What Is FICO® Score 9? How It Compares to FICO® Score 8

Published on: 02/10/2023

FICO® Score 9 is the second-latest version of the credit scoring model created by the Fair Isaac Corporation. While the score ranges are identical to older versions, FICO® designed this version to be more predictive of lending risk than previous versions.[1]

Though the FICO® Score 9 is an updated version of FICO® Score 8, the FICO® Score 8 is still the most widely used base score by lenders, meaning that, while you may have a better credit score from the FICO® Score 9 model, lenders are more likely to still use the previous version.[2]

In this article, we explain the details of FICO® Score 9, FICO® credit scoring factors, the differences between FICO® Score 8 and 9 and credit-building tips.

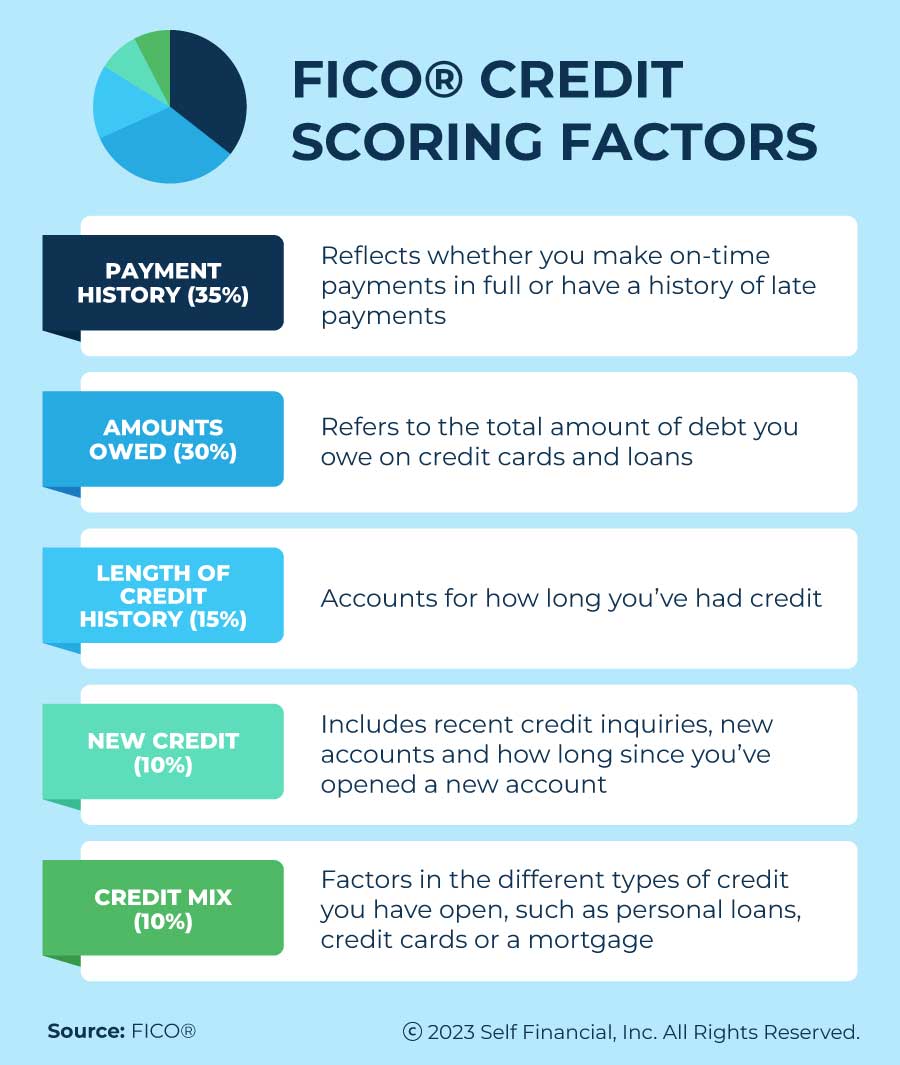

What are the FICO® credit scoring factors?

While FICO® uses the same general factors to calculate FICO® Scores, a FICO® Score 8 may differ from a FICO® Score 9 because various details of your credit report, like paid versus unpaid collections accounts, are weighted differently.

FICO® credit scores use the following factors to calculate a score:[3]

- Payment history (35%): The most important credit scoring factor, payment history takes into account whether you make on-time payments in full or have a history of late payments or delinquency.

- Amounts owed (30%): This factor is made up of the total amount of debt you owe across your credit accounts, like on credit cards and loans, as well as your credit utilization rate (CUR), which is your total revolving debt divided by your total revolving credit limits.

