How to File Taxes Without a Social Security Number

Published on: 04/02/2025

If you need to file taxes but don’t have a Social Security number (SSN), this post helps you figure out what forms you need to fill out to file taxes. We also walk you through the steps of applying for a Social Security number as well as who qualifies for Social Security numbers and ITINs.

Do you need your social security card to file taxes?

Most people file taxes with their Social Security number, but while you need an approved form of identification to file taxes, you are not required to have a SSN or physical Social Security card to file a tax return.

Although you may see a Social Security number requested on federal tax return forms, the IRS issues Individual Taxpayer Identification Numbers (ITINs) for those who don’t qualify for an SSN but need to file a tax return.

How to file taxes with an ITIN

If you’re not eligible for an SSN, you may be able to apply for an Individual Taxpayer Identification Number (ITIN) which you can use to file your taxes.[1]

The IRS uses an ITIN to facilitate filing a tax return and making tax payments. They’re issued, regardless of immigration status, to what the IRS defines as both “resident aliens” and “nonresident aliens” who may have tax filing or reporting requirements in the U.S.[1]

An ITIN does not:

- Authorize you to work in the U.S.[2]

- Make you eligible for Social Security benefits[1]

- Provide legal immigration status[2]

- Provide proof of legal presence in the United States[1]

An ITIN is used for federal tax reporting for people without Social Security numbers. However, if you eventually apply for U.S. citizenship, having an ITIN can help demonstrate that you have complied with federal tax laws. An ITIN can also be a way to document your work history, demonstrate your contribution to the economy, and even show that you have “good moral character” when looking to legalize your immigration status.[3]

1. Apply for an ITIN if you don’t have one

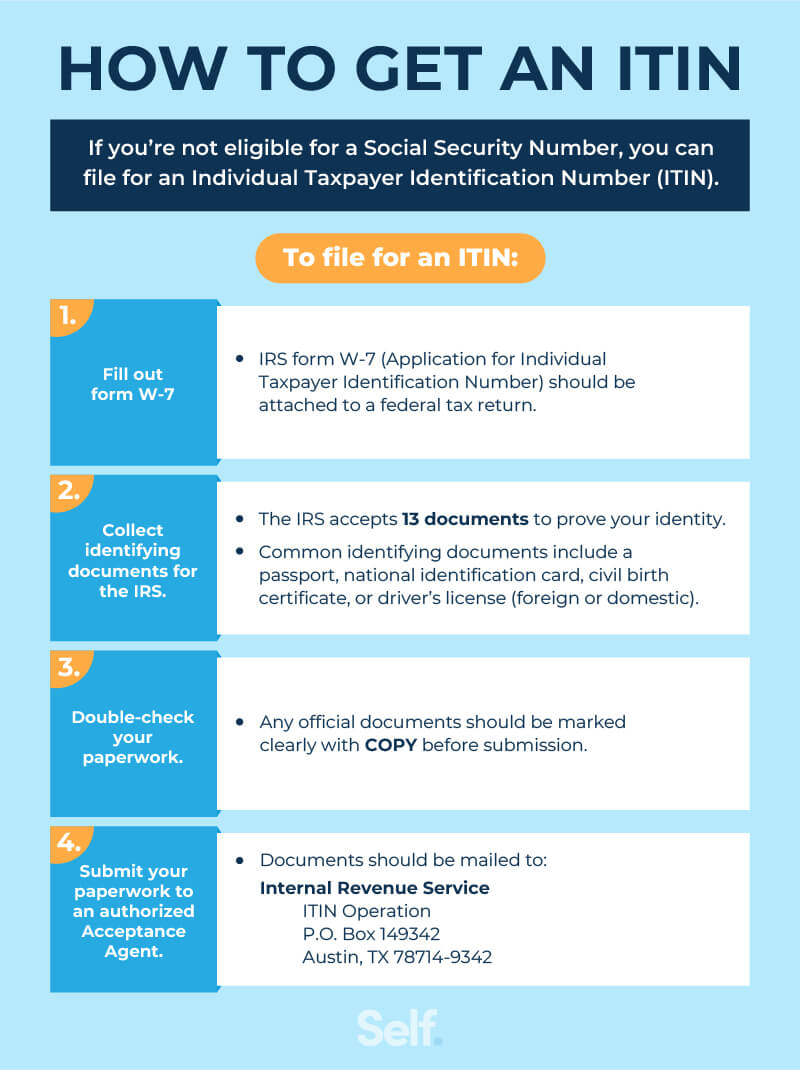

There are three ways to apply for an ITIN:

By mail: Fill out Form W-7, Application for IRS Individual Taxpayer Identification Number.[4] Be sure to submit it with your federal income tax return along with original or certified copies of documents to prove your identity and foreign status. You will not be able to electronically file your return without the ITIN, so you’d have to file a paper return and mail it to:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Check the IRS website to ensure the above address has not changed, and remember that you need only to file a tax return to this address once when you file Form W-7. In subsequent years, when you have an ITIN, you can file your tax return as directed in the form’s instructions.[4]

