Does Paying off Collections Improve Your Credit Score?

By Ana Gonzalez-Ribeiro, MBA, AFC®

Published on: 02/27/2023

Published on: 02/27/2023

When you don’t pay a bill by the due date, your account is considered delinquent. After a certain amount of time, usually around 120 to 180 days after your first missed or late payment, the lender may charge it off and send it to a debt collection agency, which then tries to collect on your unpaid debt.[1]

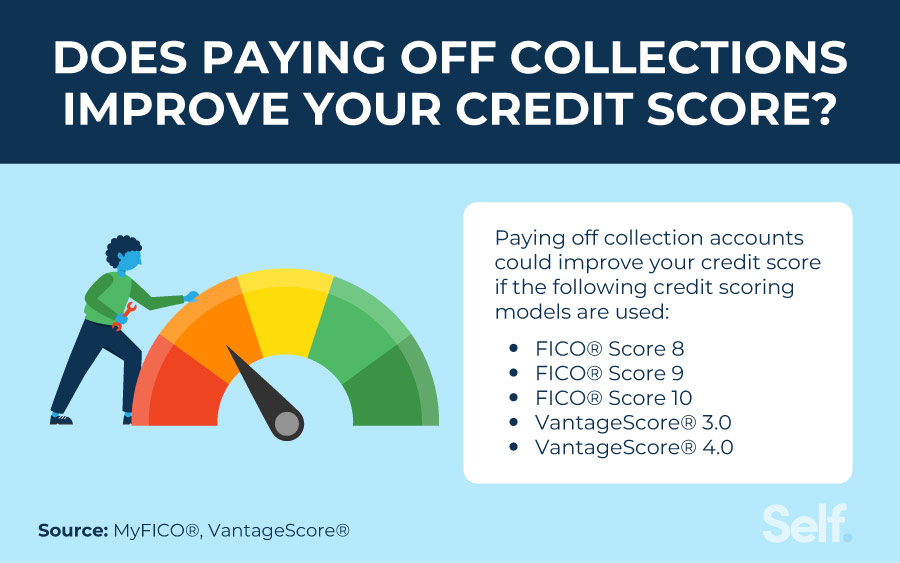

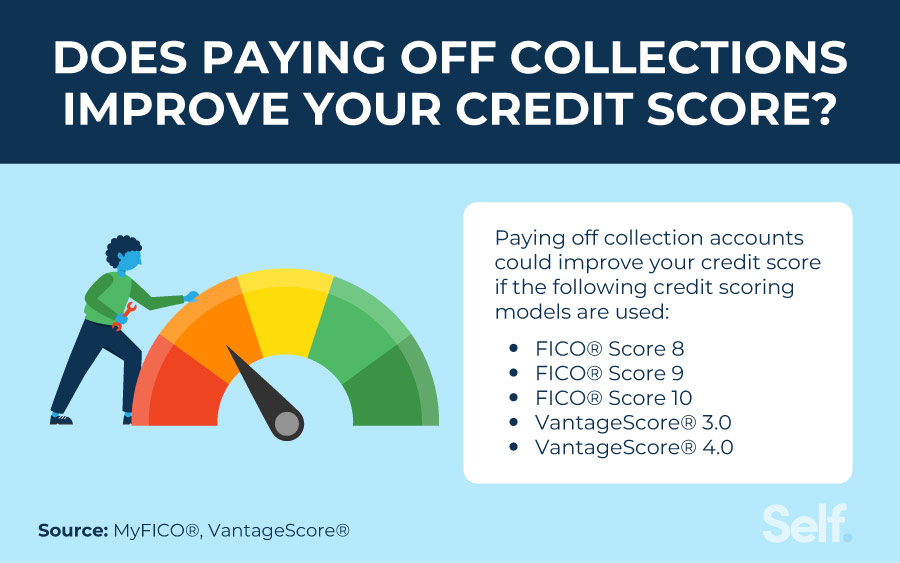

In this guide, we explain how paying off collection accounts may improve your credit score, depending on the credit scoring model and type of debt you have. We also discuss how collections accounts impact your credit score and suggest ways to pay off your debt to a collection agency.

