How to Rebuild Your Credit: 8 Effective Strategies

Published on: 03/28/2023

When you experience financial difficulties, your credit score can suffer. Poor credit often makes it harder to qualify for credit cards, car loans, or mortgages. The good news is that there are effective strategies that can help you rebuild your credit.

While you may wish to fast track your financial improvement, achieving better credit requires time and effort. How long it takes to build credit depends on your unique financial situation and credit history.

Although your score won’t jump up overnight, you can follow the credit-building strategies described below as you work to rebuild credit.

8 strategies to rebuild your credit

You may have heard of all kinds of ways to repair your credit, but sometimes it’s difficult to separate fact from fiction. To set the record straight, we’ve come up with the eight best ways to rebuild your credit.

1. Check your credit report and correct any errors

The first step in rebuilding your credit involves finding out exactly what your credit file contains. Checking your credit report—and seeing all your credit accounts and balances listed there—shows you what potential lenders see when they check your report, which can help you better understand your financial position and help you detect any errors your report may contain.[1]

Federal law typically entitles you to a free credit report every year from each of the three nationwide credit bureaus, which you can access at AnnualCreditReport.com. Through 2023, you’re allowed a free credit report each week. You can also request a copy of your credit report any time you like for a fee directly from the reporting agencies (Experian, Equifax, TransUnion). They cannot legally charge you more than $14.50 for each report [2].

If you find mistakes in your credit report, contact the credit bureau and the business that reported the inaccurate information in order to dispute it. After you file a dispute, the credit bureau has 30 days to investigate it and must do so for free. Note that you can only dispute negative information if it contains errors or inaccuracies.[3]

2. Pay your bills on time (and catch up on overdue ones)

Whether you pay your bills late or on time has a significant effect on your credit score. In fact, payment history impacts your credit more than any other individual factor, making up 35% of your FICO® score [4] and 40% of your VantageScore®.[5] Setting reminders and enrolling in autopay for at least the minimum payment can help you avoid delinquencies.[6]

Delinquent payments can remain on your credit report for seven years from the original delinquency date—and the more due dates you miss, the greater the negative impact is on your credit score.[6], [7]

3. Keep your credit utilization ratio low

Your credit utilization ratio (CUR), which shows how well you manage credit card debt, is calculated by dividing your total revolving debt by your total revolving credit limits. This number makes up 20% of your VantageScore® [5] and contributes to the total amounts owed category, which makes up 30% of your FICO® score.[4] Keeping your CUR low will positively impact your credit.[8]

If you often max out your credit cards or use most of your available credit, it might imply that you’re struggling to manage your finances without debt. However, having a CUR of 0% shows you’re not using your credit at all. Some experts suggest maintaining a CUR below 30%, with a number below 10% generally offering the best chance of building good credit scores.[8]

The following guidelines can help lower your CUR:

- Pay down existing debt as quickly as possible: Chipping away at chronic credit card debt can improve your CUR and your personal finances overall.

- Don’t spend too much on your credit cards: Remember that credit utilization is a ratio (CUR) that divides total revolving debt by total revolving credit limits. So while a charge on one credit card may barely make a dent in your available credit for that card, it can add up in terms of your CUR when viewed across all cards.

- Keep old credit cards instead of closing the account: Whenever you close a credit card account, it lowers your total available credit. So if you no longer use a certain card, consider keeping it open — as long as you don’t have to pay an annual fee or find yourself tempted to overspend.

- Make payments before the statement closing date: If you do incur larger credit card balances, try to pay them off by the due date. If you can’t pay the entire balance, pay as much as you can afford by the due date and at least the minimum due. Making a larger payment before your statement closing date means you’ll have a lower balance reported to the credit bureaus, which helps your CUR. [8]

4. Apply for a credit builder loan

Designed specifically for people with bad credit or a limited financial history, credit builder loans work a little differently than typical loans. After approving your application for a traditional loan, the lender gives you a lump sum of money upfront, which you pay back in installments. With a credit builder loan, however, your loan funds are secured in a savings account or certificate of deposit (CD) after you are approved. Then you make monthly payments, and at the end of the loan receive the money back (minus interest and fees). Because your payments get reported to the credit bureaus, credit builder loans can improve your credit history.

Self’s Credit Builder Account (CBA) offers you a way to build both savings and credit history at the same time. After approval, the funds for your loan are secured in a bank-held (CD). You make your monthly payments, and Self reports those payments to all three credit bureaus. At the end of the period, you get the money back minus interest and fees. You can then use the money for any purpose you wish, while having the opportunity to build credit in the process.

5. Get a secured credit card

If credit card companies have rejected your applications for a new account, you may consider opening a secured credit card. Unlike standard credit cards, secured cards require a cash deposit upfront as collateral. Your security deposit typically acts as your credit limit, so you can use the card to make charges up to the amount you deposited.

