How Old Do You Have to be to Open a Bank Account?

Published on: 03/01/2022

It’s never too early to start learning about personal finance, but how old do you have to be to open a bank account?

In most banks, the age requirement to open a bank account is at least 18 years old. Anyone younger is considered a minor and will generally need a legal guardian to be the joint account holder. To open an account for a minor, you must be a signer.

Table of contents

- Bank account requirements for minors

- Bank account options for minors

- What do you need to open a bank account?

- Should you open a bank account for your child?

- Tips before opening a bank account

Bank account requirements for minors

There is no federal law preventing a minor from opening a savings account. But in most places, they can’t do so on their own. This is because a banking relationship is governed by state contract laws, and minors don’t have the legal authority to enter into a contract on their own.[1]

Most states allow a parent or guardian to open a bank account for a minor. As of 2016, however, some limits were in place in Texas, Oklahoma, Missouri, West Virginia, Florida, and the District of Columbia. The practice was not permitted in Massachusetts, New Hampshire, and Wisconsin.[2]

Banks also have their own requirements. Each bank’s eligibility requirements are different, but there are a few commonalities: The adult account holder must be a U.S. citizen 18 or older with a government-issued ID. (The adult doesn’t have to be a parent or guardian; they can be any family member or even a friend of the family.) Typically, these types of accounts are called student checking accounts or teen checking or savings accounts.

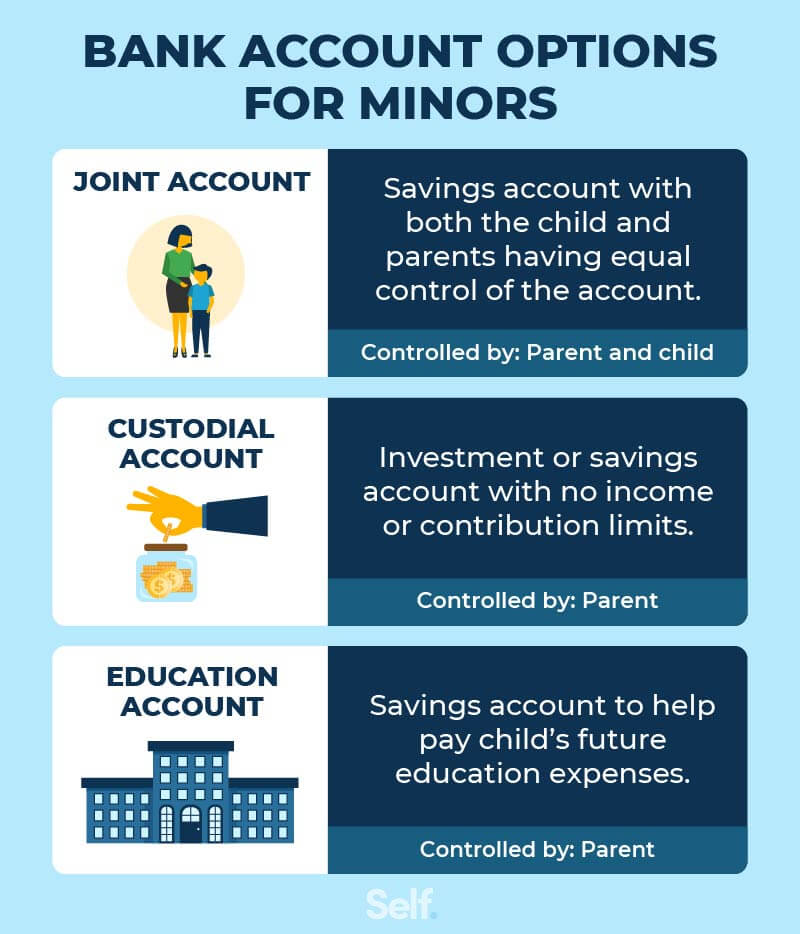

Bank account options for minors

Bank accounts with or for minors fall into three categories: custodial, education, and joint accounts.

