Nacha, which created and enforces the rules for the ACH network, implemented same-day ACH payments in 2016 and they expanded their same-day processing window on March 21, 2021.[8][9]

How are ACH transfers processed?

ACH transfers are a complicated, multi-step process.

- The originator initiates a transaction.

- The transaction information is forwarded to the originating depository financial institution (ODFI). For example, your bank.

- The ODFI forwards the information to the ACH operator, which is either the Federal Reserve or The Clearing House.

- The ACH operator distributes the ACH information to the receiving depository financial institution (RDFI). For example, the receiver's bank.

- Finally, the funds are made available to the receiver.[4]

Given this lengthy process, it makes sense that it may take several days for them to clear.

Can ACH transfers be reversed?

Reversals can be made for specified reasons: if there was an incorrect account number or dollar amount; in the case of a duplicate transaction; or in cases where the date is wrong and the credit was later or the debit earlier than intended.[10]

Pros and cons of ACH transfers

ACH transfers allow for quicker transactions. However, it’s important to understand both their benefits and limitations.

Pros

- Convenience: You can make a transfer from your smartphone or anywhere you have online access.

- Direct deposit: ACH can be used to receive direct deposits from your employer for your paycheck or government benefits, if you’re receiving assistance.

- Bill payments: You can avoid late payments by setting up automatic bill pay, which can help you build credit, especially with something like a credit builder account.

- Security: ACH is a secure network, but you can avoid liability for unauthorized payments if they do occur by notifying your bank within 60 days after the bank statement was issued.

- Cost: ACH transfers can cost less than other payment methods (almost nothing in most cases) such as wire transfers, debit cards or credit cards.

Cons

- Transfer limits: Banks may limit the amount of money you can transfer using an ACH network payment.

- Time lag: Even though many ACH transfers are same-day transactions, they can still be slower than wire transfers, which occur almost immediately once they’re initiated.

- Insufficient funds: If you have overdraft protection and have insufficient funds, an ACH payment will typically go through but you may be charged a fee. If you don’t have overdraft protection, the payment may not go through and you’ll likely be charged a non-sufficient funds fee.[11]

- Transactions typically take a few business days: ACH transfers are not immediate and may take several business days. They may take longer if the system suspects a fraudulent transaction.[12]

