ITIN vs. SSN: What Are The Differences?

Published on: 11/10/2025

Social security numbers (SSNs) and Individual Taxpayer Identification Numbers (ITINs) both enable people to comply with U.S. tax laws.

Both of these numbers are taxpayer-identification numbers and work within the Internal Revenue Service (IRS) framework. But both are used by different groups of people. Understanding which number you should be using will help ensure tax filing goes smoothly. [1]

Key points

- SSNs are for citizens and authorized workers and provide broader identification beyond just tax purposes.

- ITINs are for non-citizens who need to file U.S. taxes but cannot get a Social Security Number.

- Both numbers ensure tax compliance, but serve different populations based on citizenship and work authorization status.

Table of Contents

- What is an individual taxpayer identification number (ITIN)?

- What is a social security number (SSN)?

- ITIN vs. SSN: What are the differences?

- How to apply for an ITIN

- How to apply for an SSN

What is an individual taxpayer identification number (ITIN)?

An ITIN is used for tax purposes, but unlike an SSN its eligibility is limited to nonresident or resident aliens. In other words, an ITIN allows individuals who aren’t eligible for an SSN to file and pay federal taxes. [2] It may also allow people to open a bank account.

Specifically, an ITIN is a tax processing number available for Individuals who are not eligible for an SSN, such as :

- Foreign nationals or nonresident aliens.

- Undocumented immigrants.

- Spouses of U.S. citizens, green card holders, or visa holders.

- Individuals who need a U.S. taxpayer ID number (required to file a U.S. tax return) and aren’t eligible for an SSN.

Like an SSN, an ITIN is also a nine-digit number, beginning with a number 9. It is formatted like an SSN; that is: 9XX-XX-XXXX.

Who needs an ITIN?

As mentioned above, anyone who earns an income must pay federal taxes. Those without a social security number should still file taxes using an ITIN. This includes:

- Nonresident aliens who need to file a tax return.

- Dependents or the spouse of a U.S. citizen or resident alien.

- Dependents or spouses of nonresident alien visa holders.

- Tax filers who live abroad.

Dependents and spouses in the U.S. on a temporary visa will also need an ITIN if they earn taxable income. Non-resident foreign national students and professors will need an ITIN for tax purposes, especially if involving U.S. student financial aid.

What is a social security number (SSN)?

A social security number is a unique number that identifies a person to their earned wages and other financial records. This number allows the IRS (and other entities) to record and track your financial history. [3]

Social security numbers are typically assigned to U.S. citizens at birth. Only U.S. citizens and certain non-citizens who are authorized to work can get an SSN. Otherwise, they will need to use an ITIN for tax purposes.

Issued by the Social Security Administration (SSA), social security numbers are nine digits long, formatted as XXX-XX-XXXX. Aside from tax purposes, SSNs are used for:

- Opening bank accounts

- Applying for a driver’s license

- Applying for a visa

- Accruing social security benefits

Employment statistics such as yearly earnings and years employed are also tracked through a social security number. In short, a social security number is not just an identity marker. An SSN is important as it is a record of your contribution to the social security network and to financial society as a whole.

Who needs an SSN?

Citizens and authorized permanent residents should have an SSN if they plan on working. Any citizen (and anyone eligible and authorized to work) who gains an income and pays taxes in the U.S. needs an SSN However, there are several scenarios that require one outside of tax purposes.

Credit lenders sometimes need an SSN during credit card applications, but that isn’t always the case. You may also need an SSN to:

- Apply for jobs

- Open a bank account

- Apply for a loan

- Claim government benefits

- Apply for Medicare

- Gain a passport or other proof of identity

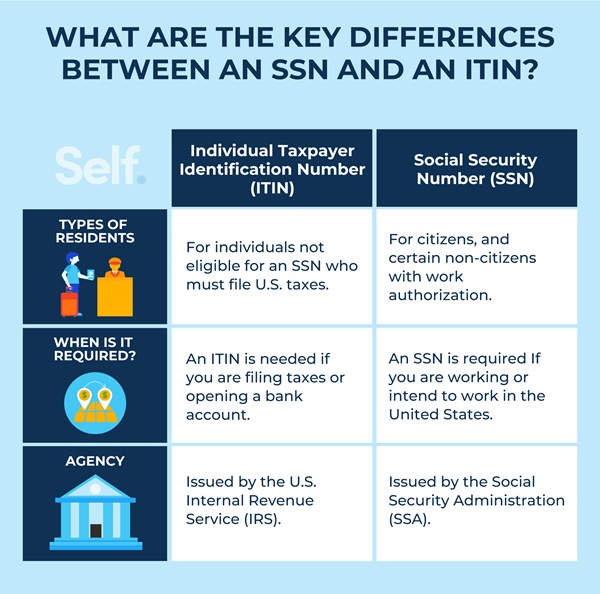

ITIN vs. SSN: What are the differences?

