Do You Have To Pay Back Unemployment Benefits?

Published on: 09/23/2021

Many have been helped by unemployment benefits and Pandemic Unemployment Assistance (PUA) benefits. And if you're one of those who were helped, you may wonder whether you need to pay back the benefits.

You may have to pay back unemployment benefits if you were overpaid, ineligible, or made fraudulent claims, but these circumstances vary from state to state. In terms of overpayment, if you’ve missed a deadline to validate your eligibility claims, you may be deemed ineligible for benefit status and could have to pay back benefits received since December 27, 2020.[1]

It’s also worth noting that you have to pay taxes on your unemployment benefits, and they’re not automatically withheld from your paycheck. There's a difference between having to pay back unemployment and having to pay taxes on unemployment.

Unless your income is too low to require a tax return (the threshold varies based on your age and filing status), you will have to pay taxes on your benefits, and with the average worker receiving $978 in gross unemployment pay per week, they could bump you into a higher tax bracket. If this happens, you may end up with a higher tax bill than you anticipated.[2] [3]

Some states withhold taxes from your paycheck, while others don’t.

In some states, such as Colorado, the requirement to repay overpayments will be waived for reasons like the forms were too confusing.[4] Yet, there are still deadlines to file additional documents if you’ve received an overpayment, and some people might have to pay back a portion of what they were given. Specifically, you may be responsible for paying back benefits you’ve received since December 27, 2020 if you missed the deadline or weren’t eligible to continue receiving benefits.[1]

Most people will not have to pay back unemployment or PUA benefits.

How do unemployment benefit payments work?

Unemployment benefits (also known as unemployment insurance or UI) are funded by unemployment taxes under the Federal Unemployment Tax Act. Most employers pay both federal and state unemployment tax, and if you’re an employee, it’s not deducted from your wages in most states.[5] Only Alaska,[6] Pennsylvania,[7] and New Jersey[8] require employers to withhold state unemployment tax from employee wages.

To apply for unemployment benefits, you must file a claim with the program in the state where you worked — and you should do so as soon as possible. To ensure that your claim isn’t delayed, you’ll need to provide all the necessary information, including the dates and addresses of your former employment.[9]

If everything goes smoothly, it usually takes about two or three weeks after you file to get your first benefit check.

If you’ve moved and now live in another state, your current state can help you determine how to file elsewhere. The Department of Labor has an interactive map and list you can use to find contact information for each state’s unemployment insurance office.[9]

Each state has its own criteria to determine eligibility for unemployment insurance. In most states, eligibility is determined in part by two factors. One factor is whether you're out of a job due to a lack of available work. The other factor is whether you've previously worked for an established "base period." The base period is typically the first four of the last five calendar months before filing your claim.

Other states may have additional requirements, so check with your state to find out what applies to you.

What is Pandemic Unemployment Assistance?

The CARES Act, passed in March 2020, set up three new federal programs specifically in response to the coronavirus pandemic:

- Pandemic Unemployment Assistance covers people not formerly eligible for unemployment aid, such as:

- Gig workers

- Freelancers

- Independent contractors

- Federal Pandemic Unemployment Compensation (FPUC) was created as a $600-a-week increase, later reduced to $300, to help unemployed workers recover lost wages.

- Pandemic Unemployment Emergency Compensation (PEUC) extended aid to workers who’d run out of state benefits.

Those benefits were extended to Labor Day 2021 in March under the American Rescue Plan Act.[10]

Who qualifies for Pandemic Unemployment Assistance?

The PUA primarily helps workers not traditionally covered by unemployment insurance. In the past, these workers weren't covered before because they didn't have a traditional employer that pays unemployment taxes. However, because of the COVID-19 emergency, a law was passed allowing them to file unemployment claims for UI benefits during a specific period.

As mentioned above, PUA covers people like gig workers, independent contractors, and people who are partially employed or underemployed during the pandemic. This could apply to people like Uber or Lyft drivers, freelance writers or editors, consultants, and people who work on a contract basis.

Do you have to pay back unemployment during the COVID-19 pandemic?

The federal government has given states some discretion on whether to require that PUA recipients repay overpayments.

