8 Ways to Become Debt Free (For Good)

By Lauren Bringle

Published on: 09/22/2021

Published on: 09/22/2021

The average American has more than $90,000 in debt across all sources.[1] Though debt can be a challenge, eliminating it doesn’t have to be a hopeless struggle. Here are eight practical ideas to help you reach debt-free status and stay there.

This strategy is great for minimizing the impact of long-term interest. However, it takes time to fully pay off large debts. Still, the avalanche method can be a powerful tool for lower total costs for those who stay the course.[2]

This strategy is ideal for those who prefer to see more immediate results and free up monthly funds. The momentum from fully paying off a debt can be rewarding. However, with this strategy, total interest payments will be higher because the higher interest debts may not be the ones you owe the least on. If all of your debts have a similar balance, this strategy won’t be as effective.[2]

Note that both methods assume steady finances. Although sudden windfalls or emergency expenses can happen, you can easily adapt your payments to fit either of these strategies.

Another option is credit counseling services, which create personalized debt management plans to help you tackle your debt. Many of them are government-approved and work with a diverse range of people and debt types.

You could hire a debt settlement company, though you’ll want to carefully weigh the pros and cons. These companies usually require paying deposits into special accounts to set up a lump-sum payment and they may ask you to stop paying your creditors.[3]

Switching an existing student loan payment plan to the income-driven repayment plan or vice versa is similar to completing an initial online application. You have to provide information regarding your income and family size. Studentaid.gov provides a list of possible plans, along with the monthly payment for each repayment plan.[6]

Note, the repayment plans mentioned are for federal student loans. Private lenders set their student loan payment terms. Some private lenders offer customized repayment plans for private student loans, while some do not. Their payment terms are up to them, so directly asking your lender for assistance is the best course of action. Some lenders allow postponement or forbearance, which would allow you to focus on other debts. However, doing this could mean more fees and higher interest rates.[7]

If you decide to refinance with a different lender, verify you chose the lowest interest rate and fees. Changing your lender might require prepayment penalties. When calculating the best refinancing offer, always balance the reduction of interest expenses against the costs the refinancing might cause.

Tell the new lender the outstanding balance you owe, and give them the required financial documents. If your refinancing is approved, you’ll be awarded a new loan for the amount needed to pay off the original. Once the original is paid off and closed, start paying off the new loan.

As with any form of lending, this process will trigger a hard credit inquiry. Expect a drop in your credit score after opening a new loan account. Also, before starting any refinancing process, be sure you can afford the new payment amount.

A major benefit of refinancing personal loans is the ability to reduce monthly payments. Reducing the monthly amount is typically achieved by extending the term of the loan. However, this will cause you to pay more over the course of the loan due to interest. It is a viable option if you need to reduce monthly expenses to tackle more critical debts.[8]

Naturally, this requires having enough funds to save and donate. Those who need to pay down large amounts of debt rapidly might not be able to donate 10% of their income until the debts are paid in full.[10]

Start your budget by determining the financial goal you want to achieve from budgeting. In this case, it is to maximize monthly income allocation for debt payoff. Create a list of essential and nonessential expenses. Then determine their priority. Paying off debt should be a budget priority after essential costs are paid. From there, you can customize your budget to spread your money however you prefer.[11]

Debt consolidation results in just one monthly payment for all of your previous debts and the loan is fixed-term. One debt account and one ongoing payment could help lower credit utilization and improve payment history, both of which positively impact credit scores.

Before consolidating your debt, make sure to consider the following factors. Origination fees for processing the loan can be up to 5% of the loan amount and some of your previous loans might have prepayment penalties. The fees could significantly reduce the funds you have to pay off debt, so calculate and balance the costs before signing a new loan.

Sometimes debt consolidation can be done with a second mortgage or a home equity line of credit. Unlike other consolidation loans, this way uses your house as collateral, and they can charge points equal to a percent of the borrowed amount.[12]

Some debt might be unavoidable, such as mortgages or car loans. However, having a budget that accounts for your expenses will help ensure the debt is well-managed, kept to a minimum, and quickly paid off. [13]

Also, refinancing your mortgage to a lower interest rate could help reduce the total amount. A flexible term mortgage can help create a shorter loan period, but be sure to check with your lender since some mortgage loans do not allow additional payments.[15]

Paying off credit card debt will reduce your credit utilization, which will directly and positively impact your credit score. However, closing paid-off debt accounts can cause score dips, especially if the accounts have been open for many years.

