How Long Do Collections Stay on Your Credit Report?

Published on: 02/07/2023

Collection accounts remain on your credit reports for up to seven years from the original delinquency date,[1] and each state has a limit to how old a debt can be before it’s too old for you to be sued, referred to as a statute of limitations. However, regardless of whether the statute of limitations for your state has been reached, if the debt belongs to you, the amount is correct, and the debt collector has the right to collect it, the collection agency can continue to contact you to attempt to get you to pay what you owe. After the statute of limitations has been reached, they can only contact you — not sue you. Although the debt itself doesn’t generally disappear unless you pay it, the negative information will eventually disappear from your credit report.[2]

In this guide, we explain how collection accounts can impact your credit score, how long collections accounts stay on your credit report, and how to remove negative information from your credit report.

How long do collections stay on your credit report?

Collections generally stay on your credit report for up to seven years.[1] Below we explain how collections accounts get on your credit report and what you can do about them.

After repeatedly trying but failing to recover payment on an account, creditors may “charge off” your debt, typically around 120 to 180 days after your first late or missed payment. This means they write off the debt as a loss. If it’s a revolving account, your creditor likely already closed the account to future charges. The creditor may then transfer the account to a debt collection company. Both installment loans, such as student loans, auto loans and mortgages, and revolving accounts, such as credit cards, can be charged off.[1]

If the original creditor transfers your account to a debt collector, you will likely find yourself making payments to a third-party collection agency. When this happens, the debt may show up on your credit report twice: once listing the original account from the original creditor and once from the debt collector.[1]

Old debts — even if a creditor has charged them off — may disappear from your credit report after seven years, but what you owe usually doesn’t disappear until you pay off the debt. While you may still owe a debt to a creditor, your state’s statute of limitations may restrict the amount of time that collectors and creditors have to sue you over unpaid debt. You may want to keep the following considerations in mind:

- Although the statute of limitations for debt lawsuits generally range from three to six years, the exact period depends on the state where you live, the type of debt you have and the state law named in your credit agreement. Making a partial payment (or even acknowledging the debt in writing) may restart the statute of limitations in some states. [3]

- After the statute of limitations runs out, debt collectors generally can no longer sue you to collect. If you have such “time-barred” debt, you typically have three options: pay nothing, pay part of what you owe, or pay off the debt (either the full amount or a negotiated settlement). Because each option has its own repercussions, consult with an attorney to decide the best route for you.[3]

How do collection accounts impact your credit score?

One of the most important factors in your credit score, payment history counts for 35% of your FICO® score. Although your payment history includes positive information, such as your history of on-time payments and paying as agreed with your creditor or lender, your payment history also includes information about the following negative information:[4]

- The amount of money still owed on delinquent accounts

- Accounts that have been charged off

- How overdue delinquent accounts are or were

- The number of past due items on a credit report

- Public record and collection items (such as lawsuits)

