How to Cash a Cashier's Check and Where to Do It

Published on: 01/14/2022

If you need to cash a cashier’s check, you can do so at the issuing bank or financial institution, but there may be fees associated if you’re not a customer. Fortunately, there are other ways to cash a cashier’s check — even if you don’t have a bank account.

What is a cashier’s check?

When a bank issues you a cashier’s check, it’s acting as a middleman in your transaction.

How does that work?

First, the bank transfers the amount you’ve requested from your account into its account. Then the bank issues a check drawn from its funds to the person you want to pay. Because the bank’s funds are secure, the money may be available to the payee faster, especially on large deposits that may normally take several business days to clear if they’re made via personal check.

You will have to pay a little for that security and convenience, though. Payments over $1,000 come with a fee, generally ranging from $5 to $15.[1]

How to get a cashier’s check

You’ll need to have enough money in your account to cover the transfer. You’ll also need to provide your bank with the payee’s name, and you’ll have to have a driver’s license or other valid form of identification.

You can get a cashier’s check at your local bank branch: just ask your bank teller. You may be able to get one online if your bank offers that service.

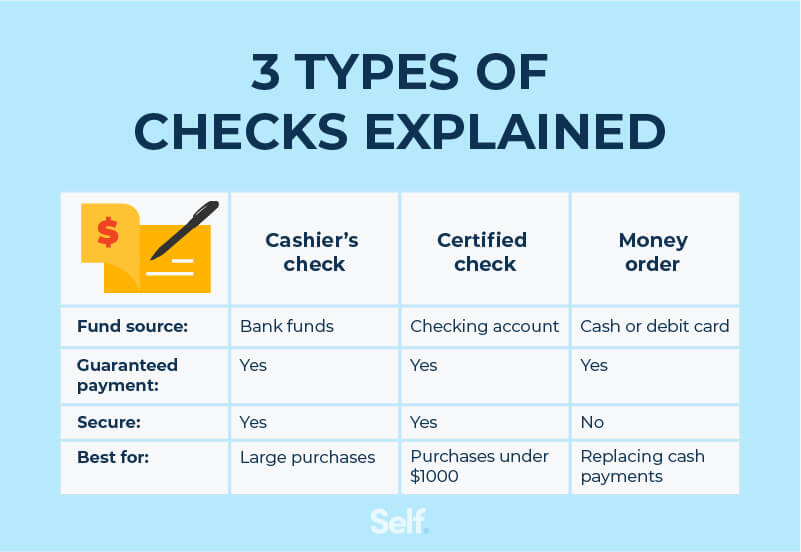

Types of checks

Cashier’s check vs. personal check

A cashier’s check and a personal check are two different types of checks.

A personal check is drawn from your bank account, whereas a cashier’s check is drawn from the bank’s account. You can stop payment on a personal check because it’s drawn from your account, but you don’t have that option with a cashier’s check.[2]

There’s always a risk you won’t have enough funds in your account to cover a check you’ve written, but there’s no such risk with a cashier’s check. That’s because the bank determines whether you have enough funds to cover a cashier’s check before it issues one, so availability of funds isn’t a factor.

Cashier’s checks generally allow for the funds to be released quickly. Some banks may require a special deposit slip for next-day availability. Also, banks may place a hold on cashier’s checks if the total deposited in a single day is more than $5,525 or if they have reason to suspect it’s not collectible from the issuing bank.[3]

Cashier’s check vs. certified check

A certified check, like a regular check, is a form of payment drawn from the bank customer’s account.

However, with a certified check, the bank checks to confirm there’s enough money in that account to cover the amount of the check. Once that’s verified, the bank will print the word “certified” or “accepted” on the check. This assures the payee that the check won’t bounce.

Some people or companies may ask for a certified check as payment, particularly on large payments, such as a down payment on a house. However, not all banks issue them, and you can’t get them online because you need the issuer to stamp the physical check you’ve written as certified.

Cashier’s check vs. money order

A money order is used, like a cashier’s check, to guarantee the funds you’re paying are available. Money orders are generally used for smaller purchases, and they’re a helpful option for people who don’t have bank accounts.

