What Happens If You Don’t Pay Medical Bills?

Published on: 03/21/2023

If you don’t pay your medical bills, your healthcare provider may sell the debt to a collections agency, which may then try to collect on the debt.

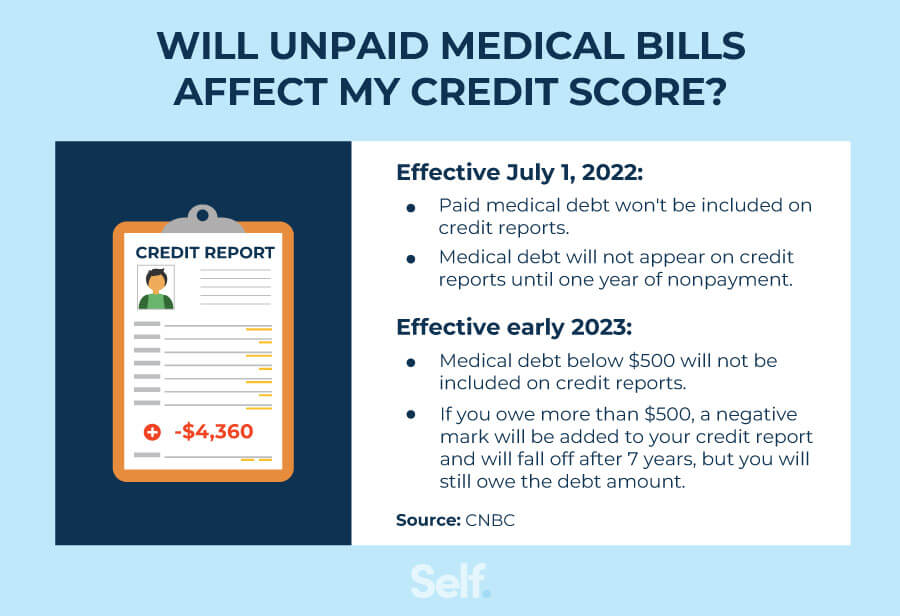

However, medical debt doesn’t necessarily impact your credit score, even if it goes to a debt collection agency. As of July 1, 2022, paid medical debt that was in collections will not appear on credit reports. Plus the time it takes for unpaid medical debt to appear on your credit reports was extended to a year, giving you additional time to pay it off before it impacts your credit. Also, in the first half of 2023, the major credit bureaus won’t include any medical debt in collections under $500 on credit reports.[1]

In this post, we go over what happens to a medical bill you haven’t paid, how it impacts your finances and what to do if you can’t afford your medical bills.

What happens if you don’t pay medical bills?

If you don’t pay your medical bill, your medical provider will try to collect on what you owe. If they can’t collect on it after several months, they might sell your debt to a debt collector.

How unpaid medical bills become medical debt, and what happens to that debt once it goes to collections, usually goes something like this:

- You receive a bill from your provider. This can be a bill from a doctor’s office, a hospital bill or another care provider.

- Your provider sends you reminders of what you owe, and you may even receive phone calls directly from your provider asking for payment.

- After several months since your first late or missed payment, your debt may be written off as a loss, and the bill amount may be sent to a debt collection agency to collect on it.[2]

- Medical debt may appear on your credit report. Although paid medical debt from collections no longer appears on your report, as of July 1, 2022, you have a year before unpaid medical collection debt appears on credit reports, so it shouldn’t impact your credit immediately. However, if your debt is under $500, the credit bureaus will not report it at all beginning in the first half of 2023.

- Once your debt goes to collections, the debt collector will attempt to collect it and could sue you to collect the debt. If you’re successfully sued by a debt collector and can’t pay the amount, you may deal with penalties like wage garnishment. However, the statute of limitations for debt lawsuits generally ranges from three to six years. The exact period depends on the state where you live and your debt type. Making a partial payment (or even acknowledging the debt in writing) may restart the statute of limitations in some states.[3]

- After the statute of limitations runs out, although you will still owe the debt, debt collectors may not be able to sue you to collect. If you have such “time-barred” debt, you typically have three options: pay nothing, pay part of what you owe or pay off the debt (either the full amount or a negotiated settlement). Because each option has repercussions and each state has its own statute of limitations, consult an attorney to decide the best route for you.[3]

What if you can’t afford your medical bills?