- The length of time since negative items appeared on your credit report

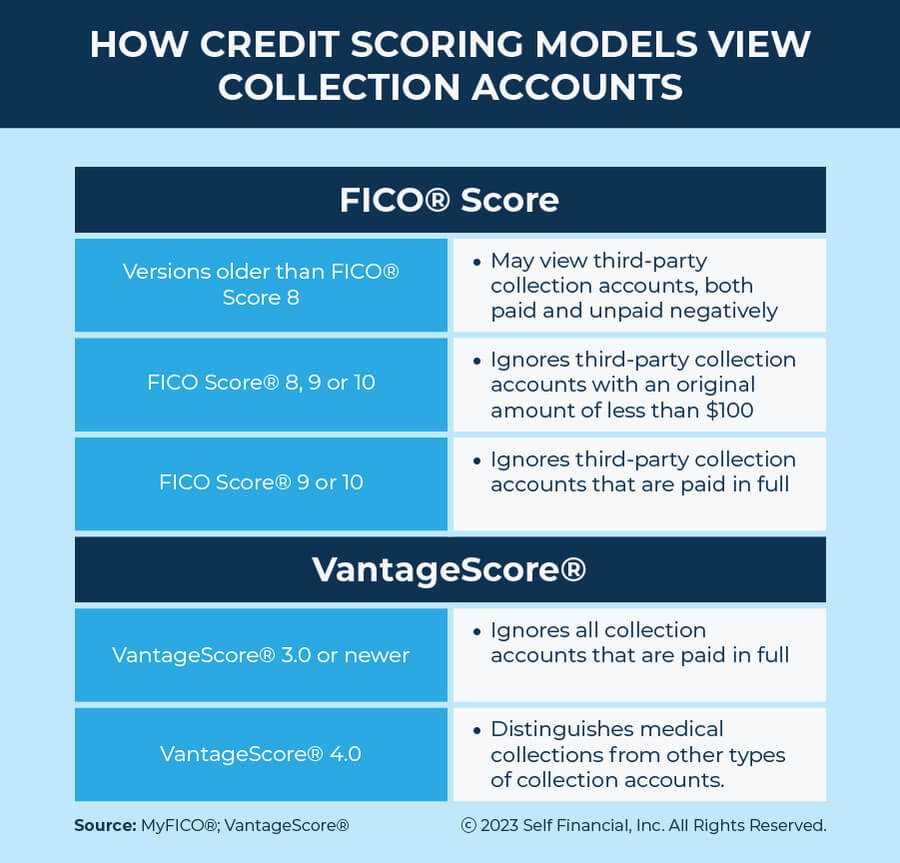

When you make late payments or stop paying on an account altogether, the creditor could send it to collections. All three credit bureaus may receive reports about the collection account, which appear in your credit history and could negatively impact your credit score. As you can see below, how much this information impacts your credit score depends somewhat on the scoring model.[5]

- Versions older than FICO® Score 8: Any third-party collection is considered negative in FICO® scoring models older than FICO® 8.[6]

- FICO® Score 8 or newer: Newer FICO® versions ignore smaller third-party collection accounts with an original amount of less than $100.[6]

- FICO® Score 9 or 10: The most recent FICO® models ignore any third-party collections (including medical) that are paid in full.[6]

- Versions older than VantageScore® 3.0: VantageScore® 3.0 and 4.0 ignore all collection accounts that have been paid.[7]

- VantageScore® 4.0: The most current generation, VantageScore® 4.0 distinguishes medical collections from other types of collection accounts on your credit report. It also minimizes the impact of such collections on your credit score relative to other types of collections.[7]

How long does medical collection debt stay on your credit report?

The major credit reporting agencies recently announced changes in how medical bills affect credit reporting. As of July 1, 2022, paid medical collection debt no longer appears on consumer credit reports. In addition, the time period before unpaid medical debt appears increased from six months to one year, giving consumers more time to address accounts owed. In the first half of 2023, the three major credit bureaus will also no longer include medical debt under at least $500 on your credit report.[8]

Unpaid medical debt may still impact your credit score depending on the type of debt, the amount you owe and the credit scoring model used. For example, while unpaid medical collections count as negative information in FICO Score 9 and FICO Score 10, they have less impact on your credit score than in previous versions.[6]

