How Much Debt Is Too Much? Understanding Debt-to-Income Ratio

Published on: 07/01/2022

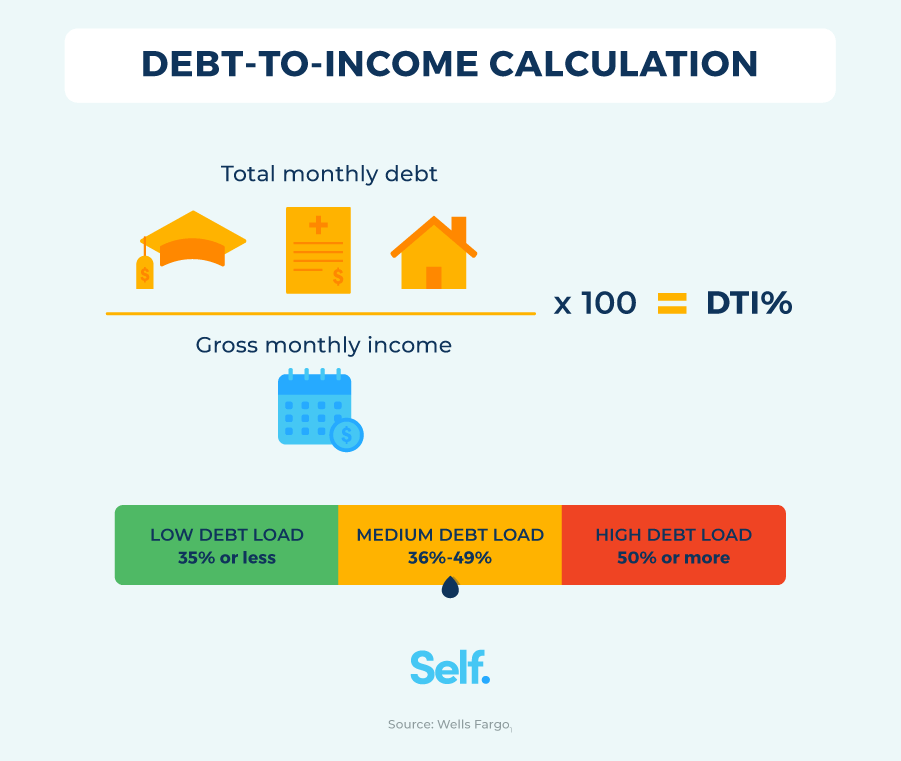

How much debt is too much? The debt-to-income ratio (DTI) formula will help you determine if you have too much debt for your income level. It’s not only useful to assess your personal finance; it’s something lenders use when considering whether to approve you for new credit.

A manageable debt-to-income ratio is typically described as less than 35%. Lenders might prohibit certain borrowing actions once you hit 50% or more.[1]

This article could help you calculate your debt-to-income ratio, determine how much debt is too much, and help you take steps toward becoming debt-free.

Table of Contents

- How to calculate debt-to-income ratio

- How to lower your debt-to-income ratio

- Good debt vs. bad debt

- Managing different types of debt

- Signs you have too much debt

- Tracking your debt payments

- How does debt impact your credit score?

How to calculate debt-to-income ratio

How exactly do you determine the ratio of your debt to income? First, add up all your total monthly debt payments. Then divide them by your total monthly gross income. Multiply the resulting number by 100 to get your DTI percentage.[2]

For example, if you have debt payments of $2,000 a month and a gross monthly income of $4,000, your debt-to-income ratio is 50%. It’s important to note that this example is a simplistic way to demonstrate your debt-to-income ratio. Each lender may approach your verifiable debt and income in its own calculation, so the results may vary.[1]

- Manageable debt (35% or less): Ideally, your DTI is less than 35%, especially if you want to buy a home. The 28/36 rule suggests that your mortgage shouldn’t exceed 28% of your gross monthly income and your debt shouldn’t exceed 36%.[1] [3]

- Tolerable debt (36% - 49%): Generally, 49% is the highest ratio a borrower can have to obtain a qualified mortgage.[1] [2] (Qualified mortgages are more stable loans that don’t include things like balloon payments, “interest-only” periods, and negative amortization.)[4]

- Concerning debt (50% or more): Lenders consider a debt-to-income ratio exceeding 50% as high and may be hesitant to lend to you.[1]

How to lower your debt-to-income ratio

If you have too much debt and want to lower your DTI, you need to raise your income, reduce your debt, or both. There are debt management strategies including:

- Reducing unnecessary spending: Budgeting is ground zero when it comes to both staying out of debt and reducing it. There are several approaches to budgeting from which to choose, including the 50-30-20 budget, zero-based budgeting and goal-based budgeting. This will help you understand where you can spend less and use that money to pay off debt faster.

- Lowering your interest rates: You can try to negotiate with lenders to reduce your interest rate, refinance your loan, or try debt consolidation loan. It’s important to understand how debt consolidation can affect your credit before taking this step.

- Paying off high interest debt: The debt avalanche method targets the loan with the highest interest rate first, with the idea being to eliminate as much interest as possible.

