5 Ways to Pay Off Your Car Loan Faster

By Ana Gonzalez-Ribeiro, MBA, AFC®

Published on: 04/17/2023

Published on: 04/17/2023

It sometimes makes financial sense to pay off your car loan early because it can reduce the amount of interest you pay over your loan term. In other cases, however, you may benefit from paying off other debts with higher interest rates.

Before making a decision, you should assess your particular financial situation (including any prepayment penalties in your contract) to see if paying off your loan faster is the right move for you.[1] In this article, we cover effective ways to pay off your car loan faster and the pros and cons of doing so — including how it may affect your credit score.

Whether you saved up and bought a new car or a used car, we show you whether to aim for an early payoff or stick to your original payment plan.

The size of the impact depends on your unique credit profile, including what other types of credit accounts you have, how long you’ve had those accounts open, and whether you’ve been applying for other forms of credit. The good news is that any credit score drop caused by a loan payoff is typically temporary, so you shouldn’t avoid paying off debt for this reason. You can often recoup your score by following responsible habits with your credit.[2]

For example:

However, just be sure you don’t extend the loan term. Refinance your new loan for however many years you have left on your original loan to save on loan interest. Then if you continue to pay your old payment amount on the refinanced loan, it’s similar to making extra car payments within the year, and you may be able to pay the loan off more quickly.

You may also find a loan with lower interest rates but a shorter repayment term, which may make your monthly payments more expensive. If you can afford to pay more per month, this strategy could help you pay off the loan sooner. If you refinance for a lower interest rate and a longer repayment term, however, you may end up paying more interest over the life of the loan, which may not benefit you depending on your financial situation.[4]

For example: If you pay $276 a month, you could round it up to $300. The extra $288 ($24 x 12) would add up to more than one of your original monthly payments.

When you want to make a large payment over and above your scheduled monthly payment, just be sure to check with your lender first. When rounding payments, you should be sure you can apply the extra to the principal and avoid other fees.[5]

However, it may not make sense to make an additional payment on your car loan when you have other outstanding debt. If you have credit cards or personal loans with higher interest rates than your car loan, it may make better financial sense to direct your extra income there instead.[6]

Debt consolidation typically combines debts into one account in the form of a personal loan or a home equity loan. Although this strategy can help streamline your finances into a single payment, it does not guarantee a lower interest rate. You may not qualify for a personal loan with a lower interest rate, especially if you don’t have a good credit score. In addition, if you are struggling financially, you may not want to risk losing your home by using it to secure a loan.[7]

A lower DTI shows lenders you have enough income after your debt obligations to make new loan payments. However, a higher DTI can indicate more risk to lenders, so they compensate by charging you a high interest rate or they may deny you the loan altogether.[8] Paying off your car loan early would reduce your total monthly debt obligation, potentially lowering your DTI and helping you qualify for new loans.

Credit utilization, which makes up 20% of your VantageScore® 3.0, looks at how much of your credit limit you use. Although this factor focuses more on your revolving credit like credit cards, it also includes your balances on installment loans. Credit utilization shouldn’t be confused with your credit utilization ratio (your total revolving balances divided by your total revolving credit limits; CUR), which focuses solely on revolving credit.[10] Paying off your car loan early could help reduce your credit utilization, which may also positively impact your VantageScore®.

The length of your credit history can also impact your credit, making up 15% of your FICO® Score.[13] When you pay off a car loan and the account is closed, you may see your score go down due to a less diverse credit mix and decreased account age. However, any drop due to early payoffs is usually temporary so this reason alone may not be strong enough to keep you from paying off a debt.[2]

In the end, whether to pay off your loan early or stick with your original loan length is a personal decision. Although making financial decisions that involve your credit may seem daunting, you can use our tools and resources to help you understand how credit works and how your decisions can impact your credit. So when deciding to pay off your car loan early or making any financial choice that affects your credit, make sure to consider both the pros and cons as well as your own personal finances before choosing which option makes sense for you.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Before making a decision, you should assess your particular financial situation (including any prepayment penalties in your contract) to see if paying off your loan faster is the right move for you.[1] In this article, we cover effective ways to pay off your car loan faster and the pros and cons of doing so — including how it may affect your credit score.

