Can You Be Denied a Job Due to Bad Credit?

Published on: 03/05/2018

Summary and Key Takeaways

Can you be denied employment due to bad credit? State laws vary when it comes to employer credit checks. But your personal finances can be a factor in your potential employment. Potential employers may run employment credit checks and deny you a job based on what they find.

What does the Fair Credit Reporting Act (FCRA) say? A prospective employer has to make it clear that they’re asking your permission, and you have the right to be notified if they plan to beforehand and sign a form to authorize.

What if you decline to permit credit checks? Companies also have the right to stop the employment application process if you refuse permission, though you have avenues to take when your rights are violated.

It can be easier said that done to build good credit, and the reasons why some people have a poor credit history are different for each individual.

Organizations may look at your credit history, whether you're securing a loan, leasing a property, or even applying for a job. For the latter, a potential employer may hold employment credit checks on a job applicant and their credit history.

But can you be denied employment due to bad credit?

There are many reasons you can be turned down for a job, like not having enough experience or performing poorly during the interview.

But did you know your personal finances can be a factor in your potential employment? A prospective employer has the right to check your credit and not offer you a job because of what they find.

This can be a surprising and disturbing situation to find yourself in, especially if you’re an otherwise solid candidate.

Read below to see how you can be denied a job because of bad credit, how to prepare yourself and how to prevent it from happening.

How employer credit checks affect workers

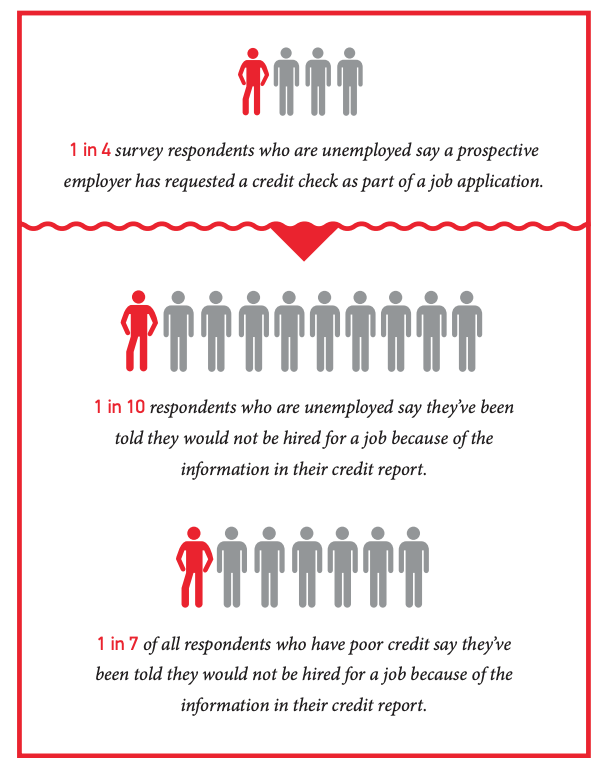

Employer credit checks have a huge impact on applicants. According to a report from think tank Demos, one in 10 workers with credit card debt say they’ve not been hired because of their credit report. About one in seven of those with poor credit histories say their credit report was the reason they weren’t hired.

Unfortunately, this can cause a negative spiral. If you can’t get a better job because of your credit report, you may struggle paying off debt and increasing your credit score. This is a big reason why you should know what's in and how to read your credit report.

The report also states that many people who have poor credit do so because of medical debt and household unemployment.

What is an employer credit check?

Many employers run background checks on potential staff members. This is different from a credit check and is a more common part of the hiring process. A background check verifies your identity and education, screens for a criminal history and checks other relevant details.

A report from the National Association of Professional Background Screeners found that companies who ran background checks included credit information on 16% of their candidates and 31% of them included some credit or financial information on those candidates.

An employer credit check is different than what a bank might see when approving you for a loan. The employer doesn’t see a total credit score so they won’t know if you’re rocking a perfect 850 or a bad credit score of 450.

What’s on a credit check

A company may use one of the three major credit bureaus for an employer credit check: Experian, Equifax or TransUnion. They may also hire an outside third-party company to conduct this credit check.

The employer credit check will show your current legal name, any previous legal names, current and previous address and Social Security Number. It won’t show your birthday, though that will likely appear on the job application form.

The credit check will show any lines of credit you have, current balance and available credit. If you have a medical bill sent to collections, they’ll see it. If you have a $0 balance on your credit cards, they’ll see that too.

An employer credit check only shows your information, not your spouse’s. If your spouse has debt in his or her name, it won’t show up on your credit report unless you’re an authorized user on the account or if it’s a joint debt. For example, if your spouse has a medical bill that’s gone to collections, it won’t be on your credit report.

Learn about how being an authorized user to increase credit score results can help you.

