Non-Sufficient Funds (NSF) Fees: What They Are and How to Avoid Them

Published on: 03/23/2022

A non-sufficient funds (NSF) fee, also known as an insufficient funds fee, can cost bank account holders between $27 and $35 per occurrence, on average.[1]

NSF fees are legal, but there are no legal guidelines that govern NSF fees. The Truth in Lending Act is the only guideline financial institutions must follow regarding NSF fees, and that just stipulates that a bank must disclose its fee schedule to customers.[1]

You can avoid paying NSF fees by ensuring you don’t spend more than the funds you have available in your account. Read on to learn more about NSF fees and how they might impact you.

Table of contents

- What are non-sufficient funds (NSF) fees?

- Overdraft fees vs. NSF fees

- How much do NSF fees cost?

- What triggers NSF fees?

- How to waive an NSF fee

- How NSF fees can impact your credit score

- How to avoid NSF fees

What are non-sufficient funds (NSF) fees?

Non-sufficient funds fees (also called insufficient funds fees) occur when an account doesn’t have enough funds to cover transactions, including checks you have written or account withdrawals.[1]

Fees are charged to make up the cost of returning declined transactions. However, banks make a tremendous amount of money from NSF and overdraft fees — $11.68 billion in 2019, to be exact.[1]

The government doesn’t regulate NSF fees. Banks have full control over NSF fee amounts and charges. However, banks will typically not charge fees for items that would be automatically declined at the point of sale, such as debit card transactions. In other words, NSF fees are generally from checks or electronic payments.[1]

These should not be confused with overdraft fees, which are charged when a bank balance goes below zero.

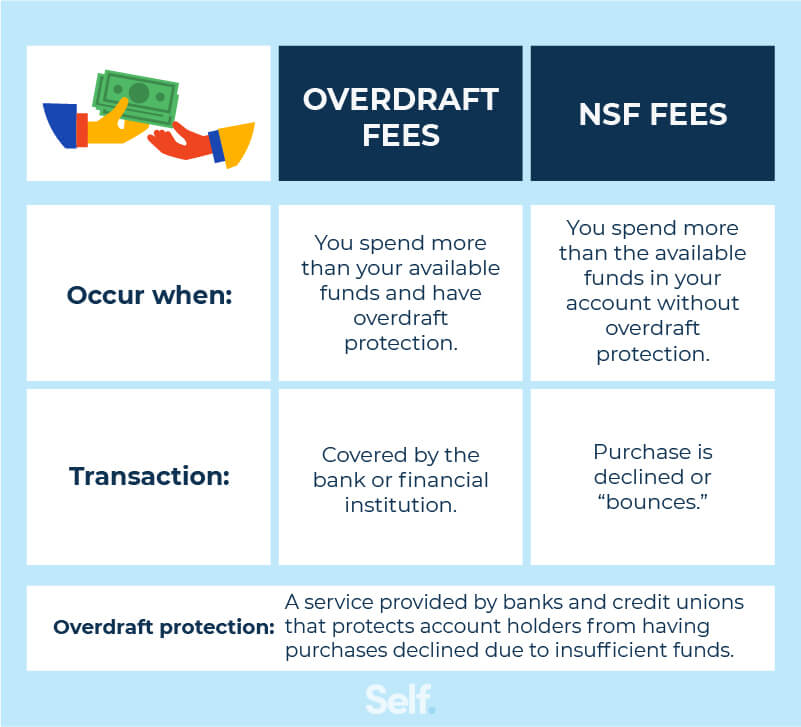

Overdraft fees vs. NSF fees

As mentioned above, NSF fees and overdraft fees are not the same. The major differences are as follows:

- Overdraft fees are charged when an account balance goes below $0.

- NSF fees are charged on returned payments.

Certain transactions can trigger scenarios that result in both NSF fees and overdraft fees. For example, say you write a check that is returned for non-sufficient funds. That fee could bring your account negative, resulting in an overdraft fee.[2]

These scenarios are somewhat rare, especially if you have overdraft protection. Overdraft protection is a bank service that you must opt into. It authorizes the bank to honor payments even if you don’t have funds, but there are often high fees involved.