How to remove collection accounts off your credit report

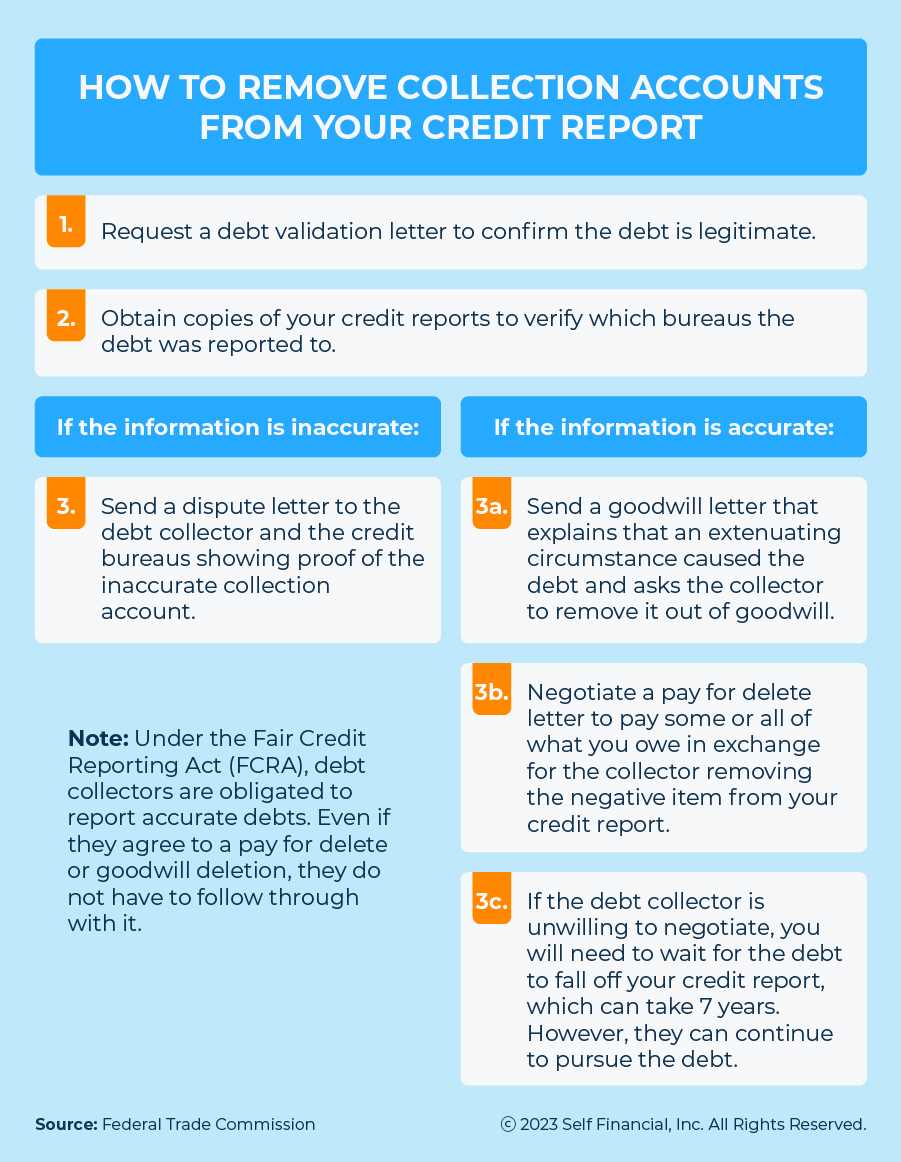

You can only get collections removed from your credit report if they are inaccurate by disputing the information with the agencies and creditor reporting the information.[9] Debt collectors do not have a legal obligation to delete any accurate items, even if you have paid off an account. Collections can impact your credit score until it falls off your credit report in 7 years.[4]

Obtain a copy of your credit report and verify if the collection account is legitimate

Consider reviewing your credit report to determine if the collection account belongs to you and contains accurate information. Federal law entitles you to one free credit report per year from the major credit reporting companies, which you can access at AnnualCreditReport.com. Because of the importance of checking your credit during COVID-19, the three credit bureaus (Experian, Equifax and TransUnion) will continue to offer free weekly reports until December 31, 2023. Experian allows a free credit score as well.[10]

Dispute any inaccurate information

If you believe the debt contains inaccuracies or does not belong to you, you can consider disputing any incorrect information. You can start by contacting the relevant credit agencies to dispute the error in writing, including documentation to support your case. You can also reach out to the company that provided the information to the credit bureaus, such as your bank, landlord or credit card issuer.[9]

The Consumer Finance Protection Bureau (CFPB) provides dispute forms and letter templates, as well as guidelines for how to approach each of the major credit reporting agencies. You may wish to consult these guidelines before you start fixing errors on your credit report.[11]

Write a goodwill letter

If you missed a single payment but have an otherwise outstanding payment history, you may consider writing a goodwill letter. In a goodwill letter, you explain your circumstances to the lender and ask them to remove the negative information from your credit report.[12]

While you always have the option of writing a goodwill letter, you won’t always find that they succeed. If you don’t have a legitimate reason for the missed payment or your payment history contains a number of derogatory marks, your appeal for a goodwill deletion may not help. Creditors have a legal obligation to report accurate information under the Fair Credit Reporting Act (FCRA).[13] So if you owe the debt, the creditor is obligated to report it.

Write a pay for delete letter

If you have an unpaid collection account, you can consider writing a pay for delete letter. With this strategy, you ask a lender to remove a collection item from your credit report in exchange for payment of that account.[14]

While this concept may sound appealing, again, the FCRA requires reporting of accurate information.[13] Only inaccurate or incomplete entries qualify for removal from your credit report, not accounts that have been paid. In addition, most recent credit scoring models don’t consider paid collections accounts so this practice may soon become irrelevant.

