How to Reduce Your Sewer Bill: 6 Simple & Effective Tips

Published on: 04/17/2023

Monthly utility bills, including water and sewer bills, can pile up fast. If you’re facing higher sewer rates or a monthly water bill that barely keeps your finances above water, you may wonder how you can keep your budget on track.

In this post, we’re focusing specifically on water and sewer bills, helping you understand how your credit is impacted if you don’t pay them and how you can reduce costs.

How is your sewer bill calculated?

Depending on where you live, sewer charges may be included in your monthly water bill. You can usually see a breakdown of charges in the billing detail or summary of charges on the bill.

Some utility companies measure the water entering the property and the wastewater leaving to the sewer system separately. Others have only one meter on location and calculate both bills based on the volume of water entering the building. In either case, you can reduce your sewer bill by reducing the amount of water you use in your home.[1]

6 tips to reduce your sewer bill

Taking steps to reduce your water use means first thinking about how water is used in your home. We provide six ways homeowners can examine their water use and start practicing water conservation.

1. Check for leaks

Checking for and repairing leaks can help you reduce your water and sewer bills. In addition to driving up your utility bills, leaks are also a waste of water — they account for over 10,000 gallons of wasted water per household per year, with 10% of homes experiencing leaks that waste 90 gallons or more per day.[2]

While you may need a plumber to investigate and repair major leaks in your home, some leaks are often easy to fix on your own. Common sources of leaks include toilets, faucets, shower heads and garden hoses. To find surface leaks, check your faucet gaskets and pipe fittings for water on the outside of the pipe. You can also check for leaks by checking your water meter after not using water for a two-hour period. If the meter shows a change during a time when you didn’t use water, you may have a leak.[2]

Fixing a leak might save you as much as 10% of your water bill, which can really add up, especially over weeks or months of water usage.[2]

2. Change your shower habits

Taking shorter showers and leaving the water off before getting in the shower also reduces the amount of water you use. According to the Environmental Protection Agency (EPA), standard shower heads use around 2.5 gallons of water per minute, so long showers can really add up.[3]

In addition to cutting down your shower time, switching to a low-flow shower head can also help you save water. Water-saving shower heads that meet the EPA’s WaterSense criteria are designed to use no more than 2 gallons of water per minute.[3]

You can also take some of your showers outside of the home. For example, if you belong to a gym, try using the showers there when you can.

3. Don’t leave your faucet running

Similar to turning off the shower when you aren’t using it, it’s better to turn off your faucets than let the water run.

For example, turning off the faucet when you brush your teeth could save as much as eight gallons of water per day. Turning it off while you shave could save as much as ten gallons of water each time. If you brush your teeth twice a day and shave five times a week, you could save nearly 5,700 of water per year just by turning off your faucet.[4]

This applies to other areas of the home, too. Letting your faucet run for as little as five minutes while washing dishes can waste as much as 10 gallons of water.[4]

For the quick and easy action that it is, turning off your faucet can have a huge payoff when it comes to decreasing your water consumption.

4. Wait until you have a full load

Waiting to use your washing machine or dishwasher until you have a full load to do can also help reduce your bill.

Limiting your dishwasher use to when it’s full could eliminate one load of dishes per week, saving the average family nearly 320 gallons of water each year.[4]

Doing fewer loads of laundry — about 25% fewer than you normally would — could save around 3,227 gallons of water per year. Reducing the water level in your washing machine by as little as 10% can help you save an additional 1,291 gallons annually.[5]

5. Use energy-efficient appliances

Consider making the switch to water-efficient appliances. Similar to energy-efficient appliances, water-efficient appliances are designed to conserve water, and require less water to accomplish the same tasks as traditional appliances.

The average family reportedly spends more than $1,000 per year in water costs. Retrofitting their household appliances with ENERGY STAR certified appliances and WaterSense labeled fixtures could save them as much as $380 per year.[4]

For example, ENERGY STAR certified clothes washers, which are both energy- and water-efficient, use approximately 20% less energy and 30% less water than regular washing machines. Models with ENERGY STAR certification can save nearly $360 in energy costs over the lifetime of the product.[6]

6. Use low-flow fixtures

In addition to water-efficient appliances, using more efficient fixtures on existing appliances can help reduce your water usage. WaterSense labeled products are reportedly 20% more water-efficient but perform as well as or better than standard versions.[4]

By replacing old faucets and aerators with WaterSense labeled models, the average family could potentially save $250 in water and electricity costs over the products’ lifetime.[4]

Examples of low-flow fixtures include low-flow toilets, low-flow shower heads and low-flow faucets. These fixtures are also made for outdoor and landscaping equipment, like garden hoses and sprinkler systems.