###Custodial accounts

A financial account that is opened and controlled by someone over 18 for a minor is called a custodial account. These come in two forms:

- UGMA accounts, governed by the Uniform Gift to Minors Act, mainly include financial assets such as stocks, bonds, and mutual funds.

- UTMA accounts, governed by the Uniform Transfers to Minors Act, cover a wider range of assets, including real estate, art, jewelry, etc.

The minor takes control of the account and becomes the account owner when they come of age, but don’t have access to the money until then.

Education accounts

These accounts, known as 529 plans, help pay for education expenses from kindergarten through college. Withdrawals are tax-free as long as they’re used for eligible expenses. They’re investment or savings accounts with no income or contribution limits, but the parent controls the accounts.

Joint accounts

With a joint account, you and your child share an account and both have access to it.

These savings accounts can help pay a child’s future education expenses or teach them to save for another goal, such as a car or a rent deposit when they decide to move out, but the adult controls the account.

Here are examples of what different banks have to offer:

- Wells Fargo offers joint-ownership accounts opened in a minor’s name and accounts under the Uniform Transfers/Gifts to Minors Act.[3]

- U.S. Bank allows you to open an account for a minor 14 years of age or older if you are both present, have valid ID, and can show proof of address.[4]

- Capital One offers a MONEY teen online checking account that any child 8 and older can participate in as a joint account holder with a parent or guardian.[5] The bank also offers a Kids Savings Account with a 0.3% annual percentage yield (APY).[6]

- Bank of America has a Minor Savings Account that offers an APY of 0.01% for children under 18 with joint account holders 18 or older. It requires a $25 minimum opening deposit.[7]

What do you need to open a bank account?

The papers you need to open a bank account with or for a minor may vary for each financial institution. Whether you are applying at an online bank or a brick-and-mortar bank, most banks will ask you for the following:

- Social Security number or Social Security card

- Birth certificate

- Government issued-ID (driver’s license)

- Proof of address (utility bill or similar correspondence showing your name and address)

- Minimum initial deposit

In addition, you will likely be required to meet monthly balance requirements or maintain a minimum balance so the account doesn’t close.

What happens to the bank account when the minor turns 18?

When the minor reaches the age of majority, which varies by state, they gain control of the account. The age of majority is commonly 18, but sometimes it can be 21 or older. Make sure to understand when the beneficiary, who in this case is the minor,can take control of the account and how long you can maintain custodianship.

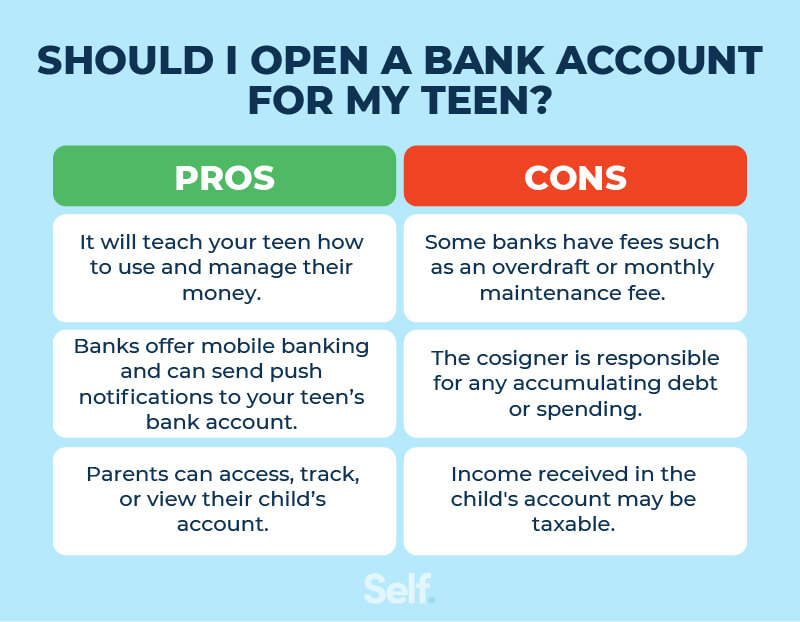

Should you open a bank account for your child?