You might balk at spending $15 in fees to pay a $100 repair bill with a cashier’s check, but paying $1 for a money order at Walmart or a dollar or two at the post office is a lot more reasonable for a small purchase or payment.[4]

That’s right: You don’t have to go to a bank to get a money order, and that convenience can be a big advantage.

You can purchase a money order worth up to $500 at any post office for $1.45, or you can pay 50 cents more for any amount up to the maximum of $1,000. Postal money orders issued by military facilities are just fifty cents.[5] The post office will take payment in the form of cash, a debit card, or a traveler’s check, but won’t take a credit card. You just pay the amount of the money order plus the fee, then keep the receipt for tracking purposes.

Where can you cash a cashier’s check?

Banks and credit unions

You can cash a cashier’s check at banks and credit unions. If you’re not a customer of the financial institution, you’ll likely have to pay a fee.

Other requirements may be in play, too. For example, U.S. Bank requires you to provide your Social Security number to cash any check of more than $500. You’ll have to show a photo ID almost anywhere you go, but some places, such as Bank of America and Citibank, require two forms of ID.[6]

Check cashing services

You can also cash a cashier’s check at many check cashing stores such as Ace Cash Express, Check ’n Go, Check Into Cash, Pay-O-Matic, PLS Check Cashing, Money Mart, and Moneytree.

Check-cashing stores make money by charging a fee to cash your checks, and the fees can be significant because they’re sometimes charged as a percentage of the check’s face value.

So if you’re cashing a $2,000 cashier’s check at a store that charges a 5% fee, you’ll pay $100 just to get your money. The fees vary from store to store, and with some, you have to pay a minimum fee or a nominal sign-up fee for first-time use. For example, PLS cashes checks for “as low as 1% + $1.”[7] And fees at Advance Financial range from 1% to 5% with a $5 minimum fee.[8]

Big box stores

Walmart and other big box stores can cash a cashier’s check for you, too. So can major grocers like Kroger and H-E-B.

Rules and restrictions vary according to the store. Walmart charges a $4 fee for checks up to $1,000 and $8 that for checks above $1,000, while Texas-based H-E-B has a $3 fee for checks as high as $3,000 and varying fees for higher figures.[6]

Kroger gives you a slight fee break with a store card: You’ll pay $4 to cash a cashier’s check of less than $2,500 with a card and $4.50 without one. For larger amounts, the fee is $7 with a card and $7.50 if you don’t have one.[9]

Some travel centers, such as TA/Petro offer check-cashing services, as well. You can sign up for a membership (for a $25 fee), and you can cash checks up to $999. There’s a service fee, but it’s waived with a qualified purchase such as 60 gallons of diesel fuel, a convenience store purchase of $50, or truck maintenance/repair services of $250 or more.[10]

How to cash a cashier’s check online

Some banks offer the ability to cash a cashier’s check online with mobile apps and other methods of mobile deposit.

You typically need to endorse the check, just as you would a regular check, then follow the app’s instructions. You’ll be asked to enter the amount of the check and choose the account where you want to deposit it.

After that, you will need to take a picture of both sides of the check — the front, with the routing and account numbers clearly legible, and the back, with your signature. Make sure the pictures are in focus. Banks often limit the amount of money you can deposit via mobile app (such as the $5,000 limit imposed by Bank of America).[11]

You can also deposit cashier’s checks via online services like PayPal and have the money sent to your bank account or a special debit card.

Who can cash a cashier’s check?

In order to cash a cashier’s check, you’ll be asked to provide a government-issued photo ID. Fees and other requirements will vary depending on the location you choose. Some companies will require two forms of identification.

Can you get a cashier’s check without a bank account?

Most institutions will provide cashier’s checks to customers, but some smaller banks and credit unions also offer the service to non-customers for a fee. You’ll need to look around in your area to find one.

