Does Paying Off a Loan Early Hurt Your Credit?

Published on: 04/25/2023

While paying a loan off early can give you a sense of accomplishment, it may also cost you some points on your credit score. That’s because FICO® weighs open accounts more than closed ones and also because closing an account can impact your credit history length and credit mix.

The exact effect that paying off your loan has on your particular credit score depends on your financial situation as a whole.[1] If the loan you pay off is the only active installment loan you have, you may see your credit score drop when you close the account.[2] However, it might not impact your credit score significantly if you manage other credit accounts responsibly.[2]

We discuss how paying off a loan affects your credit, how to decide whether to pay off your loan early and how you might work toward bettering your credit score.

Table of contents

- Does paying off a loan early hurt your credit score?

- How does paying off a loan early hurt you?

- How does paying off a loan early help you?

- Should you pay off your loan early?

- How to improve your credit score

Does paying off a loan early hurt your credit score?

Paying off a loan early may hurt your credit score, but the exact impact depends on your specific financial situation. Once you pay off a loan, the account is closed. If you have no active installment loans, your credit score can drop because FICO® data indicates that having a low ratio of loan balance to loan amounts represents a stronger chance that you’ll follow through on repayment than having no active loan accounts at all.[2]

Installment loans (like student loans and mortgage loans) are when you receive a lump sum for a specific purpose and then make scheduled payments until you pay off the full amount plus interest and fees. They represent a different type of account and work differently from revolving credit. Revolving credit gives you access to an always available credit line (like a credit card) and you make monthly payments based on how much you use, associated fees, and whatever amount of interest you’ve accrued.[3]

Paying off an installment loan can hurt your credit by decreasing the diversity of accounts you have, known as your credit mix. If you pay all your installment loans off, your credit report reflects these as closed accounts, which means you’re not handling different types of credit at once. Lenders like to see that you can deal with different types of credit accounts, reflected in your credit mix, which accounts for 10% of your FICO® Score.[4] Because having a long, positive credit history can also help your credit score, closing an account may impact your score by lowering the age of your accounts.[5]

While paying off a loan can result in a credit score drop, you can build it back up over time by responsibly managing other accounts. Even after paying off your installment debt, it’s possible to achieve a high credit score if you continue to demonstrate positive financial behaviors.[6]

How does paying off a loan early hurt you?

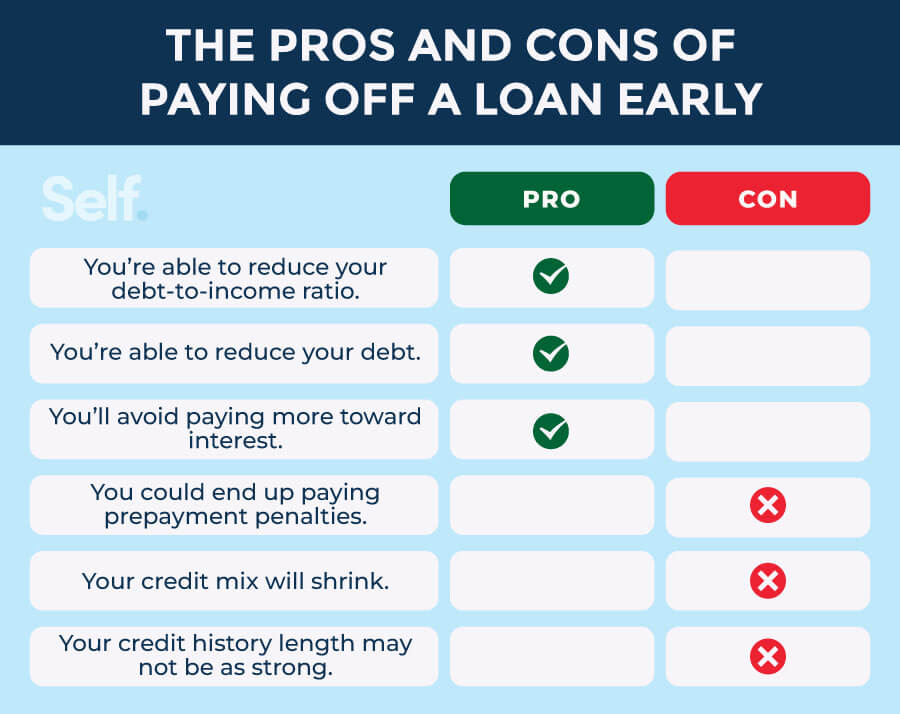

Paying off a loan early may mean paying extra in fees or penalties, and it may hurt your credit score by decreasing your credit mix and lowering your account age. Since the exact impact depends on your unique financial situation, however, you’ll need to weigh the pros and cons to see what makes sense for you.

