Everything You Need to Know about Your Credit Score and Self

Published on: 03/27/2019

Working at Self we get a lot of questions about how exactly our product helps people build credit. We wanted to take a moment to peel back the curtain, dig a little deeper and help give you a better understanding of how it all works.

With that goal in mind, we put together this guide to combine everything you need to know about your credit score and Self’s Credit Builder Account in one place.

Here’s the rundown of what’s included in this guide:

- What’s a credit score and how is it calculated?

- How could Self potentially improve your credit?

- How much does Self raise your credit score?

- Will you be denied if you have bad credit or no credit?

- Could Self negatively impact your credit?

- Why did your credit score decrease after getting the Credit Builder Account?

What is a credit score and how is it calculated?

Before we talk about anything else, we need to talk about the most basic element in building credit – what a credit score is and how it’s calculated. Understanding this piece of the puzzle could make the rest of your experience with building credit (and with Self) much easier. After all, as cliché as it sounds, knowledge is power.

Good credit plays a vital role in your financial life. It’s necessary for obvious reasons like getting:

- A credit card

- A car loan

- A mortgage

But it can also be necessary for less obvious reasons, such as:

- Renting a car, apartment or home

- Getting approved for a cell phone contract

- Getting a job, especially one that needs higher security clearance

Basically, your credit score is a three-digit number based on your credit report. Think of it like the letter grade to your financial homework – the higher the score, the better chance you have at “passing.”

There are two types of credit scores primarily used by lenders: the FICO score and the VantageScore. Both scores range between 300 on the low end to 850 on the high end.

Your credit report is basically your financial resume to potential lenders. Just like a potential employer would look at your resume to see if you’re the right fit for a job, lenders look at your credit report to see if you’re the right fit for the product they’re offering. Learn how to read your credit report here.

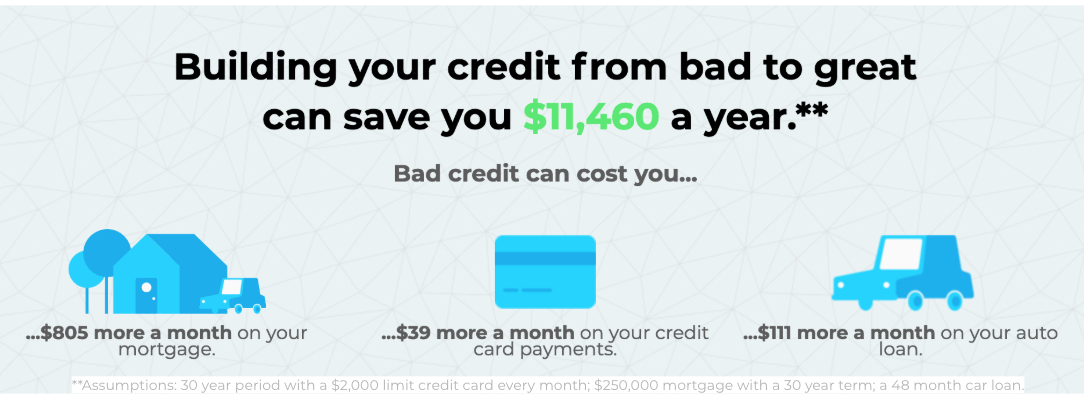

A good credit score not only makes it easier to get access to credit, it could also save you thousands of dollars over your lifetime.

What factors decide your credit score?

Here’s a little chart to help you out.

Notice that your payment history plays the largest role in determining your credit score. This is the biggest factor that a Self Credit Builder Account could help you with, too – if you use it correctly.

The other important aspects are the amounts you owe, the types of credit you use, the length of your credit history and access to new credit.

Where do you fall on the credit score spectrum? Nowadays, there are options to check your credit score at no cost, including tools such as Credit Karma. It’s always a good idea to know where you stand credit-wise, especially if you’re considering a large purchase such as a home or a car in the near future.

Here are the general ranges from Experian, to give you a better idea of what “good” looks like:

How Could Self Potentially Improve Your Credit?

The main areas where a Self Credit Builder Account could help improve your credit would be by:

- Building positive payment history (35% of your FICO credit score)

- Diversifying the types of credit you use (10% of your FICO score)

1 - Building Payment History

The Self Credit Builder Account is a type of installment loan that helps users build payment history. Similar to other installment loans, such as car loans, you make a monthly payment with interest. This payment – whether made or missed – gets reported monthly to all three major credit bureaus (Experian, Equifax and TransUnion).

Basically, if you make your payments on time and in full each month, you build positive payment history and your credit could improve over time. If you miss your payments or make late payments, this would negatively impact your credit.

Keep in mind, you have to keep making on time payments on your credit lines outside of Self too.

2 - Building Credit Diversity

Having a healthy credit mix accounts for 10% of your FICO credit score. To create this healthy mix, experts recommend that you have both installment loans (like a car loan or mortgage) and revolving credit lines (like a credit card). This basically expands your financial resume by showing lenders you can manage different types of credit responsibly.

If you don’t already have an installment loan, or can’t qualify for a traditional one yet, Self can build credit by providing access to this credit type.

Don’t forget! Self isn’t the only thing that impacts your credit score. What you do outside of Self can positively – or negatively – impact your score too.