It’s not unusual for states to overpay unemployment benefits. In fact, state PUA overpayments amounted to $3.6 billion nationwide from March 2020 to February 2021.[11]

According to the Department of Labor, “states may choose to waive recovery of overpayments under certain circumstances when an individual is not at fault.” Because unemployment insurance is a federal partnership administered by the states, each state has discretion.[12]

Some states have decided not to pursue reimbursement of overpayments. Virginia, for example, granted such a waiver through July 3.[13] And Colorado decided in October 2020 not to try to collect $1.4 million in overpaid unemployment insurance benefits it had distributed.[4]

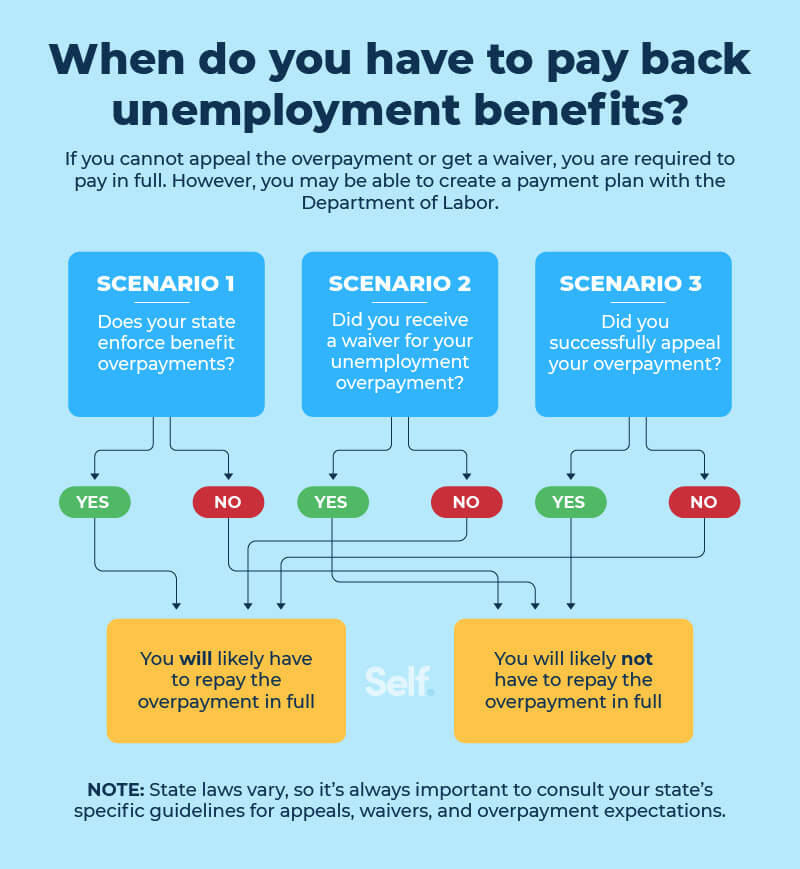

When do you have to pay back unemployment benefits?

Overpayments received as the result of fraud on the part of the individual have serious repercussions. Unemployment insurance fraud occurs when you're overpaid because you've made false statements, provided false information, or withheld information to receive benefits. If you've received the benefits through no fault of your own, you haven't committed fraud.[14]

The amount of the overpayment matters in terms of the seriousness of fraud. Large-scale fraud, in which you receive a sizable overpayment amount, can constitute a felony. In that case, you may also have to pay a financial penalty in addition to repaying the overpaid benefits themselves.

Examples of information withheld that could constitute fraud include:

- Not reporting earnings

- Failure to report bonus, training, or severance pay

- Returning to work while continuing to collect unemployment benefits

Failing to look for work or to document that you have may also be considered fraud.

However, this will not affect the vast majority of those filing for unemployment benefits because only a small fraction of overpayments result from fraud.[15]

Due to its legal structure, PUA fraud has been a particular problem, according to an audit by the Office of the Inspector General.[16] The top issue cited by states in combating PUA fraud was that recipients could simply claim that they were eligible for the program under penalty of perjury.

