VantageScore® vs. FICO®: How Credit Score Models Differ

Published on: 03/29/2023

Credit scoring models are the mathematical models used to determine your credit score, which lenders consider — in addition to other factors — when assessing your applications for credit. Taking into account your recent credit behavior, such as credit usage, payment history and length of credit history, these models calculate the probability that you would default on what you borrow.

There are two main types of credit scoring models: VantageScore® and FICO®, and each model has different versions. All three of the major credit bureaus — TransUnion, Equifax and Experian — use a version of FICO scores, but your score may vary based on which version is used as well as which report was used to collect your information. The VantageScore scoring system, created in collaboration with the three credit bureaus, may be used to generate a score, too.[1] But VantageScore and FICO calculate your credit scores differently.

The different types of credit scores may vary, and these credit scoring models can affect your chances of being approved for loans and other types of credit. Lenders select a specific credit scoring model to use when evaluating applications for credit. So you should check the information reported by all three bureaus and how their scoring systems process that information to know where you stand.[2]

In this article, we go over the main credit scoring models, the differences between them and how to stay on top of the information used to calculate your credit score.

Table of contents

- What is a FICO® score?

- What is a VantageScore®?

- How FICO and VantageScore compare

- Why is one credit score higher than another?

- How to get your credit score

What is a FICO score?

A FICO® score is a type of credit score developed by the Fair Isaac Corporation, a three-digit number that measures your ability to pay back what you owe, based on how you measure up against several factors, like payment history, amounts owed and credit utilization. The FICO credit score range is 300 to 850, with good credit scores falling in the range of 670 to 739.

FICO is an incredibly common credit scoring model, with 90% of top lenders[3] taking your FICO credit score into account when determining your likelihood of not paying what you owe or the likelihood that you may fall behind for at least 90 days on a bill in the next two years. Other companies, such as utility companies, may also check FICOscores to decide if you must pay a deposit or provide a letter of guarantee to start service.

FICO® credit scoring models[4] include:

- FICO® 8: The FICO® 8 score is a base credit scoring model developed and released by FICO® in 2009. It’s still one of the most commonly used credit scoring models today.

- FICO® 9: The FICO® 9 score treats some types of debt differently than previous FICO® scoring models — any third-party collections accounts that are paid off in full have no negative impact on your credit report, and unpaid medical debt collections accounts have less of a negative impact. (Since unpaid medical debt in collections isn’t reported for a year and medical debt under $500 isn’t reported at all, you may not see an impact to your score.) Reported rental payment history can also be factored into your credit score.[5]

- FICO® 10, 10T and XD: These variations of the FICO® credit score attempt to build on previous versions of the scoring system to cover more modern shifts in consumer credit data. While the FICO® 10 score is basically an update of the FICO® 9, the FICO® 10T specifically uses trend data, calculating your credit score based on a longer period of time (24 months or more), rather than mainly weighing your most recent credit behavior. FICO® XD is designed to evaluate previously unscorable borrowers who have little to no credit history.

What is a VantageScore?

A VantageScore is a credit score determined by a credit scoring model created in collaboration with the three major credit bureaus, TransUnion, Experian and Equifax.[6] VantageScore models allow consumers with thin credit files — 21% of millennials — as well as borrowers with young profiles, dormant profiles and no trades to be scored. VantageScore® use has allowed 37 million more consumers who were previously unscorable to have credit scores.[7]

VantageScore® credit scoring models include:

- VantageScore 3.0: VantageScore® 3.0 uses trending consumer credit information to expand the range of who could be considered a scorable borrower. It ignores collections accounts that are paid in full, gives less weight to medical collections accounts, even if they’re unpaid.[8],[9]

- VantageScore 4.0: VantageScore® 4.0 builds upon the predictive ability of VantageScore 3.0, but is better adapted to consumer credit trends due to innovations in machine learning that use algorithms and data combined with expert human analysis to better understand consumer habits. Like VantageScore 3.0, it ignores paid collections accounts and gives less weight to medical debt.[9],[10]

When considering the impact medical debt has on your credit score, changes in reporting are worth noting, specifically:

- Paid medical debt from collections is no longer reported.