If you need to cash a cashier’s check but don’t have an account, you may be able to find a bank or credit union that will provide checks for non-customers. Be prepared to pay a fee in such instances. Another option is a check-cashing service, although such services frequently charge high fees. [12]

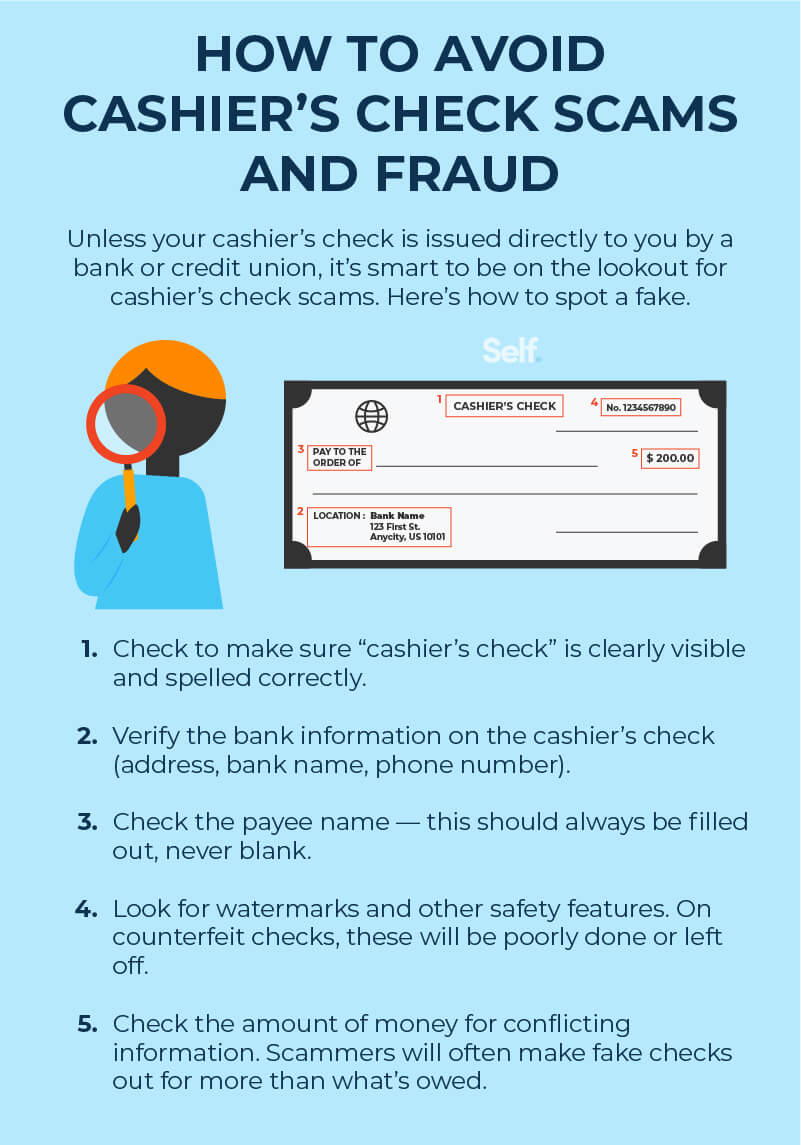

Cashier’s check fraud and scams

Cashier’s checks are more secure than personal checks because they’re backed by a financial institution, but that doesn’t mean they’re immune to fraud.

To ensure a check you’ve received is legitimate, contact the issuing bank using the contact information on its website. If there’s a phone number on the check, don’t call that: If the check is fake, the number will be, too. And most check scams involve fake checks.

You may be tempted to breathe a sigh of relief when you see the check has cleared, but that doesn’t mean it’s not fake. Under U.S. law, banks have to make deposited funds available within days, but fake checks can be discovered after that time. When they are, you have to repay the bank, and if you’ve paid any money to a scammer in the meantime, you’re out that amount.[13]

Sending and receiving money via recognized, trusted apps such as PayPal or Google Pay, or through your own bank’s website, is a good way to avoid scams.

How to spot cashier’s check fraud and scams

Since most scams involve fake checks, verify that the checks have been issued by the institution whose name is on the front.

Common scams include:

- Someone using a cashier's check to purchase goods from you, only to find that the check is fraudulent.

