5 Benefits of a Secured Credit Card

In many ways, your credit score is a reflection of how you manage your credit obligations. So, it makes sense that you’ll want to have some current, open accounts on your credit report if you hope to earn a good credit rating.

Credit cards can be a great tool to accomplish your credit-building goals. When you manage your credit cards wisely, they could even help you build credit without going into debt.

There is, however, one potential hiccup with this credit-building strategy. When you have no credit or damaged credit, qualifying for a new credit card account might be difficult. Some credit card companies may not want to do business with you due to your current credit standing.

Enter the secured credit card. Even with bad credit or no credit, there’s a good chance you can qualify for this popular credit-building tool. Below we’ll explain how secured credit cards work, and show you several ways this type of account might benefit you.

What is a secured credit card?

What is the difference between a secured vs unsecured credit card? A secured credit card is a type of credit card account that you back (or “secure”) with a deposit of your personal funds. Your deposit serves as collateral for the issuing bank, and it significantly reduces the risk involved in approving you for a new credit card account. In the event you don’t pay as promised, the secured credit card issuer can use your deposit to cover the debt.

In general, the cash deposit you make when you open a secured credit card is equal to the credit limit you receive on the account. In other words, a $300 deposit often results in a credit limit of the same amount. On the other hand, some card issuers, like Self, may give you the opportunity to access an additional unsecured credit limit increase to supplement your deposit. So, your credit limit could exceed the size of your deposit in these situations. (See more about how security deposits for secured credit cards work.)

Aside from the initial deposit, a secured credit card works the same as an unsecured card. You can use the card anywhere that accepts an unsecured credit card as a form of payment. Furthermore, anytime you use your card (or the secured credit card issuer charges you an annual fee or the interest rate), you’ll need to make a payment to the credit card issuer by your statement due date.

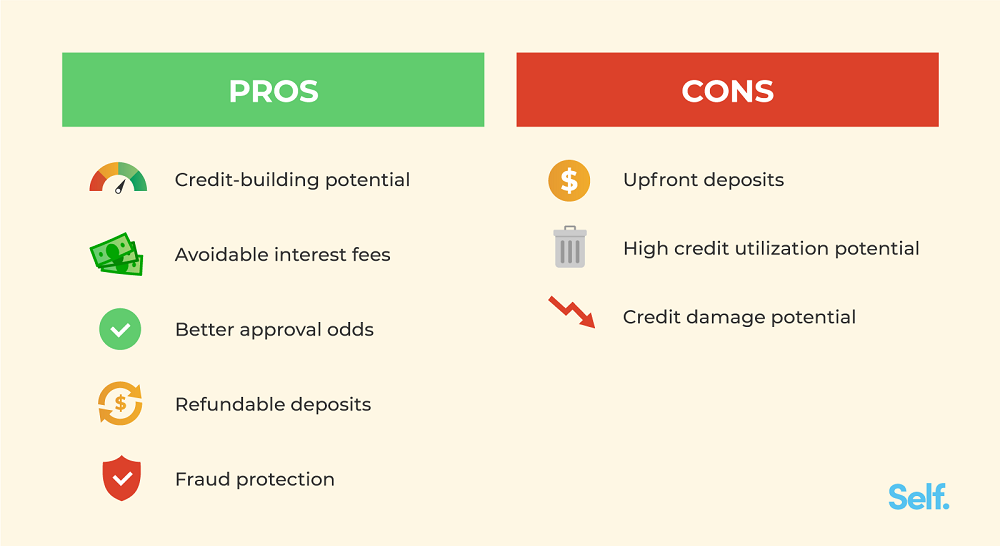

What are the benefits of having a secured credit card?

If you’re asking “can you rent a car with a secured credit card,” then yes, you can. In fact, secured credit cards have a lot to offer. If you’re thinking about opening a secured credit card, here are five benefits that may appeal to you.

1. Credit-building potential

Many secured credit card issuers will report your account to the three credit reporting agencies—Equifax, TransUnion, and Experian. (Tip: Ask the lender if it reports to all three major credit bureaus before you apply.) Once the account appears on your three credit reports, a secured credit card has the potential to help you build your credit scores.

Follow this link if you're wondering “how much will a secured credit card raise your score”. The amount a secured credit card will impact your credit score depends on your unique credit history and how you use the account.

To get the most out of your secured credit card, it’s important to follow some best practices with your account. Timely payments are a must. You’ll also want to watch your credit utilization rate by keeping the balance-to-limit relationship on your account at a healthy level when you’re building credit.

2. Avoidable interest fees

Just like unsecured credit cards, you can avoid paying interest on a secured credit card account if you follow one simple rule. Make sure to pay off your full statement balance every month, by no later than the due date. As long as you don’t carry a balance over from one billing cycle to the next, you should be able to enjoy your account without incurring the cost of high interest rate fees.

