Can You Raise Your Credit Score 100 Points Overnight?

Published on: 12/29/2021

If you need to boost your credit score and want to build credit, then we’ve got a few strategies to consider.

FICO® Scores and VantageScore credit scores feature a range from 300-850. That means if your current credit score is 750 or below, then it is possible to raise it by 100 points.

From new credit holders to those with decades-old accounts, and even those who have dealt with debts and collections calls, a strong credit score is achievable by making smart financial decisions.

In fact, credit scoring models only take your financial history into account. In other words, they don’t discriminate. What’s more, a federal law known as the Equal Credit Opportunity Act (ECOA) makes it illegal for lenders to use any credit scoring system that does so. So, no matter who you are, until your score hits a perfect 850 credit score, your financial decisions have the potential to boost your credit score.

However, the amount of time it takes to raise your score depends on several factors.

Table of contents

- How Fast Can You Raise Your Credit Score?

- 8 Ways to Raise Your Credit Score Quickly

- Why Try to Raise Your Credit Score by 100 Points?

- Facts to Consider When Raising Your Credit Score

How fast can you raise your credit score?

The journey toward a higher credit score is different for everyone. For some people, a potential 100-point score increase might happen fast from paying off a long-standing debt. Or, if a defaulted account has recently fallen off of their credit report.

Others who are already focusing on smart credit and financial decisions might take months or even years to reach the same goal. Good credit requires time and continued smart usage to build great credit, especially since the length of your credit history is a determining factor.

Likewise, people with credit scores above 750 won’t be able to achieve a 100-point score increase at all because 850 is the highest score possible.

It’s worth noting that your credit score starting point may affect your potential for improvement as well. A low credit score has more room to increase. And certain positive actions may help a bad credit score improve quicker than a good credit score.

Opening new positive accounts, for example, tends to help new credit files or those without much credit history more than well-established credit files with numerous accounts (though both types of files may benefit).

Decreasing your credit utilization rate might also help you more if you have bad credit versus good credit. FICO® provides a simulated example of several consumers who paid down their credit card balances by 25%. The person with the lowest starting FICO® credit score (607) had an estimated increase of 8-28 points, while the person with the highest starting credit score (793) experienced a 2-22 point estimated increase for the same action.

How often do credit scores update?

Credit score updates aren’t scheduled events. And there are different types of credit scores, including FICO® and VantageScore. Different lenders use different scoring models.

These scores are calculated whenever they are requested by a business or yourself. Many services, such as banking apps and financial programs, will request a credit score every month. An individual can also request their credit score at any time.

However, what that score will report might not be up to date. Credit companies will report payments and other card activity at different times of the month—usually, the beginning or the end. Until the credit card company reports the activity, the credit score won’t be impacted. [1]

How are credit scores calculated?

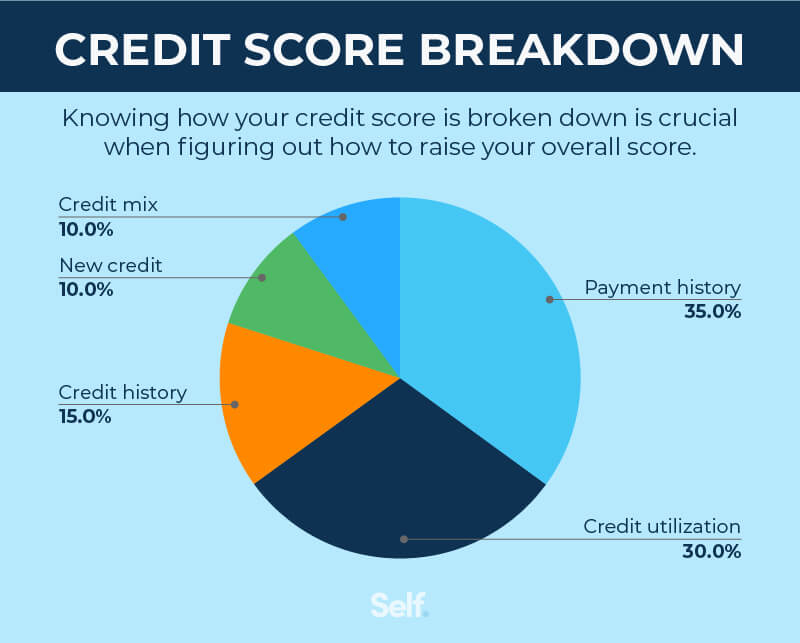

Credit scores are calculated through many variables, and there are various scoring models with different scoring metrics. The following are all important factors that affect a credit score:

- Payment history (including any late payments)

- Credit utilization (used credit vs. available credit)

- Type of credit account (revolving debt is weighed differently than mortgages)

- Length of credit history

- New credit accounts

Recent credit applications, also known as hard inquiries, may also affect a credit score. [2]

8 ways to raise your credit score quickly

1. Keep balances low or pay off credit card debt

Aside from your payment history, credit utilization is the most important credit score factor. Credit utilization is defined as the percentage used of your total credit. Creditors and lenders like to see utilization under 30%. And, the lower the debt, the higher the scores.

The easiest way to ensure low utilization is to pay off debts as soon as possible. However, credit limits and balances also have some influence. Closing an account or getting a credit limit increase will change the amount of your total credit, thus affecting your credit utilization percentage. [3]

2. Ask for late payment forgiveness

Having late payments on your credit history can cause considerable damage to your credit score. If you have a recent late payment, then consider a goodwill letter for late payment forgiveness. These letters are sent to creditors, asking to remove late payments from the account.

In the letter, explain why the payment was late. What factors caused it to happen? Showcase how it has never happened before. And point out the steps taken to ensure it never happens again.

There is no guarantee that a creditor will pay these letters any mind. If you have enough goodwill with your creditor, though, they will be more apt to listen and remove a payment.

3. Don’t close old credit accounts

Unless credit card accounts are charging high annual fees or are compromised, keep them open. You want to have a mix of credit accounts. Also, some old accounts might have no balance, but have high credit limits. It is therefore beneficial to keep these open for positive utilization. Plus, the length of your credit history makes up 15% of your credit score.

Closing credit accounts can hurt the score. It can lead to an increase in credit utilization. And, closing accounts could shorten your credit history, which could also impact your score. [4]

4. Become an authorized user

An authorized user is exactly as the name suggests. You are added to someone else’s credit account with your own card. To become an authorized user, the primary cardholder has to add you. This can be done online, on an app, or over the phone, whichever method the card company offers.

Being an authorized user allows their credit to boost your score. Authorized usage is reported to the three major credit bureaus: Experian, Equifax, and TransUnion. So, smart usage will count for more with a higher score. After some time, your score will rise because of it. [5]

5. Dispute any errors on your credit report

From a misstep in data entry to stolen data, there are times where an error can arise on your credit report. Of course, this can harm your score.

You get one free credit report each year from each credit bureau, so examine each for errors. Common mistakes include incorrect balances or account statuses. There might also be errors in personal data, such as a wrong name or address. Check for anything that looks incorrect. With routine credit monitoring, you should be able to spot any errors that may occur.

These errors can be disputed in writing with the involved credit bureaus. Include your name and contact information. In the letter, ask the bureau to remove the negative items and correct your report. Highlight the mistakes that need to be fixed, and include any supporting documents.

Credit bureaus have 30 days to investigate. If the investigation confirms the error, then the incorrect items will be removed from your report, and your score will go up. [6]

6. Consider opening a secured credit card

A secured credit card is a credit card that requires a cash deposit to create a credit limit. They can be used exactly like other credit cards, except the limits are dependent on the initial secured deposit.

Obtaining a secured card is much the same process as with an unsecured card. Applications can be made online. The lender will run a credit check using your information. They will also ask for your bank account information to process the secured deposit.

Once open, use the card as a standard credit card. Follow smart credit rules, such as on-time payments and low usage. Secured cards can safely build credit while keeping balances in check. [7]

7. Pay off delinquent balances

A delinquent account means it has not received payment and is now past due. Delinquent accounts have a high impact on credit scores. They will reflect poorly on payment history and credit utilization ratio.

The easiest way to avoid delinquencies is to make all payments on time. Keeping balances low will keep payments small and easy to manage.