- Credit history (15%): This factor tracks the length of time you’ve had credit.

- New credit (10%): This factor considers your recent credit inquiries and new credit accounts.

- Credit mix (10%): This factor evaluates the different types of credit accounts you have open to see how you handle different credit products, like personal loans, credit cards, car loans, student loans and mortgages.

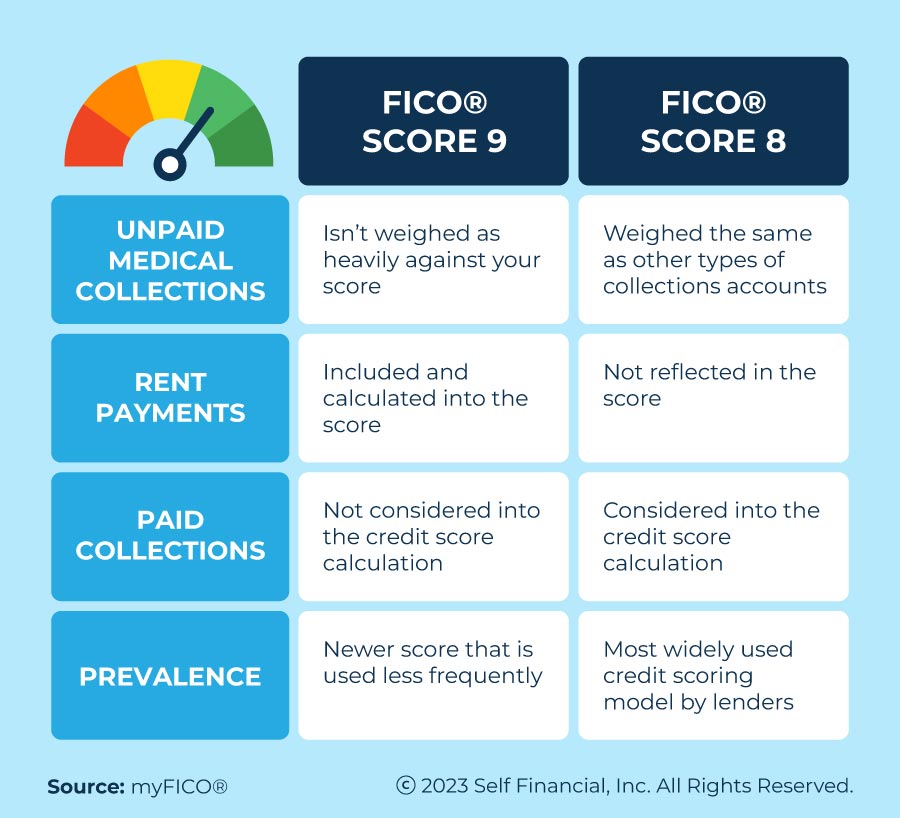

FICO® Score 9 vs. FICO® Score 8

As an update to the FICO® Score 8, the FICO® Score 9 differs in several ways to reflect current trends in consumer credit habits. Checking out the following key differences between these credit scoring models can help you understand why one of your scores may be different from the other.

Medical collections are treated differently than other collection types for FICO® Score 9

Medical collections are weighted differently than other collection accounts for FICO® Score 9. FICO® and the Consumer Financial Protection Bureau found that unpaid medical debt was less indicative of creditworthiness — your likelihood of paying back what you owe or credit risk. So unpaid medical debt now has less of a negative impact on credit score calculations than it did in previous versions.

While this is good news for borrowers who have had their unpaid medical bills accumulate into unpaid medical debt, this change only affects lending decisions or credit evaluations based on FICO® Score 9. If the lender uses a previous FICO® score version, like the FICO® Score 8, medical collections will be treated like any other type of collections accounts.[2], [4]

Rent payments are included in FICO® Score 9 calculation

Previous FICO® versions didn’t include rental history, or payment history for rent payments, in credit score calculations, although it was sometimes reflected on credit reports. FICO® Score 9 now takes rental payment history into account, which helps borrowers with little to no credit history as well as those who make on-time rent payments.

Making on-time payments through a third-party rental reporting company, like LevelCredit, or through a landlord who reports them to the major credit bureaus, may have a positive impact on your FICO® score as determined by the FICO® Score 9.[2]

Paid collections no longer have a negative impact on FICO® Score 9 calculations

If you’ve dealt with a collection agency, you may be encouraged to know that FICO® Score 9, does not factor paid collections into the credit score. So with FICO® Score 9, your score no longer feels the negative impact once your debt is paid in full.