- Medical debt in collections will not be reported for a year.

- Medical debt under $500 will not be reported at all, beginning the first half of 2023.

[5]

How FICO and VantageScore compare

As credit scoring models, FICO and VantageScore are designed to evaluate the same thing: your likelihood of paying back what you owe, which is what many people commonly think of as “creditworthiness.” How they determine your credit score is pretty similar, taking much of the same information into account, but there are key differences between them, too.

Here’s how these two credit scoring models compare, and how you may end up with different credit scores from each.

Both FICO and VantageScore scores range from 300 to 850

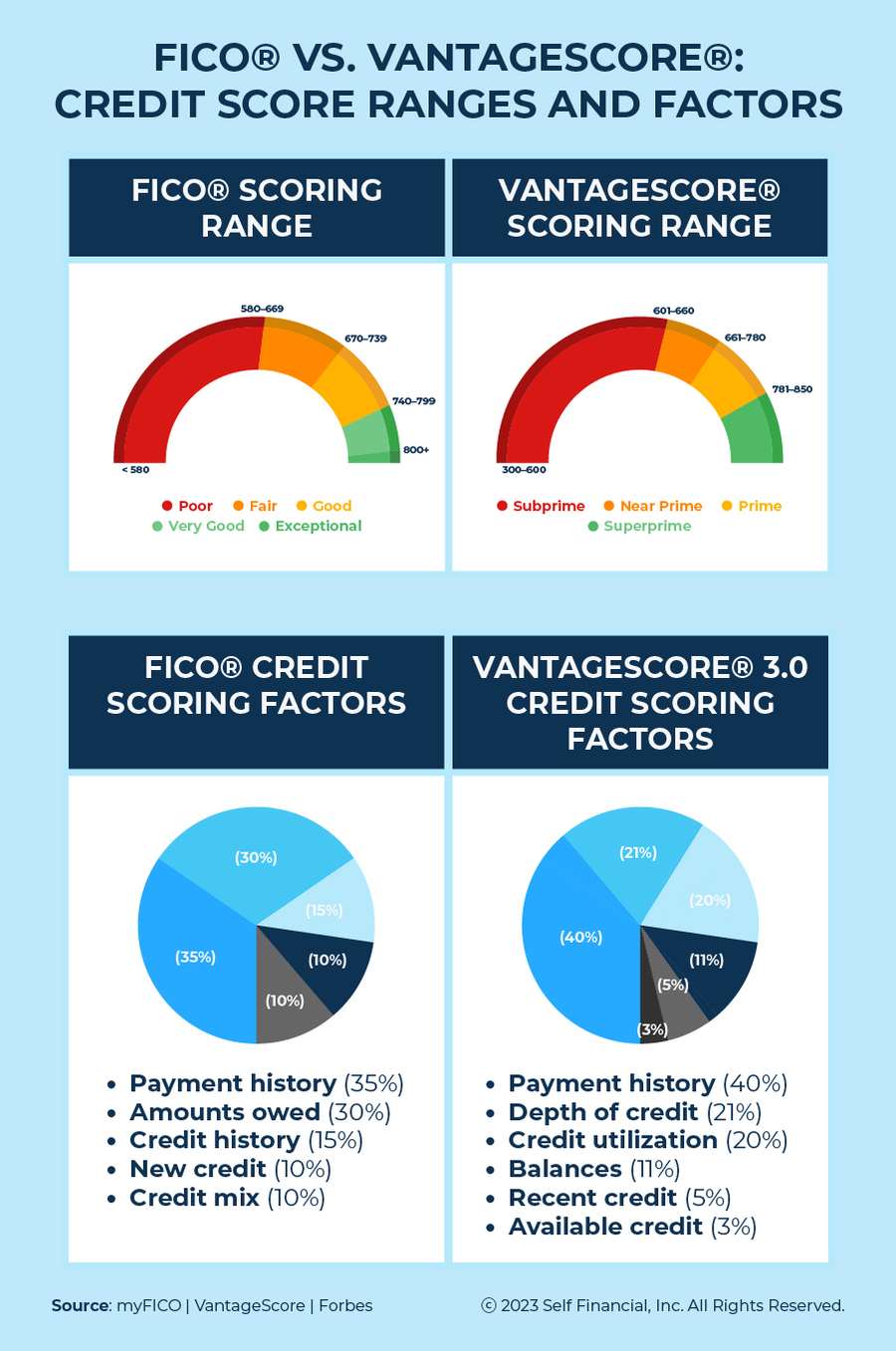

Though the credit score range for both FICO and VantageScore is the same, with a low end of 300 and high end of 850, they consider credit scores somewhat differently, with different cutoffs to determine what is poor, good and excellent.

A “prime” VantageScore starts at a lower number than a “good” FICO score

VantageScore’s “prime” credit score range is reached by having a credit score of 661 or higher. FICO, on the other hand, considers a “good” credit score to start at 670.

FICO® score models range as follows:[3]

- Poor: < 580

- Fair: 580–669

- Good: 670–739

- Very Good: 740–799

- Exceptional: 800+

VantageScore® models range as follows:[6]

- Subprime: 300–600

- Near Prime: 601–660

- Prime: 661–780

- Superprime: 781–850

FICO calculates your credit score based on fewer factors

While these credit scoring models take some of the same factors into account, what makes up your credit score and how the factors are weighed differs. For starters, FICO uses five total factors to determine credit scores, while VantageScore uses six. The factors themselves, other than payment history, are different too.

FICO and VantageScore weigh credit score factors differently

The two credit scoring models pull information from your credit report. However, how they consider that information, including what nuances are weighed the most, differs between the FICO and VantageScore models.

Payment history is weighted the highest for FICO scores, making up 35% of your FICO credit score. VantageScore also weighs payment history the highest, but at 40% of your VantageScore credit score.

FICO breaks down its scores as follows:

- Payment history (35%): This category influences your score the most. It reflects whether you make on-time payments in full or have a history of late payments.