While you can’t open a secured card without collateral, on-time payments can build positive payment history just like regular credit cards. If you can qualify for a standard credit card, however, that usually makes the better choice.

One secured option, the Self Visa® Secured Credit Card, is an option for eligible applicants without a hard credit check. All you need is a Credit Builder Account in good standing, three monthly on-time payments, and a savings progress of $100 or more, which you can use as a security deposit for your card. (These requirements are subject to change.) Self’s secured card allows you to set (and potentially increase) your credit limit based on your savings.

6. Become an authorized user on a credit account

Becoming an authorized user of a credit card may help you piggyback off the established history of the account owner. See if a trusted individual with good credit, such as a family member, will agree to add you to their account. Seek out someone who pays their credit card balances on time, maintains a low CUR, and preferably has had the account open for a while. If they do, becoming an authorized user on their account may positively impact your credit score.

Be aware that the reverse can also hold true. If the primary account holder misses payments or has a high CUR, being an authorized user may have no impact or even a negative impact on your credit score. Also check whether the credit card issuer reports to all three major credit bureaus, as not all of them do.

Your own credit history factors into how much your authorized user status affects your credit score. If you have poor credit, you may see less of a positive impact than a newcomer who has no credit history at all. Note that liability for the debts falls only on the primary cardholder, so you will need to set up an arrangement for repaying them for any charges you make.[9]

7. Find a cosigner for a loan (if you’re struggling to get approved)

Because personal loans don’t usually have collateral to back them up, they often require good credit for approval. If you have trouble qualifying on your own, a co-signer with good credit may help you get approved. The loan will appear on both the primary borrower and the co-signer's credit report, so making on-time payments may help build credit for both parties. However, this option also includes risk for the co-signer because any missed payments may negatively affect both individuals’ credit scores.[10]

Taking out a loan may also help you build credit by contributing to your credit mix, which accounts for 10% of your FICO® score. Having different types of credit—such as an auto loan and a credit card—shows whether you can manage a variety of accounts successfully.

However, credit scoring models reflect the payment history of these accounts, too, not just your credit mix. So you shouldn’t take out different credit products just to improve your mix, especially if they increase the risk of falling behind on payments.[11]

8. Be cautious applying for a lot of new credit at once

Opening new credit accounts can help you build a credit history, improve your credit mix and lower your CUR (if you don’t use a lot of credit). However, opening multiple new accounts in a short time frame can also drop your credit score.

Applying for new credit usually triggers a hard inquiry on your credit report, which can take a few points off your score. In addition, opening new accounts lowers your average account age, which can potentially ding your credit score. Finally, lenders may see opening a lot of new credit accounts at once as a sign of risk, especially for people without a long credit history.[12]

How long does it take to rebuild credit?

How long it takes to rebuild your credit depends on many factors, including your unique financial situation and credit history. Although there is no guaranteed timeframe, you may see your credit score go up by applying the strategies that help build a positive credit history.

How long does negative information stay on your credit report?

Most negative items stay on your credit report for 7 to 10 years, but the older they are the less impact they usually have.[13] Below are some examples of the types of negative information that can appear on your credit report and how long it may stay there.

- Late payments: 7 years

- Bankruptcies: 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies

- Foreclosures: 7 years

- Collections: Generally about 7 years, depending on the age of the debt being collected.

- Public Record: 7 years

[13]