Responsible management of fixed debt terms, such as mortgage payments, also helps boost credit scores.[16]

Stay disciplined and committed to your debt payoff strategy because, in the end, getting rid of debt will lead to a higher credit score and the financial freedom to achieve your goals.

How to get out of debt

It goes without saying: Debts must be paid off to achieve a debt-free life. Fortunately, there are various ways to meet this goal. Each of these methods has pros and cons, but all of them will help cut debt and promote financial freedom.

1. Choose a Repayment Strategy

Two popular approaches for reducing debt are the debt snowball method and the debt avalanche method. Learn more about each below.Debt avalanche

Paying off a debt by focusing on the highest to the lowest interest rate is known as the “debt avalanche” method. Like an avalanche, this method attacks one location — the debt with the highest interest rate. Once that debt is paid, priority shifts to the debt with the next highest interest rate. When using this strategy, you should also pay the monthly minimums for all other loans.This strategy is great for minimizing the impact of long-term interest. However, it takes time to fully pay off large debts. Still, the avalanche method can be a powerful tool for lower total costs for those who stay the course.[2]

Debt snowball

The snowball method focuses on the size of the debt. Like rolling a snowball, repayment starts with the smallest debt and works up to the largest debt. Like the avalanche method, minimum payment amounts should still be paid on each debt.This strategy is ideal for those who prefer to see more immediate results and free up monthly funds. The momentum from fully paying off a debt can be rewarding. However, with this strategy, total interest payments will be higher because the higher interest debts may not be the ones you owe the least on. If all of your debts have a similar balance, this strategy won’t be as effective.[2]

Note that both methods assume steady finances. Although sudden windfalls or emergency expenses can happen, you can easily adapt your payments to fit either of these strategies.

2. Reduce credit card debt

High interest rates can make managing credit card debt a challenge. However, for those with credit card debt, there is help available. The first step is working to reduce the debt yourself.Another option is credit counseling services, which create personalized debt management plans to help you tackle your debt. Many of them are government-approved and work with a diverse range of people and debt types.

You could hire a debt settlement company, though you’ll want to carefully weigh the pros and cons. These companies usually require paying deposits into special accounts to set up a lump-sum payment and they may ask you to stop paying your creditors.[3]

3. Negotiate lower interest rates for mortgages

Mortgage rates for 15 and 30-year mortgages are at a historic low. Negotiating your mortgage interest rates depends on multiple factors, which include existing credit scores and debt-to-income ratios. If you’re in the market for a mortgage, shop around for the lowest rates. Try and get other lenders to beat the lowest rate you found so they win you as a customer. Be sure to ask for a rate lock, so your rates stay low for as long as possible.[4]4. Refinance your auto loan and car payments

Refinancing a car loan starts with talking to your lender. Negotiating a lower interest rate can reduce the total amount you’ll pay over the course of the loan. Asking to extend your auto loan term could reduce monthly payments in the short term, but it will add more interest fees over the life of the loan. Another option is to change the loan payment dates to better align with your paychecks.[5]5. Apply for an income-driven student loan repayment plan

Income-driven repayment plans use your gross yearly income to adjust your monthly loan payments. You can start an online application at studentaid.gov. The application process will determine which repayment plan works best for your specific student loan debt. Income-driven plans are great for debt reduction because they keep payments low, which allows you to use extra funds to tackle higher interest debts.Switching an existing student loan payment plan to the income-driven repayment plan or vice versa is similar to completing an initial online application. You have to provide information regarding your income and family size. Studentaid.gov provides a list of possible plans, along with the monthly payment for each repayment plan.[6]

Note, the repayment plans mentioned are for federal student loans. Private lenders set their student loan payment terms. Some private lenders offer customized repayment plans for private student loans, while some do not. Their payment terms are up to them, so directly asking your lender for assistance is the best course of action. Some lenders allow postponement or forbearance, which would allow you to focus on other debts. However, doing this could mean more fees and higher interest rates.[7]

6. Refinance your personal loans

Refinancing personal loans could lower your interest rates. Another option is to use a fixed-rate loan to lock in a lower interest rate. If you have a minimum credit score of 660, you’ll be able to shop for refinancing lenders. Once you have a list of favorable rates, contact your lender. They might be willing to extend a refinancing offer.If you decide to refinance with a different lender, verify you chose the lowest interest rate and fees. Changing your lender might require prepayment penalties. When calculating the best refinancing offer, always balance the reduction of interest expenses against the costs the refinancing might cause.