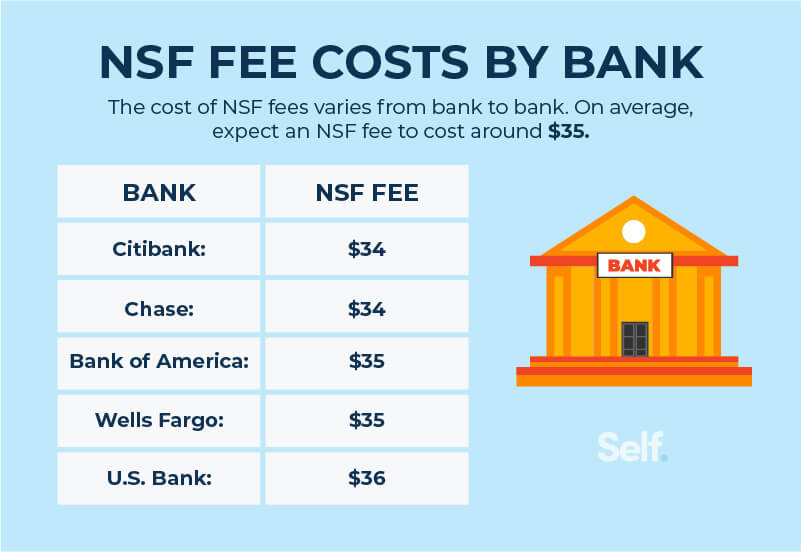

How much do NSF fees cost?

NSF fee costs vary from bank to bank. The average fee in the U.S. ranges from $27 to $35, with most around $35 per fee.

What triggers NSF fees?

Typically banks don’t charge NSF fees on debit card or ATM transactions. These are usually declined without needing any funds returned. Bounced or fraudulent checks often trigger NSF fees.

Bounced checks

Bounced or NSF checks are checks that won’t clear due to non-sufficient funds in the originating account. Having sufficient funds when the check is written doesn’t determine the validity of the check. The account must have sufficient funds to avoid an NSF fee when the check is presented for payment.

For example, let’s say you wrote a family member a birthday check for $100 two weeks ago. At the time, you had $300 in your account. Since then, your account balance has dropped to $75. Your family member has just tried to cash your check, but it is rejected, and you incur an NSF fee. Checks can easily lead to NSF fees due to their “unconfirmed” nature. Often, people incur NSF fees accidentally; checks are “unconfirmed” for the amount they’re written simply because people lose track of their current account balance.

NSF checks can cause many fees. There is no limit to how many times a bank can attempt to deposit a check. Therefore, every time a deposit is attempted, your account could be charged an NSF fee. Each bank will have different fee guidelines, so be sure to understand your bank’s policies.[3]

In these instances, NSF fees might be referred to as returned item fees. Since the check or payment is declined, it is “returned” to the originating bank. This is the reason for NSF fees — to cover the maintenance of accepting returned items. Returned item fees can occur on NSF checks, automatic payments, and online payments when the account has insufficient funds.[4]

Fraudulent checks

When a bank deposits a check, it must make those funds available within a certain number of days — specifically, the next business day for checks deposited in a branch and the second business day for overnight or ATM deposits. Often, this occurs before the funds can be verified with the originating bank.

Because of this, a fraudulent check won’t immediately be flagged as bad. It can take up to five days for a check to clear. Consequently, it can take five days or more before a bank rectifies the problem. They will do that by withdrawing the check amount from your account, and potentially charging a returned item fee.[5]

Additionally, the withdrawn amount could cause your balance to go lower than the total cost of any pending transactions. This could result in the following:

- Additional NSF fees for any items yet to post.

- A negative account balance.

- Overdraft fees and overdraft protection transfer fees.

It is vital to only accept checks from trusted sources to avoid these fees and the hassle associated with them. Fraudulent checks offer no protection to the account holder. Fraudulent checks will often be found, and the funds removed from your account.[6]

Likewise, never write a check if your account doesn’t have the funds to cover it. Doing so has a specific name: check fraud.