- With an in-person agent: Fill out Form W-7 and apply in person using the services of a Certifying Acceptance Agent authorized by the IRS.[5]

- At an in-person assistance center: Fill out Form W-7 and make an appointment at an IRS Taxpayer Assistance Center.[6]

If you apply with an in-person agent or at an in-person assistance center, you can apply for an ITIN without mailing your original documents. If you qualify and your application is complete, the IRS suggests you allow seven weeks for processing time (or nine to 11 weeks in peak periods) for your application after which you can look for a letter in the mail.[7]

To know which documents you need to send with your application, check the IRS website, which can offer you all the information you need for filling out and mailing your ITIN application. If you mail your documents, the originals are returned to you at the mailing address you provided on Form W-7. The IRS says you can expect to receive them within 60 days.[7]

However, mailing your original documents puts them at risk of getting lost in the mail, winding up in the wrong hands and exposing you to identity theft. For that reason, consider applying in person whenever possible.

2. Determine your tax residency status

Your tax residency status determines how you file your federal tax return. Check the IRS website to determine your residency status and how best to file or discuss your situation with a legal professional who specializes in immigration law.

3. Fill out and submit tax returns using your ITIN

The IRS sets a deadline for some time in mid-April every year for filing taxes. In 2025, the deadline was set for April 15 for most taxpayers, and you can check the IRS website for the exact date each year. So prepare ahead of April to get your documents and filing in order so you can submit your tax returns on time.

You can use your ITIN to file federal tax returns if you don't have an SSN. Just enter your ITIN in the space for the SSN on the tax form and fill out the rest of your tax form. Then you submit your tax return and supporting documents to the IRS.

4. Wait for the IRS to process your tax return

The IRS website has an entire page dedicated to answering questions about your tax return, and many refer to how long it takes to process a refund.

According to the IRS, it generally takes more than 21 days to process refunds, and you can follow the status of your tax return through Where’s My Refund. However, the IRS also notes that many things cause a delay in processing. From errors or incomplete information to mailing in a paper tax return, several circumstances can add delays to your return’s processing.[8]

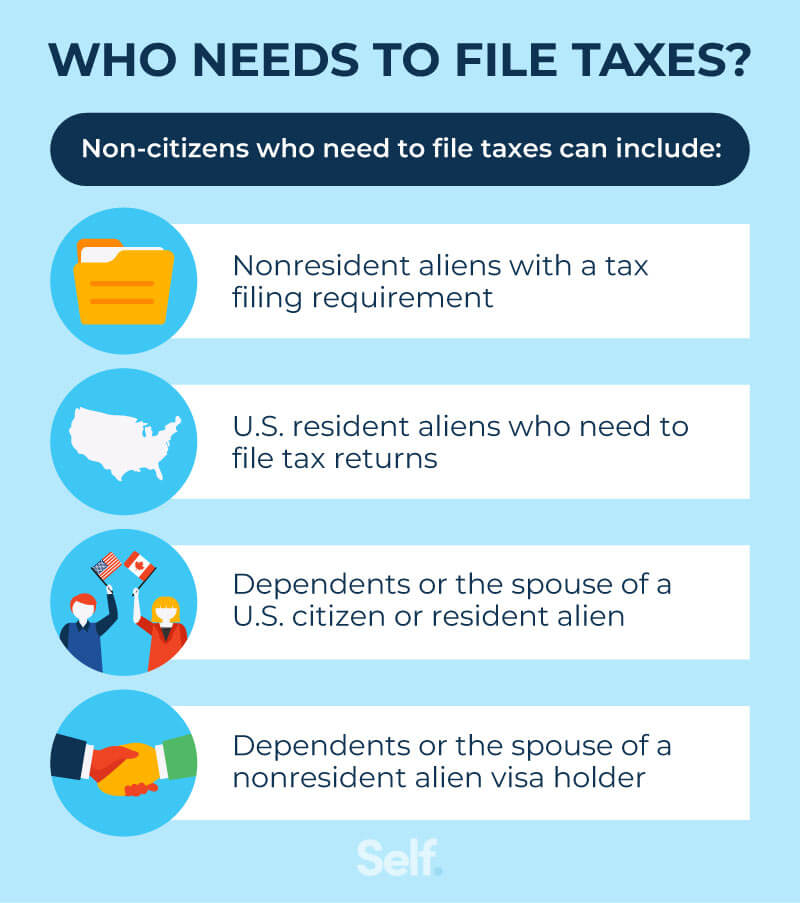

Which non-citizens need to file taxes?