Tell the new lender the outstanding balance you owe, and give them the required financial documents. If your refinancing is approved, you’ll be awarded a new loan for the amount needed to pay off the original. Once the original is paid off and closed, start paying off the new loan.

As with any form of lending, this process will trigger a hard credit inquiry. Expect a drop in your credit score after opening a new loan account. Also, before starting any refinancing process, be sure you can afford the new payment amount.

A major benefit of refinancing personal loans is the ability to reduce monthly payments. Reducing the monthly amount is typically achieved by extending the term of the loan. However, this will cause you to pay more over the course of the loan due to interest. It is a viable option if you need to reduce monthly expenses to tackle more critical debts.[8]

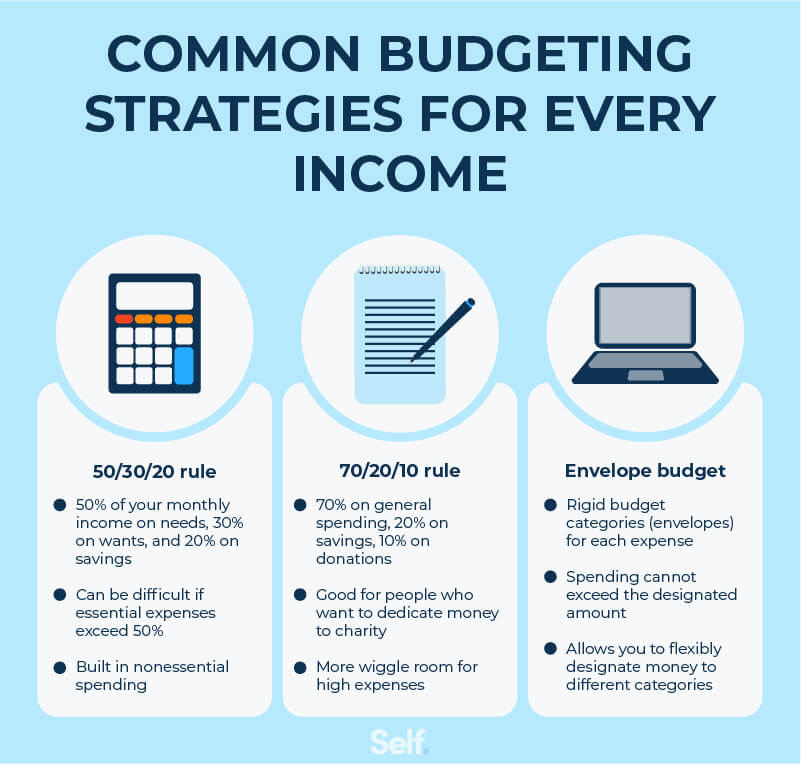

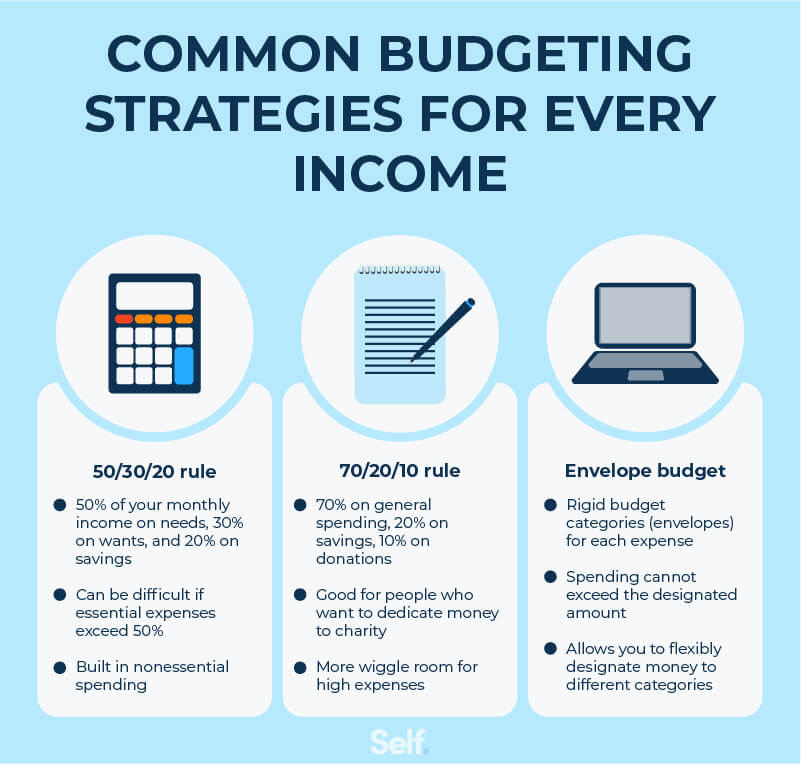

7. Use a budget

Creating a budget helps you see where your money is going. Knowing your spending trends and habits can help you cut unnecessary expenditures. The extra money from the budget cuts can be applied to debt payments.

Use the 50/30/20 rule

The 50/30/20 budgeting strategy is straightforward. It divides your paycheck into three main categories:- 50% essentials

- 30% nonessentials

- 20% savings and investments

Use the 70/20/10 rule

Similar to the 50/30/20 rule, the 70/20/10 rule is a monthly expense breakdown. Unlike the previous rule, 70/20/10 splits monthly income into:- 70% spending

- 20% savings

- 10% donations

Naturally, this requires having enough funds to save and donate. Those who need to pay down large amounts of debt rapidly might not be able to donate 10% of their income until the debts are paid in full.[10]

Other common budgeting strategies

Of course, budgeting doesn’t have to follow a specific breakdown of expenses. The key to any budget is to understand your cash flow and establish where it should be going. When building a budget, it is beneficial to overstate expenses and understate income. This system will allow you to have buffer space for unexpected expenses and emergencies.Start your budget by determining the financial goal you want to achieve from budgeting. In this case, it is to maximize monthly income allocation for debt payoff. Create a list of essential and nonessential expenses. Then determine their priority. Paying off debt should be a budget priority after essential costs are paid. From there, you can customize your budget to spread your money however you prefer.[11]