You could end up paying prepayment penalties

Depending on your contract and whether your state’s laws allow it, paying off a loan early may come with prepayment penalties. If a lender wants to charge you for paying off the balance before the end of the loan term, your contract must include a prepayment penalty clause.[7] If you discover a prepayment penalty in your contract, you should compare that amount to how much you’d end up paying in interest for the term of the loan to decide if it makes sense to pay it off early.

Your credit mix will shrink

Paying off a loan can lower your credit score by reducing your credit mix. In the FICO® credit scoring model, credit mix determines 10% of your score. Keeping various types of credit accounts open — such as credit cards, retail cards and auto loans — can help you retain a good mix of credit, showing lenders you can handle different types of credit at once.[4]

Your credit history length may not be as strong

Longer credit histories tend to have a positive impact on credit scores. When you close an account by paying off a loan, it may drop your score by lowering the average age of your accounts and the length of your credit history. This factor accounts for 15% of your FICO® score, so you might consider keeping older accounts open rather than paying them off early.[5]

How does paying off a loan early help you?

While paying off a loan may temporarily drop your credit, it can also have positive financial effects. Consider the following benefits when weighing the pros and cons in your particular situation.

You’re able to reduce your debt-to-income ratio

When you apply for a loan, lenders consider the amount of debt you have compared to your income, also known as your debt-to-income ratio (DTI). Paying off a loan early may help you get approved for another loan if it keeps your DTI in the “manageable” range of 35% or lower.[8]

You’re able to reduce your debt

Paying off your loan may also help your credit by lowering the total amount of debt you have. Amounts owed on your credit accounts — including credit card debt, lines of credit and personal loans — makes up 30% of your FICO® Score. As the second-largest factor in your credit score, amounts owed is an important part of your credit performance.[9]

You may reduce your credit utilization ratio

For VantageScore®, paying off your loan may help you reduce your credit utilization ratio (CUR), which is your total debt divided by your total credit limits.

This credit scoring model includes credit utilization as a separate factor in its scoring system. Although it focuses more on revolving credit, VantageScore does take into account any balances you may have on installment loans. Because credit utilization is the third most important factor in VantageScore® 3.0 (accounting for 20%), paying off a loan may favorably impact your score.[10]

FICO® considers CUR as part of your total amounts owed, and it considers CUR only as revolving debt balances (like credit card accounts) divided by revolving debt limits.[11]

You’ll avoid paying more toward interest

Loan payments typically consist of both principal (the amount you borrowed) and interest (the cost a lender charges you for borrowing money and is typically a percentage charged on your principal). If you pay off a loan balance early, you can potentially save money on interest and use that extra money for other needs. If you don’t have a high interest rate, however, carefully evaluate whether paying off debt or saving money would benefit you more, especially if your loan agreement includes prepayment penalties.

Should you pay off your loan early?