Whether you saved up and bought a new car or a used car, we show you whether to aim for an early payoff or stick to your original payment plan.

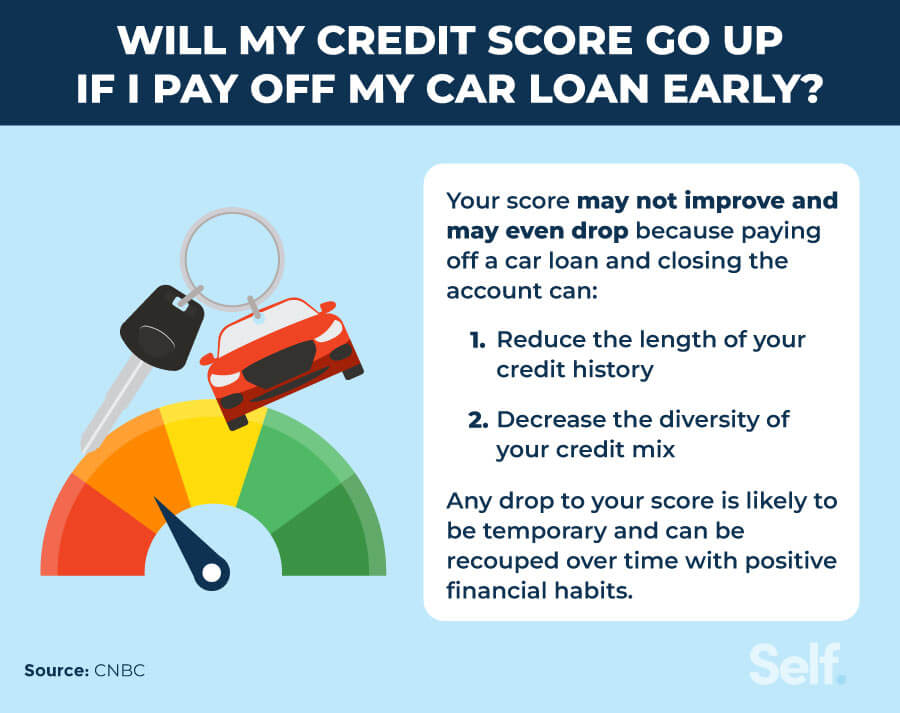

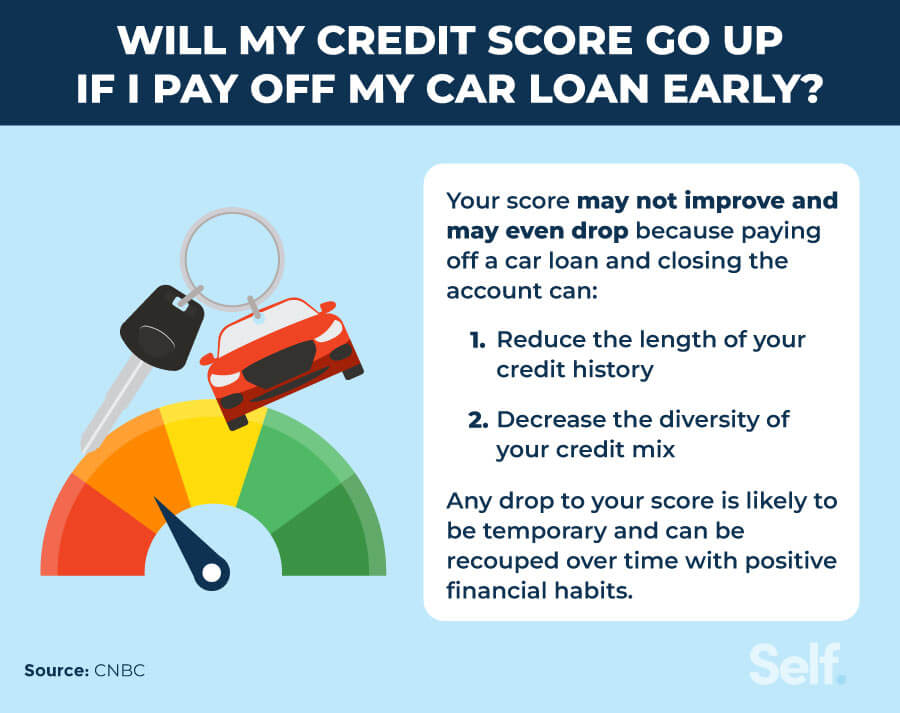

Will my credit score go up if I pay off my car loan early?

While paying off an installment loan — such as an auto loan or student loan — represents a financial achievement, you may not see it reflected in your credit score. In some cases, your score may even drop. That’s because closing the account can reduce your credit mix and the length of your credit history, both which represent factors in calculating your credit score.

The size of the impact depends on your unique credit profile, including what other types of credit accounts you have, how long you’ve had those accounts open, and whether you’ve been applying for other forms of credit. The good news is that any credit score drop caused by a loan payoff is typically temporary, so you shouldn’t avoid paying off debt for this reason. You can often recoup your score by following responsible habits with your credit.[2]

5 ways to pay off your car loan faster

Whether you want to pay less in interest or you just want to own your car outright sooner, several strategies can help you achieve an early payoff.

1. Make biweekly payments

Instead of making a full payment every month, you can pay off your car faster by making half-payments every two weeks. While the difference may seem small, it adds up over the term of your loan. Making 26 biweekly half-payments (52 weeks in a year, divided by 2) allows you to make 13 full payments per year rather than 12 monthly ones.[3]For example:

- Making monthly payments of $400 for 12 months totals $4,800 per year (400 x 12 = $4,800)

- Making 26 biweekly payments of $200 for 12 months totals $5,200 (200 x 26 = $5,200)

2. Consider refinancing with a different lender