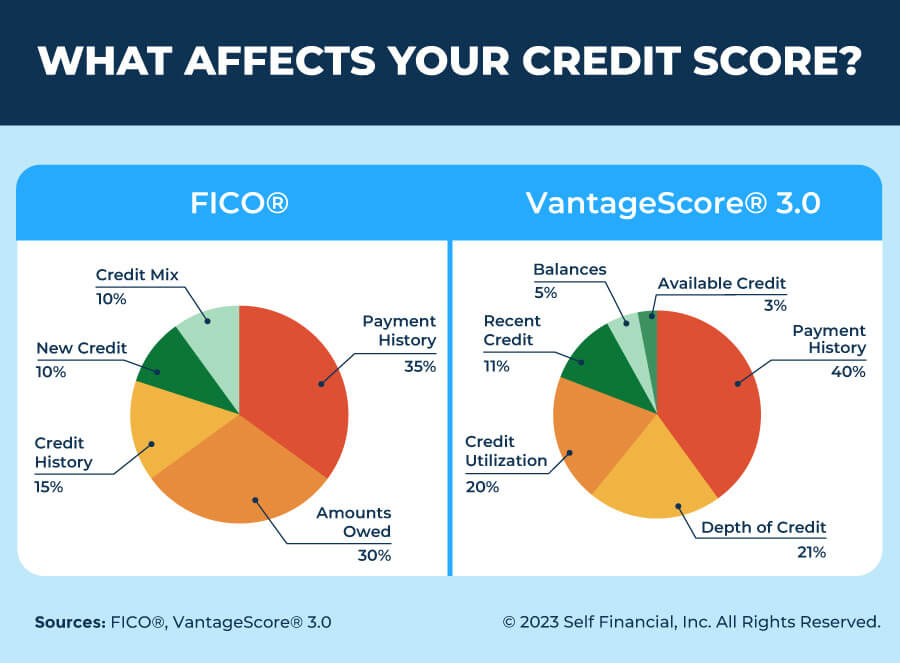

What affects your credit score?

While various scoring model companies use similar credit score factors in their calculations, there are some differences among them. The two most commonly used scoring models, FICO® and VantageScore®, both consider information reported to the three main credit bureaus (Experian, Equifax and TransUnion) but weigh the data slightly differently.

FICO® uses the following factors to calculate your credit score:[4]

- Payment history (35%): The most important component of your credit score, payment history reflects whether you make on-time payments in full or have a history of late payments.

- Amounts owed (30%): This factor includes the total amount of debt you owe on credit cards and loans, as well as your credit utilization rate (the amount of revolving debt you owe divided by the total amount of your revolving credit limits).

- Credit history (15%): Credit history deals with the length of time that you have had credit. Generally, having a longer credit history is beneficial for your credit scores.

- New credit (10%): This factor covers recent credit inquiries and new lines of credit. Inquiries typically have a smaller impact and this score allows for rate shopping, offering a 14-day or 45-day window when rate shopping for a new loan like mortgages, auto loans and student loans.[14]

- Credit mix (10%): Your FICO® score takes into account whether you have a good mix of credit products, such as personal loans, credit cards, car loans, student loans, or a mortgage.

VantageScore® 3.0 breaks its scores down as follows: [5]

- Payment history (40%): Just like the FICO® model, VantageScore® uses payment history as the most important factor in determining your score. This component reflects whether you make on-time or late payments.

- Depth of credit (21%): This category considers both the age of your credit accounts as well as the type of credit accounts you have (known as “credit mix” for FICO® scoring).

- Credit utilization (20%): This factor looks at the relationship between the credit you use and the credit you have access to. While it focuses on revolving credit (like FICO®), the VantageScore® considers installment loans as well. VantageScore® suggests keeping your CUR (the ratio of revolving debt compared to your credit limit) above 0% but below 30%.

- Recent credit (11%): This category weighs the number of accounts you’ve opened recently as well as the number of hard inquiries on your credit report. To account for rate shopping, VantageScore® considers all hard inquiries within a 14-day period as one inquiry.

- Balances (5%): This factor calculates the total remaining balances on both current and delinquent accounts.

- Available credit (3%): This component looks at how much available credit you have on revolving accounts.

Taking the first steps to rebuild your credit

While you can’t rebuild credit instantly, you can start taking steps to meet your financial goals right away. Self has tools that may help you on your journey to better credit—no matter what your credit score. You can start building credit with a Credit Builder Account, apply for a secured credit card once you qualify, and track how your credit score changes over time.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Equifax. “Why Should I Check my Credit Reports and Credit Scores?” https://www.equifax.com/personal/education/credit/report/why-check-your-credit-reports-and-credit-score/. Accessed on January 6, 2023.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed on January 6, 2023.

- Federal Trade Commission. “Disputing Errors on Your Credit Reports,” https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed on January 6, 2023.

- MyFICO. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed on January 6, 2023.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed on January 6, 2023.

- Experian. “What Is a Delinquency on a Credit Report?” https://www.experian.com/blogs/ask-experian/what-is-a-delinquency-on-a-credit-report/. Accessed on January 6, 2023.

- MyFICO. “Glossary of Credit Terms,” https://www.myfico.com/credit-education/glossary#D. Accessed on January 6, 2023.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed on January 6, 2023.

- Experian. “Credit Card Authorized User: What You Need to Know,” https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user/. Accessed on January 6, 2023.

- Experian. “Can You Get a Personal Loan With a Cosigner?” https://www.experian.com/blogs/ask-experian/can-you-get-a-personal-loan-with-a-cosigner/. Accessed on January 6, 2023.

- MyFICO. “What Does Credit Mix Mean?” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed on January 6, 2023.

- MyFICO. “What is New Credit?” https://www.myfico.com/credit-education/credit-scores/new-credit. Accessed on January 6, 2023.

- MyFICO. “Chapter 7 & 13: How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed on January 6, 2023.

- MyFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed on January 13, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).