Why credit matters for work

The employer credit check is designed to check for financial problems that could pose a problem on the job. If you’re a public service employee, you might be a target for bribes. If you have significant debt, your employer might think you’re more willing to accept those bribes because they’ll get you out of your financial predicament.

In 2018, the acting mayor of Dallas took more than $450,000 in bribes, part of which he used to pay down debt.

Some companies also require credit checks because you’re applying for a finance-related position, and they want to know their future employee hasn’t defaulted on their student loans, for example. The thinking is – if you’ve done a bad job managing your own finances, you probably can’t handle running the finances of a business either.

What jobs check your credit?

The most common industries that conduct employer credit checks are finance, government and other public service jobs. Though in certain states, other industries will check credit too.

For example, in Connecticut, employees who have access to more than $2,500 worth of assets including prescription drugs and other pharmaceuticals may have their credit checked.

Most, if not all jobs that require a security clearance will also require a credit check.

Consent required

Most companies use third-party services to conduct these credit checks. Rod Griffin, director of consumer education and awareness for credit bureau Experian, said companies can decide to pull a prospective employee’s credit report, but it doesn’t mean they’re acting within the legal bounds.

“They would need to have a permissible purpose and should work with their compliance team or department to ensure they are in compliance with state and federal laws when it comes to the use of credit reports as part of the employment process,” he said.

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act is a piece of legislation that dictates what employers, insurance companies, landlords and other third parties are allowed to see when they look at your credit report. It also shows what rights you have when it comes to letting outside parties look at your credit report.

The FCRA provides both prospective and current employees with several legal rights. First, the employer has to make it clear that they’re asking your permission to look at your credit report. You have to sign and authorize this clearly.

They can’t hide this disclosure or request with other application materials or forms, though there may be some exceptions.

For example, according to the Consumer Financial Protection Bureau, “Written consent generally is not required in the trucking industry.”

Employee rights and credit checks

If you’re applying for a job, you have the right to be notified of an employer credit check before it happens. The company is legally prohibited from notifying you after the fact that they’ve conducted an employer credit check.

You also have to sign a form saying that you’ve agreed to an employer credit check. Many companies get in trouble when they conduct a credit check without getting permission first.

Again, it’s not unheard of for a company to violate these rules, either by not giving you enough of a warning or by not asking your permission at all.

You have the right to say no to an employer credit check, though you should be aware that the employer then has the legal right to stop the application process too. If you’re up for a promotion, your current employer has the right to conduct a credit check, even though you’re already an employee. You can also deny this request.

When an employer sees something negative in a credit report, they have to give you a formal notice and a copy of the report. This gives you time to refute the information or state your side. They must give you a few days before deciding not to hire or promote you.

If they do decide not to hire you, they have to give you the name and contact information of the credit bureau they used. You also have a legal right to get a free copy of the report within 60 days.

State laws for credit checks vary

Some states have very strict laws that either prohibit or restrict how and when employers can conduct credit checks.

The following states have their own laws regarding employer credit checks:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Illinois

- Maryland

- Nevada

- Oregon

- Vermont

- Washington

Cities such as Chicago and New York City have their own local laws regarding employer credit checks.

These states have limits on employer credit checks because they want employees to have more options in an attempt to help break the cycle of poverty. If you have poor credit, a good job can help you dig your way out of the mess.

There are jobs where a credit check is required because of security or potential for corruption and bribery. According to the New York City government, these include “police and peace officers, and high-level positions involving trade secrets, financial authority, and information technology.”

Still, the law can limit credit checks even for people in those industries. If you’re a bank teller, you may not have your credit checked even though you’re technically working in the financial industry.

In general, if you’re a non-salaried worker in an entry-level position, your job should be exempt from employer credit checks.

What to do if your rights have been violated

It’s not uncommon for an employer to violate the law when reviewing an individual's credit report. Some major employers have been fined in recent years for violating state and federal laws.

If you think the employer has violated the Fair Credit Reporting Act during this process, you can report them to your state or local government if they have specific laws pertaining to employer credit checks. Otherwise, you can report them to the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

“The consumer can report to the FTC or the CFPB, but those agencies don’t take action on behalf of individuals,” said consumer attorney Jay S. Fleischman, consumer attorney at Shaev & Fleischman, P.C. “For someone to get a resolution of the problem, they’d want to hire a lawyer.”

Hiring a lawyer can be expensive, but if you know multiple people who have been violated by the same company, you can consider hiring a lawyer together.

How to troubleshoot employment credit issues

If you know there are red flags on your credit report, you should disclose those when you find out the employer’s going to conduct a credit check. It’s better for them to hear your explanation first than to find out later. You may fare better if you’re honest in the beginning before they’ve looked at your credit report. If you try to skirt the issue, they may be suspicious about your behavior.