On the other hand, FICO® Score 8 includes unpaid and paid collections accounts in credit score calculations, which can have a negative impact on your credit score after the collection debt has been paid off unless the amount is less than $100.[5]

FICO® Score 8 is the most used credit score model by lenders

FICO® Score 8 is still the most widely used credit scoring model[2], with 90%[6] of lenders using some version of FICO® and some using VantageScore.

You can check both your FICO® Score 8 and 9 and see the differences in your FICO® scores through FICO® Open Access.[7] Then you can get your free credit report to see what items may be making a difference between your scores.

You’re entitled to a free credit report once per year from each of the major credit bureaus, which you can access at AnnualCreditReport.com. You can also check your credit report for a fee any time you like with any of the three major credit bureaus (Experian, Equifax and TransUnion).

Understanding the differences between the newer and older versions helps you understand why your scores may differ. With your credit report, you can see what items FICO® is factoring into your scores and determine what you might adjust in your personal finances and credit habits to give your scores a positive impact.

Which credit score version do lenders use?

Lenders can choose which credit score they use when assessing applications. Not only might lenders use base credit scoring models, but they can also use industry-specific credit models. Lenders determine which score to use based on the credit product type and whether they want a more detailed credit risk prediction tailored to that specific type of credit.[2]

Some industry-specific FICO® scores include:

- FICO® Auto Score: Lenders may use this score if you apply for an auto loan.

- FICO® Bankcard Score: Credit card issuers may check this score if you apply for a credit card.

Base credit scoring models like FICO® Score 8 and FICO® Score 9 can be used by lenders for these credit products and a range of others. Lenders may check your FICO® score if you apply for a mortgage, personal loan, student loan, credit card or other credit accounts.[2]

How to check your FICO® score?

You can check your FICO® scores for free or through some credit card providers and FICO® Score Open Access[7], which works with credit card issuers and other financial institutions to give you free access to your credit scores.

How can I improve my credit score?

If you’re struggling to improve your credit score, try these strategies:[3]

- Make payments on time. Making on-time payments over time not only contributes to the most important FICO® credit scoring factor, payment history, but also demonstrates to lenders that you’ll pay back debts as agreed.

- Pay down debt balances. Although keeping your CUR (your revolving debt balance divided by your revolving credit limit) between 10% and 30% is a step in the right direction, experts suggest that staying closer to 10% offers you the best chance of gaining a positive impact on your score.[8]

- Keep credit accounts open. The longer your credit accounts are open, the more opportunity you have to show you manage them well. FICO® reports that longer credit histories always impact scores positively.[9]

- Have a mix of credit accounts. Having a good credit mix for which you make on-time payments indicates to lenders that you can handle multiple types of debt. However, you don’t need to apply for new accounts just to add to your credit mix.[10]

- Add new credit only when you need it. Although having a mix of credit that you pay on time can positively impact your score, avoid opening accounts you don’t need. Each hard inquiry — when you authorize lenders to pull your credit to assess your loan or credit application — can slightly decrease your score temporarily.[11]

Whether you’re starting from scratch or are on the road to recovery, it takes time to build credit. With the information in this article, you have some insight into how FICO® scores are calculated and how to work on yours.

If you need more help along the way, check out some of Self’s credit products for support at any stage of your credit-building journey.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- FICO®. “FICO® Score 9 Now Available to Consumers at myFICO.com,” https://www.fico.com/en/newsroom/fico-score-9-now-available-consumers-myfico-com. Accessed October 12, 2022.

- myFICO®. “FICO® Score 8 and Why There Are Multiple Versions of FICO® Scores,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed October 12, 2022.

- myFICO®. “How are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed October 12, 2022.

- Consumer Financial Protection Bureau. “CFPB Estimates $88 Billion in Medical Bills on Credit Reports,” https://www.consumerfinance.gov/about-us/newsroom/cfpb-estimates-88-billion-in-medical-bills-on-credit-reports/. Accessed October 12, 2022.

- myFICO®. “7 Common Questions about Collections and FICO® Scores,” https://www.myfico.com/credit-education/blog/7-common-collection-questions. Accessed October 12, 2022.

- myFICO®. “What is a Credit Score?” https://www.myfico.com/credit-education/credit-scores. Accessed October 12, 2022.

- FICO®. “FICO® Score — The Score that Lenders Use,” https://www.ficoscore.com/where-to-get-fico-scores#OpenAccess. Accessed October 12, 2022.

- myFICO®. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed October 21, 2022.

- myFICO®. “What is the Length of Your Credit History?” https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed October 21, 2022.

- myFICO®. “What Does Credit Mix Mean?” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed October 21, 2022.

- myFICO®. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed October 21, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).