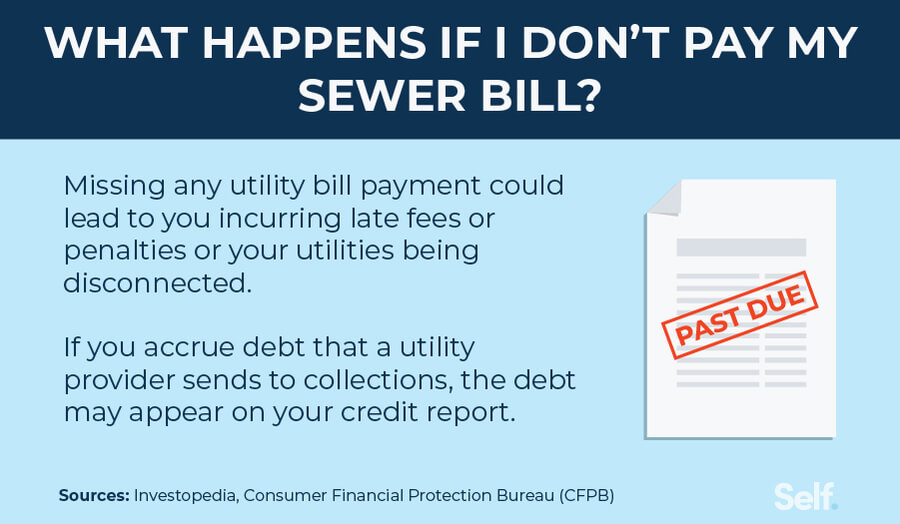

What happens if I don’t pay my utility bills on time?

If you miss a utility bill payment, you might be charged late fees or penalties. If you miss multiple payments, your utilities could be disconnected.[7]

Most utility companies don’t report your utility bill payment activity to the three major credit bureaus (Experian, TransUnion and Equifax), but if you don’t pay a utility bill, after 120 to 180 days from the date it was first late, the provider may turn the debt over to a collection agency, and that collections account could appear on your credit report.[8], [9]

Collection accounts generally have a negative impact on your credit score. They’re factored into your payment history, the most significant credit scoring factor: it makes up 35% of your FICO® score[10] and 40% of your VantageScore®.[11] The actual impact to your credit score can vary, depending on your unique financial situation and which model is used, but it’s best to avoid collections debt as much as possible.[12]

Collections generally stay on your credit report for seven years from the first date of delinquency, but the older these negative items are, the less impact they generally have on your credit score.[13]

How paying your utility bills may help you build credit

Although utility providers don’t typically report utility bill payment activity to the credit bureaus, you can use an opt-in service to get your activity reported so you can build a credit history. Some service providers only report to certain credit bureaus, rather than all three, so the impact on your credit score can vary.

eCredable Lift allows you to report up to eight utility bill payments to TransUnion every month[14], while Self reports rent payments to all three bureaus. There's a charge for some of these services so evaluate the costs and benefits to see if it’s a right fit for your needs.

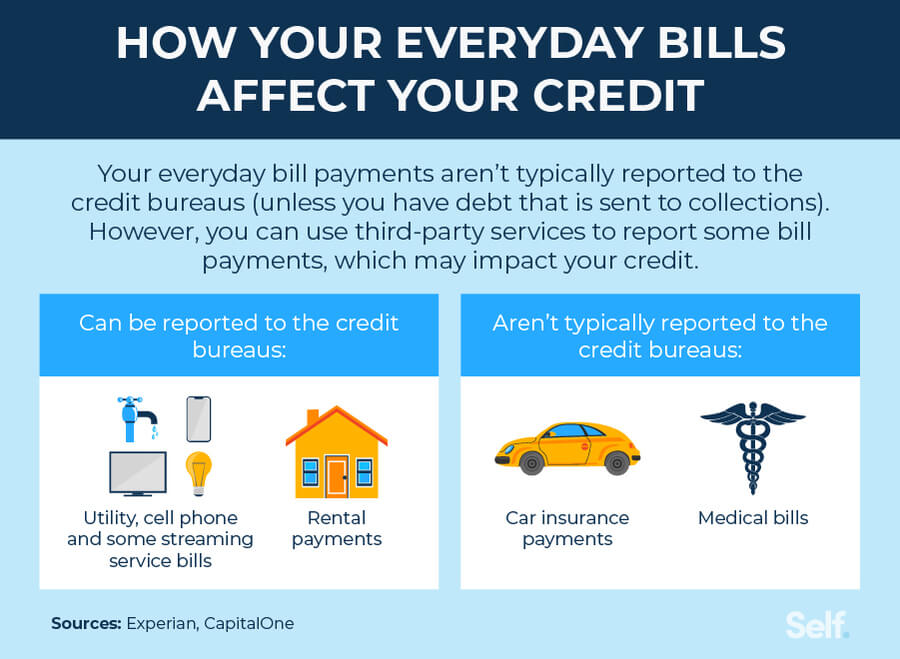

Which bills are reported to the credit bureaus?

Whether or not your monthly bills, like utilities and rent, or other regular bills, like car insurance and medical bills, affect your credit score depends on if they are reported to the credit bureaus.