It’s helpful to consider the pros and cons of opening an account before you do so. Remember: You will be the signer and joint owner. If you’re not quite ready to open a bank account for your minor, you may want to look into other options like prepaid debit cards.

Pros

These accounts tend to be easy to set up and allow you to deposit as much money as you want, giving you flexibility with no penalties for early withdrawal.[8]

Teaches kids about saving and money

Access to a bank account can teach your child budgeting and money management skills. Some savings accounts designed for minors include educational materials, either via apps or pamphlets, that can increase their financial literacy.

If you choose a checking account, it can provide your child with their first ATM card, debit card, or credit card. Having an account with your child can prepare them to begin building credit.

Offers mobile banking

Most banks now allow you to access your bank account online, which makes it convenient for you to be able to access or pay your child’s account within a tap of a button at all times. You may opt-in to receive notifications of fraud alerts, deposits, and spending alerts.

Easy access of the account

As mentioned above, you’ll be able to view or access your child’s account since you are the joint co-owner. Your child can withdraw the money at any time for whatever purpose they want, but they need your permission to do so.

Cons

There are some downsides to opening an account with or for your child, including fees and tax implications. You may have control over your child’s activity now, but once they turn 18 (or in some cases 21), the money will belong to them.

Joint account fees

Since you are the account co-owner, you are responsible for overdraft fees, monthly maintenance fees, bank account fees, etc.

Tax and legal issues

Any income or growth is taxable at the child’s income rate. If their interest, dividends, and other unearned income adds up to more than $2,200, it can trigger an unearned income tax for children.[9] In addition, if your child is saving for college, it will count as part of their assets when applying for financial aid, which could hurt their application.

Tips before opening a bank account

- Shop around for interest rates: Look around for the best interest rates and benefits. Consider the types of accounts that different banks offer.

- Determine if you prefer an in-person or online bank: Will you be visiting a brick-and-mortar location or is that unimportant to you? If there is no brick-and-mortar location, what ATMs are accessible without fees?

- Consider different types of bank accounts: Savings or checking accounts are available for minors, though setting up savings accounts for minors is more common.

- Be aware of fees: Most accounts aimed at kids waive monthly fees. However, make sure to ask about all fees that could be charged to the account.

Build money management skills early

Opening an account for or with a minor can provide opportunities for them to learn about money and prepare for the future at the same time. A variety of accounts and programs exist, and they vary from one bank to another, so it is important to investigate your options and choose the best one for your child’s current situation and the future.

Sources

- FDIC. “Guidance to Encourage Financial Institutions’ Youth Savings Programs and Address Related Frequently Asked Questions,” https://www.fdic.gov/news/press-releases/2015/pr15021a.pdf. Accessed December 10, 2021.

- CSBS. “Statutory Requirements for Opening Bank Accounts for Minors,” https://www.csbs.org/statutory-requirements-opening-bank-accounts-minors. Accessed December 10, 2021.

- Wells Fargo. “Kids Savings Account,” https://www.wellsfargo.com/savings-cds/kids/. Accessed December 10, 2021.

- U.S. Bank. “Set your teen up for success. Open their first bank account together.” https://www.usbank.com/bank-accounts/how-to-open-a-bank-account-for-a-minor.html. Accessed December 10, 2021.

- Capital One. “MONEY teen checking account,” https://www.capitalone.com/bank/checking-accounts/teen-checking-account/. Accessed December 10, 2021.

- Finder. “Capital One Kids Savings Account review,” https://www.finder.com/capital-one-kids-savings-account. Accessed December 10, 2021.

- Finder. “Bank of America Minor Savings Account review,” https://www.finder.com/bank-of-america-minor-savings. Accessed December 10, 2021.

- Union Bank. “Understand The Pros And Cons Of A Custodial Account,” https://www.unionbank.com/personal/financial-insights/investing/family-finance/custodial-accounts-pros-and-cons. Accessed December 10, 2021.

- IRS. “Topic No. 553 Tax on a Child's Investment and Other Unearned Income (Kiddie Tax),” https://www.irs.gov/taxtopics/tc553. Accessed December 10, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.