If you don’t want to take action on accurate debt, you can wait for those items to fall off your credit report. Keep in mind that collection accounts can take up to 7 years to disappear from your credit report. However, older negative items have less impact on your credit score than newer items.[4]

Establish credit-building habits

Having an account in collections can cause stress and worry, but ignoring the situation can make it worse. Whether your credit score and personal finances have suffered due to a collection account or you simply want to improve your credit, you may want to follow these credit-building habits:

- Check your credit report. Monitoring your credit regularly can help you identify potential issues as soon as they arise. Your annual free credit report is a great place to start.

- Have a low credit utilization rate (CUR). Your CUR calculates the total amount of your available credit divided by your available revolving credit limits. Your amount owed makes up 30% of your FICO® score, and your CUR is included in this factor. So aim to keep your CUR low — experts suggest keeping it under 30% but ideally under 10%.[15]

- Pay off past-due accounts. Newer credit problems can hurt your score more than older ones, so prioritize any accounts that recently became overdue.[4]

- Pay your bills on time. The biggest factor in your FICO® score, payment history can have a big impact on your credit.[4]

- Pay down debt. Paying some of what you owe on revolving accounts can help lower your CUR and may positively impact your credit score. [15]

- Monitor your credit card spending. Keep tabs on your credit card spending to make sure your CUR doesn’t go too high.[15]

As you work to improve your credit, know that the Fair Debt Collection Practices Act protects consumers from abusive debt collection methods. Among other provisions, the federal law governs communications of debt collectors, defines harassment, addresses legal actions and forbids deceptive debt collection practices. Before they can legally report your debt to a credit reporting company, debt collectors must contact you in person, by phone or in writing. If you believe a debt collector has improperly reported your account to a credit bureau, you can file a complaint with the Consumer Financial Protection Bureau.[16] [17]

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Equifax. “What is a Charge Off?” https://www.equifax.com/personal/education/credit/report/charge-offs-faq/#. Accessed on October 4, 2022.

- Consumer Financial Protection Bureau. “My debt is several years old. Can debt collectors still collect?” https://www.consumerfinance.gov/ask-cfpb/my-debt-is-several-years-old-can-debt-collectors-still-collect-en-1423. Accessed on October 4, 2022.

- Federal Trade Commission. “Debt Collection FAQs,” https://consumer.ftc.gov/articles/debt-collection-faqs. Accessed on October 4, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on October 4, 2022.

- MyFICO. “FICO® Scores Versions,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed on October 4, 2022.

- MyFICO. “7 Common Questions about Collections and FICO® Scores,” https://www.myfico.com/credit-education/blog/7-common-collection-questions. Accessed on October 4, 2022.

- VantageScore. “The impact of medical debt on your credit reports and VantageScore credit scores.” https://vantagescore.com/newsletter/the-impact-of-medical-debt-on-your-credit-reports-and-vantagescore-credit-scores-1. Accessed on October 4, 2022.

- Experian. “Equifax, Experian, and TransUnion Support U.S. Consumers With Changes to Medical Collection Debt Reporting,” https://www.experianplc.com/media/latest-news/2022/equifax-experian-and-transunion-support-us-consumers-with-changes-to-medical-collection-debt-reporting. Accessed on October 4, 2022.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314. Accessed on October 4, 2022.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5. Accessed on October 4, 2022.

- Consumer Financial Protection Bureau. “Credit report dispute,” https://files.consumerfinance.gov/f/documents/092016_cfpb__CreditReportingSampleLetter.pdf. Accessed on October 4, 2022.

- U.S. News & World Report. “What Is a Goodwill Letter?” https://money.usnews.com/credit-cards/articles/can-a-goodwill-letter-improve-my-credit. Accessed on October 4, 2022.

- Federal Trade Commission. “Fair Credit Reporting Act (FCRA).” https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act. Accessed October 20, 2022.

- Forbes. “Pay For Delete: Learn About This Collection Removal Strategy,” “https://www.forbes.com/advisor/credit-score/pay-for-delete. Accessed on October 4, 2022.

- MyFICO.”What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed on October 4, 2022.

- Federal Trade Commission. “Fair Debt Collection Practices Act,” https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text. Accessed on October 4, 2022.

- Consumer Financial Protection Bureau. “When can a debt collector report my debt to a credit reporting company?” https://www.consumerfinance.gov/ask-cfpb/when-can-a-debt-collector-report-to-a-credit-reporting-agency-en-2111. Accessed on October 4, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).