Automatic payments

Another example involves paying a bill via electronic check or ACH (automated clearing house). If you have less than the amount of the bill in your account when the electronic check tries to clear, your bank will reject the withdrawal, and your account will receive an NSF fee.

How to waive an NSF fee

Most banks are willing to listen to requests for fee reversals. Everyone is human, and even bankers understand that life events can sometimes occur unexpectedly. If you receive an NSF fee, use these steps to get NSF and overdraft fees refunded.

- Contact the bank as soon as you notice the fee.

- Be polite, and ask for a reversal. (You’re asking for a courtesy, after all.)

- Detail the rarity of the situation, especially if circumstances were out of your control.

- Include your positive history and longevity with the bank.

Sometimes, the first person you speak with won’t have the authority to reverse fees. Politely ask for a supervisor. You may also have to go into the branch and speak with someone in person. But by following these steps and remaining professional, you have a good chance to get your fees reversed.[7]

Note: this will typically only work for the first occurrence. It is unlikely to work if you have a history of multiple NSF or overdraft fees.

How NSF fees can impact your credit score

As explained above, NSF fees have no direct impact on your credit score. They aren’t reported to the credit bureaus. They should not affect you and your attempts to build credit. You can receive NSF fees without having any credit accounts. Likewise, you can have many credit accounts, and NSF fees will have no impact on any of them.

However, problems may arise if there are multiple NSF or other fees. For example, suppose there are enough fees to render an account unredeemable. In that case, it can be closed off and sent to collections. As with any collections account, this will have a severe impact on your credit score.[8]

This is why staying on top of your finances is so important. One bad check can lead to endless fees, and before you know it, you owe hundreds in fees on an account that had $10 in it.

How to avoid NSF fees

Avoiding paying NSF fees starts with keeping a close eye on your accounts. Understanding your checking account balance at any given time will help you track your money. However, there are plenty of situations where an NSF fee could occur, even with smart financial decisions.[9]

Keep tabs on your bank accounts

If you aren’t watching your financial accounts, you can never be safe from fees. You must keep close tabs on your deposit accounts. Know when automatic transfers and payments come out every month. Make sure you have the funds available when bills are due. And always pay attention to pending transactions that aren’t reflected in your balance.[9]

Create a budget

Learning how to create a budget is a great way to stay on top of your finances. Budgets can help you fit your finances into the specific details of your life. When you are tracking every dollar, you should never have transactions occur without the proper funds.

One common budgeting strategy involves breaking your monthly financial needs into broad categories. For example, the common 50/20/30 budget advises:

- Using 50% of your income for your needs.

- Setting aside 20% for savings.

- Holding 30% for wants.

The final 30%, as mentioned above, can be used for any wants. Many people will use the remaining 30% to get out of debt or add more to their savings contributions.

Link another bank account

Another way to avoid NSF and overdraft fees is to link another account to your main account. These types of bank accounts act as safety nets. When set up as account protection, your bank will automatically transfer enough money to cover the available balance from one account to the other.

Common accounts include:

- Savings accounts with the same bank

- Lines of credit specifically offered as overdraft protection

- Bank credit cards used for overdraft protection

All of these can help someone avoid NSF fees, but they can also come with their own stipulations. For example, transfers from credit cards and some lines of credit count as cash advances, which have higher interest rates than normal credit transactions. Though it won’t count as a fee, you might end up paying a hefty sum in finance and regular charges. As always, understanding the specific terms of your financial accounts will help with debt management.

Additionally, some financial institutions will charge a fee for every automatic transfer they initiate. Others have minimum transfer amounts of $100 or more. While all of these options can help you avoid an NSF or overdraft fee, they are not all free, and many come with plenty of additional hassle.[10]

Enable email or mobile alerts for low funds

Given the popularity of mobile devices, low funds alerts through email or text notifications can be a powerful tool to help avoid fees. Most banks will offer the option to opt-in for account alerts through their online banking portal or on their mobile banking app.

Often, account holders can set alerts for specific balance levels. Other alerts will trigger automatically, including fraud and suspicious purchase alerts. These features will help account holders stay on top of their finances. Sometimes, even the most financially prudent need a reminder or two.

