What’s a Good APR for a Credit Card?

Published on: 09/26/2022

APR stands for annual percentage rate, and it refers to the amount of interest you’ll pay if you carry a balance on your credit card.[1] A good APR is anything below the national average, which is 16.17% (as of February 2022).[2]

Your APR will often largely depend on your credit score. The lower your credit score, the higher your APR typically is. While you may see offers for 0% APR credit cards, this rate is often only for an introductory period, so make sure to understand its stipulations and the card’s APR once the promotional period is over.

We’ll explain the different types of credit card APRs, how APR is calculated and what you can do to reduce your APR and avoid paying interest on your credit cards.

Table of contents

- What is a good APR?

- High-APR vs. low-APR credit cards

- How is APR determined?

- Types of credit card APRs

- How to avoid paying APR

- How to qualify for a good credit card APR

- How to lower your credit card APR

- Navigating credit card APR

What is a good APR?

A good APR is anything lower than the national average, but the lower the better. According to the Federal Reserve, the national average APR is 16.17% (as of February 2022) [2] and according to the U.S. News database, the average APR for credit cards is between 15.56% and 22.87%.[3]

Your APR is typically determined by your credit history and debt-to-income ratio.[4] If your credit score and debt-to-income ratio are high, you may only qualify for cards with an APR higher than the national average. Similarly, if you’re trying to build your credit for the first time or you’re trying to repair your credit, then you may not qualify for a low-APR card.

High-APR vs. low-APR credit cards

High-APR and low-APR cards differ not only in the amount of interest they charge on credit card balances but also in qualification requirements and perks.

High-APR credit cards

Credit cards that offer rewards in the form of points, miles or cashback tend to have higher APRs than similar cards that don’t offer rewards. However, other cards, called “subprime cards” have higher APRs because they are designed for applicants with lower credit scores.[5]

Rewards cards with high APRs may help you earn cash back or other perks with purchases, but if you carry a balance, you end up owing a lot in interest on those purchases. The same is true for subprime cards. While they may be easier to qualify for, you still get charged a lot of interest for purchases if you carry a balance.

Low-APR credit cards

Just like any credit product, when you apply for a credit card, your credit score affects the terms your lender will offer you. Typically, the better your score the lower APR you may be offered. Even with perks and rewards cards, a better score may get you a lower APR. You may find lower APRs with other financial institutions as well, such as cards from credit unions.

Although some cards may offer promotions of 0% APR for several months, these offers are limited in time and scope. A promotional offer that gives you a lower or 0% APR on purchases for a promotional period of time will then charge interest on your balance at the APR you qualify for when the promotional period ends. Additionally, since the promotion was only on purchases, any balance transfers or cash advances you make, will be charged interest immediately.

You may also see promotional, low-interest or 0% interest offers that allow you to transfer high-interest debt to a new card. However, if you can’t pay your transferred debt off in time, you end up adding interest to your debt after the promotion runs out, and you could be charged interest on new purchases cash advances within the promotional period.[6]

Although promotional offers may work well if you’re making a purchase or balance transfer that you can pay off within the promotional period, understand the terms so that you pay it off before you incur interest charges. Just make sure that you pay the balance before the promotion ends or you could end up paying unanticipated high interest. This can be useful for large purchases that require more time to pay off.

How is APR determined?

The APR that you are eligible for is largely based on your credit history and your debt-to-income ratio. At the time of application, the credit card issuer determines which cards you qualify for based on your creditworthiness. Most issuers offer different types of cards with varying APRs, depending on your credit history and debt load. The better your credit history, the lower the interest rate you’ll likely be offered.

Credit card issuers reserve the right to change your interest rate under certain circumstances. For example, your minimum payment is over 60 days late, a temporary rate expires, or the index your variable rate is tied to changes. In most cases, they must give you a 45-day notice before increasing your interest rate. This does not apply to fluctuations due to the prime rate changes.[7]

Interest rates are based on an index, often on the U.S. Prime Rate.[8] Banks add to the Prime Rate, or whatever index they use, when adjusting interest rates on lending products. Since interest represents the price you pay for borrowing money, typically, borrowers with less risk have less added to the Prime Rate than those with high risk.

For example, with the September 1, 2022, Prime Rate of 5.5%, borrowers that represent less risk may be charged an additional 10% for a total APR of 15.5% (Prime Rate of 5.5% plus 10%). On the other hand, banks may charge even more for risky borrowers to cover potential losses (such as 20% plus 5.5% for a total of 25.5% APR).[8], [9]