An account isn’t delinquent until 30 days have passed since the payment was due. At that point, the delinquent status will negatively impact your score. If you do have delinquent accounts, pay them as soon as you can to avoid worsening consequences. [8]

8. Get a credit builder loan

Another option to boost your score is a credit builder loan. These are reported as installment loans. However, all payments have to be made before the lender releases the funds. So, you’re paying for the loan before you can use it.

As long as you don’t have any missed payments, these loans can build your credit through on-time monthly payments and credit variety. [9]

Why try to raise your credit score by 100 points?

Anytime you’re working to improve your credit, it can be helpful to identify why you want a better credit score in the first place. In other words, you need to ask: what is your goal?

Working to increase your credit score isn’t always an easy journey. Still, if you focus on why you’re trying to improve your credit, it might keep you motivated if the process doesn’t go as smoothly or as quickly as you’d hoped. Here are some reasons to consider putting in the work to raise your credit score and build credit, even if the results won’t be immediate.

- Better approval odds for loans and credit cards: Credit, or the 5 C’s of credit, aren’t the only factors that lenders and other companies consider when deciding whether or not to do business with you. Good credit could stack the deck in your favor, though.

- Lower interest rates and savings on fees: Lenders like to work with people who have good credit, and they’re willing to compete for that business. As a result, you may qualify for more attractive loan terms—including lower interest rates and fees—when you have a good credit score. [10]

- Lower security deposits: Do you plan to open a new utility account, mobile phone account, or lease an apartment soon? Good credit might help you qualify for a lower security deposit and sometimes avoid a deposit altogether.

- More borrowing power: Your income and current debts have a big influence over your credit card limits and loan amounts when you apply for financing. In many cases, a higher credit score could help you qualify to borrow more money.

- Competitive insurance premiums: Depending on your state of residence, your credit score can affect how much you pay for auto insurance. Better credit scores can equal lower premiums. [11] [12]

Factors to consider when raising your credit score

Do you have a good credit mix?

Your credit mix is the combination of all your credit accounts. It’s only worth 10% of a FICO® score, but a good mix will help you reach your maximum score.

A good mix will feature revolving and installment accounts. Revolving accounts include credit cards and lines of credit. Loans are installment accounts. However, applying for too many accounts in a short period will dip your score.

Creditors will look favorably on a well-managed mix of credit accounts. Likewise, too many retail credit cards with high utilization will limit most credit opportunities. [13]

How many new credit accounts do you have?

Inquiries for new credit accounts stay on your report for two years. But, FICO® scores only look for inquiries made in the past 12 months.

There is technically no limit to how many new accounts you can have. Depending on your existing credit, though, applying for too many accounts in a short time can have negative consequences. Every new inquiry will lower a score anywhere from 6 to 12 points.

New credit users might not have other credit factors to help buffer inquiries. This can make multiple credit inquiries have a greater negative effect on a score.

New credit card accounts make up 10% of a FICO® score. Too many inquiries in a short time can have a noticeable impact. However, as long as payments are made by the due date, and utilization is kept low, opening new accounts to create a strong mix can have a beneficial impact in the long run. [14] New credit card accounts make up 10% of a FICO® score. Too many inquiries in a short time can have a noticeable impact. However, as long as payments are made by the due date, and utilization is kept low, opening new accounts to create a strong mix can have a beneficial impact in the long run. [14] [15]

Do you have many hard inquiries?

A hard inquiry is the result of a credit check arising from a loan or credit application. These have a slight but negative impact on a credit score. They remain on record for two years but are only reported for one. As mentioned above, too many hard inquiries in too short a time span could cause negative issues.

In contrast, soft inquiries are those left when you check your credit score, or anytime you’re “pre-approved” for a promotional credit card. Soft inquiries have no score impact, but, like hard inquiries, they do form a credit history that lenders will examine.

Most scoring models group inquiries made during the same period of time. These are just reported as one inquiry. So, if you’re looking for credit, do your research and be ready to complete all your searching at once. [16]

What’s your overall credit history?

The term “credit history” simply refers to your record of credit. It starts with the first credit account you opened or were an authorized user on. Credit history will include all revolving and installment accounts. It will highlight how many accounts you’ve had, and if they have been paid on time.