How paid collections impact your credit score depends on the credit scoring model your lender uses, the type of debt you paid off and your unique credit history.[3], [4] For example, if the lender is using FICO® Score 8 or older of VantageScore®, paying off a collection may not have a positive impact on your credit score.[2], [5]

Here’s a breakdown of how collection accounts can impact your credit score based on some of the most common credit scoring models:

In general, collections accounts stay on your credit report for up to seven years, even when they’re paid off in full. That means that paid collections can continue to hurt your creditworthiness for that length of time. However, the impact of collection accounts on your score lessens with time.[6]

In newer credit scoring models, medical debt is treated differently from other types of debt. As of March 2022, unpaid medical debt won’t appear on your credit report for one year (increased from six months), giving you more time to address your debt.

Additionally, in the first half of 2023, the three major credit bureaus — Equifax, Experian and TransUnion — will no longer include unpaid medical debt under $500 on your credit report, and paid medical collection debt will no longer count against you.[7]

Verifying the accuracy of your unpaid debt is an important step to take before you pay it off. You want to be sure that the debt is actually yours, and that there are no errors for you to dispute. If you’re unsure about a collection account, you can request verifying information, like the name of the original creditor and debt amount, from the collection agency.

There are federal laws in place to protect borrowers from unfair practices by debt collectors. In its list of protections, the Fair Debt Collection Practices Act states that:

Even if you do negotiate a debt settlement successfully, bear in mind that debt collectors under the Fair Credit Reporting Act (FCRA) are obligated to report debts accurately. Goodwill letters and pay for deletes aren’t officially recognized practices, so debt collectors aren’t required to take action, or remove negative items from your credit report as a result of them.[13]

If the removal of the collections account from your credit report is part of your agreement with a debt collection agency, be sure to get it in writing.

Even if the debt falls off your credit report, you still owe it. However, after the statute of limitations on your unpaid debt ends, creditors can’t sue you. Partial payment may restart the statute of limitations in some states. Check the statute of limitations in your state as they vary state by state.[8]

Keeping an eye on your credit helps you know where you might need to make improvements. If you’re seeking credit repair, a credit report lets you know where you stand. Even if you have bad credit or are dealing with debt, don’t give up — with the right financial planning and good habits, a good credit score can be just around the corner.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

In this guide, we explain how paying off collection accounts may improve your credit score, depending on the credit scoring model and type of debt you have. We also discuss how collections accounts impact your credit score and suggest ways to pay off your debt to a collection agency.

Does paying collections improve your credit score?

Paying off your collection account may improve your credit score if the following credit scoring models are used:

How paid collections impact your credit score depends on the credit scoring model your lender uses, the type of debt you paid off and your unique credit history.[3], [4] For example, if the lender is using FICO® Score 8 or older of VantageScore®, paying off a collection may not have a positive impact on your credit score.[2], [5]

Here’s a breakdown of how collection accounts can impact your credit score based on some of the most common credit scoring models:

| Credit scoring model | How collection accounts are viewed |

|---|---|

| FICO® Score 8 or earlier |

|

| FICO® Score 8 or later |

|

| FICO® Score 9 or 10 |

|

| VantageScore® 3.0 or later |

|

| VantageScore® 4.0 |

|

In newer credit scoring models, medical debt is treated differently from other types of debt. As of March 2022, unpaid medical debt won’t appear on your credit report for one year (increased from six months), giving you more time to address your debt.

Additionally, in the first half of 2023, the three major credit bureaus — Equifax, Experian and TransUnion — will no longer include unpaid medical debt under $500 on your credit report, and paid medical collection debt will no longer count against you.[7]

Benefits of paying off collection accounts

While there may not be an immediate boost to your credit score, paying off collections accounts is overall beneficial for your personal finances. Some benefits of taking care of unpaid collections include:- Avoiding a lawsuit from the debt collection agency or the original creditor

- Minimizing interest charges and other fees associated with your balance

- Avoiding wage garnishment[8]

- Improving your chances of getting future loans and lines of credit[4]

How to pay off debt in collections

If you’re ready to pay off your collection debt, here are the steps you can take.