- Increasing your salary: You may consider a side hustle, negotiating a higher salary, or finding a new job to increase your income.

While you want to maintain a manageable debt-to-income ratio, not all debt is bad.

Good debt vs. bad debt

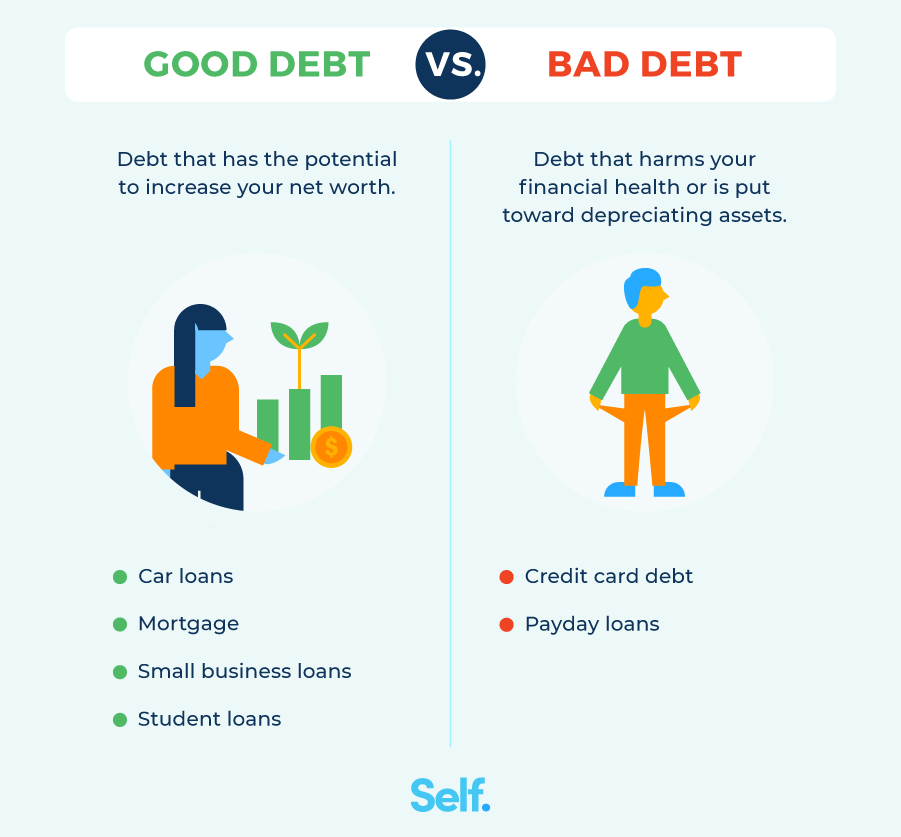

Not all debt is inherently bad. Good debt is an investment. It puts you in a position to benefit and improve your financial situation. Bad debt, on the other hand, costs you money. Here are some examples of each.

Good debt

Debts such as a mortgage, small business loans, and student loans can help you in the future. Of course, there’s an inherent risk: You're assuming your investment in your career or home will pay off, but that might be a risk worth taking.

- Car loans: Cars can be a necessity to get to work and earn an income, making some auto loans good debt. However, not all auto loans are created equal. High cost auto loans can be considered bad debt, especially if the monthly payment is beyond what you can afford.

- Mortgage: You can build up home equity over time and mortgage rates tend to be lower than rates on other types of loans. However, interest rates on adjustable-rate mortgages can move in the wrong direction, home repairs can be costly, and the real estate market can be volatile.

- Small business loans: This kind of debt can help you launch your business, which may pay for itself with profits. However, starting a business is risky and not all businesses are profitable. Make sure to assess market need, competition and the level of investment you require to determine if your business idea is viable.

- Student loans: Student loans can be a good investment if your degree allows you to get a well-paying job. A degree isn’t always necessary, so assess the risks and rewards ahead of time.

Bad debt

Bad debt is debt that doesn’t provide any value to you. It’s not an investment, but a way of “buying time” to purchase something or pay bills.

- Credit card debt: You’ll pay high interest rates if you don’t pay the entire balance.

- Payday loans: Payday loans are even worse than credit cards because of their high interest rates. They can dig you even deeper into debt.

Managing different types of debt

Different kinds of debt can require different approaches. Some loans are secured, meaning what you’re purchasing serves as collateral in case you can’t pay. Others are revolving credit, like credit cards. It’s essential to understand interest rates and payment plans for each type of loan before creating a plan to pay off your debt.

Medical debt

If you are unable to pay what you owe upfront, healthcare providers often have billing departments that are willing to work with patients to come up with a payment plan for their medical bills.

Credit card debt

Although credit cards may be considered good debt if you pay your balance in full each month, not paying the entire balance adds interest to your debt that may quickly accumulate.

If you’re in over your head, you may want to talk to your credit card issuer and see if you can work out a payment plan. Credit card issuers may choose to close your account if you’ve failed to keep up with payments, which could negatively impact your credit score.