Mobile alert settings and features for your debit card will vary from bank to bank. It’s a good idea to check through your bank’s website to get more information on what’s offered and how to set up alerts.

Switch to a bank with lower fees

Of course, you can always go to a bank with lower or no fees. As stated earlier, many online banks offer fee-less accounts. If you find yourself running into numerous NSF or overdraft fees, an online or otherwise fee-less bank might be your best option.

If you decide to switch banks, you must make sure you do so properly. If you have connected accounts, such as a credit card or a line of credit, those may not be affected by closing a checking account. Also, your checking account must be closed in good standing — that is, without a negative balance. If your account is closed due to neglect or prolonged negativity, it could be reported to collections agencies or ChexSystems. This could limit your ability to open a checking account in the future.[11],[12]

With that said, closing a checking or savings account in good standing will not affect your credit score. If you need to close your account in favor of a better bank, do so.

NSF fees are common but avoidable

Typically assessed on checks and automatic payments, NSF fees result from not having enough funds to cover a payment. Also known as insufficient funds fees or returned item fees, NSF fees can add up. Banks can attempt to deposit a bad check many times.

NSF fees are a common occurrence. Banks make billions of dollars in profit off of NSF fees every year. And though they have been decried as predatory, NSF fees are legal under all aspects of the law. The best way to avoid them is to stay on top of our finances and understand our banks’ fee schedules.

Sources

- Investopedia. “Non-Sufficient Funds (NSF) Definition,” https://www.investopedia.com/terms/n/nsf.asp. Accessed December 8, 2021.

- Help With My Bank. “Shouldn't the bank notify me if I overdraw my account?” https://www.helpwithmybank.gov/help-topics/bank-accounts/nsf-fees-overdraft-protection/nsf-fees/nsf-multiple-fees.html. Accessed December 8, 2021.

- Help With My Bank. “How many times will a bank allow an NSF check to be resubmitted?” https://www.helpwithmybank.gov/help-topics/bank-accounts/nsf-fees-overdraft-protection/overdraft-protection-programs/overdraft-resubmitted.html. Accessed December 8, 2021.

- Consumer Financial Protection Bureau. “Comment for 1005.3 Coverage,” https://www.consumerfinance.gov/rules-policy/regulations/1005/interp-3/#3-b-2-Interp. Accessed December 8, 2021.

- Forbes. “Non-Sufficient Funds: What It Means And How To Avoid NSF Fees.” https://www.forbes.com/advisor/banking/non-sufficient-funds-and-how-to-avoid-nsf-fees/. Accessed December 8, 2021.

- Federal Trade Commission. “How To Spot, Avoid, and Report Fake Check Scams,” https://www.consumer.ftc.gov/articles/how-spot-avoid-and-report-fake-check-scams. Accessed December 8, 2021.

- Sapling. “How to Get the Bank to Reverse Your NSF/OD Fees” https://www.sapling.com/5233743/bank-reverse-nsfod-fees. Accessed December 8. Experian. “NSF Checks on a Credit Report” https://www.experian.com/blogs/ask-experian/non-sufficient-funds-checks-on-a-credit-report/. Accessed December 8, 2021.

- Consumer Finance Protection Bureau. “How do I avoid or minimize overdraft fees?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-avoid-or-minimize-overdraft-fees-en-979/. Accessed December 8, 2021.

- Consumer Finance Protection Bureau. “My bank/credit union offered to link my checking account to a savings account, a line of credit, or a credit card to cover overdrafts. How does this work?” https://www.consumerfinance.gov/ask-cfpb/my-bankcredit-union-offered-to-link-my-checking-account-to-a-savings-account-a-line-of-credit-or-a-credit-card-to-cover-overdrafts-how-does-this-work-en-1047/. Accessed December 8, 2021.

- Experian. “Could Closing a Bank Account Affect My Credit?” https://www.experian.com/blogs/ask-experian/does-closing-a-bank-account-affect-your-credit/. Accessed December 8, 2021.

- Experian. “What Is ChexSystems?” https://www.experian.com/blogs/ask-experian/what-is-chexsystems/. Accessed December 8, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.