1. Check and verify that the collection account is accurate

You should first check to see what credit reports list the collection account so you can verify that the information is accurate. You can check your credit report once per year for free from each of the major credit bureaus, through AnnualCreditReport.com, and you can also check your credit report for a fee (no more than $13.50 per report) any time you like with any of the three major credit bureaus (Experian, Equifax and TransUnion).[9]Verifying the accuracy of your unpaid debt is an important step to take before you pay it off. You want to be sure that the debt is actually yours, and that there are no errors for you to dispute. If you’re unsure about a collection account, you can request verifying information, like the name of the original creditor and debt amount, from the collection agency.

2. Check if your debt is time-barred

If your collection account is time-barred, and the statute of limitations has passed on it, your debt collector may no longer have the right to sue you for your unpaid debt. In some states, however, making a partial payment on a collection account can restart the statute of limitations on a debt. Even if the debt is time-barred, it doesn’t mean you don’t owe it. You owe a debt until it is paid. So if you think the debt is time-barred, speak to an attorney about the statute of limitations in your state.[8]3. If the debt is inaccurate, dispute it to the credit bureaus or the collection agency

If you believe that the debt is inaccurate (the name of the creditor or amount of the debt is wrong) or not yours, you can dispute it with the credit bureaus it was reported to or the collection agency trying to collect on the debt.[10] The Consumer Finance Protection Bureau (CFPB) provides dispute forms and letter templates, as well as guidelines for how to approach each of the major credit bureaus.[11]There are federal laws in place to protect borrowers from unfair practices by debt collectors. In its list of protections, the Fair Debt Collection Practices Act states that:

- Debt collectors can’t tell you that you owe a different amount than what you actually owe.

- Debt collectors can’t contact you before 8 a.m. or after 9 p.m. in your time zone unless you have given them prior consent.

- Debt collectors can’t tell anyone else about your debt, or make it public knowledge.

- Debt collectors may not engage in conduct that is used to harass, oppress, or abuse you in connection with the collection of a debt, such as threatening or violent acts to you or harassing you by continually calling without disclosing meaningful details.

- Upon your request for validation, a debt collector is required to send you a written notice containing the following: the amount of the debt owed, the name and contact information of the creditor to whom the debt is owed and a statement that the debt is valid (unless you have disputed the validity of the debt within 30 days of the notice.[8]

4. If the debt is accurate, negotiate a settlement

If your unpaid debt is accurate, it can’t be disputed or removed. At this point, you may want to try to negotiate a debt settlement, a pay for delete or a goodwill letter.[12]Even if you do negotiate a debt settlement successfully, bear in mind that debt collectors under the Fair Credit Reporting Act (FCRA) are obligated to report debts accurately. Goodwill letters and pay for deletes aren’t officially recognized practices, so debt collectors aren’t required to take action, or remove negative items from your credit report as a result of them.[13]

If the removal of the collections account from your credit report is part of your agreement with a debt collection agency, be sure to get it in writing.

Request a pay for delete

You may be able to get the collection account removed from your credit report with a pay for delete. This involves paying a negotiated amount to settle the debt, usually less than the actual amount, in exchange for removing the account from your credit report.[14] Debt collection companies may deny your request, and even if accepted, they have no obligation to remove the information. Additionally, they cannot remove the negative information associated with the original creditor.Request a goodwill removal

If you don’t have the means to pay off your unpaid collection debt, you can try sending a goodwill letter, asking the debt collector to forgive your debt. If they find that you’re reasonably unable to pay due to extenuating circumstances, they may agree to remove the negative item from your credit report and close the collection account.[15] Like pay for deletes, they don’t have to remove the collection information, and they can’t remove the negative information associated with the original account.5. Set up a payment plan with the collection agency

If you’re saddled with unpaid collection debt, one of the best strategies to deal with it is to call the collection agency directly and see if you can come to an agreement. They may be open to negotiating a payment plan with you, or other debt settlement that is easier on your bank account. You may have the option to choose to pay in a single lump sum or with monthly payments under an installment plan.[16]How long do collections stay on your credit report?