The IRS requires both residents and nonresidents to file taxes in the U.S., and the IRS offers a tool to help you determine whether you should file a federal tax return.[9]

Non-citizens who need to file taxes include:

- Nonresident aliens with a tax filing requirement

- U.S. resident aliens who need to file tax returns

- Dependents or the spouse of a U.S. citizen or resident alien

- Dependents or the spouse of a nonresident alien visa holder

If you don’t owe taxes, you may still file a tax return to claim a refund for taxes overpaid or to claim a deduction or credit. If you owe taxes and fail to file, the IRS can assess penalties and interest, seize your assets and impose immigration consequences.[10]

What documents do you need to file taxes?

When you are filing taxes, you often have to submit supporting documentation with your federal tax return. Although everyone’s individual tax situation is different, the following lists some documentation you may commonly need:[11]

- Bank account/routing number: Your routing and account number allows you to receive your tax refund via direct deposit or to pay your remaining balance.

- Form W-2 from employer: The W-2 tax form contains information about how much income you earned from your employer, how much taxes were withheld from your paycheck and how many benefits you received.

- Form 1099: Freelancers and independent contractors who earn income from the gig economy can report their earnings on the 1099 form.

- Form 1099-K or Form 1099-MISC: 1099-Ks report the gross amounts paid via credit cards and digital payments through third-party networks like PayPal and Venmo. You use form 1099-MISC to report miscellaneous income, such as rent, prizes and medical payments.

- Form 1099-INT: Taxpayers use Form 1099-INT to report interest income, for example, interest earned on bank deposits.

Who can get a social security number?

Noncitizens authorized to work in the U.S. can get a Social Security number. To do this, you can either apply for an SSN in your home country before coming to the U.S. or visit a Social Security office in person.[12]

You may be able to use this identification number to:

- Get a driver’s license

- Allow your employer to withhold and report federal and state income and payroll taxes

- Open a bank account, apply for federal loans, prove eligibility for assistance programs and enroll in Medicare

Without an SSN, you may find it challenging to establish a credit score in the U.S. and take out loans if you need them for major purchases.

How to apply for a Social Security Number

If you, your spouse or a dependent qualify for an SSN, you should file Form SS5, Application for a Social Security Card, with the Social Security Administration (SSA).

If visiting a Social Security office in person, you’ll need to show documentation to prove your identity and work-authorized immigration status, and you can find a list of documentation through the Social Security Administration’s publication for nonresidents.[12]

How to replace your Social Security card

If you lose your card, you can get a replacement by applying online via the SSA website, calling your local SSA office or 800-772-1213.

Seek out tax help from professionals if needed

The U.S. laws require both residents and nonresidents of the country to pay taxes, even if they don't have a Social Security number. To file taxes without a SSN, you can use your ITIN. Determine your tax residency status, gather and submit the appropriate documents using the ITIN in place of SSN and wait for the IRS to process your returns.

If you’re stuck in any part of the tax preparation process, we recommend consulting a tax professional.

Sources

- Internal Revenue Service. “Individual Taxpayer Identification Number,” https://www.irs.gov/individuals/individual-taxpayer-identification-number.

- American Immigration Council. “The Facts About the Individual Taxpayer Identification Number (ITIN),” https://www.americanimmigrationcouncil.org/research/facts-about-individual-taxpayer-identification-number-itin.

- National Immigration Law Center. “Individual Taxpayer Identification Number (ITIN) A Powerful Tool for Immigrant Taxpayers,”https://www.nilc.org/issues/taxes/itinfaq/.

- Internal Revenue Service. “Form W-7,” https://www.irs.gov/pub/irs-pdf/fw7.pdf.

- Internal Revenue Service. “Acceptance Agent Program,”https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program.

- Internal Revenue Service. “Taxpayer Assistance Center (TAC) Locations Where In-Person Document Review is Provided,” https://www.irs.gov/help/tac-locations-where-in-person-document-verification-is-provided.

- Internal Revenue Service.“Instructions for Form W-7,”https://www.irs.gov/instructions/iw7.

- Internal Revenue Service. “Tax Season Refund Frequently Asked Questions,”https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions#:~:text=We%20need%20more%20than%2021,the%201040NR%20for%20your%20refund.

- United States Government. “Do You Need to File a Tax Return?,” https://www.usa.gov/who-needs-to-file-taxes.

- Internal Revenue Service. “Instructions for Form 1040-NR,” https://www.irs.gov/pub/irs-pdf/i1040nr.pdf.

- Internal Revenue Service. “Tax filing step 1: Gather all year-end income documents,” https://www.irs.gov/newsroom/tax-filing-step-1-gather-all-year-end-income-documents.

- Social Security Administration. “EN-05-10096 - Social Security Numbers for Noncitizens,” https://www.ssa.gov/pubs/EN-05-10096.pdf.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).