- Amounts owed (30%): This factors the total amount of debt you owe on credit cards and loans, as well as your credit utilization rate (CUR), the amount of revolving debt you owe divided by the total amount of your revolving credit limits.

- Credit history (15%): This deals with the length of time that you have had credit.

- New credit (10%): This factor covers recent credit inquiries and new lines of credit.

- Credit mix (10%): Your FICO score takes into account the different types of credit you have open, assessing whether you have a good mix of credit products, such as personal loans, credit cards, car loans, student loans or a mortgage.[11]

VantageScore breaks its scores down as follows:

- Payment history (40%): Just like the FICO model, VantageScore considers this factor to be highly influential to your score. It reflects whether you make on-time or late payments.

- Depth of credit (21%): This category considers both the age of your credit accounts as well as the type of credit accounts you use.

- Credit utilization (20%): Slightly different than the credit utilization referred to with FICO scoring, this factor looks at the relationship of credit you use and the credit you have access to. While revolving credit is the focus, installment loans are considered as well. When it comes to your credit utilization ratio (CUR), the ratio of revolving debt compared to your credit limit, VantageScore suggests keeping this above 0% but below 30%.

- Recent credit (11%): This category weights the number of accounts you’ve opened recently as well as the hard inquiries reflected on your credit report. All hard inquiries within a 14-day period will be considered as one inquiry by VantageScore.

- Balances (5%): With this factor, VantageScore evaluates the remaining balances on your current and delinquent accounts.

- Available credit (3%): As the category suggests, this factor looks into how much available credit you have on revolving accounts.[6]

FICO and VantageScore both help lenders determine risk

FICO and VantageScore both serve the same purpose, determining your credit score for lenders to review when they’re deciding whether or not to give someone credit. Higher scores from both credit scoring models are generally associated with less risk, but because lenders assess more than just your credit score, specific scores are never guarantees that your credit application will be approved. Your credit score is just one of many factors lenders use to examine your application.

