How Many Hard Inquiries Is Too Many and How to Remove Them

Published on: 01/21/2025

Hard inquiries are an ever-present aspect of credit and credit reporting. Though the impact of a hard credit inquiry will differ from person to person, too many hard inquiries can lead to trouble. Hard inquiries can even pose potential issues for major financial transactions, such as buying a home.

By understanding how inquiries work, and how to request them strategically, you can steer yourself away from the pitfalls of hard credit inquiries.

What is a hard inquiry?

A hard credit inquiry is a request for credit information during the application process for a credit account. This includes a new line of credit like a credit card or a loan like a mortgage or car loan. Your creditor will request to look at your credit file to see how much risk you pose as a borrower. Because this inquiry affects the lending decision, hard inquiries will affect your credit score. For most people, one additional credit inquiry can lower a credit score by up to five points.[1]

Scenarios that generate a hard inquiry include:

- Applying for a new credit card or line of credit from a credit card company.

- Applying for a loan from a lender (e.g. auto loan, student loan, car loan, or mortgage loan).

- Applying to rent an apartment

- Requesting a credit limit increase.

The difference between hard and soft credit inquiries

Hard inquiries are in-depth and look at multiple facets of a person’s credit history. But these aren’t the only inquiries that can be made. Soft inquiries, also known as soft credit pulls, occur when lenders and non-lenders view your credit information. These will not affect your credit score. They aren’t usually attached to a specific application for credit.[2]

Specific instances that generate a soft inquiry include:

- Applying for or beginning a new job and your employer views your credit report as part of the screening process.

- A company checking your credit for a pre-approval process for a loan or credit card.

- Checking your own credit report.

Soft inquiries do not have a negative impact on your credit score.

Checking your credit report regularly

Experts recommend checking your credit report for inaccuracies and errors throughout the year. Each of the three major credit bureaus — Experian, Equifax, and TransUnion — under federal law are required to provide one free copy of your credit report each year. These credit reporting agencies now allow you to obtain your free credit report weekly at annualcreditreport.com.

How many hard inquiries is too many?

While there is no set limit on the number of hard inquiries that are “too many”, in general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds statistically to being eight times more likely than average to declare bankruptcy than people iwht no inquiries in their report. This heightened credit risk can damage a person’s credit options and lower one’s credit score.[1]

Hard inquiries are listed on your credit report for 24 months. However, they are used to determine a FICO score for only 12 months. Therefore, several hard credit inquiries within 12 months or less can impact your score. The impact will be more pronounced for individuals with a short credit history or those deemed as being higher risk for creditors.

Soft inquiries don’t cause a drop in your credit score, so there isn’t a number that could be considered too much.

Rate shopping may be treated as one hard inquiry

Since multiple hard inquiries can negatively impact credit, how can anyone shop around for favorable rates? Fear not — there is a specific use of hard inquiries just for this situation. It is known as rate shopping.

Rate shopping refers to checking the offerings of several different lenders when you need to borrow money. Whether you’re planning on taking out a car loan, or student loan, or applying for a mortgage, rate shopping helps you narrow down which lender works best for you, and it can help you gind the best loan rate and terms to save money on interest and fees.

It’s a good idea to group your loan applications together because of how credit scoring models like FICO and VantageScore treat rate shopping. VantageScore will count all inquiries within a 14-day period as one inquiry providing they’re all for one particular type of loan. FICO treats multiple inquiries within a 45-day period in the same way.

In other words, focus on one credit need at a time, rather than applying for different types of credit within a short period. This will help limit the potential negative impact on your credit score.[3]

