Credit Card Closing Date vs. Payment Due Date

Published on: 09/20/2021

What’s the difference between a credit card closing date and a payment due date? They might sound like the same thing, but they’re really not.

It can be easy to get confused about credit card terms, especially where there’s plenty of it (credit report vs. credit score is another example).

A credit card closing date is the last day of the credit card billing cycle or billing period. It's also when your monthly billing statement is issued.

Your bill isn’t due then, but it starts the clock ticking toward your credit card payment due date, which is the day by which you have to make a payment. Typically, you’ll have anywhere from 21 to 25 days from the end of the billing cycle to pay your credit card bill, depending on which credit card company you’re dealing with.

Twenty-one days is the minimum amount of time allowed by law between the closing date and the due date under the Credit Card Accountability, Responsibility and Disclosure Act of 2009 (or the CARD Act).[1]

Credit card closing date

Your credit card closing date, also sometimes called your credit card statement closing date, is the date on which your statement is generated. You then have at least 21 days before your payment due date, depending on the credit card company.

Credit card payment due date

Your credit card payment due date is when your payment is due. Before this date, no interest is charged if you aren’t carrying a balance on your account. After that (or before, if you carry a balance on your card from month-to-month) you will be subject to interest charges known as finance charges.

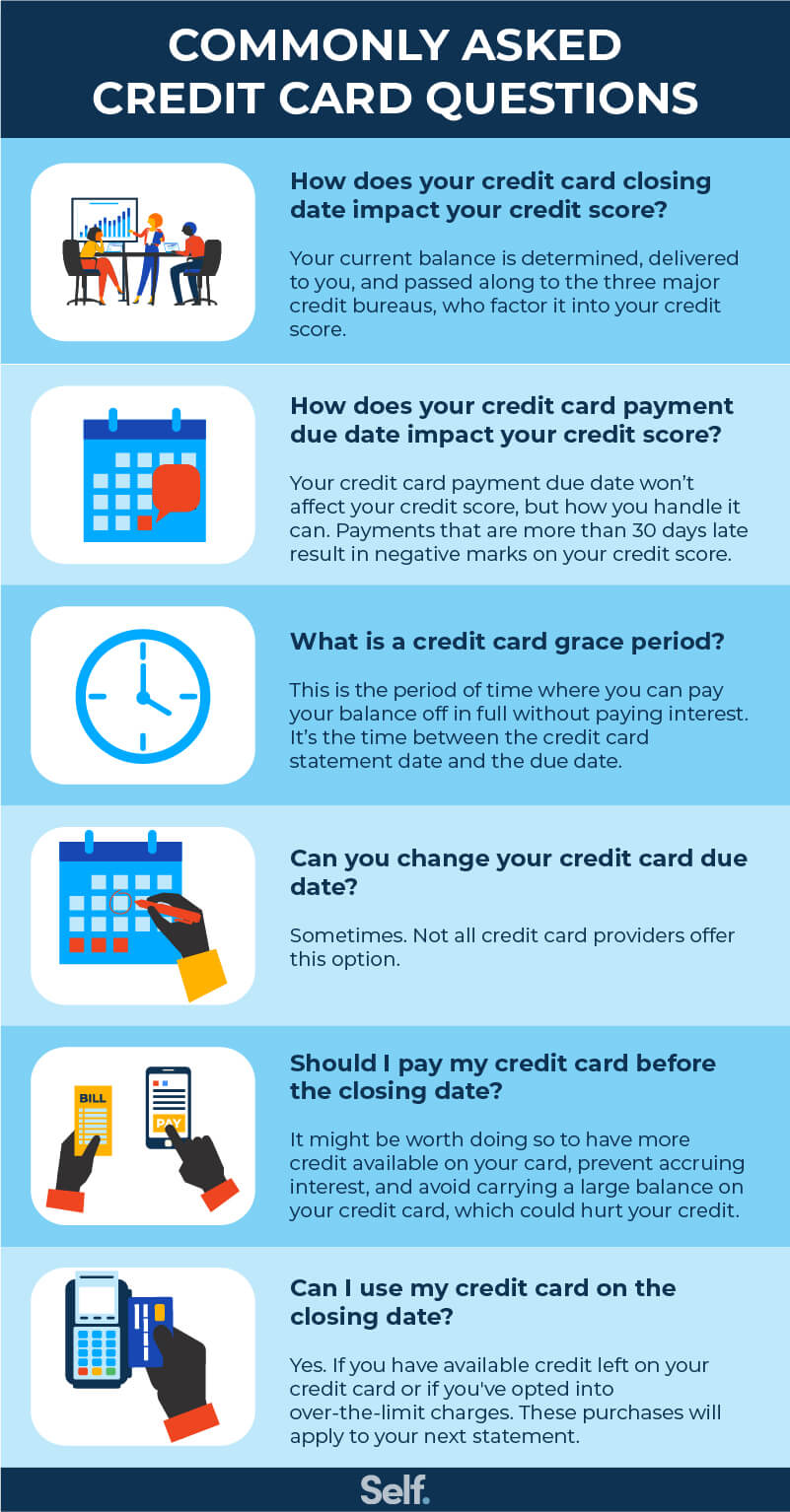

Commonly asked credit card questions

Credit card customers naturally have many questions about how the billing cycle works, like:

- When is the best time to make payments?

- How do your payments affect your balance and credit score?

Here are a few answers.

How does your credit card closing date impact your credit score?

The closing date is important because it’s the date some information updates that can impact your credit score. For one thing, it’s the time at which your monthly interest charge and minimum payment are calculated.

Your current balance is determined at that point and mailed to you or delivered electronically in your monthly statement. But that's also the balance passed along to the three major credit bureaus, who factor it into your credit score.