FICO and VantageScore both comply with the Equal Credit Opportunity Act

Both credit scoring models comply with the Equal Credit Opportunity Act (ECOA). The ECOA ensures that credit scores are fair and accessible to consumers, protecting them from any form of discrimination, like a denial of credit on the basis of race or sex.[12] [13]

FICO offers a longer rate-shopping window than VantageScore

When shopping around for a mortgage, student loan or other type of loan, you may run into credit inquiries as part of the qualification process. When you apply and authorize lenders, like mortgage lenders or other credit issuers, to access your credit file, this access becomes a hard inquiry. Soft inquiries occur for non-lending related inquiries, when lenders look at your existing obligations against your current credit situation, or when lenders look at your credit file for possible preapproval offers. Soft inquiries generally don’t affect your credit score, while hard inquiries stay on your credit report for up to two years, and can negatively impact your score temporarily.

When rate shopping for loans, older FICO versions consider multiple inquiries made during a 14-day period as just one inquiry while newer versions offer a 45-day window for rate shopping. This rate-shopping window applies only when rate shopping for the same type of loan.

FICO also only considers inquiries that happen within the past 12 months, though the inquiries still stay on your credit report for two years.[14]

VantageScore, on the other hand, has a more limited rate-shopping window, giving consumers only 14 days.[15] All inquiries made within that period, however, are still considered just one inquiry on your credit report, as long as you stick to the same type of loan.

FICO and VantageScore have different minimum requirements to get a credit score

FICO and VantageScore have different criteria for who can get a credit score. VantageScore has fewer, or lower, minimum requirements by comparison, because it was designed to help previously unscorable consumers qualify for credit scores.

While FICO requires consumers to have at least one open credit account that’s at least six months old, and one account reported to the credit bureaus within the past six months,[16] VantageScore requires consumers to have only one active tradeline, regardless of age, or to have external collections or public records in their file.[17]

Why is one credit score higher than another?

If you check your credit reports between the three credit bureaus, you may find that you have different information listed on them, and thus you’ll generate a different credit score based on that information. The differences in your credit scores depend on both the credit scoring model used and the credit reporting company being used by your lender.

One score might be higher or lower than another based on what information is being considered by your lender, and how the pieces of that information are weighted according to the model.[18]

Your lender is checking a specific credit score model

Specific credit scoring models can produce higher or lower scores. This happens even when the models are created by the same company.

For example, your credit score according to the FICO 8 may be higher or lower than if your credit score was determined by an older FICO model. This is because of how trends in consumer data have changed newer models. FICO 8 specifically is more forgiving of one-off late payments of 30 days or more, as well as of debt collections accounts; previous FICO models factored these into your credit score, no matter how small the debt was.

FICO scores are specific to each credit bureau

FICO credit scores can also vary between credit reports because they’re specific to each credit bureau. If your lender is checking your FICO score through Experian, it might be different from the credit score you got from Equifax or TransUnion, even slightly. This is why it’s important for you to know your FICO scores from all three credit bureaus.

An industry-focused credit score model is used for specific credit products

Industry-specific credit score models are optimized for specific types of credit products. While the scoring system for these is the same as a base credit scoring model, they’re calibrated to determine risk as it relates to that specific product. An industry-specific credit score for an auto loan, for example, would weigh your experience with auto loans more heavily than your experience with other types of credit.

These models also have slightly different credit scoring ranges, with FICO’s industry-focused credit scores ranging from 250 to 900 instead of the standard 300 to 850.

How to get your credit scores

You’re entitled to request free copies of your credit report from all three credit reporting agencies once each year, through AnnualCreditReport.com or by calling 1-877-322-8228.[19]

FICO allows you to keep tabs on your FICO score regularly through its myFICO portal. You can open a free myFICO account for a free credit score, monthly Experian credit report and monthly Experian credit monitoring, or sign up for paid membership for added benefits.[20]

VantageScore®, offers free credit scores to consumers through its partners.[21] If you have a credit card, you may also be able to access free credit monitoring tools through your card issuer.

Keeping tabs on your credit score is essential

One of the best ways to stay on top of your personal finances is to check your credit score regularly. Checking your credit report and score whenever possible keeps you aware of any fluctuations, behaviors that might negatively impact your credit and mistakes on your credit report that you’d want to dispute. It also helps you make better decisions if you’re trying to make a large purchase or take out a loan.