Types of credit card APRs

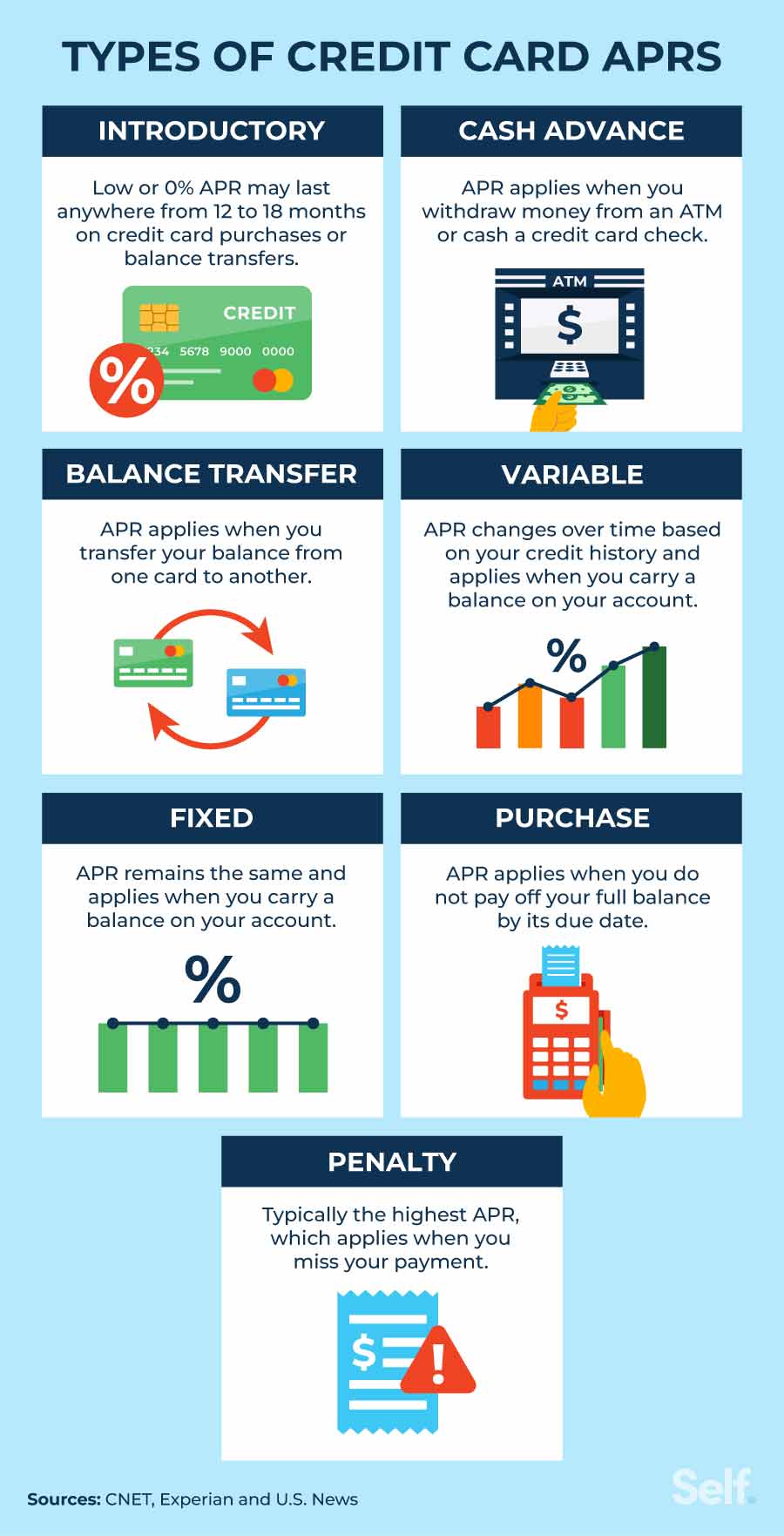

Your credit history, as well as the credit card type and the Prime Rate, can all play key roles in determining your APR. However, credit cards can have different types of APR, and understanding how each type works may help you avoid adding unnecessary interest charges. The different types of APRs include:

- Introductory: Many cards will offer a low introductory rate to incentivize consumers to open a new account or transfer existing balances onto a new card. These rates may be as low as 0%, but they’re time-sensitive, often expiring within 12 to 18 months. At the end of the introductory period, the APR on any remaining balance will often increase significantly, based on the average APR for all cards in the U.S. News database, this could be anywhere from 15 to 22% or higher.[3]

- Cash advance: A cash advance means that you have used your credit card to withdraw cash from an ATM or you’ve cashed a credit card check. Unlike purchases, which, if you don’t carry a balance, typically have a grace period before you are charged interest, cash advances do not invoke a grace period. In addition, the interest rate tends to be higher on cash advances than on other charges on a credit card. A cash advance fee, in addition to interest, is most likely to apply.[3]

- Balance transfer: A balance transfer allows you to move your credit card debt from a higher-APR card to a lower-APR card. You can also use a balance transfer to consolidate credit cards and even some loan debts onto a single low-interest card. Many credit card companies offer a 0% introductory APR for balance transfers, although, as noted above, average interest rates will kick in on any balances that remain when the introductory period expires.[3]

- Variable: A variable rate, not surprisingly, is one that can change over time. It’s usually based on the Prime Rate or some other benchmark, plus a specific amount determined by the lender.[3]

- Fixed: A fixed-rate is one in which the APR is determined at the time that you open your account. A fixed APR will not change, even if the Prime Rate decreases or your credit score changes. Credit card typically do not have fixed rates.[3]