8. Consider consolidating debt

Similar to refinancing a loan, a debt consolidation loan is used to pay off existing debt. Anyone with a credit score of at least 500 should be able to apply for a consolidation loan. But, it pays to shop around for the best rates and for providers that meet your specific needs.Debt consolidation results in just one monthly payment for all of your previous debts and the loan is fixed-term. One debt account and one ongoing payment could help lower credit utilization and improve payment history, both of which positively impact credit scores.

Before consolidating your debt, make sure to consider the following factors. Origination fees for processing the loan can be up to 5% of the loan amount and some of your previous loans might have prepayment penalties. The fees could significantly reduce the funds you have to pay off debt, so calculate and balance the costs before signing a new loan.

Sometimes debt consolidation can be done with a second mortgage or a home equity line of credit. Unlike other consolidation loans, this way uses your house as collateral, and they can charge points equal to a percent of the borrowed amount.[12]

How to stay out of debt

Once you’ve eliminated your debt, staying out of it becomes the new focus. Consistent budgeting is the first step to ensure your finances are on the right track. If you are using credit cards to help you build your credit back up, be sure only to use ones with low fees and interest rates and fully pay off the card balance each month.Some debt might be unavoidable, such as mortgages or car loans. However, having a budget that accounts for your expenses will help ensure the debt is well-managed, kept to a minimum, and quickly paid off. [13]

What is the most common type of debt?

Mortgage debt is the largest single debt category in America.[14] Thirty-year mortgages are a massive time and money investment. If you can afford it, making bi-weekly payments can help remove 4-6 years off the life of a mortgage loan.Also, refinancing your mortgage to a lower interest rate could help reduce the total amount. A flexible term mortgage can help create a shorter loan period, but be sure to check with your lender since some mortgage loans do not allow additional payments.[15]

How does debt affect my credit score?

