What Happens If You Get A Job While On Unemployment Insurance?

By Ana Gonzalez-Ribeiro, MBA, AFC®

Published on: 11/13/2022

Published on: 11/13/2022

Unemployment insurance provides temporary financial help to employees who lose their income. Whether you can work while earning unemployment benefits, the amount you are allowed to earn and the process for reporting a new job all vary by state. While your local unemployment office is the best source for your specific case, this post helps you better understand what happens when you get a job while on unemployment insurance.

Although eligibility guidelines vary by state, you generally qualify to receive unemployment benefits in the following circumstances:

If you do receive unemployment, you should know that the IRS taxes benefits like any other wages. Some states do as well, some tax only a portion of it, and some don’t charge income tax at all.[3]

You can take care of unemployment tax by withholding a portion of your benefits as you receive them. You may also choose to make estimated quarterly payments or simply wait until the end of the year to see how much you owe.[3]

While you may be tempted — or find it financially necessary — to opt to receive your full benefit amount, know that this option may leave you with large tax bills and even penalties come April. Whatever option you choose, understanding your tax obligations may prevent financial surprises.[3]

Each state has its own rules about whether you can collect unemployment while working — and how much you can earn before you lose your benefits. Contact your local unemployment office for the specific regulations for part-time, full-time and temporary workers in your state.

If you receive benefits to which you are not entitled — either because you failed to notify your office when you started working full-time or because another error occurred — your state will require you to repay any overcompensation. If you fail to report an error that is later discovered, you could face fees and penalties as well as delays or denials on future unemployment claims.[5][6]

In addition to having different definitions of partially versus totally unemployed, states have varying formulas for reducing weekly benefit payments due to part-time work. For example, in Illinois, you can earn up to 50% of your unemployment benefit amount before the state starts lowering your weekly payment.[7] In Texas, your partial unemployment amount is calculated by subtracting your earnings from 1.25 times your normal weekly benefits.[8]

If you start a temporary full-time job, depending on your state’s rules, you may be ineligible for unemployment benefits. However, some states may allow you to reopen an inactive claim if your temporary job ends within a certain time period, so ask your local office for the details of how temporary work might affect your unemployment benefits.

While you must report earnings when you start working again, how you notify your local unemployment office varies by state. Typically, states have one of two systems that we explain in the following sections.

If you receive an overpayment for a reason that was not your fault, you may have your future weekly amount reduced or otherwise be required to pay back benefits. However, if you receive an overpayment due to fraud, you may face more serious consequences including interest charges, financial penalties, forfeiture of future tax refunds and even criminal prosecution.[12]

Usually temporary in nature, furloughs can have a variety of structures, including reduced work hours, unpaid time off or a requirement to use up all of your vacation pay by a certain date. If you’re still receiving a full or partial paycheck during your furlough, you may not qualify for unemployment benefits.[13]

Layoffs, however, provide a more clear-cut definition. Whether a layoff is permanent or seasonal, you likely won’t be earning wages during that time and will want to look into filing for unemployment immediately.[13]

When filing, you generally want to check your state’s requirements and have the following information on hand:

Check with your state’s agency to make sure you comply with applicable regulations — and avoid having to pay back unemployment benefits or even being charged with fraud. One bit of good news regardless of where you live — filing for unemployment doesn’t directly affect your credit score.

Table of contents

- How does unemployment work?

- What happens if you collect unemployment while working?

- Can self-employed people receive unemployment?

- How to stop unemployment benefits when you get a job

- How to file for unemployment benefits

- Understand your state’s laws

How does unemployment work?

Unemployment insurance protects employees who lose their job through no fault of their own. If you qualify for assistance, you receive a portion of your previous wages as a cash benefit while you look for a new job. All states must follow federal unemployment rules, but each state administers its own unemployment program with differing regulations, criteria and maximum benefit amounts.Although eligibility guidelines vary by state, you generally qualify to receive unemployment benefits in the following circumstances:

- You lost your job through no fault of your own. Qualifying circumstances involve your employer closing its doors or laying you off.

- You meet minimum work and income requirements. To receive benefits, you must meet your state’s requirements for wages earned and/or time worked during an established period. In most states, this “base period” is the first four out of the previous five completed calendar quarters before you file a claim.