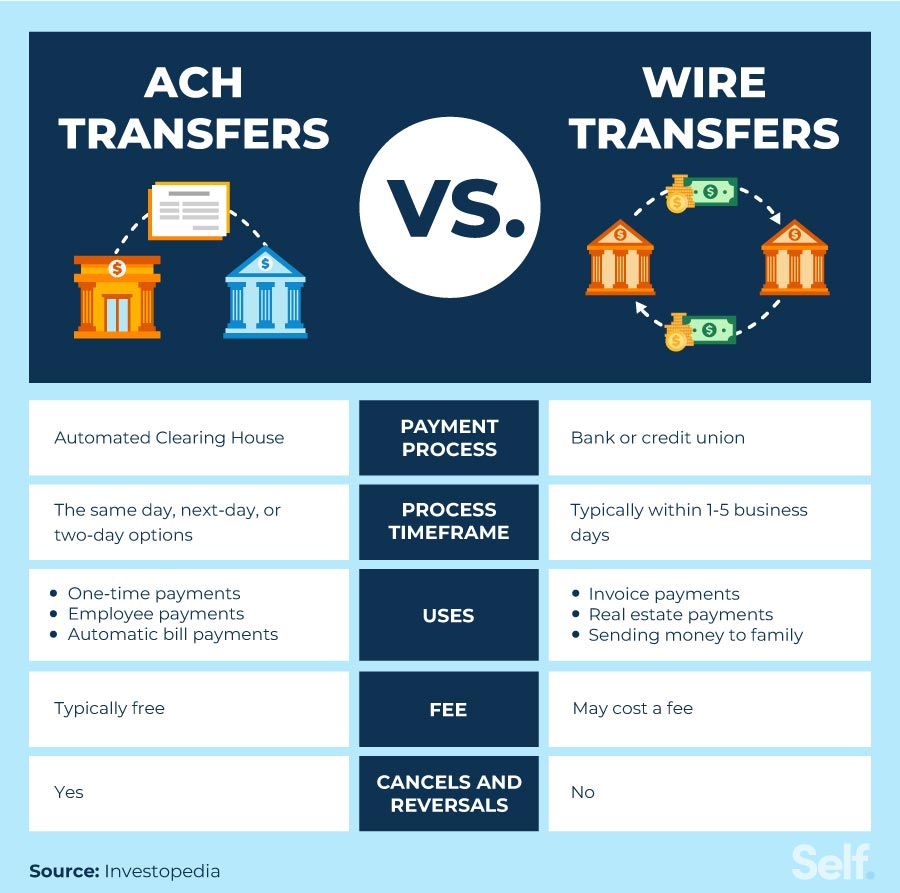

What are the differences between ACH and wire transfers?

ACH transfers only work within the United States, whereas wire transfers of more than $15 can be made internationally, but you’ll have to pay a fee (typically $10 to $35) for each wire transfer.[12]

One of the primary differences between these two money transfers involves timelines. Wire transfers are real-time transactions, which is a good thing if you need to transfer money fast. However, you can’t cancel wire transfers once initiated. You can reverse ACH transactions under certain circumstances.[12]

ACH transfers aren’t automatic

Most of us use ACH payment processing instead of other payment options like paper checks. It’s a convenient, cost-effective way of transferring funds electronically that you can access remotely from almost anywhere. It doesn’t work as fast as a wire transfer, but you can still get or send money quickly with the option of reversing a transaction if there’s an error or fraudulent activity or stopping a transaction three days before the scheduled payment date.[13] These options are not available with a wire transfer.

It’s important to remember that ACH transfers may take a few business days to process and the timeline can vary from bank to bank.

Sources

- Wells Fargo. “Transfer Money FAQ,” https://www.wellsfargo.com/help/online-banking/transfers-faqs/. Accessed February 25, 2022.

- Chase. “ACH Transfer,” https://www.chase.com/digital/transfer. Accessed February 25, 2022.

- Consumer Financial Protection Bureau. “What is an ACH?” https://www.consumerfinance.gov/ask-cfpb/what-is-an-ach-en-1065/. Accessed February 25, 2022.

- Payments Innovation Alliance. “How ACH Works,” https://achdevguide.nacha.org/how-ach-works. Accessed February 25, 2022.

- Nacha. “Payments Myth Busting,” https://www.nacha.org/content/payments-myth-busting. Accessed February 25, 2022.

- Nacha. “ACH Schedules and Funds Availability,” https://www.nacha.org/system/files/2021-03/SDA_Schedules_and_Funds_Availability.pdf. February 25, 2022.

- The Federal Reserve. “FedACH® Processing Schedule,” https://www.frbservices.org/resources/resource-centers/same-day-ach/fedach-processing-schedule.html. Accessed July 6, 2022.

- Nacha. “Same Day ACH for Debits Begins Today, Providing Another Option for Faster Payments,” https://www.nacha.org/news/same-day-ach-debits-begins-today-providing-another-option-faster-payments. Accessed February 25, 2022.

- Nacha. “Expanding Same Day ACH,” https://www.nacha.org/rules/expanding-same-day-ach. Accessed February 25, 2022.

- Nacha. “Reversals and Enforcement,” https://www.nacha.org/rules/reversals-and-enforcement. Accessed February 25, 2022.

- Consumer Financial Protection Bureau. “My bank/credit union charged me a fee for overdrawing my account even though I never agreed to let them do so. What can I do?” https://www.consumerfinance.gov/ask-cfpb/my-bankcredit-union-charged-me-a-fee-for-overdrawing-my-account-even-though-i-never-agreed-to-let-them-do-so-what-can-i-do-en-1037/. Accessed July 7, 2022.

- Experian. “What Is the Difference Between ACH and Wire Transfer?” https://www.experian.com/blogs/ask-experian/what-is-the-difference-between-ach-and-wire-transfer/. Accessed February 25, 2022.

- US Bank. “How do I place a stop payment on ACH or recurring debit card transactions?” https://www.usbank.com/customer-service/knowledge-base/KB0186839.html. Accessed June 22, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).