Collection accounts typically remain on your credit reports for up to seven years from the date that the original debt became delinquent.[1]Even if the debt falls off your credit report, you still owe it. However, after the statute of limitations on your unpaid debt ends, creditors can’t sue you. Partial payment may restart the statute of limitations in some states. Check the statute of limitations in your state as they vary state by state.[8]

How to check your credit report for free

Remember, you can check your credit report for free annually at AnnualCreditReport.com, and because of the COVID pandemic, the three major credit reporting bureaus (Experian, Equifax and TransUnion) continue to offer free credit reports weekly through the end of 2023. Some institutions that provide financial services, like credit cards and banks, also partner with the credit bureaus to offer access to free credit scores and credit monitoring tools, as part of your accounts with them, and if you sign up for a free account, Experian provides a free credit score.Keeping an eye on your credit helps you know where you might need to make improvements. If you’re seeking credit repair, a credit report lets you know where you stand. Even if you have bad credit or are dealing with debt, don’t give up — with the right financial planning and good habits, a good credit score can be just around the corner.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Equifax. “Charge Off FAQs,” https://www.equifax.com/personal/education/credit/report/charge-offs-faq/#. Accessed October 27, 2022.

- VantageScore®. “The impact of medical debt on your credit reports and VantageScore® credit scores,” https://vantagescore.com/newsletter/the-impact-of-medical-debt-on-your-credit-reports-and-vantagescore-credit-scores-1/. Accessed October 27, 2022.

- FICO®. “7 Common Questions about Collections and FICO® Scores,” https://www.myfico.com/credit-education/blog/7-common-collection-questions. Accessed October 27, 2022.

- FICO®. “How Do Collections Affect Your Credit?” https://www.myfico.com/credit-education/faq/negative-reasons/should-i-pay-my-collections. Accessed October 27, 2022.

- FICO. FICO Score 8 and Why There Are Multiple Versions of FICO Scores,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed October 27, 2022.

- FICO®. “Chapter 7 & 13: How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed October 27, 2022.

- Experian. “Equifax, Experian, and TransUnion Support U.S. Consumers With Changes to Medical Collection Debt Reporting,” https://www.experianplc.com/media/latest-news/2022/equifax-experian-and-transunion-support-us-consumers-with-changes-to-medical-collection-debt-reporting/. Accessed October 27, 2022.

- Federal Trade Commission. “Debt Collection FAQs,” https://consumer.ftc.gov/articles/debt-collection-faqs. Accessed October 27, 2022.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed October 27, 2022.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed October 27, 2022.

- Consumer Financial Protection Bureau. “SAMPLE LETTER: Credit report dispute,” https://files.consumerfinance.gov/f/documents/092016_cfpb__CreditReportingSampleLetter.pdf. Accessed October 27, 2022.

- Federal Trade Commission. “Disputing Errors on Your Credit Reports,” https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed October 27, 2022.

- Federal Trade Commission. “Fair Credit Reporting Act,” https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act. Accessed October 27, 2022.

- Forbes. “Pay For Delete: Learn About This Collection Removal Strategy,” https://www.forbes.com/advisor/credit-score/pay-for-delete/. Accessed October 27, 2022.

- Credit Karma. “Goodwill Letters: What You Need To Know,” https://www.creditkarma.com/advice/i/goodwill-letter. Accessed October 27, 2022.

- Consumer Financial Protection Bureau. “What is the best way to negotiate a settlement with a debt collector?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-best-way-to-negotiate-a-settlement-with-a-debt-collector-en-1447/. Accessed October 27, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on February 27, 2023

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.