- Purchase: The purchase APR is the standard APR that is applied when you make purchases and carry a balance from month-to-month. These tend to be lower than the interest rate for non-standard charges such as cash advances.[3]

- Penalty: If you’ve fallen behind on your credit card payments for 60 days or longer, or if you’ve had a returned payment, then you may be subjected to a penalty APR. This means that you will be required to pay a higher APR than your original purchase APR for a period of at least 6 months. At the end of every 6-month period, your credit card issuer will re-evaluate your account to determine if the penalty APR should remain in effect or if you have re-established your payment history sufficiently to return to a lower APR.[3]

How to avoid paying APR

Remember that the APR only applies when you carry a balance on your credit card. You can avoid interest rates entirely by paying off your debt before the due date. That’s not always feasible for many people, but there are things you can do to reduce the amount you pay in interest. Once you have established a record of timely payments and decreasing debt, you may qualify for lower-APR cards.

Setting up a budget can help you ensure you’re not spending beyond your means. A budget will also potentially help you set up a plan to pay more than your minimum monthly payment on your cards, which can reduce the amount of interest you’re paying in the long run.

How to qualify for a good credit card APR

Though you certainly can’t control the Prime rate and other benchmarks, you can control your credit history. With a high credit score, you should qualify for a credit card with a good APR, often sooner than you think.

It’s essential to make payments on time so that creditors don’t see you as a risk. You should also pay down existing debt, which may help your debt-to-income ratio (the percentage of your monthly debt payment in relation to your monthly income) as well as your credit utilization ratio (CUR). Typically, when applying for a mortgage, a debt-to-income (DTI) ratio of less than 36% shows that you’re responsible for your debt.[10]

Your credit utilization ratio calculates the percentage of credit used based on your credit limit. FICO suggests maintaining a CUR of under 10%.[11]

How to lower your credit card APR

If you’re looking to lower your credit card APR, there’s good news. You have several options.

- Negotiate with the credit card company. One of the best ways to lower your APR is to reach out to the company, especially if you’ve been with them for a while and have been a good customer and paying as agreed. They might be willing to lower your rate than risk losing your business entirely.

- Apply for a credit card with a low APR. If you have a high-APR card and the company is unwilling to negotiate for a lower rate, consider applying for a different card. The lower your APR, the less interest you’re going to pay over time.

- Search for credit alternatives. Sometimes it makes better financial sense to look for an alternative than to carry debt on a high-APR card. A personal loan, for instance, may involve lower interest rates than some high-APR cards. Plus, you get help structuring your repayment because you get a fixed payment you can budget for that helps you pay off the balance in full after a specified period of time.

- Improve your credit score before applying for a credit card. Once again, so much about the APR depends on your credit score. Focus on building your credit and reducing your debt before you apply for a credit card. In general, the higher your credit score, the lower your APR.

Navigating credit card APR

Understanding APR isn’t always easy, but it is essential. A low APR can save you thousands of dollars in interest. The key to a good APR, though, is finding the right card, negotiating the best rate, and keeping your debt low and credit score high.

Sources

- Experian. “What Credit Score Do You Need for a 0% APR Credit Card?” https://www.experian.com/blogs/ask-experian/what-credit-score-do-you-need-for-a-0-apr-credit-card/. Accessed on April 26, 2022.

- The Federal Reserve. “Consumer Credit - G.19,” https://www.federalreserve.gov/releases/g19/current/. Accessed on May 2, 2022.

- U.S. News and World Report. “Average Credit Card APR,” https://money.usnews.com/credit-cards/articles/average-apr. Accessed on April 26, 2022.

- Forbes Advisor. “What is the Average Credit Card Interest Rate?” https://www.forbes.com/advisor/credit-cards/average-credit-card-interest-rate/. Accessed on April 26. 2022.

- Business Insider. “The average credit card interest rate by credit score and card,” https://www.businessinsider.com/personal-finance/average-credit-card-interest-rate. Accessed on September 19, 2022.

- Experian. “How to Avoid Paying Credit Card Interest,” https://www.experian.com/blogs/ask-experian/do-you-pay-apr-if-you-pay-in-full/. Accessed on April 26, 2022.

- Consumer Finance Protection Bureau. “When can my credit card company increase my interest rate? What can I do to get the rate back down?” https://www.consumerfinance.gov/ask-cfpb/when-can-my-credit-card-company-increase-my-interest-rate-what-can-i-do-to-get-the-rate-back-down-en-69/. Accessed on April 26, 2022.

- The Federal Reserve. “Selected Interest Rates (Daily),” https://www.federalreserve.gov/releases/h15/. Accessed on May 3, 2022.

- Forbes Advisor. “What Is The Prime Rate?” https://www.forbes.com/advisor/investing/prime-rate-definition/. Accessed on April 28, 2022.

- Investopedia. “28/36 Rule,” https://www.investopedia.com/terms/t/twenty-eight-thirty-six-rule.asp. Accessed on May 2, 2022.

- FICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed on September 19, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).