Healthcare costs can be very steep. Some medical bills may even be unexpected, like emergencies you couldn’t have planned for. No matter the situation, there are steps you can take to mitigate the cost of your medical bills, whether they’re new medical expenses or old bills that wound up in collections.

1. Check the accuracy of your bill

The first step in dealing with your medical bills is to check the bills for accuracy. Make sure that your personal information, like your name, address and health insurance information, is correct, and that the correct treatments and services are listed, including whether your care is considered in-network or outside of your insurance coverage.

If you find any errors, you’ll want to contact your medical provider or your health insurance company to remove the incorrect information and adjust the bill as necessary.[4]

2. Contact your provider to refute inaccuracies

If your bill is inaccurate, collect proof from your bills, your receipts for payment, your insurance agreement and your medical provider and note where there are errors. You can dispute these inaccuracies with both the provider and your insurance company if the amount you’re being charged is incorrect.[5]

3. Consider appealing your insurance company

Just because your insurance company denies a medical care claim at first doesn’t mean they definitely won’t cover it. You have a right to an insurance appeal. If you feel that a procedure or other care expense should fall under the scope of your insurance coverage, you can ask your insurance company to reevaluate their decision regarding payment or benefits.[6]

4. See if you can get financial assistance

Depending on where you live, what your income level is and the amount of your medical bill, you may qualify for financial assistance programs. Many programs seek to serve the uninsured, low-income individuals and more. Here are some financial assistance options you may be eligible for:

- Charity care, especially at nonprofit hospitals, by filling out the application and qualifying

- Consumer Assistance Programs provided by your state

- Centers for Medicare and Medicaid Services

- State agencies[7]

Similarly, if you need assistance with handling your medical debt, the following resources can help:

- Consumer Financial Protection Bureau (CFPB)[7]

- State financial and legal assistance[5]

- Credit counseling services[8]

5. Negotiate your bill

If your medical bill hasn’t gone to collections yet, you can contact your provider directly to negotiate the bill if it’s more than you can afford.[5] Some providers may be willing to settle the bill for a smaller amount, while others may be more flexible on the amount of time it takes you to pay them.

If you can’t afford to pay a lump sum upfront, you can try discussing payment plan options with your provider’s billing department. You might qualify for an interest-free plan or an income-driven hardship plan.

You can also ask whether your provider knows of resources that offer financial assistance on general medical costs, like prescription drugs or other medical expenses, to show them that you want to avoid collections if possible. They may be willing to work with you, so it never hurts to ask.[5]

6. If the debt has gone to collections, request a debt validation letter

If debt collectors have started contacting you about your unpaid medical bills, they should send you a debt collection validation notice notifying you of what you owe.[9] If they don’t send you a debt collection validation notice within five days of contacting you, you should verify with them that the bill is accurate by requesting they send you a debt validation letter if they haven’t. You can write a debt verification letter requesting information specific to the debt you owe.[3]

Review your rights as a patient and consumer

As a patient, you have rights. Here are some federal protections in place for patients and what they mean for you and your medical debt.

- The Affordable Care Act: This act was created to help consumers with medical expenses. In addition to reforms like expanding Medicaid, the ACA helps to make healthcare more understandable and affordable. It gives patients rights, including the right to choose their own health insurance from the marketplace instead of what their employer offers, the right to appeal health plan decisions, the right to health insurance coverage for pre-existing conditions and the right to free preventative care.[10]

- The No Surprises Act: This act protects consumers from surprise medical bills. It specifically protects you from bills for out-of-network services you received that you didn’t realize were out-of-network, like in the case of medical emergencies. Patients are protected from surprise bills from hospitals and doctor’s offices, and doctors and health plans are required to provide comprehensive cost information upfront.[11]

Similarly, you have rights as a consumer that protect you from debt collectors. Debt collectors may try to take advantage of you if you don’t know your rights regarding what they can and can’t do. If a debt collector does something that they aren’t allowed to do when collecting on your debt, you can submit a complaint to the Consumer Financial Protection Bureau (CFPB).[12]

Here’s an overview of what debt collectors can and can’t do, as outlined in the Fair Debt Collection Practices Act:

- Unless you consent to it, debt collectors can’t communicate with you about the collection of any debt, or validate the accuracy of debts attributed to you, while you are at work, outside of the hours of 8 a.m. and 9 p.m. in your time zone or if you’re clearly working with an attorney.