With the potential for fraud affecting nearly 10 million people, the Department of Labor and state agencies added a new verification process to mitigate potential fraud.[17] In Maryland, for example, PUA claimants faced a new requirement to provide proof of employment or self-employment within 90 days to be eligible for PUA payments. This proof could include W-2 forms, paycheck stubs, business licenses or receipts, tax returns, etc.[18]

How to pay back overpaid unemployment benefits

Suppose the state determines you've been overpaid, and it decides to collect. In that event, you'll receive a notice of overpayment that will include the reason you were overpaid and the number of weeks involved.[14] If you are still collecting unemployment and don’t ask for a waiver, the state may deduct what you owe from future unemployment checks.[5]

You can file an appeal if you are asked to repay unemployment benefits and believe you've received a notice in error. Ask for a hearing on your state unemployment website. If the information is accurate, see if you qualify for a waiver or forgiveness. But act quickly and check with your state because you may not have much time under its guidelines.[12]

The fact is, different states have different guidelines for filing an appeal. In New York, for example, you’ll get a notice explaining why you were found to be ineligible for unemployment benefits. If you disagree and want to appeal, you’ll need to request a hearing.[19]

If you do have to pay back the benefits, states have different mechanisms for doing that. In North Carolina, you have the option of doing so by paying through credit card, debit card, check, or money order. The state may also garnish state or federal tax refunds or lottery winnings or pursue legal action.[20]

Suppose you refuse to repay an overpayment in Illinois. In that case, the state can keep up to 25% of any future unemployment benefits you may receive over a maximum of five years until the benefits are repaid.[21]

Some states can go after an overpayment by garnishing your federal income tax refund or using your state tax refunds. In Massachusetts, if that money is unavailable, they’ll wait to collect the rest if you need unemployment insurance in the future.[22]

States can also pursue collections through the Treasury Offset Program, which collects past-due debts such as child support from those who owe federal and state agencies.[23]

States may even pursue civil action in state court, which can allow them to garnish future wages. However, potential remedies vary from state to state, and some jurisdictions are more likely to pursue repayments than others.

Is there a downside to collecting unemployment?

If you’re worried that you won’t have enough money to cover your expenses, including things that can affect your credit like utility and credit card payments, collecting unemployment is probably a good idea. Unemployment insurance is one form of assistance you can use to protect your finances and credit in difficult times. By providing the funds to maintain consistent payment history, it helps you build your credit.

However, there are a couple things you should be aware of.

Delayed Payment

It takes multiple weeks to process your unemployment claim and send payment. Before you can submit a claim, you’ll need to provide a lot of documentation.

If you seek PUA payments, you'll need to collect documentation, including paycheck stubs, earnings and leave statements, or W-2 forms if you've been traditionally employed. Gig workers will have to provide business receipts, a copy of their business license, tax returns, state or federal employer ID numbers, and signed affidavits verifying self-employment.[1] [17]

Taxes

Your unemployment benefits are taxable. You will have to pay federal taxes and may have to pay state taxes depending on where you live.

States don’t automatically withhold taxes from unemployment benefits. You have to request to have federal income taxes withheld by filling out Form W-4V, Voluntary Withholding Request, and giving it to the state agency paying your benefits. Some states also offer the option of requesting withholding online through their benefits portal. According to Federal law, recipients of unemployment benefits may choose to withhold 10% of their benefits to cover all or part of what they owe in taxes. [24]

If you don’t choose to have taxes withheld from your benefits, or 10% isn’t enough, you may need to make quarterly estimated payments.

If your state taxes unemployment compensation, you may also want to have state income taxes withheld from your benefits as well.

The bottom line

For the most part, unemployment benefits are going to help people more than they hurt financially. They've also been a good resource during the pandemic for people who haven't been eligible before.

Though there are instances where people find themselves with an overpaid status and owing money, they are particular occurrences. Many states have waived overpayment repayment requirements for many reasons.

As a result, the pros of claiming unemployment insurance may outweigh the cons if you're eligible for it.

Sources

- NextAdvisor in partnership with TIME. “Millions Could Have to Pay Back Unemployment Benefits If They Miss This Deadline,” https://time.com/nextadvisor/in-the-news/pay-back-unemployment-benefits/. Accessed August 9, 2021.

- H&R Block. "How much do you have to make to file taxes — What is the minimum income to file taxes?" https://www.hrblock.com/tax-center/income/other-income/how-much-do-you-have-to-make-to-file-taxes. Accessed October 4, 2021.

- CNBC. "How are unemployment benefits taxed?" https://www.cnbc.com/2020/04/28/how-are-unemployment-benefits-taxed.html. Accessed October 4, 2021.

