What Is the Difference Between a Charge Card and a Credit Card?

Published on: 08/19/2024

Charge cards and credit cards are similar, but not the same. Charge cards and credit cards both offer ways to purchase items based on a promise to pay later.

The main difference lies in how much you can charge and when you pay. While a charge card does not have a spending limit, and does not incur interest charges, like credit cards do, you typically must pay the full balance each month.

What is a charge card?

A charge card is a form of payment that allows you to spend with no limit and no interest, but the balance typically must be paid off in full at the end of each period. Charge cards usually have steep annual fees and high penalties if the balance is not paid.

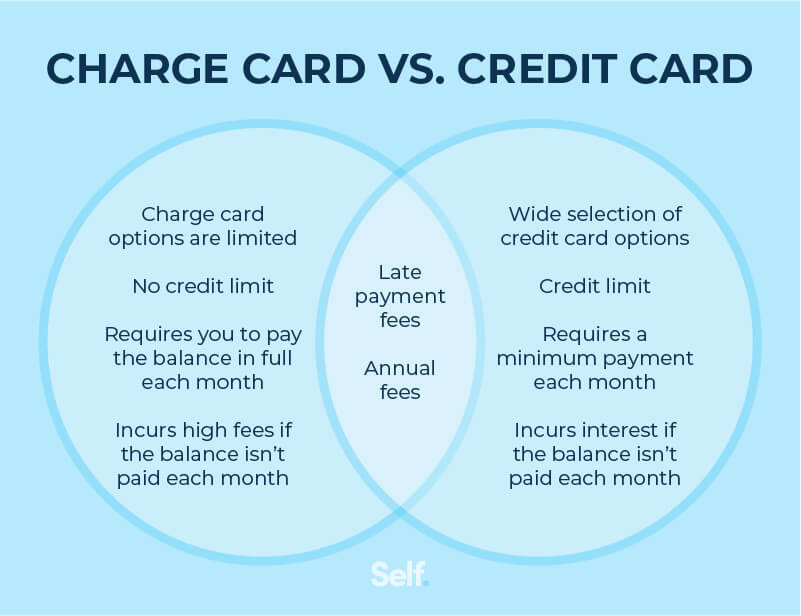

Charge cards vs. credit cards

Credit cards, unlike charge cards, allow you to carry over a balance from month to month. You don’t have to pay everything off at the end of each billing cycle. American Express still offers charge cards, and so do some gas stations and retailers. Diners Club still offers a charge card, as well.[1]

Although charge cards came first, they’re increasingly rare: Credit cards are far more numerous and popular.

There are multiple reasons for this. Credit cards are easier to obtain and give you the option of carrying a balance over from month to month. Charge cards also may come with fees, which can make them less desirable. Other key differences include the following:

Application process

Charge cards can be more difficult to get than credit cards because they’re designed for people with excellent credit. Charge card issuers need to be sure the person who’s applying can pay off the full balance by the due date every month.

Credit card applicants don’t have to do that. It’s possible to get a credit card with bad credit (although you’ll pay a high interest rate). A charge card? Not so much.

Credit limit

Credit cards have a preset spending limit based on your creditworthiness, whereas charge cards generally don’t. It’s less likely that you will spend more than you can pay off because you have to pay what you owe in full every month.

By contrast, revolving credit on a credit card allows you to increase the amount you owe from month to month if you continue to spend more than you can pay off.

Minimum payment

The monthly payment for a charge card is your full balance. The minimum payment for a credit card is generally a percentage of what you owe. If your minimum payment is 2% of your balance, and you’ve got a balance of $500, you’ll have to pay $10; but if your balance is $5,000, you’ll have to pay at least $100. And interest will keep accruing on whatever you don’t pay.

Fees

Charge cards and credit cards both charge fees for late payments, but charge cards also carry high annual fees just to remain as a cardholder. Credit cards may or may not charge annual fees, but they’re likely to be less.

For instance, the American Express Platinum charge card’s annual fee is $695.[2] And a Diners Club Elite card will cost you $300 a year.[3] Also, keep in mind that late fees are easier to avoid on credit cards than on charge cards, because you only need to make a minimum payment.

Interest

Interest charges can accrue on credit cards unless you pay off your full statement balance every month. By contrast, you’re usually required to pay off the full balance on your charge card every month, so if you use it as intended, you won’t pay anything more than the cost of your purchase — except for those fees (see above).