- Debt collectors cannot harass, abuse, threaten or mislead you, misrepresent your debt or engage in any other unfair practices. They cannot threaten to take any action that isn’t intended (such as filing suit or garnishing your wages) or that can’t legally be taken. Any communication from them should contain meaningful details about your debt.

- Debt collectors cannot use unfair means to collect on your debt. For example, they can’t collect on any amount — like interest or a fee — that isn’t expressly authorized by the agreement that created the debt.

- If you request validation, debt collectors are required to send you a written notice containing the following information: the amount of debt you owe, the name and contact information of the original creditor and a statement that the debt is valid (unless you’ve disputed the validity of the debt within 30 days of the notice).[13]

Also, look out for scammers who try to pretend to be debt collectors. Never give out your personal information or send money to a debt collector unless you’ve verified that they’re a legitimate debt collection agency.

Will unpaid medical bills affect my credit score?

Some medical debt may still show up on your credit history, impacting your credit score. However, the three major credit bureaus — Experian, Equifax and TransUnion — have announced the following changes to medical debt reporting:

- Paid medical debt will no longer be reported.

- Unpaid medical debt in collections will only be reported after one year, extended from six months.

- Beginning in the first half of 2023, medical bills less than $500 will not be reported on consumer credit reports. If you owe medical debt in an amount above $500, it will be reported and can negatively impact your credit score. A negative item about collections will generally fall off after seven years after the date you were first delinquent, but even though it isn’t reported, you’ll still owe the debt amount.[1]

Will unpaid medical debt ever go away?

Debt doesn’t go away until it’s paid.[3] No matter what your personal financial situation is, Self has tools to help you get back on track. Whether you’re working to pay off debt in collections, or looking to build your credit, we can provide you with the resources that you need.

Sources

- Equifax. “Can Medical Debt Impact Credit Scores,” https://www.equifax.com/personal/education/credit/score/can-medical-debt-impact-credit-scores/. Accessed December 19, 2022.

- Equifax. “Charge Off FAQs,” https://www.equifax.com/personal/education/credit/report/charge-offs-faq/#. Accessed December 19, 2022.

- Federal Trade Commission. “Debt Collection FAQs,” https://consumer.ftc.gov/articles/debt-collection-faqs. Accessed December 19, 2022.

- Experian. “6 Common Medical Bill Errors,” https://www.experian.com/blogs/ask-experian/common-medical-bill-errors/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “What should I do if I can’t pay a medical bill?” https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-if-i-cant-pay-a-medical-bill-en-2125/. Accessed December 19, 2022.

- Healthcare.gov. “How to appeal an insurance company decision,” https://www.healthcare.gov/appeal-insurance-company-decision/appeals/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “Is there financial help for my medical bills?” https://www.consumerfinance.gov/ask-cfpb/is-there-financial-help-for-my-medical-bills-en-2124/. Accessed December 19, 2022.

- Federal Trade Commission. “Choosing a Credit Counselor,” https://consumer.ftc.gov/articles/choosing-credit-counselor. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “Understand how the CFPB’s Debt Collection Rule impacts you,” https://www.consumerfinance.gov/about-us/blog/understand-how-cfpb-debt-collection-rule-impacts-you/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “Exploring the connection between financial assistance for medical care and medical collections,” https://www.consumerfinance.gov/about-us/blog/exploring-connection-between-financial-assistance-for-medical-care-and-medical-collections/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “What is a ‘surprise medical bill’ and what should I know about the No Surprises Act?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-surprise-medical-bill-and-what-should-i-know-about-the-no-surprises-act-en-2123/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “Submit a complaint,” https://www.consumerfinance.gov/complaint/. Accessed December 19, 2022.

- Federal Trade Commission. “Fair Debt Collection Practices Act,” https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text. Accessed December 19, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).