Car dealerships often use captive finance from automakers to extend you a loan. However, that doesn’t mean they always offer you the lowest rates you qualify for, so you could possibly find a better deal by refinancing.[3] Refinancing means replacing your current loan with a new one, typically from a different lender. Your credit score may have improved since you took out the original loan, market rates may have decreased, or you may have discovered better terms through other providers, such as a credit union or bank. In this case, you may get a lower interest rate, which would lower your monthly payment.[4]However, just be sure you don’t extend the loan term. Refinance your new loan for however many years you have left on your original loan to save on loan interest. Then if you continue to pay your old payment amount on the refinanced loan, it’s similar to making extra car payments within the year, and you may be able to pay the loan off more quickly.

You may also find a loan with lower interest rates but a shorter repayment term, which may make your monthly payments more expensive. If you can afford to pay more per month, this strategy could help you pay off the loan sooner. If you refinance for a lower interest rate and a longer repayment term, however, you may end up paying more interest over the life of the loan, which may not benefit you depending on your financial situation.[4]

3. Round up your payments

Simply rounding up your car loan payments to the next whole number can help reduce your loan balance faster without spending a lot of extra money in the short term. If you decide to pay more than your monthly payment amount, make sure your lender allows you to apply the extra money to the principal rather than a portion going toward interest.[5] Not all lenders permit extra payments and those that do allow it may charge penalties, so check with your loan provider before rounding a payment.For example: If you pay $276 a month, you could round it up to $300. The extra $288 ($24 x 12) would add up to more than one of your original monthly payments.