After payment history, credit utilization has a heavy influence on your credit reliability. The more credit card debt you have, the higher your credit utilization. A credit utilization higher than 30% of your total credit is considered undesirable to creditors.Paying off credit card debt will reduce your credit utilization, which will directly and positively impact your credit score. However, closing paid-off debt accounts can cause score dips, especially if the accounts have been open for many years.

Responsible management of fixed debt terms, such as mortgage payments, also helps boost credit scores.[16]

The bottom line

Take the steps and reduce your debt to protect your financial future. Proper budgeting is the first step in becoming debt-free. Determine where your income is going each month, then start paying off your debts with the snowball or avalanche method.Stay disciplined and committed to your debt payoff strategy because, in the end, getting rid of debt will lead to a higher credit score and the financial freedom to achieve your goals.

Sources

- Experian. “Average U.S. Consumer Debt Reaches New Record in 2020.” https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/. Accessed 8/21/2021.

- National Foundation for Credit Counseling. “Debt Avalanche vs Debt Snowball - Best Way to Pay off Debt.” https://www.nfcc.org/resources/blog/what-is-the-best-way-to-pay-off-debt-debt-avalanche-vs-debt-snowball/. Accessed 8/21/2021.

- Federal Trade Commission - Consumer Information. “Settling Credit Card Debt | FTC Consumer Information.” https://www.consumer.ftc.gov/articles/0145-settling-credit-card-debt. Accessed 8/21/2021.

- Debt.org. “How to Pay Off a 30-Year Mortgage in 15 Years: Tips & Tricks.” https://www.debt.org/real-estate/mortgages/how-to-pay-30-year-mortgage-in-15-years/. Accessed 8/21/2021.

- Consumer Finance. “Worried about making your auto loan payments? Your lender may have options that can help.” https://www.consumerfinance.gov/about-us/blog/worried-about-making-your-auto-loan-payments-your-lender-may-have-options-to-help/. Accessed 8/21/2021.

- Student Aid.gov “Lower or Suspend Student Loan Payments.” https://studentaid.gov/manage-loans/lower-payments. Accessed 8/21/2021.

- Student Loan Borrower Assistance. “Private Student Loans Repayment.” https://www.studentloanborrowerassistance.org/private-loans/private-loans-repayment/. Accessed 8/21/2021.

- Forbes. “How To Refinance A Personal Loan – Forbes Advisor.” https://www.forbes.com/advisor/personal-loans/how-to-refinance/. Accessed 8/21/2021.

- CNBC. “How to follow the 50-30-20 budgeting strategy.” https://www.cnbc.com/2021/05/11/how-to-follow-the-50-30-20-budgeting-strategy.html. Accessed 8/21/2021.

- Education Credit Union. “Should I Use the 70-20-10 Rule for My Budget? – Education Credit Union.” https://www.educationcu.com/should-i-use-the-70-20-10-rule-for-my-budget/. Accessed 8/21/2021.

- Studentaid.gov. “Federal Student Aid Budgeting Tips.” https://studentaid.gov/resources/prepare-for-college/students/budgeting/budgeting-tips. Accessed 8/21/2021.

- Federal Trade Commission - Consumer Information. “Coping with Debt | FTC Consumer Information.” https://www.consumer.ftc.gov/articles/0150-coping-debt. Accessed 8/21/2021.

- Goodwill Community Foundation. “Money Basics: Staying Out of Debt.” https://www.debt.org/faqs/americans-in-debt/demographics/. Accessed 8/21/2021.

- Federal Reserve Bank of New York. “Quarterly Report of Household Debt and Credit”. https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/hhdc_2021q2.pdf. Accessed 8/26/2021.

- Loans - US News. “How to Pay Off Your Mortgage Faster | US News.” https://loans.usnews.com/articles/pay-off-your-house-quickly-with-these-strategies. Accessed 8/21/2021.

- Experian. “What Affects Your Credit Scores?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-affects-your-credit-scores/. Accessed 8/21/2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on September 22, 2021

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of Self's issuing partner banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts. All trademarks and brand names belong to their respective owners and do not represent endorsements of any kind.