- Being told you’ve been chosen as a mystery shopper and can use part of a (fake) cashier’s check you receive to purchase goods at a specified location.

- Being employed in a work-at-home scam in which you deposit money from a phony cashier’s check into your own account, then forward it to someone else. This is, in many cases, simply a form of money laundering.

- Receiving the news that you have won a bogus foreign lottery and been sent a cashier’s check, but you’re asked to deposit it into your account and then pay associated fees and taxes with your own money.[14]

Good rules of thumb:

- Don’t accept checks that pay you more than the selling price.

- Don’t send money back to someone who sent you a check.

- Discard any offer that says you’ve won a prize — then requires that you pay to claim it.[13]

How to report a fake cashier's check

Victims of fake check scams can report them to their state attorney general, the Federal Trade Commission, or the U.S. Postal Inspection Service.[13]

Be careful with a cashier's check

Cashier’s checks can be useful tools to send and receive large sums of money quickly and securely.

They aren’t the only option, though, and you need to be on the lookout for possible scams. Certified checks and credit cards are other possibilities.

Credit cards are secure against fraud, and you can use them to build credit as you pay off debt. (If you’re just establishing your credit or looking to bolster your credit score, consider a secured credit card.)

It’s important to know all your options when deciding how to pay for your purchases. Understanding the pros and cons of the various choices could help you save money and is a good first step to improving your personal finances.

Sources

- Forbes. “Everything To Know About Cashier’s Checks,” https://www.forbes.com/advisor/banking/everything-to-know-about-cashiers-checks/. Accessed September 14, 2021.

- Office of the Comptroller of the Currency. “Can I put a stop payment order on a cashier's check?” https://www.helpwithmybank.gov/help-topics/bank-accounts/cashiers-checks/cashiers-check-stop.html. Accessed September 14, 2021.

- Office of the Comptroller of the Currency. “The bank placed a hold on a cashier's check that later turned out to be fraudulent. Aren't cashier's checks supposed to be honored immediately?” https://www.helpwithmybank.gov/help-topics/bank-accounts/cashiers-checks/cashiers-check-hold.html. Accessed September 14, 2021.

- U.S. News. “Cashier's Check vs. Money Order: When to Use Which?” https://money.usnews.com/banking/articles/cashiers-check-vs-money-order-when-to-use-which. Accessed September 14, 2021.

- USPS. “Sending Money Orders,” https://www.usps.com/shop/money-orders.htm. Accessed September 14, 2021.

- First Quarter Finance. “Where Can I Cash a Cashier’s Check? 25 Places (& How to Cash Online),” https://firstquarterfinance.com/where-can-i-cash-a-cashiers-check. Accessed September 14, 2021.

- PLS. “Cash Checks for as low as 1% + $1*” https://pls247.com/tx/money/check-cashing.html. Accessed September 14, 2021.

- Advance Financial 24/7. “Check Cashing Services,” https://www.af247.com/services/check-cashing. Accessed September 14, 2021.

- PocketSense. “Where Can I Cash a Cashier’s Check?” https://pocketsense.com/where-can-i-cash-a-cashiers-check-13729059.html. Accessed September 14, 2021.

- TA. “Check Cashing Services,” https://www.ta-petro.com/amenities/check-cashing. Accessed September 14, 2021.

- Techwalla. “Depositing a Cashier's Check With an iPhone,” https://www.techwalla.com/articles/how-to-use-a-check-to-purchase-a-cash-card-online. Accessed September 14, 2021.

- Investopedia. "Where Can You Cash Checks?" https://www.investopedia.com/where-can-you-cash-checks-5176474. Accessed October 13, 2021.

- Federal Trade Commission. “How To Spot, Avoid, and Report Fake Check Scams,” https://www.consumer.ftc.gov/articles/how-spot-avoid-and-report-fake-check-scams. Accessed September 14, 2021.

- Washington State Department of Financial Institutions. “Cashier’s Check Scams,” https://dfi.wa.gov/financial-education/information/cashiers-check-scams. Accessed September 14, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.