4. Make a large payment to take advantage of extra income

If you receive extra cash or an unexpected lump sum payment or income, such as a tax refund, work bonus or retroactive pay raise, it could provide the perfect opportunity to make a one-time payment to your car loan, thereby reducing the total amount owed and the interest you end up paying in the long run.[3]When you want to make a large payment over and above your scheduled monthly payment, just be sure to check with your lender first. When rounding payments, you should be sure you can apply the extra to the principal and avoid other fees.[5]

However, it may not make sense to make an additional payment on your car loan when you have other outstanding debt. If you have credit cards or personal loans with higher interest rates than your car loan, it may make better financial sense to direct your extra income there instead.[6]

5. Consolidate your debt

If you’re struggling with your car loan and other debt, you may be looking for ways to pay off your loans so that you can avoid missed car payments. Debt consolidation may be an option, but it’s not without its risks.Debt consolidation typically combines debts into one account in the form of a personal loan or a home equity loan. Although this strategy can help streamline your finances into a single payment, it does not guarantee a lower interest rate. You may not qualify for a personal loan with a lower interest rate, especially if you don’t have a good credit score. In addition, if you are struggling financially, you may not want to risk losing your home by using it to secure a loan.[7]

When you should consider paying off your car loan early

In some cases, paying off your car loan early can have some real financial benefits. Consider paying off your car loan faster in the following circumstances.

It could reduce your debt-to-income (DTI) ratio

Your debt-to-income (DTI) ratio measures how much of your income goes to paying debt, which allows lenders to measure how well you manage repaying the debt you have in your current financial situation as well as assess your ability to pay back the loan or credit you are applying for. To calculate your DTI, you divide your total monthly debt payments (including housing, credit cards and loans) by your gross monthly income.[8]A lower DTI shows lenders you have enough income after your debt obligations to make new loan payments. However, a higher DTI can indicate more risk to lenders, so they compensate by charging you a high interest rate or they may deny you the loan altogether.[8] Paying off your car loan early would reduce your total monthly debt obligation, potentially lowering your DTI and helping you qualify for new loans.

It may impact your overall debt and contribute to your credit score

If paying off your car loan early reduces the overall debt you carry, it may elevate your credit scores. The FICO® scoring model includes installment loans (like auto loans) in the “amounts owed” category, which makes up 30% of your score. Paying off your car loan may show that you manage and repay debt responsibly, which may help your FICO® score [9].Credit utilization, which makes up 20% of your VantageScore® 3.0, looks at how much of your credit limit you use. Although this factor focuses more on your revolving credit like credit cards, it also includes your balances on installment loans. Credit utilization shouldn’t be confused with your credit utilization ratio (your total revolving balances divided by your total revolving credit limits; CUR), which focuses solely on revolving credit.[10] Paying off your car loan early could help reduce your credit utilization, which may also positively impact your VantageScore®.

You may pay less towards interest

Car payments include both principal (amount borrowed) and interest (the cost of borrowing measured in a percentage, which is typically charged against your principal). Paying off your car loan early reduces the amount of interest you pay over the life of the loan, potentially freeing up money in your budget for savings or other expenses.[11]Owning your vehicle outright may have benefits

As long as you are still making monthly car payments, the lender owns the vehicle. Paying off the loan transfers ownership to you, so you no longer have to worry about missing a payment or having the car repossessed. Once you own your car free and clear, you can even potentially make money by selling it or using it as a trade-in for another vehicle.[11]You might avoid a higher interest rate

While not common, if you have a variable-rate auto loan, your car payment may increase anytime interest rates rise. Paying off your car could help you avoid paying more in interest — both short term and in the long run.[12]When you may not benefit from paying off your car loan early

Although it may seem counterintuitive, paying off your car loan faster doesn’t always make financial sense. You will want to evaluate your individual situation before making a decision.It could negatively impact your credit mix and length of credit history

As a kind of installment account, auto loans contribute to your credit mix. Financial institutions use this factor to assess the risk of lending you money because it shows how you successfully manage different types of credit. Credit mix determines 10% of your FICO® Score.[13]The length of your credit history can also impact your credit, making up 15% of your FICO® Score.[13] When you pay off a car loan and the account is closed, you may see your score go down due to a less diverse credit mix and decreased account age. However, any drop due to early payoffs is usually temporary so this reason alone may not be strong enough to keep you from paying off a debt.[2]

You may incur prepayment penalties

Depending on your contract and whether your state’s law allows it, paying your loan amount off early may incur a prepayment penalty fee.[14] If you do need to pay a fee, consider whether or not it makes financial sense to pay off your remaining balance early.Paying off other debts may make more financial sense

Car loans often have lower interest rates than other types of credit like credit cards. If you have debt with a higher interest rate, it may make more financial sense to pay that down first to save money on interest in the long run.[11]Should you pay extra on your car loan?