- You meet additional state requirements. These additional requirements may include being ready and able to work, registering for a local employment service and actively participating in the job search process.[1]

If you do receive unemployment, you should know that the IRS taxes benefits like any other wages. Some states do as well, some tax only a portion of it, and some don’t charge income tax at all.[3]

You can take care of unemployment tax by withholding a portion of your benefits as you receive them. You may also choose to make estimated quarterly payments or simply wait until the end of the year to see how much you owe.[3]

While you may be tempted — or find it financially necessary — to opt to receive your full benefit amount, know that this option may leave you with large tax bills and even penalties come April. Whatever option you choose, understanding your tax obligations may prevent financial surprises.[3]

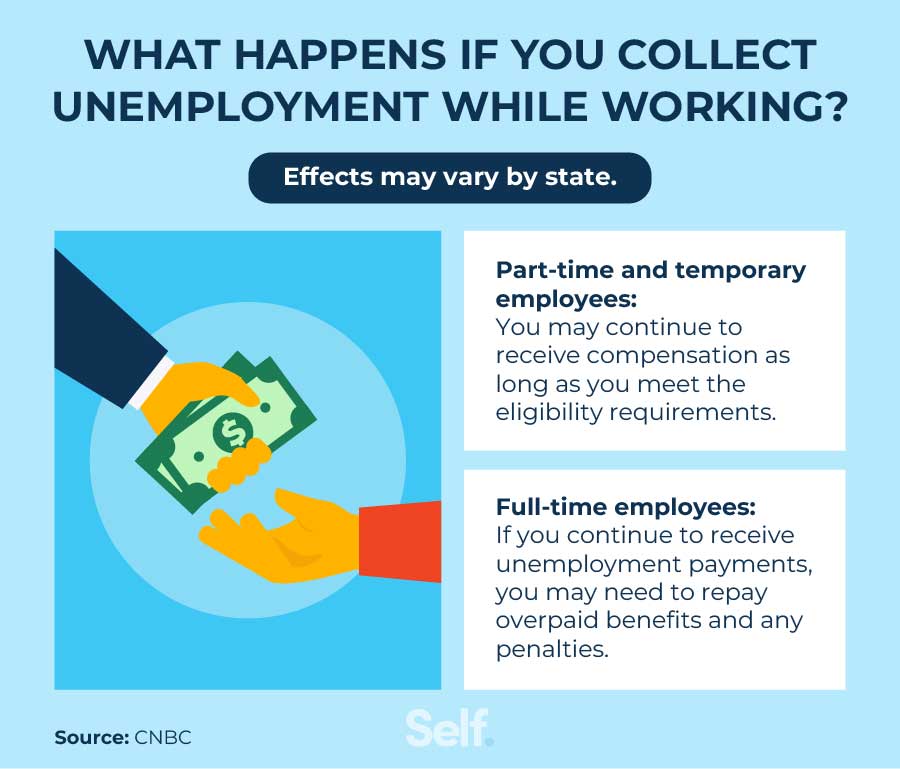

What happens if you collect unemployment while working?

Each state has its own rules about whether you can collect unemployment while working — and how much you can earn before you lose your benefits. Contact your local unemployment office for the specific regulations for part-time, full-time and temporary workers in your state.

Full-time employees

While the rules differ by state, you generally can no longer receive unemployment benefits when you get back to full-time work. Some states, such as Kansas, ask you to stop filing your claim when you return to full-time work, which automatically closes your unemployment claim with the state.[4] Checking your specific state’s rules regarding full-time work and eligibility can help you know when and how to stop filing your claim.If you receive benefits to which you are not entitled — either because you failed to notify your office when you started working full-time or because another error occurred — your state will require you to repay any overcompensation. If you fail to report an error that is later discovered, you could face fees and penalties as well as delays or denials on future unemployment claims.[5][6]

Part-time employees

If you start a part-time job while receiving unemployment benefits, you may be able to receive benefits as long as you continue to meet your state’s eligibility requirements. In general, the more money you make at your job, the lower your weekly unemployment benefit amount will be. At a certain point, the amount you earn as a part-time employee may render you ineligible for assistance that week.In addition to having different definitions of partially versus totally unemployed, states have varying formulas for reducing weekly benefit payments due to part-time work. For example, in Illinois, you can earn up to 50% of your unemployment benefit amount before the state starts lowering your weekly payment.[7] In Texas, your partial unemployment amount is calculated by subtracting your earnings from 1.25 times your normal weekly benefits.[8]

Temporary employees

Unemployment claimants who start temporary part-time or full-time jobs must also report their income according to state rules. Like part-time employees, the more they earn in wages, the less they will receive in unemployment benefits.[9]If you start a temporary full-time job, depending on your state’s rules, you may be ineligible for unemployment benefits. However, some states may allow you to reopen an inactive claim if your temporary job ends within a certain time period, so ask your local office for the details of how temporary work might affect your unemployment benefits.

Can self-employed people receive unemployment?