Bills that can be reported using opt-in services

Household bills like utilities and cell phone bills aren’t typically reported to the credit bureaus. If you report them using a third-party service, late payments won’t lower your credit score because the service only reports positive payment history on the accounts you submit. Some services report positive and negative payment history, so make sure to do your research.

Landlords generally don't report unpaid rent to credit bureaus, but breaking your lease could impact your credit score if there is past-due rent debt that is sent to collections.[15] If you want your on-time rent payments to be counted toward your credit score as positive payment history, you can use a third-party rent-reporting service to have that information reported. Some charge a fee for this service so checking out the details and comparing the benefits each service can offer can help you make an informed decision.[16]

Bills that aren’t typically reported to the credit bureaus

Many common bills don’t directly impact your credit score unless you default on payments and they go to collections and the collector reports it to the bureaus.

Medical providers typically don’t report to credit bureaus, but some medical debt could impact your credit score if it ends up in collections.[18] The laws around medical debt have recently changed for consumers. As of July 1, 2022, paid medical collection debt doesn’t appear on consumer credit reports, and the time it takes for unpaid medical debt to appear on credit reports increased from six months to one year.

New regulations are also active this year. Starting in the first half of 2023, medical collection debt under $500 won’t be included on credit reports. Also, as of January 2023, VantageScore® 3.0 and 4.0 models no longer use medical collections in credit score calculations.[18]

Use less water and save on your sewer bill

It may be overwhelming to think about your utility bills, especially if you’re in debt or dealing with high costs. But there are ways you can reduce your water and sewer bills today. Keep our six tips in mind:

- Check for leaks.

- Take shorter showers.

- Turn your faucets off.

- Wait until you have a full load to run the washing machine or dishwasher.

- Switch to energy-efficient and water-efficient appliances.

- Switch to low-flow fixtures.

Try incorporating these strategies into your life. You can start using some of them right away. The key to reducing your bills is staying consistent. The less water you use over time, the more you’ll be able to save.

Lowering your bills makes paying them more manageable, too. You can also build credit by using services like Self to report positive payment history from utility bills like your water and sewer bills. Plus, Self has the information and tools to help you understand how to stay on track with your credit-building habits.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Environmental Protection Agency. “Understanding Your Water Bill,” https://www.epa.gov/watersense/understanding-your-water-bill. Accessed January 18, 2023.

- Environmental Protection Agency. “Fix a Leak Week,” https://www.epa.gov/watersense/fix-leak-week. Accessed January 18, 2023.

- Environmental Protection Agency. “Showerheads,” https://www.epa.gov/watersense/showerheads. Accessed January 18, 2023.

- Environmental Protection Agency. “Statistics and Facts,” https://www.epa.gov/watersense/statistics-and-facts. Accessed January 18, 2023.

- Energy Star. “Laundry Made Easy!” https://www.energystar.gov/about/newsroom/the-energy-source/laundry_made_easy. Accessed January 18, 2023.

- Energy Star. “Clothes Washers,” https://www.energystar.gov/products/clothes_washers. Accessed January 18, 2023.

- Investopedia. “Can’t Pay Your Bills? Now What?” https://www.investopedia.com/can-t-pay-your-bills-now-what-5179654. Accessed January 18, 2023.

- Consumer Financial Protection Bureau. “Does my history of paying utility bills, like telephone, cable, electricity, or water, go in my credit report?” https://www.consumerfinance.gov/ask-cfpb/does-my-history-of-paying-utility-bills-like-telephone-cable-electricity-or-water-go-in-my-credit-report-en-1817/. Accessed January 18, 2023.

- Equifax. “What is a Charge-Off?” https://www.equifax.com/personal/education/credit/report/charge-offs-faq/#:~:text=A%20charge%2Doff%20means%20a,obligated%20to%20pay%20the%20debt. Accessed January 25, 2023.

- myFICO®. “How are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed January 18, 2023.

- VantageScore®. “The Complete Guide to Your VantageScore®,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed January 18, 2023.

- Experian. “Can Paying off Collections Raise Your Credit Score?” https://www.experian.com/blogs/ask-experian/can-paying-off-collections-raise-your-credit-score/. Accessed January 18, 2023.

- myFICO®. “Chapter 7 & 13: How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed January 18, 2023.

- eCredable. “How does eCredable Lift Work?” https://ecredable.com/how-it-works/ecredable-lift. Accessed January 18, 2023.

- Experian. “Does Breaking a Lease Affect Your Credit?” https://www.experian.com/blogs/ask-experian/does-breaking-a-lease-affect-your-credit/. Accessed January 18, 2023.

- Experian. “Rental Data from Experian RentBureau®.” https://www.experian.com/rentbureau/renter-credit. Accessed January 18, 2023.

- Experian. “Does My Car Insurance Policy Affect My Credit Score?” https://www.experian.com/blogs/ask-experian/does-car-insurance-affect-my-credit-score/. Accessed January 18, 2023.

- Capital One. “How Do Medical Bills Affect Your Credit?” https://www.capitalone.com/learn-grow/money-management/how-medical-bills-affect-credit/. Accessed January 18, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).