If you have debt from one or multiple lines of credit, you may want to consider a balance transfer, which moves debt to a new card with zero or low interest. Understand the balance transfer fee and any fees that may be incurred after the introductory period is over to determine if this is a good option for you.

Student loans

There are two different types of student loans: private loans and federal loans. Private student loans are like other private installment loans.

Federal loans offer many repayment plans including income-based and extended plans, so explore your options to determine what best fits into your debt repayment strategy.[6]

Car loans

As a general rule, financial experts suggest that you should allocate between 10% to 15% of your gross income on car payments, which include principal, interest and car insurance.[7] You can pay off your car loan faster by doing things like rounding up your payments, making an extra payment each year, or refinancing your loan to a lower rate.

Mortgage debt

As a general rule, you can afford a mortgage that’s twice to 2½ times your annual gross income. So if you had an income of $60,000, you could afford a mortgage of $120,000 to $150,000.[8] However, you must personally consider several factors when calculating how large of a mortgage you can afford. This calculation doesn’t take into account your unique financial situation and should only be considered a general guideline.

If you have a high interest rate, you may want to consider refinancing to a lower one. If you put less than 20% down, you will have to pay private mortgage insurance. Understand when your private mortgage insurance (PMI) falls off and if you can remove it earlier than planned.

Signs you have too much debt

The most obvious sign that you have too much debt is that your debt-to-income ratio is higher than 35%. Your debt-to-income ratio is the percentage of your monthly income before taxes that goes toward paying your monthly debt payments. Other warning signs include using most of your available credit, causing a high credit utilization ratio. Here are a few more subtle signs that can indicate your debt is unmanageable.

- You don’t know how much money you owe: Your total debt includes mortgage payments, personal loans, credit card debt, student loans, etc. Knowing what you owe can help you better handle your debt and help you develop a plan to lower it.

- You use new debt to pay off old debt: If you need to take out new loans to pay off debt, you’re likely on the debt treadmill.

- You ask for credit limit increases to put more on your card, not to improve your credit: Sometimes, asking your credit card companies for a credit limit increase can be a positive thing when it comes to improving your credit score. But, if you raise your credit limit to spend more money you can’t pay back, then it could be a sign that you probably have too much debt.

- You make late payments, skip payments, or only pay the minimum payments due: Skipping payments or paying late can get expensive in a hurry, thanks to late fees. By only paying the minimum amount, you can end up paying mostly interest on the debt (not paying the debt down) while more interest continues to add up.

Tracking your debt payments

The first step to paying down your debt is knowing how much you have. Use our debt tracker to record various debts and track your progress towards paying them off.

![]()

How does debt impact your credit score?

The amount of debt you owe affects your credit utilization ratio, which determines 30% of your FICO® score, second only to your payment history in importance, which determines 35% of your score. If you have a high credit utilization ratio — the ratio of what you owe on all your credit cards divided by your total credit limit — it will likely hurt your credit score.

Other factors that make a difference in the “amount owed” category include the amount of debt you have on different kinds of accounts, such as installment loans and revolving credit, and whether you have balances on a large number of accounts.[9] Being aware of these factors puts you in a position to boost your credit score.

Monitor your debt

Knowing how much debt is too much depends on a variety of factors. Calculating your debt-to-income ratio is a good starting point. From there, you can begin assessing the different kinds of debt you have and work to align them with what experts recommend (the 50-30-20 rule is one example).

Cutting back on things you don’t need; finding ways to reduce interest rates on loans you have, and paying them down more rapidly; and being judicious about new debt are all steps you can take to improve your financial situation. If you’re struggling to do these things yourself, you can try credit counseling.

Many resources are available to help you manage debt, so you don’t have to do it alone or feel like you’re in the dark. Attacking debt doesn’t have to be intimidating. Once you start to make progress, it can be exactly the opposite: empowering.

Sources

- Wells Fargo. “What is a Good Debt-to-Income Ratio?” https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/. Accessed February 23, 2022.

- Consumer Financial Protection Bureau. “What is a debt-to-income ratio? Why is the 43% debt-to-income ratio important?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/. Accessed February 23, 2022.

- Investopedia. “28/36 Rule,” https://www.investopedia.com/terms/t/twenty-eight-thirty-six-rule.asp. Accessed February 23, 2022.

- Consumer Financial Protection Bureau. “What is a Qualified Mortgage?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-qualified-mortgage-en-1789/. Accessed February 23, 2022.

- Forbes Advisor. “Unsecured Vs. Secured Debts: What’s the Difference?” https://www.forbes.com/advisor/debt-relief/unsecured-vs-secured-debts/. Accessed April 11, 2022.

- Federal Student Aid. “Repayment Plans,” https://studentaid.gov/manage-loans/repayment/plans. Accessed February 23, 2022.

- Investopedia. “How Much Should I Spend on a Car?” https://www.investopedia.com/how-much-should-i-spend-on-a-car-5187853. Accessed June 16, 2022.

- Investopedia. “How Much Mortgage Can You Afford?” https://www.investopedia.com/articles/pf/05/030905.asp. Accessed February 23, 2022.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed February 23, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).