3. Better approval odds

Lenders rely on credit scores to help them predict risk when loaning money to consumers. A low credit score signals to lenders that you’re more likely to have seriously late payment (90 days or worse) in the near future. No credit score or credit history can also be problematic since lenders are in the dark regarding your credit risk when you apply for financing.

If you’re struggling with either of these problems (i.e., no credit or bad credit), you might have a tough time qualifying for certain loans or credit cards. For example, issuers of premium rewards credit cards, usually want you to have a good or excellent credit rating to qualify for a new account. Secured credit cards, on the other hand, tend to feature eligibility requirements that are much easier to satisfy.

4. Refundable deposits

When you open a secured credit card, the money you use as a cash deposit should be refundable. In some cases, the card issuer or credit card company may let you, the cardmember convert your account to an unsecured credit card after a certain amount of time (and responsible account usage). With other lenders, you may be able to recover your refundable security deposit when and if you close your account in the future.

Of course, it’s important to keep your account in good standing. Late payments, past-due balances, or other mishandling of your account might prompt the lender to keep some or all of your security deposit.

5. Fraud protections

Credit cards—whether secured or unsecured—represent one of the safest payment methods available for consumers. Thanks to the Fair Credit Billing Act, if someone uses your credit card without permission (and you report the problem within 60 days), your responsibility for fraudulent charges is capped at $50. Furthermore, most credit card networks feature zero liability policies when you’re a victim of fraud or credit card theft.

Debit cards, by comparison, feature fraud protections that pack a little less punch. If someone steals your debit card number, those funds are coming straight out of your bank account until the bank can research and correct the problem. And if you lose your cash, prepaid credit card, or other payment method, the possibility of recuperating your losses is even less likely.

What are the drawbacks of secured credit cards?

Although secured credit cards offer a lot of benefits, it’s important to consider the potential drawbacks of this type of account too. There’s a lot to like about these credit-building accounts, but that doesn’t mean they’re the perfect fit for everyone.

- Upfront deposits: If finances are tight, making an upfront deposit might be difficult. That being said, some secured credit cards feature low deposit requirements. The minimum security deposit for the Self secured credit card, for example, is just $100.

- High credit utilization potential: Lower credit card utilization rates are better for your scores. Credit scoring models (like FICO and VantageScore) calculate your credit utilization ratio by comparing your credit card balances to your credit card limits. With a low credit limit, it’s easier to run up a high utilization rate. For example, a $200 balance on an account with a $200 limit is 100% utilized. Meanwhile, a $200 balance on a credit card with a $2,000 limit only has a 10% utilization rate.

- Credit damage potential: Any account on your credit report has the potential to either help or hurt your credit score. Its effect depends on how you manage the account. If you open a secured credit card and don’t use it responsibly, the account might trigger a credit score decline rather than an increase.

How fast can I build my credit with a secured credit card?

Building good credit takes time, especially if you’re starting from scratch or working to overcome past mistakes. Unfortunately, you won’t know how fast you can build your credit with a secured card or any other credit improvement strategy until you finish the journey. Everyone has their own unique credit situation and their own credit improvement timeline.

Yet, a secured card does have the potential to help your credit when you use the account wisely. You might not be able to predict exactly how long it will take to reach your credit-related goals, but there are some things you can do to make managing the process easier.

- Monitor your credit. Get your free credit reports and check your credit scores so you can track your credit improvement progress and celebrate each little victory. Reviewing your credit reports may also help you discover credit reporting errors (if applicable), which could damage your credit scores. If you find mistakes in your credit report, you can submit a dispute to the relevant credit reporting agency.

- Consider other credit improvement strategies. In addition to opening a secured credit card and managing it well, there are other moves you can make to try to boost your credit score. Paying your bills on time and paying down credit card debt can be good places to start. You might also want to consider a credit builder account, authorized user status, and other techniques.

Can I earn rewards with a secured credit card?

Most secured credit cards do not offer the opportunity to earn rewards on your spending. However, there are some exceptions to this rule. If earning rewards is an important feature to you, you may want to shop around and compare multiple secured credit card offers before you apply for an account.

There’s nothing wrong with earning credit card rewards on purchases that you need to make anyway. Just be careful not to spend extra money in an effort to secure more points, miles, or cash back perks. Remember, the best reward you can earn from using credit cards is a good credit score.

Find a secured card

Whether you’re a credit score beginner or someone who has struggled with credit management in the past, applying for a secured credit card might benefit you.

Meaningful credit improvement won’t happen overnight, unless you’re incredibly lucky. But when you maintain good credit management habits, you could put yourself in a better position to qualify for other types of financing in the future.

About the author

Michelle L. Black is a leading credit expert with over 17 years of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting and debt eradication. See Michelle on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).