Tell them what happened, what mistakes you made and how you rectified them. If you defaulted on a medical bill because you lost your job, explain the circumstances and how you’ve paid all your bills on time since then.

An employer is more likely to waive the indiscretion if you show how you’ve grown from the experience. Most employers don’t expect you to be perfect, but they do expect you to be honest.

Check your own credit first

Before applying for a job where they’ll likely check your credit, go to AnnualCreditReport.com and get a free copy of your report from the three major credit bureaus, Experian, Equifax and TransUnion.

It’s vital to do this before you apply for a job because you might discover a mistake, or something more sinister like identity theft, on your credit report.

According to the Consumer Financial Protection Bureau, one in five people will have a mistake on their credit report. This can be a bankruptcy from eight years ago that should no longer be on your credit report or a debt that isn’t yours at all.

For example, once I was checking my credit report and noticed that there was a $76 medical bill from my old doctor’s office. I was so confused. I called them and they said they had sent the bill to my house, but I hadn’t paid it.

I explained that I had recently moved and hadn’t gotten the bill, even though I had mail forwarding set up. They said I could pay the bill and they would withdraw it from collections.

You’re allowed to get one free copy from each credit bureau once a year. If you’ve already looked at a report once this year, you’ll have to pay an extra fee. This fee may be no more than $12.50 per report. If you find that the price is more, see that you’re not also being charged for a credit score.

Even though most banks and lenders report your bills to all three credit bureaus, it’s still a good idea to pull all three credit reports if you haven’t checked your credit in a while. Sometimes a lender will only report to one credit bureau.

You can also get an extra free credit report if you’re unemployed and intending to apply for a job. This can be especially helpful if you suspect your prospective employer will run a credit check.

Some states also don’t allow credit bureaus to charge for extra credit reports. When you view your credit report, save it as a PDF so you have a copy for your records.

Looking at your credit report ahead of time is crucial because you may discover that a bill was incorrectly sent to collections or a debt that appears on your account isn’t actually your responsibility. It’s better to find out and rectify these mistakes before you’re in the middle of a job interview.

It can take weeks or even months to fix a credit report mistake so it’s better to start doing it before interviewing for a job.

Do employer credit checks affect your credit?

Your credit score won't be affected if a potential employer conducts a pre employment credit check on you. Employers typically look at long-term credit history. For example, even if you've had a history of bad credit that you have since remedied, your potential employers may ask you to explain the discrepancies, especially if your current credit history is good.

Employer credit checks count as a soft pull inquiry on your credit. Unlike a hard pull, a soft pull means it may show up on your credit report, but won’t negatively impact your credit score. This is the same kind of inquiry that happens when you’re pre-approved for a credit card or when you’re getting quotes from insurance companies.

If you apply for five jobs and they all check your credit, that won’t hurt your credit. This is important to note if you’re about to buy a house or make a huge purchase and don’t want to do anything to affect your credit.

Only the accountholder will be able to see a soft pull on a credit report, except for a few exceptions.

Who else can see your credit report

Employers aren’t the only ones besides lenders to request a credit report. Landlords, insurance companies, and utility companies may also request a limited credit report to demonstrate your ability to repay a loan on time. In this case, having a good credit report may help you get a lower rate or avoid paying a deposit.

For example, an insurance company who views your credit report may charge you a higher rate if you have poor credit. Once you increase your credit score, you can ask them to review your file and see if you qualify for a lower rate.

Final Thoughts

Companies use a credit score to assess your reliability and how responsible you are. If you’re not good at paying your loans on time or in full, they may decide you’ll do the same with their bills.

The bottom line? By knowing where your credit score stands ahead of time, you can take steps to improve and build your own credit so that when you do start your next job search, you’ll be ready.

Sources:

AP. “Dallas Mayor Pro Tem Pleads Guilty to Accepting Bribes” https://www.apnews.com/e5ba2e451a2d43838ffdd8636f660d6c

House of Debt. "Can You Be Denied A Job Because Of Bad Credit?". https://houseofdebt.org/can-you-be-denied-a-job-because-of-bad-credit/

The Balance Careers. "What Is an Employment Credit Check?". https://www.thebalancecareers.com/what-is-an-employment-credit-check-2061962

Scholars. "How do employers use credit reports in hiring decisions – and how can the process be improved". https://scholars.org/contribution/how-do-employers-use-credit-reports-hiring-decisions-and-how-can-process-be-improved

CNBC Select. "Can employers see your credit score? How to prepare for what they actually see when they run a credit check". https://www.cnbc.com/select/can-employers-see-your-credit-score/

About the author

Zina Kumok is a Financial Health Counselor and Credit Counselor, certified by the National Association of Certified Credit Counselors, who writes extensively about personal finance.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).