- Colorado Sun. “Colorado won’t try to collect the $1.4 million in overpaid unemployment benefits it distributed after all,” https://coloradosun.com/2020/10/08/colorado-unemployment-overpayment-pua-pandemic-waiver/. Accessed August 9, 2021.

- IRS. “Federal Unemployment Tax,” https://www.irs.gov/individuals/international-taxpayers/federal-unemployment-tax. Accessed August 9, 2021.

- Alaska Department of Labor & Workforce Development. “Alaska Unemployment Insurance Tax Handbook,” https://labor.alaska.gov/estax/documents/taxbook.pdf. Accessed September 16, 2021.

- Pennsylvania Department of Labor & Industry. “Employee Withholding,” https://www.uc.pa.gov/employers-uc-services-uc-tax/withholding/Pages/default.aspx. Accessed September 16, 2021.

- State of New Jersey Department of Labor and Workforce Development, “Employer Handbook,” https://nj.gov/labor/handbook/chap1/chap1sec4ContributionReports.html#6. Accessed September 16, 2021.

- U.S. Department of Labor. “Unemployment Insurance Relief During COVID-19 Outbreak,” https://www.dol.gov/coronavirus/unemployment-insurance. Accessed August 9, 2021.

- CNBC. “Could pandemic unemployment be extended beyond Labor Day? What experts are saying,” https://www.cnbc.com/2021/08/06/could-pandemic-unemployment-be-extended-beyond-labor-day-what-to-know.html. Accessed August 9, 2021.

- US Government Accountability Office. “Sustained Federal Action Is Crucial as Pandemic Enters Its Second Year,” https://www.gao.gov/products/gao-21-387. Accessed August 9, 2021.

- US Department of Labor. “US Department of Labor Issues Guidance to States to Permit Greater Flexibility for Waiving the Recovery of Certain Unemployment Insurance Overpayments,” https://www.dol.gov/newsroom/releases/eta/eta20210505. Accessed August 9, 2021.

- Virginia Employment Commission. “HB 2040 Overpayment Waiver,” https://www.vec.virginia.gov/node/12973. Accessed August 9, 2021.

- NC Department of Commerce. “What is an Overpayment?” https://des.nc.gov/overpayments/what-overpayment. Accessed August 9, 2021.

- Investopedia. “What to Do About Unemployment Overpayment,” https://www.investopedia.com/what-to-do-about-unemployment-overpayment-5180862#citation-5. Accessed August 9, 2021.

- Department of Labor. “COVID-19: States Cite Vulnerabilities in Detecting Fraud While Complying with the CARES Act UI Program Self-Certification Requirement,” https://www.oig.dol.gov/public/reports/oa/2021/19-21-001-03-315.pdf. Accessed August 17, 2021.

- CNBC. “Millions of workers will have to submit new documents for pandemic unemployment benefits in 2021,” https://www.cnbc.com/2020/12/22/workers-have-new-requirements-for-pandemic-unemployment-benefits-in-2021.html. Accessed August 17, 2021.

- Maryland Department of Labor. “Proof of Employment Documentation Requirement for PUA Claimants - Unemployment Insurance,” https://www.dllr.state.md.us/employment/uipuaproof.shtml. Accessed August 17, 2021.

- New York State Department of Labor. “Unemployment Insurance,” https://dol.ny.gov/unemployment/unemployment-insurance-assistance#2. Accessed August 17, 2021.

- NC Department of Commerce. “How to Repay,” https://des.nc.gov/overpayments/how-repay. Accessed August 17, 2021.

- Illinois Legal Aid Online. “What to do if you get too much money for your unemployment benefits,” https://www.illinoislegalaid.org/legal-information/what-do-if-you-get-too-much-money-your-unemployment-benefits. Accessed August 16, 2020

- MassLegalHelp. “Has the DUA asked you to return money they paid you?” https://www.masslegalhelp.org/employment-unemployment/dua-overpayments. Accessed August 9, 2021.

- U.S. Department of the Treasury. “Treasury Offset Program,” https://fiscal.treasury.gov/top/. Accessed August 9, 2021.

- IRS. “People should have tax withheld from unemployment now to avoid a tax-time surprise”. https://www.irs.gov/newsroom/people-should-have-tax-withheld-from-unemployment-now-to-avoid-a-tax-time-surprise. Accessed October 11, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).