Paying off your car loan faster may not make sense if you have to pay hefty prepayment penalties or if you can save more money by paying down other high-interest debt. In addition, paying off your car loan and closing the account may drop your credit score. The good news is that the positive payment history will stay on your credit report for up to 10 years after you pay off your loan.[15] On the other hand, negative information from closed accounts may stay on your credit report for up to seven years, but their impact on your score lessens over time.[16]In the end, whether to pay off your loan early or stick with your original loan length is a personal decision. Although making financial decisions that involve your credit may seem daunting, you can use our tools and resources to help you understand how credit works and how your decisions can impact your credit. So when deciding to pay off your car loan early or making any financial choice that affects your credit, make sure to consider both the pros and cons as well as your own personal finances before choosing which option makes sense for you.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Forbes. “Should You Pay Off Your Car Loan Early?” https://www.forbes.com/advisor/auto-loans/pay-off-car-loan-early. Accessed on January 18, 2023.

- CNBC. “Here’s why your credit score may drop after paying off your personal loan,” https://www.cnbc.com/select/why-credit-score-may-drop-after-paying-off-personal-loan. Accessed on January 18, 2023.

- Experian. “5 Ways to Pay Less Interest on a Car Loan,” https://www.experian.com/blogs/ask-experian/how-to-pay-less-interest-on-car-loan. Accessed on January 18, 2023.

- Experian. “How to Refinance Your Car Loan,” https://www.experian.com/blogs/ask-experian/how-do-i-refinance-a-car-loan. Accessed on January 18, 2023.

- Consumer Financial Protection Bureau. “What is the difference between paying interest and paying off my principal in an auto loan?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-paying-interest-and-paying-off-my-principal-in-an-auto-loan-en-845. Accessed on January 18, 2023.

- Experian. “Which Debts Should I Pay Off First?” https://www.experian.com/blogs/ask-experian/what-debts-should-i-pay-off-first. Accessed on January 18, 2023.

- Equifax. “What Is a Debt Consolidation Loan? Does Debt Consolidation Hurt Your Credit?” https://www.equifax.com/personal/education/debt-management/what-is-debt-consolidation. Accessed on January 19, 2023.

- Experian. “What Is Debt-to-Income Ratio and How Do I Calculate It?” https://www.experian.com/blogs/ask-experian/how-to-calculate-your-debt-to-income-ratio. Accessed on January 19, 2023.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed on January 19, 2023.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore. Accessed on January 19, 2023.

- Forbes. “Should You Pay Off Your Car Loan Early?” https://www.forbes.com/advisor/auto-loans/pay-off-car-loan-early. Accessed on January 19, 2023.

- Experian. “Fixed-Rate vs. Variable-Rate Car Loans: Which Is Better?” https://www.experian.com/blogs/ask-experian/fixed-rate-vs-variable-rate-car-loans. Accessed on January 19, 2023.

- MyFICO. “What Does Credit Mix Mean?” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed on January 19, 2023.

- Consumer Financial Protection Bureau. “Can I prepay my loan at any time without penalty?” https://www.consumerfinance.gov/ask-cfpb/can-i-prepay-my-loan-at-any-time-without-penalty-en-843. Accessed on January 19, 2023.

- Equifax. “How Long Does Information Stay on My Equifax Credit Report?” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report. Accessed on January 19, 2023.

- MyFICO. “Chapter 7 & 13:How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed on January 19, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on April 17, 2023

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.