There are some charge cards, like American Express Platinum, that offer pay over time features for qualifying purchases. However, APRs are between 15.99% to 22.99% and only select purchases are eligible.[2]

What type of card should you get? Credit cards and charge cards each have pros and cons, which may be more or less important to you depending on your financial situation.

Pros and cons of charge cards

Charge cards reward and encourage responsible payment practices by requiring that you pay your balance in full every month or risk being hit with high fees. There are some advantages to this approach, but there are also drawbacks.

Pros

- As mentioned above, the requirement that you pay off your full balance each month can create good financial habits. You get used to paying off your debt in full, rather than delaying it.

- Because you avoid accumulating interest by paying in full each billing cycle, you won’t be racking up more debt by carrying a balance.

- The lack of a firm spending limit gives you flexibility.

- Charge cards may come with larger rewards and perks than credit cards.

- You’ll always have available credit, as long as you make your full payment each month.

Cons

- There are limited charge card options and you must have excellent credit to be approved.

- Annual fees can be high, so if you don’t use your card much, it may not be worth it.

- You’ll need to monitor what you’re spending on the card to avoid racking up more debt than you can pay off in a month.

- You may not be able to afford large purchases if you can’t pay them off within the month.

Pros and cons of credit cards

Many consumers find credit cards to be a more attractive option than charge cards. But you should weigh the pros and cons before applying to a credit card issuer.

Pros

- Credit cards allow you to carry balances from one month to the next, giving you the spending power to afford big purchases.

- You have more types of credit cards to choose from with a variety of terms, fees and rewards.

- You don’t have to deal with the high annual fees that accompany a charge card.

- Credit cards tend to be more widely accepted than charge cards.

- You don’t need good credit to get a credit card, although better credit will get you better terms, specifically lower interest rates.

- Balance transfers using a 0% annual percentage rate (APR) can help you pay down debt if you can do so within the introductory period.

Cons

- It’s easier to get into debt by continually carrying over your balance and making new charges in the meantime.

- You have to pay interest, something you don’t have to do with a charge card.

- Carrying high credit balances can hurt your FICO® credit score. You don’t have that problem with a charge card balance, because you pay it off each month.

- You can only spend within your credit limit.

How do charge cards and credit cards impact my credit?

A charge card can help you build and maintain a good credit score by encouraging you to make on-time payments, which become part of your credit history and boost your FICO® score. (Payment history is the biggest single factor in determining your FICO® score).

The second biggest factor is your credit utilization ratio, or CUR: your total outstanding balance divided by your credit limit. But charge cards don’t have a credit limit, and since you’ll be paying your balance in full every month, your CUR won’t be affected. There won’t be any credit utilization for credit bureaus to put on your credit report.

Credit cards can help you build credit, too. They can increase your credit mix, which counts for 10% of your credit score under the FICO® system (one of two main scoring models). If you’ve got other kinds of credit on your record, such as a car loan and student loans, adding a credit card and keeping up with payments can help.

If you don’t have much credit history or are seeking to rebuild your credit, a secured credit card can help. You secure your card by depositing a few hundred dollars into a linked account that isn’t touched as long as you make your payments on time, which will help you improve your credit score.

Adding another credit card may help your credit utilization ratio if you make only nominal charges on that card, because you’ll be adding to your overall credit limit without significantly changing your level of debt.

However, opening a new credit card may not increase your credit right away. The age of your credit accounts is a factor in determining your credit score and every time you apply for credit, it counts as a hard inquiry, which can shave a few points off your score.

Moving forward

Credit cards and charge cards each have advantages and disadvantages. Together or separately, they can provide you with payment options and they can give you greater protection than a debit card.

Knowing the difference between the two is important in deciding what kind of role you want each to play in your life. You’ll want to consider a number of factors, from your spending habits to your financial goals, in determining whether and how to use them.

Sources

- University of North Carolina. “Diners Club,” https://finance.unc.edu/services/card-services/diners-club/. Accessed September 30, 2021.

- American Express. “The Platinum Card” https://www.americanexpress.com/us/credit-cards/card/platinum/. Accessed September 30, 2021.

- Diners Club. “Diners Club Card Elite,” https://www.dinersclubus.com/home/consumer-cards/conscards-l2/diners-club-card-elite. Accessed September 30, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.