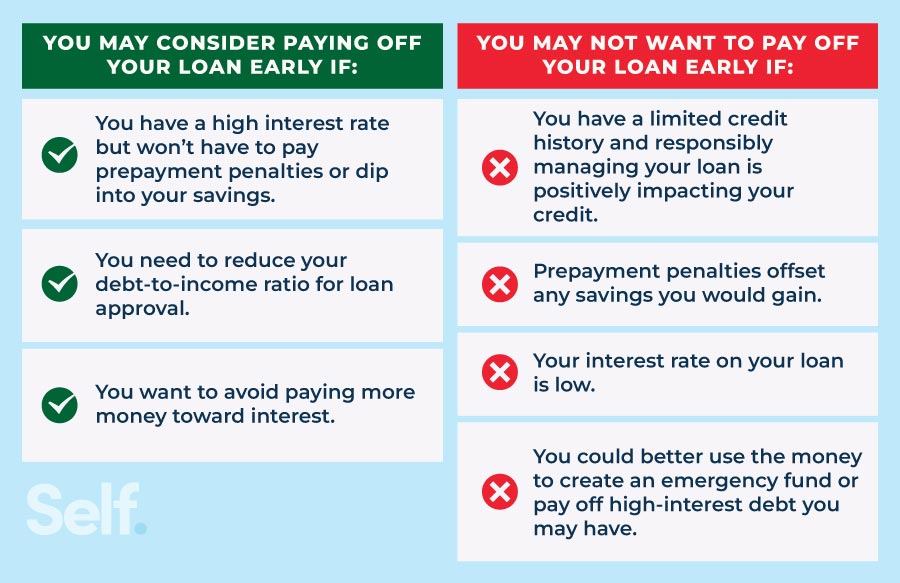

In the end, the decision to pay off a loan early depends on your financial situation. In some cases, it makes perfect sense to pay it off as soon as you can, while in others it won’t make a substantial difference in your life (and may even hurt your credit). When deciding whether or not to pay off a loan early, consider the following factors.

You may consider paying off your loan early if:

- You have a high interest rate, with a few caveats:

- You won’t have a prepayment penalty.

- You won’t have to dip into all of your your savings to pay it off early.

- You need to reduce your debt-to-income ratio for loan approval.

- You want to avoid paying more money toward interest.

You may not want to pay off your loan early if:

- You have a limited credit file and responsibly managing the loan is positively impacting your payment history, credit mix and length of credit history.

- Prepayment penalties are included in your loan agreement.

- You have a loan with a low interest rate and you can afford to pay it off at regular intervals.

- You could better use the money for an emergency fund or to pay off debt with a higher interest rate.

How to improve your credit score

If you have bad credit or a limited credit history, you may be looking for ways to lift your credit score. While there is no one-size-fits-all solution, the following tips can help you build credit and start working towards a good credit score.

- Become an authorized user: Having a trusted friend or family member add you as an authorized user on their credit card can allow you to piggyback off of their good credit. Make sure they responsibly manage their account, including paying their balances on time, have had the account open for a while and maintain a low CUR. Otherwise, it won’t likely help your credit score (and may even hurt it).

- Stay on top of your credit cards: With revolving credit accounts like credit cards, any balance you don’t pay by the due date will start to accrue interest. Making more than the minimum payment can help you avoid snowballing credit card balances.

- Make on-time payments: Payment history counts for the largest portion of your credit score, so paying on time is one of the most important things you can do to help your credit.

- Have a good credit mix: While you shouldn’t open unneeded credit accounts just to improve your mix, consider your overall credit diversity when deciding whether to close or open a new account.

- Dispute inaccurate information on your credit report: Credit reports sometimes contain mistakes that can damage your credit score, so make sure to regularly monitor yours. Federal law entitles you to a free annual report from the three major credit bureaus, which you can access at annualcreditreport.com. Because of the COVID pandemic, the three major credit reporting bureaus (Experian, Equifax and TransUnion) continue to offer free credit reports weekly through the end of 2023. Experian allows a free credit score as well.[12]

While an early payoff on your loan may cause a drop in your credit score, the exact impact varies by individual. Even if you see your score go down, however, positive credit management practices can help you build and maintain good credit over time. If you need a little assistance, Self offers a variety of services that can help you get your credit on track.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- MyFICO. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed on January 17, 2023.

- MyFICO. “Can Paying off Installment Loans Cause a FICO® Score To Drop?” https://www.myfico.com/credit-education/faq/scores/paying-off-installment-loan. Accessed on January 17, 2023.

- TransUnion. “The Difference Between Installment and Revolving Accounts,” https://www.transunion.com/blog/credit-advice/difference-between-installment-revolving-accounts. Accessed on January 17, 2023.

- MyFICO. “What Does Credit Mix Mean?” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed on January 17, 2023.

- MyFICO. “I recently paid off my car loan and my FICO® Score dropped. Is that possible?” https://support.myfico.com/hc/en-us/articles/4407687450647-I-recently-paid-off-my-car-loan-and-my-FICO-Score-dropped-Is-that-possible. Accessed on January 17, 2023.

- MyFICO. “What is the Length of Your Credit History?” https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed on January 17, 2023.

- Consumer Financial Protection Bureau. “Can I prepay my loan at any time without penalty?” https://www.consumerfinance.gov/ask-cfpb/can-i-prepay-my-loan-at-any-time-without-penalty-en-843. Accessed on January 17, 2023.

- Wells Fargo. “What is a Good Debt-to-Income Ratio?” https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/. Accessed April 7, 2023.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed on January 17, 2023.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore. Accessed on January 17, 2023.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed January 26, 2023.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed January 26, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).