How to remove inaccurate credit inquiries from your credit report

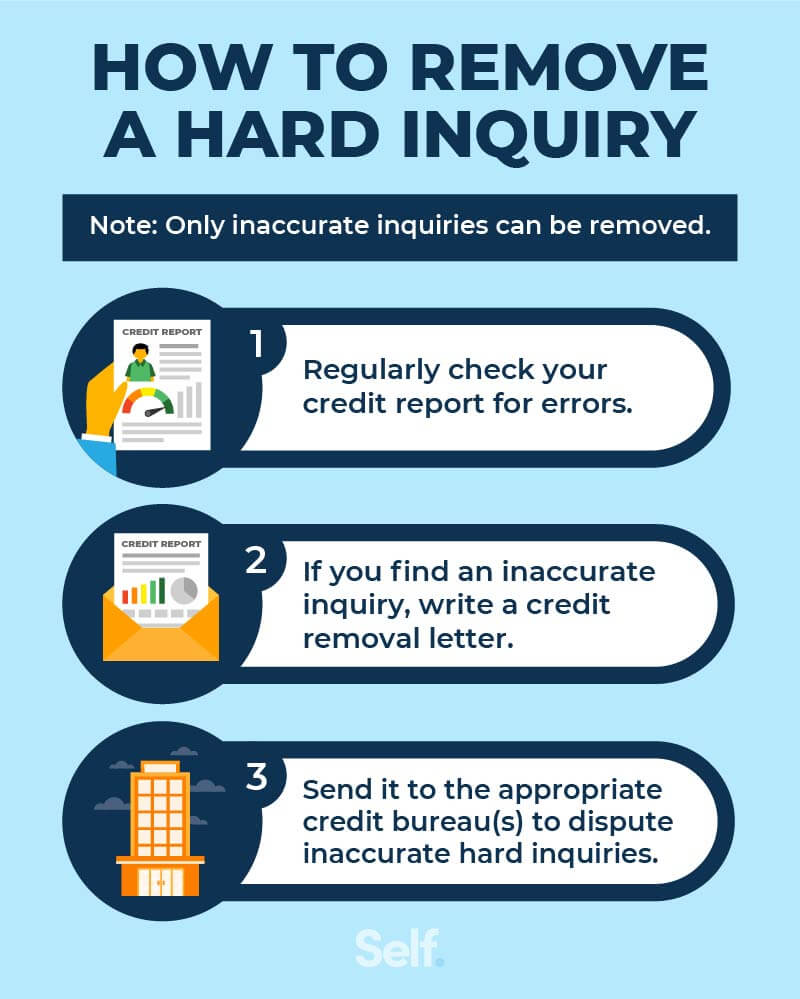

Sometimes, errors and even identity theft can lead to hard inquiries appearing on a credit report when they shouldn't. These occurrences may not be noticed until the number adds up. This highlights the importance of routine credit report monitoring.

It is also worth noting that if a hard inquiry is legitimate, it can’t be removed. However, if you feel there are erroneous inquiries on your credit history, there are ways to deal with them. Follow these steps to remove a credit inquiry:

- Review your credit report from the three bureaus (it can take up to 45 days for your report to update).[4]

- Send a letter of dispute to the credit bureau reporting the error (include all necessary evidence to prove it was not your actions that led to the inquiry).

- Contact the lender and verify the information at the source.

- Send a credit inquiry removal letter.

- Report any identity theft to the Federal Trade Commission.

Keep in mind: You must prove that a hard inquiry is a fraud for it to be removed. Some inquiries will show up under a different name from the entity that handled the business. It is up to you, the customer, to perform your due diligence before reporting an issue.

How to minimize the impact of hard inquiries?

Hard credit inquiries are a part of the credit process, and when used responsibly, hard inquiries and other uses of credit can highlight strong credit health to lenders.

There are five major factors that affect your credit score. A clean payment history that shows you pay your debts on time is the most important one.

However, you must also keep your total amount of debt relatively low. In other words, don’t max out any of your credit lines. Try to keep your oldest credit account open. And strive for a healthy mix of credit accounts, including new accounts.

Since hard inquiries can lead to new accounts, it is best to plan a favorable time to have them impact your credit, especially if you’ll be shopping around. When you're applying for new credit, here are some tips to help further minimize the impact of hard inquiries on your credit score:

- Check if you are pre-approved or pre-qualified for any credit card offers before starting.

- Apply for credit accounts only when you need to.

- Keep your credit needs focused while you rate shop.

- Don’t apply for several types of loans at once while rate shopping (do your research beforehand).

Even with responsible use, hard inquiries will still impact your score.

Avoid too many hard inquiries at once

Everyone from the new card user to the successful CEO will have hard inquiries on their credit report. They are one of the many pieces of your credit history, and potential lenders like to see a strong history when assessing your creditworthiness.

Know that hard inquiries do impact your credit score. However, all hard inquiries of the same credit type within a short period of time are counted as a single inquiry. Think carefully before applying for multiple types of credit at the same time.

Too many hard inquiries for different types of credit can demonstrate that you are regularly looking to take out different loans or new lines of credit. This might signal to creditors that you are not maintaining healthy credit habits, and could impact your ability to be approved for credit. Making sure you’re shopping for one type of credit at a time can help group these inquiries together and reduce the potential damage of hard inquiries.

Sources

- myFICO. “Credit Checks: What Are Credit Inquiries and How Do They Affect Your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries.

- Experian. “What Is a Soft Inquiry?” https://www.experian.com/blogs/ask-experian/what-is-a-soft-inquiry/.

- TransUnion, “How Rate Shopping Can Impact Your Credit Score” https://www.transunion.com/blog/credit-advice/how-rate-shopping-can-impact-your-credit-score.

- TransUnion. “How Long Does It Take for a Credit Report to Update?” https://www.transunion.com/blog/credit-advice/how-long-does-it-take-for-a-credit-report-to-update.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).