The major difference between an ITIN and an SSN is who receives them. SSNs are for citizens or authorized non-citizen residents. ITINs are for foreign-status residents.

Immigration status

An SSN is for U.S. citizens and authorized non-citizen residents. This includes green card holders and international students on visas when authorized to work. U.S. citizens receive an SSN at birth. For others, they are generated when requested.

Alternatively, an ITIN is for residents with foreign status. This includes undocumented immigrants and noncitizen residents. Also, ITINs are not automatically generated. Because of this, individuals needing an ITIN should apply for one as soon as possible.[4]

Business entities

To work in the United States, you must have an SSN. You can be hired without an SSN if you have government authorization to work. However, a foreign resident looking to settle down and start working should also start the SSN process when they begin job searching. [5]

How to apply for an ITIN

There are a few options when it comes to applying for an ITIN. First, one can send in an ITIN application along with IRS form W-7, tax return, proof of ID, and foreign status documents to [5]:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Be sure to send in original documents or certified copies. This includes proof of ID, proof of age, and federal income tax returns. The IRS returns all documents at the end of the licensing process. Typically, it takes 7 weeks (or 9 to 11 weeks during tax season) timeline varies, so be sure you won’t need them if applying by mail. [6]

You can also visit a certifying acceptance agent and apply for an ITIN in person. Bring the same documents as listed above. You can also submit an application at IRS Taxpayer Assistance Centers. Both of these options will avoid the need for sending in personal documents. [7]

Once you have an ITIN, you can check your status or get assistance by contacting the IRS.

How to apply for an SSN

Applying for an SSN is a similar process. An SSN application (form SS-5) must be accurately completed. If applying for an original card, you will also need to include two documents that prove age, identity, and U.S. citizenship or current, lawful, work-authorized immigration status. If you are not a U.S. citizen and do not have DHS work authorization, you must provide that you have a valid non-work reason for requesting a card.

Any citizen aged 12 and older who is applying for an SSN for the first time has to do so in person at any social security office. It is completely free to apply for an SSN.

If you need a replacement card, the same SS-5 form is used.

[8]

You need an SSN or ITIN

Individual taxpayer identification numbers are similar to social security numbers. Both are needed to pay federal income taxes, and both act to identify a person with their financial history.

There are stark differences, though. An ITIN is needed by any non-citizen earning an income in the U.S. and responsible for federal taxes. Applying for an ITIN and an SSN is straightforward. However, as the process may take some time, be sure to make it a priority.

Sources

- Internal Revenue Service. “Individual Taxpayer Identification Number | Internal Revenue Service.” https://www.irs.gov/individuals/individual-taxpayer-identification-number. Accessed December 7, 2021.

- American Immigration Council. “The Facts About the Individual Taxpayer Identification Number (ITIN).” https://www.americanimmigrationcouncil.org/research/facts-about-individual-taxpayer-identification-number-itin. Accessed December 7, 2021.

- Social Security Administration. “Social Security Number and Card | SSA.” https://www.ssa.gov/ssnumber/. Accessed December 7, 2021.

- American Immigration Council, “Facts About Individual Taxpayer Identification Number (ITIN) https://www.americanimmigrationcouncil.org/fact-sheet/facts-about-individual-tax-identification-number-itin/ Accessed September 10, 2025

- Social Security Administration. “Foreign Workers and Social Security Numbers.” https://www.ssa.gov/pubs/EN-05-10107.pdf. Accessed December 7, 2021.

- Internal Revenue Service. “How do I apply for an ITIN? | Internal Revenue Service.” https://www.irs.gov/individuals/how-do-i-apply-for-an-itin. Accessed December 7, 2021.

- Internal Revenue Service. “Acceptance Agent Program | Internal Revenue Service.” https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program. Accessed December 7, 2021.

- Social Security Administration. “Application for Social Security Card.” https://www.ssa.gov/forms/ss-5.pdf. Accessed December 7, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.