Information is empowering. If you don’t know where you stand, it’s hard to know how to work towards better credit. And as an added bonus, regular credit monitoring helps protect you from risks like fraud or identity theft.

If you’re feeling overwhelmed by your financial situation, or are struggling to build or maintain good credit, Self is here to support you throughout your journey. Whether you’re in need of credit repair or are just getting started, Self has credit-building tools for any situation. The sooner you get started on your journey, the closer you’ll be to reaching your financial goals.

Disclaimer:__ FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.__

Sources

- Business Insider. "What is a VantageScore?" https://www.businessinsider.com/personal-finance/credit-score/what-is-vantagescore?. Accessed September 24, 2022.

- FICO®. “Do I need to know all my FICO® scores?” https://www.myfico.com/credit-education/faq/scores/do-i-need-to-know-my-scores-for-all-bureaus. Accessed September 24, 2022.

- FICO®. “What is a FICO® Score and why is it important?” https://www.myfico.com/credit-education/what-is-a-fico-score. Accessed September 24, 2022.

- FICO®. “FICO® 8 Score and Why There Are Multiple Versions of FICO® Scores,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed September 24, 2022.

- Equifax. "Can Medical Collection Debt Impact Credit Scores?" https://www.equifax.com/personal/education/credit/score/articles/-/learn/can-medical-debt-impact-credit-scores/. Accessed January 3, 2023.

- VantageScore®. “The Complete Guide to Your VantageScore®,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed September 24, 2022.

- VantageScore®. “VantageScore’s Key Benefits,” https://vantagescore.com/lenders/why-vantagescore/key-benefits/. Accessed October 6, 2022.

- VantageScore®. “VantageScore® 3.0,” https://vantagescore.com/wp-content/uploads/2022/01/VantageScore3-0_WhitePaper.pdf. Accessed September 24, 2022.

- Capital One. "Do medical bills affect your credit?" https://www.capitalone.com/learn-grow/money-management/how-medical-bills-affect-credit/. Accessed October 6, 2022.

- VantageScore®. “Ushering in a new standard for credit scoring,” https://vantagescore.com/wp-content/uploads/2022/09/4.0-Fact-Sheet-UPDATE-Sep-2022.pdf. Accessed September 24, 2022.

- FICO®. “How are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed September 24, 2022.

- Federal Trade Commission. “Equal Credit Opportunity Act,” https://www.ftc.gov/legal-library/browse/statutes/equal-credit-opportunity-act. Accessed September 24, 2022.

- Rocket Money. "What’s The Difference Between VantageScore® And FICO®?" https://www.rocketmoney.com/learn/debt-and-credit/understanding-the-differences-between-fico-and-vantagescore. Accessed March 7, 2023.

- FICO®. “How Do Credit Inquiries Affect Your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed September 24, 2022.

- TransUnion. “How Rate Shopping Can Impact Your Credit Score,” https://www.transunion.com/blog/credit-advice/how-rate-shopping-can-impact-your-credit-score. Accessed September 24, 2022.

- FICO®. “What are the minimum requirements of a FICO® score?” https://www.myfico.com/credit-education/faq/scores/fico-score-requirements. Accessed September 24, 2022.

- VantageScore®. “Credit Scoring and Financial Inclusion,” https://vantagescore.com/wp-content/uploads/2022/02/Scoreability-WP-1-Credit-Scoring-and-Financial-Inclusion-FNL-@-11.11.pdf. Accessed September 24, 2022.

- Experian. “Why Is My Credit Score Different When Lenders Check My Credit?” https://www.experian.com/blogs/ask-experian/why-is-my-credit-different-when-lenders-check-my-credit/. Accessed September 24, 2022.

- Consumer Financial Protection Bureau. “Where can I get my credit score?” https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/. Accessed September 24, 2022.

- FICO®. “Your FICO® Score, from FICO®,” https://www.myfico.com/. Accessed September 24, 2022.

- VantageScore®. “Free Credit Scores,” https://vantagescore.com/consumers/tools/free-credit-scores/. Accessed September 24, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).