Lenders look at credit history as an account of your ability to handle credit, specifically, financial responsibility and debt repayment. It helps make up your credit profile.

However, there is no specific “credit history” value when forming a credit rating. Instead, scores examine the length of history. This value is determined by looking at the oldest account, the newest account, and the average age of all accounts.

The length of the credit history makes up 15% of a credit score. Payment history and credit utilization will hold more sway. And, having a short credit history won’t bring down other favorable factors. However, as the average age does have an impact, you should never close an old account. [17]

It Will Take Time, But You Can Improve Your Credit Score

With all this in mind, we can finally answer the question: Can you achieve a 100 point boost in your credit score overnight?

No.

You can potentially raise it 100 points over time. With sound practices and regular credit checks, anyone can take charge of their credit. A good credit score will come from years of good credit decisions. Starting on a good foot will help keep your credit on the right path.

Focus on improvement and eliminating problem areas. You will begin to see positive changes relatively quickly.

Sources

- Forbes Advisor. “How Long Does It Take to Improve Your Credit Score?” https://www.forbes.com/advisor/credit-score/how-long-does-it-take-to-improve-your-credit-score/. Accessed October 7, 2021.

- Equifax. “How Are Credit Scores Calculated? | Equifax®.” https://www.equifax.com/personal/education/credit/score/how-is-credit-score-calculated/. Accessed October 7, 2021.

- CNBC. “What Is a Credit Utilization Rate and How to Calculate Yours.” https://www.cnbc.com/select/what-is-credit-utilization-rate/. Accessed October 7, 2021.

- TransUnion. “How Closing Accounts Affects My Credit Score.” https://www.transunion.com/article/closing-accounts-and-your-credit-score. Accessed October 7, 2021.

- CNBC. “What You Need to Know About Being an Authorized User on a Credit Card.” https://www.cnbc.com/select/becoming-an-authorized-credit-card-user-what-you-should-know/. Accessed October 7, 2021.

- Consumer Information. “Disputing Errors on Your Credit Reports.” https://www.consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed October 7, 2021.

- Forbes. “What Is a Secured Credit Card and How Does It Work?” https://www.forbes.com/advisor/credit-cards/what-is-a-secured-credit-card/. Accessed October 7, 2021.

- Equifax. “When Does a Late Credit Card Payment Show up on Credit Reports?” https://www.equifax.com/personal/education/credit/report/when-late-credit-card-payments-post/. Accessed October 7, 2021.

- Experian. “Everything You Need to Know About Credit-Builder Loans.” https://www.experian.com/blogs/ask-experian/what-is-a-credit-builder-loan/. Accessed October 7, 2021.

- Experian. “What is Interest and How Does it Work?” https://www.experian.com/blogs/ask-experian/what-is-interest/. Accessed October 20, 2021.

- Federal Trade Commission. “Credit-Based Insurance Scores: Impacts on Consumers of Automobile Insurance: A Report to Congress by the Federal Trade Commission.” https://www.ftc.gov/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal. Accessed October 7, 2021.

- III. “Credit and Insurance Scores.” https://www.iii.org/article/what-does-my-credit-rating-have-do-purchasing-insurance-1. Accessed October 7, 2021.

- MyFICO. “Types of Credit and How They Affect Your FICO Score.” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed October 7, 2021.

- CNN. “Myths About Credit: Does Opening a New Credit Card Hurt Your Credit Score?” https://www.cnn.com/2020/06/24/cnn-underscored/does-opening-new-credit-card-hurt-credit-score/index.html. Accessed October 7, 2021.

- MyFICO. “How New Credit Impacts Your Credit Score.” https://www.myfico.com/credit-education/credit-scores/new-credit. Accessed October 7, 2021.

- Equifax. “Understanding Hard Inquiries on Your Credit Report.” https://www.equifax.com/personal/education/credit/report/understanding-hard-inquiries-on-your-credit-report/. Accessed October 7, 2021.

- Consumer.gov. “Your Credit History.” https://www.consumer.gov/articles/1009-your-credit-history. Accessed October 7, 2021.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.