As a result, if you pay your bill on the due date, the information will have already been sent to the credit reporting agencies and won’t reflect that payment.

How does your credit card payment due date impact your credit score?

The credit card due date itself won’t affect your credit score, but how you handle it can. For instance, your payment history accounts for 35% of your total credit score under the FICO® system.

So if you miss your due date repeatedly and you’re more than 30 days late on a payment, negative marks will appear on your credit history and can stay there as long as seven years. And, conversely, the more consistently you pay on time, the more you will build your credit.

Second, the more credit card debt you carry compared to your credit limit, the more it can impact your credit score. The amount you owe, and more specifically, your credit utilization ratio, accounts for 30% of your FICO score.

Your credit utilization ratio is simply the amount of money you currently owe divided by your credit limit, expressed in percentage terms.[2] For instance, if a cardholder has an account statement balance of $2,000 in credit card debt and a $6,000 credit limit, that person’s credit utilization ratio would be expressed as 33%. It’s best to keep your credit utilization ratio at 20% or less.[3]

What is a credit card grace period?

A grace period is a time during which you can pay your balance in full without paying interest. It’s the number of days between the credit card statement date and the due date.

However, if you are carrying a balance from the previous month, interest on that money will continue to accrue.

Grace periods do not generally apply to balance transfers or cash advances. Those types of transactions begin accruing interest the day they're made unless they're part of a 0% APR promotion.[4]

Can you change your credit card due date?

Some lenders will allow you to change your credit card due date. However, it isn’t guaranteed so make sure to ask the lender prior to opening your credit card if you’re concerned. If a due date change is allowed, you can contact the company’s customer service department to request it. If it’s approved, it will take a billing cycle or two to take effect and the statement following your request is likely to have your initial due date.[5]

Adjusting your due date may not be the best course of action, anyway. If you’re having trouble making payments, changing your due date won’t help since interest accumulates regardless of when your due date falls.

Should I pay my credit card before the closing date?

If you can do so, it's not a bad idea to pay your credit card bill before the closing date, especially if you carry a balance from month to month. However, there are a few reasons to avoid having a large credit card balance:

- It can cause interest to accrue, leading you to pay substantially more money over time — hundreds or even thousands of dollars.[6]

- It will leave you with less available credit on your card in the event you need it.

- Maintaining a large credit card balance can hurt your credit. The amount you owe is the second most influential factor in determining your credit score.

Suppose you can't pay the entire balance every month. In that case, you can reduce your interest charges by making a payment early. Paying more than the minimum payment is most helpful because it's the least you can pay without being considered delinquent.

Making an early payment is always better than making a late payment.

Your closing date and payment due date are important dates to remember, but you should also know post dates. Post dates are when transactions are factored into your balance. They typically occur one to three days after a transaction.[7]

Post dates apply to bank accounts, too. For example, you may have noticed your bank account isn't debited for some transactions until a few days after you've authorized them. These may show up as “pending transactions” on your electronic records until they’re posted, which will give you an idea of your actual available funds.

But it's a good idea to keep your own record of what you've spent so you can account for this lag, so you don't risk overdrawing your bank account and triggering late fees. In addition, since some lenders don't provide the same level of instant account oversight as banks, it benefits you to be vigilant.

Can I use my credit card on the closing date?

Under normal circumstances, you can use your credit card on its closing date just as you would any other time. Suppose your account statement has already been mailed. In that case, any purchases you make will simply appear on the following statement.

If, however, you make purchases that put you too far over your credit limit, you may run into trouble. Your card may be denied or you could be charged an overage fee.

Under the CARD Act, over-limit fees can’t be imposed upon you without your consent: For the fee to be charged, you had to opt-in when you got the card. However, the credit card company can prohibit over-the-limit transactions at any time for any reason, regardless of consent.[8]

Whether or not a fee is charged, going over your credit card account limit is not a good idea. Carrying high balances can hurt your credit, making it hard to maintain a good credit score and access lower interest rates.

The bottom line

Understanding the credit card billing cycle and how it can affect you matters. Managing the billing cycle well can protect your personal finances, keep your credit in good standing, and minimize the amount you'll pay in finance charges.

Knowing the difference between a credit card closing date and payment due date is an excellent first step toward navigating the credit card calendar effectively.

Sources

- Public Law 111-24—May 22, 2009. “Credit Card Accountability Responsibility and Disclosure Act of 2009,” https://www.ftc.gov/sites/default/files/documents/statutes/credit-card-accountability-responsibility-and-disclosure-act-2009-credit-card-act/credit-card-pub-l-111-24_0.pdf. Accessed July 29, 2021.

- Experian. “What is a Credit Utilization Rate?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization-rate/. Accessed July 29, 2021.

- Investopedia. “Credit Card Balance,” https://www.investopedia.com/terms/c/credit-card-balance.asp. Accessed July 29, 2021.

- Investopedia. “Grace Period (Credit),” https://www.investopedia.com/terms/g/grace-period-credit.asp. Accessed July 29, 2021.

- Chase. “How to change your credit card payment due date,” https://www.chase.com/personal/credit-cards/education/basics/how-to-change-your-credit-card-payment-due-date. Accessed July 29, 2021.

- Experian. “Should I Pay My Credit Card Bill Early?” https://www.experian.com/blogs/ask-experian/what-happens-if-i-pay-my-credit-card-early/. Accessed September 21, 2021.

- Investopedia. “Post Date,” https://www.investopedia.com/terms/p/post-date.asp. Accessed July 29, 2021.

- Consumer Financial Protection Bureau. “§ 1026.56 Requirements for over-the-limit transactions.” https://www.consumerfinance.gov/rules-policy/regulations/1026/56/#b-1-i. Accessed September 21, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).