Personal Finance

What Your Zodiac Sign Says About Your Spending Habits

What Your Zodiac Sign Says About Your Spending Habits September 26, 2022

Everything from a person’s upbringing to their current situation plays a role in their financial journey, but we’ve decided to take it a step further and look to the stars for some clarity when it comes to our spending habits. Read more.

What’s a Good APR for a Credit Card?

What’s a Good APR for a Credit Card?September 26, 2022

An APR is “good” if it’s lower than the national average APR. This article discusses APR, how it is calculated, and what you can do to reduce your APR. Read more.

How To Pay Your Credit Card Bill

How To Pay Your Credit Card BillSeptember 21, 2022

We'll explain how to pay your credit card bill in multiple ways, what to do if you have credit card debt, and how to automate your credit card payments. Read more.

How Payment History Impacts Your Credit Score

How Payment History Impacts Your Credit ScoreSeptember 21, 2022

Payment history is the record of your on-time and late payments, making up the largest factor in your credit score. Learn how to lift it. Read more.

4 Ways To Manage Financial Stress

4 Ways To Manage Financial StressSeptember 7, 2022

From rising gas prices to higher rents, the economic realities that many are facing can start to feel overwhelming. Here are four strategies that could help you cope with the financial stressors you might be encountering.

Read more.

Can Credit Card Companies Garnish Your Wages?

Can Credit Card Companies Garnish Your Wages?August 29, 2022

If a credit card company files a court order and secures a judgment against you, then they can garnish your wages. We'll explain how wage garnishment works. Read more.

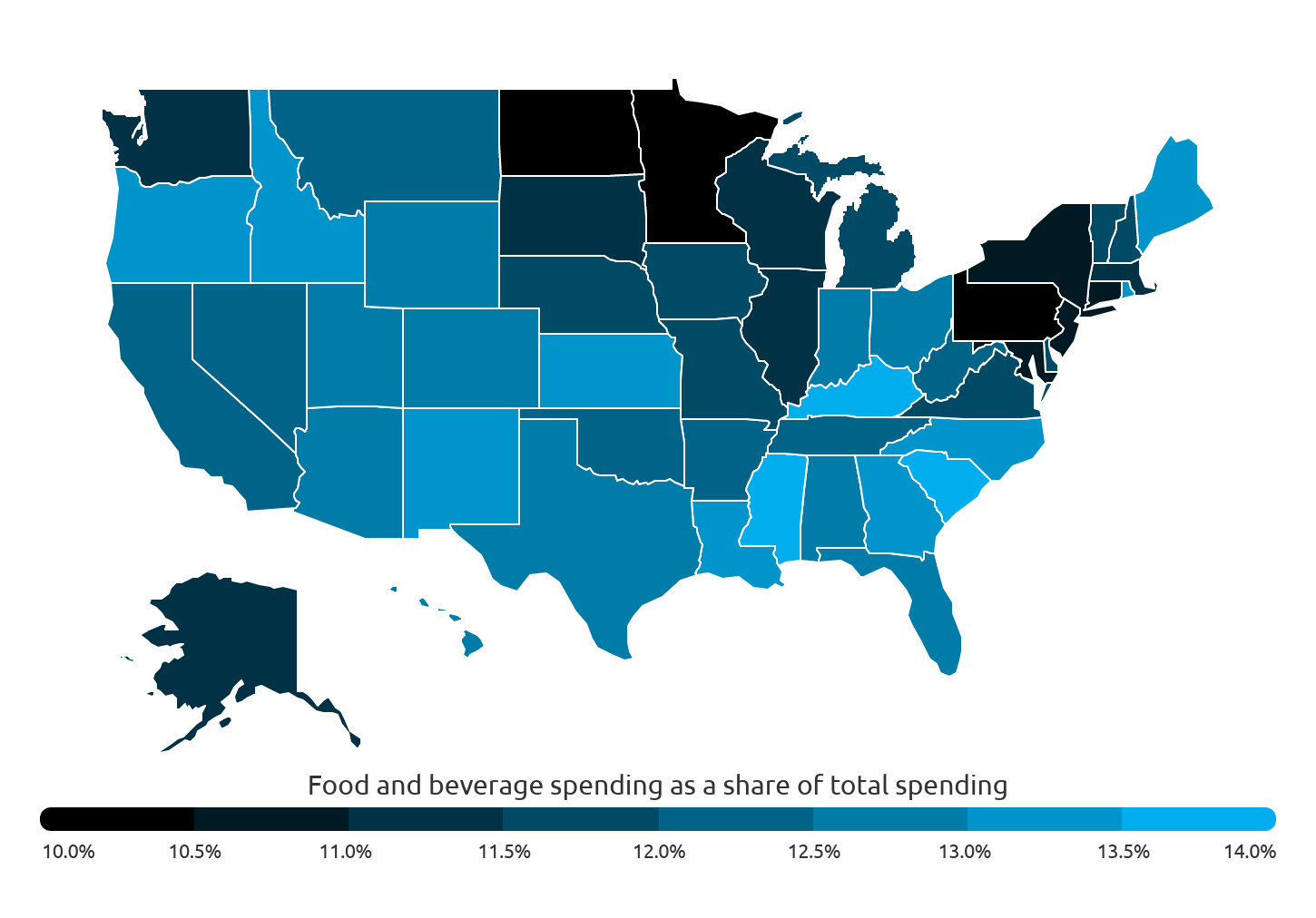

States Where Residents Are Spending the Most on Food

States Where Residents Are Spending the Most on FoodAugust 29, 2022

The COVID-19 pandemic and its aftermath reshaped many aspects of life in the U.S., and how Americans eat and drink is no exception. Read more.

How To Deal With Debt Collectors

How To Deal With Debt CollectorsAugust 26, 2022

It’s important to know how to deal with debt collectors when they contact you, what your rights are, and what to do if you can’t pay your debt right away. Read more.