How Much Could Self Raise Your Credit Score?

It’s hard to say how much exactly Self could raise your credit score, because everyone’s credit situation is nearly as unique as their fingerprint, so individual results vary.

Some of our customers, like Dawn M., have seen significant increases when working to rebuild their credit.

Here’s what Dawn had to say:

“When I started Self my credit was terrible and within the first 3 months my score increased 40 points!!!! It did take a few weeks before it reported the first time but it was well worth the wait. When I cashed my account out it was fast and easy and I will be applying for another account soon!”

And that’s just for credit rebuilding, which sometimes involves people who are recovering from bankruptcy or trying to build positive payment history to balance out some negative credit history in their past.

People who are brand new to credit often report seeing much higher lifts in credit scores.

Here’s what another of our customers, Neil M., had to say about his success using Self to build his credit for the first time in the U.S.:

Notice that Neil here also had a good credit mix going, meaning he was using different types of credit to help improve his score. That’s important to remember as you look to improve your credit too.

Does paying more each month help you build more credit or build it faster?

I’ll keep this one short and sweet. The short answer is no. However, paying a larger amount each month could help reduce the amount of interest you pay and increase the amount of principal you get back at the end of your loan too.

A larger loan amount could also make you look better to future lenders. How? If you build good payment history with a higher loan amount, you could better demonstrate to certain lenders your responsibility with paying larger bills on time and in full.

So there are some situations where it could help you out. Remember that credit report as a job resume scenario? Well, using that analogy, a higher loan could be comparable to a higher education degree in some cases. Though not always.

Will I be denied a Self loan if I have bad credit or no credit?

Nope! We do not deny people based on their credit score. In fact, for many of our users, their Self Credit Builder Account is the first credit product they ever get.

If Self is your first credit product, you might need to take an additional step to verify your identity with us though, since we do pull credit files just to verify someone’s identity before opening an account.

This is the point in the process where it’s important to understand the difference between a hard credit inquiry and a soft credit inquiry.

A hard credit inquiry on your credit report will impact your credit score. If you have too many hard inquiries within a short period of time, this could also negatively impact your score. This is not the type of credit inquiry Self performs.

Instead, we do what’s called a soft inquiry on your credit report, which does not impact your score. We use this to confirm your identity only.

If you already have a credit file, Self will pull from it to ask questions and confirm your identity. However, we will not deny you based on a previous history of bad credit.

Could Self negatively impact my credit?

The short answer is if you don’t make your payments on time or if you miss payments, then yes, Self - like any credit product - could actually hurt your credit.

Ultimately, it’s important to keep in mind that Self is just a tool. Like any tool, it can be great for some people and not so great for others. It really just depends on your situation and how you use it.

Here are some instances where Self’s credit builder loan might not help your credit:

If you don’t make your payments. If you miss payments or make late payments, then having a credit builder loan could actually hurt your credit. That’s because whether you pay or not, that payment history gets reported to the credit bureaus.

If you already have a great credit score. If you already have a great credit score and have no trouble gaining access to financial products, Self might not be right for you. This product is typically the most beneficial for people who are new to credit or who are looking to rebuild their credit and don’t already have a good score.

When it comes to building credit, too much of a good thing (like too many lines of credit) could be a bad thing, depending on how you use them. Keep that in mind before you sign up for Self.

If you already have installment loans, but no revolving credit. If you already have an installment loan, such as a car loan, but do not have any revolving credit (like a secured credit card or traditional credit card) Self might not be the right option for you.

One of the keys to building credit is to have a good credit mix, so if you have too many products that fit one type of credit and don’t have any others, your credit mix will be off. This means your credit score might not benefit as much.

Why did my credit score decrease after getting the Credit Builder Account?

If you opened a Self account and noticed a drop in your credit score, this could mean one of several things. While we’ll show you how to troubleshoot in a minute, the first thing to keep in mind is that when you open a new line of credit – any new line of credit – it reduces the average age of your accounts and adds to the amount you owe.

Typically though, as you pay down the loan and build on time payment history, your credit could improve over time. Just remember, no aspect of your credit exists in a vacuum, so how you manage other lines of credit during this time also matters.

Remember, we report to the credit bureaus at the beginning of each calendar month for the previous month. So if you sign up on January 1st, for instance, it won’t show up on your credit report until after February 1st. So give it time, and give it at least a few months to start taking off before you panic.

If you notice your score continuing to decline, here are a few questions to ask yourself to better troubleshoot your credit situation. These troubleshooting questions apply, not just with your Self account, but with any credit accounts you might have:

- Are you making all your payments on time and in full each month?

- Have you missed any payments? Made any late payments?

- What is your credit utilization ratio? Are you using too much of your available credit?

- Do you have any credit cards that have high balances?

- Do you have any debt in collections?

- Are there any errors on your credit report?

How you answer these questions could determine the changes you need to make in your financial habits to improve your credit. And this is just a short list. Learn more about how to build your credit in our guide “The Simple Guide to Building Credit and Saving Money."

Most importantly, remember that your Self account isn’t the only thing that impacts your credit score. There are other factors that come into play, which is why your habits outside of Self matter too. While Self can help if used properly, remember that building better credit is more about a lifestyle change than a crash-diet fix.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to help people build credit and savings.