Independent contractors, gig workers and other self-employed people usually cannot receive unemployment benefits because they haven’t paid into the state’s unemployment fund. An exception created by the Pandemic Unemployment Assistance (PUA) program ended in September 2021. Passed in 2020, the PUA extended unemployment benefits to the large numbers of self-employed people who lost work during the COVID-19 crisis. Now that the federal government has ended this special pandemic-related coverage, self-employed workers are again ineligible for regular unemployment benefits.[10]How to stop unemployment benefits when you get a job

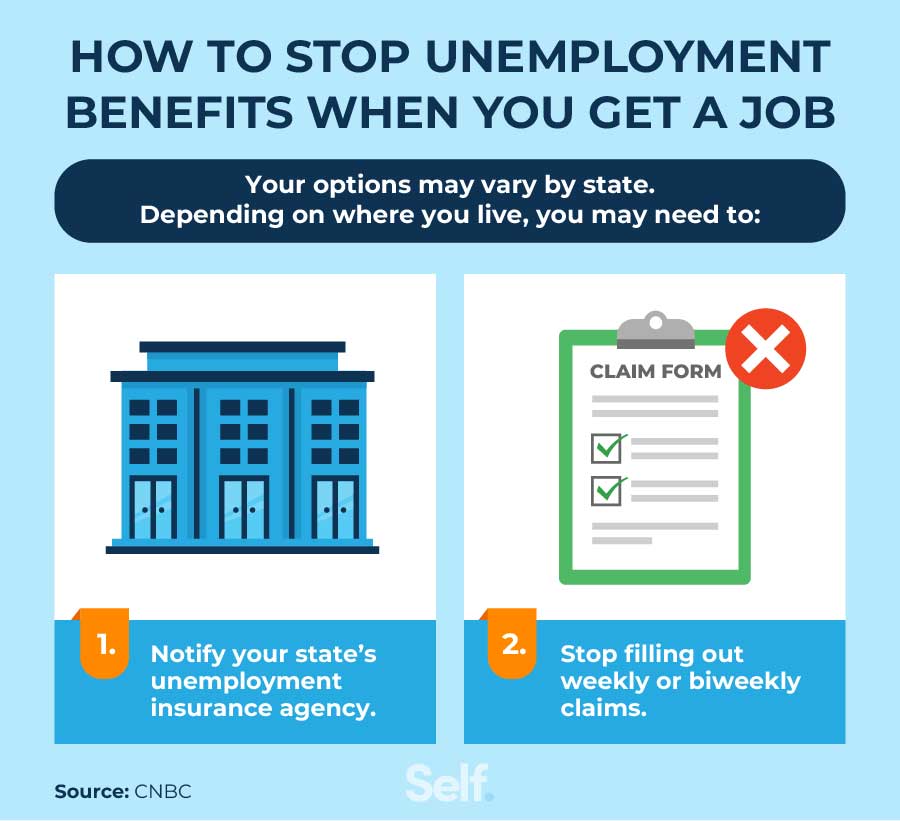

While you must report earnings when you start working again, how you notify your local unemployment office varies by state. Typically, states have one of two systems that we explain in the following sections.

Notify your state’s unemployment insurance agency

How you notify your unemployment office about your change in status may differ from state to state. In states such as Pennsylvania, you need to notify your unemployment agency immediately upon returning to work.[11] Unemployment benefits are generally based on when you work, not when you are paid, so filing for unemployment during your first week of work may result in an overpayment.If you receive an overpayment for a reason that was not your fault, you may have your future weekly amount reduced or otherwise be required to pay back benefits. However, if you receive an overpayment due to fraud, you may face more serious consequences including interest charges, financial penalties, forfeiture of future tax refunds and even criminal prosecution.[12]

Stop filling out your weekly or biweekly claims

Many states don’t require you to notify them directly when you go back to work. In Ohio, Texas and Kansas, for example, you simply stop requesting your weekly unemployment benefits, and the state will cancel your claim.How to file for unemployment benefits

While specific regulations, eligibility criteria and weekly benefit amounts vary by state, filing for unemployment usually follows the same general steps no matter where you live. Before you file, think carefully about whether your employer has actually laid you off or furloughed you.Usually temporary in nature, furloughs can have a variety of structures, including reduced work hours, unpaid time off or a requirement to use up all of your vacation pay by a certain date. If you’re still receiving a full or partial paycheck during your furlough, you may not qualify for unemployment benefits.[13]

Layoffs, however, provide a more clear-cut definition. Whether a layoff is permanent or seasonal, you likely won’t be earning wages during that time and will want to look into filing for unemployment immediately.[13]

1 - Contact your state’s unemployment agency

The first step in filing for unemployment is to contact your local unemployment agency. Some states have a waiting period before you can receive benefits, so you may want to reach out to the unemployment office as soon as possible. You can find your state’s contact information by visiting the U.S. Department of Labor’s unemployment benefits web page and clicking on your state for more information.[11]2 - File your claim within your state

Next, you will file your unemployment claim with your state agency. To make the process go more smoothly, you may want to familiarize yourself with your state’s unemployment office website before you file. You can learn about eligibility criteria, information required and steps to follow. Depending on your state, you may be able to file by phone, in person or online.When filing, you generally want to check your state’s requirements and have the following information on hand:

- Documentation verifying your income

- Information about your work status, including your first and last day of work and your reason for leaving. Proof of unemployment may include emails or letters from your boss laying you off or notifying employees that the business has closed.

- Your Social Security number

- Your contact information including address, email address and phone number

- Your employer’s name, address and phone number

- Your bank name, address, account number, and routing number, for direct deposit into your bank account

- Pension or severance package information (if applicable)[1]

3 - Wait for your claim to be processed

In normal circumstances, you can expect to receive your first unemployment benefits two or three weeks after you file.[1] If the state denies your claim, all is not necessarily lost. After reviewing the information you submitted, contacting your employer and maybe even interviewing you, the employment agency will make a decision about whether you qualify. If they decide you don’t meet all their requirements, they may deny your claim. If that happens, file an appeal. Your status may change the second time around.[14]Understand your state’s laws

Know your state’s unemployment laws both when filing and while collecting benefits. Key regulations and restrictions vary greatly by state, such as your maximum benefit amount, the number of required work search contacts per week, what constitutes a contact, and even whether or not you can leave town while on unemployment.Check with your state’s agency to make sure you comply with applicable regulations — and avoid having to pay back unemployment benefits or even being charged with fraud. One bit of good news regardless of where you live — filing for unemployment doesn’t directly affect your credit score.

Sources

- U.S. Department of Labor. “How Do I File for Unemployment Insurance?” https://www.dol.gov/general/topic/unemployment-insurance. Accessed June 7, 2022.

- Forbes. “Unemployment Insurance: Nine Things That May Stop You From Collecting Benefits,” https://www.forbes.com/sites/deborahljacobs/2013/09/03/unemployment-insurance-nine-things-that-may-stop-you-from-collecting-benefits/?sh=6ade6a3a4f8a. Accessed June 7, 2022.

- Forbes. “How To Handle Taxes If You Received Unemployment Benefits In 2021,” https://www.forbes.com/advisor/taxes/how-is-unemployment-taxed/. Accessed June 7, 2022.

- Kansas Department of Labor. “Unemployment FAQs,” https://www.dol.ks.gov/ui-faqs#:~:text=If%20you%20return%20to%20work,your%20claim%20will%20become%20inactive. Accessed June 14, 2022.

- Indiana Department of Workforce Development. “Unemployment Insurance Claimant Handbook.” https://www.in.gov/dwd/files/Claimant_Handbook.pdf. Accessed November 3, 2022.

- Illinois Department of Employment Security. “UI Fraud by Individuals.” https://ides.illinois.gov/unemployment/insurance/by-individuals.html. Accessed November 3, 2022.

- Illinois Department of Employment Security. “Partial Benefits (Working Part Time).” https://ides.illinois.gov/unemployment/resources/partial-benefits.html. Accessed November 3, 2022.

- Texas Workforce Commission. “How to Report Your Work & Earning,” https://www.twc.texas.gov/jobseekers/report-your-work-earnings#:~:text=You%20may%20earn%20up%20to,you%20benefits%20for%20that%20week. Accessed November 3, 2022.

- Indeed.com. “How Temporary Jobs Might Affect Unemployment,” https://www.indeed.com/career-advice/starting-new-job/temporary-jobs-and-unemployment. Accessed June 7, 2022.

- Indeed. Unemployment Benefits for Self-Employed, Contract and Gig Workers,” “https://www.indeed.com/career-advice/finding-a-job/unemployment-for-self-employed. Accessed June 7, 2022.

- Pennsylvania Office of Unemployment Compensation. “Filing for Unemployment Compensation FAQs,” https://www.uc.pa.gov/faq/claimant/Pages/Filing%20for%20Unemployment%20Compensation%20FAQS.aspx. Accessed June 14, 2022.

- Pennsylvania Office of Unemployment Compensation. “Overpayments and Collections,” https://www.uc.pa.gov/unemployment-benefits/handbook/Pages/Overpayments-and-Collections.aspx. Accessed June 7, 2022.

- Investopedia.com. “Furlough vs. Layoff,” https://www.investopedia.com/furlough-vs-layoff-5213743. Accessed June 7, 2022.

- CareerOneStop, “What if I’m denied?” https://www.careeronestop.org/WorkerReEmployment/UnemploymentBenefits/what-if-im-denied.aspx. Accessed November 7, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on November 13, 2022

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.