How Long Does Credit Repair Take?

Published on: 11/16/2022

The time that credit repair takes varies because repairing credit is a journey, not a quick fix, and it will look a little different for everyone. This post guides you through the process of rebuilding credit so you can take control of your personal finances.

The credit repair process

There are several areas you can focus on when repairing or rebuilding your credit. To get the credit rebuilding process started, try taking the steps outlined in the following sections.[1]

1. Get a free copy of your credit report

Anyone can obtain a free credit report, and you can do so immediately. The law requires Equifax, TransUnion, and Experian — the three major credit bureaus — to provide you with a free copy of your credit report once every 12 months. You may want to request a report from one bureau every four months so that you can regularly monitor your credit. You can do so by visiting AnnualCreditReport.com, or by calling 1-877-322-8228.[1]

2. Identify negative marks and errors on your credit report

Take the next step and carefully examine your credit report for any negative marks or errors that you might be able to get removed. Keep in mind that only inaccuracies can be removed — if you spot a negative mark but it reflects accurate information about your credit, you can’t remove it. However, you may find incorrect dates, accounts erroneously attributed to you, incorrect personal info and more. You might be surprised at the mistakes listed on your report, so check it to ensure all of your information is accurate.[1], [2]

3. Dispute negative marks or inaccuracies

You can only dispute information that is inaccurate — you can’t dispute a negative mark just because it’s negative. So after you have identified the inaccuracies in your report, take action to get them removed. You must file a dispute with each of the three credit reporting agencies. They have 30 days to respond to your dispute. Follow this step-by-step breakdown of the actions you should take:[2]

- Write dispute letters to the credit bureaus. Draft a letter addressed to each bureau (Experian, Equifax, TransUnion) that provides specifics on what information you are disputing and provide evidence to back it up.

- Write dispute letters to businesses. Draft a letter to the business that has placed the inaccurate, negative mark on your report, again providing evidence and urging the business to remove that mark.

- Keep copies of everything you send. Always keep good records so there is a paper trail for your dispute in case you need to take the issue further.

- Check for an official response. Wait for an official response, which can take as long as 30 days.

- Monitor your credit report. Monitor your credit report for changes. If you have provided enough evidence, they should eventually remove the mark from your report.

How long do negative marks stay on your credit report?

You can dispute negative marks if they are inaccurate, but if the negative marks are accurate, they stay on your report for years no matter what you do. The actual length of time depends on what type of negative mark is listed on your credit report.[3]

| Negative Mark | Maximum Time on Credit Report |

|---|---|

| Late payments | 7 years |

| Collections and charge-offs | 7 years |

| Bankruptcy | 7 to 10 years, depending on the type of bankruptcy |

| Repossession and foreclosure | 7 years |

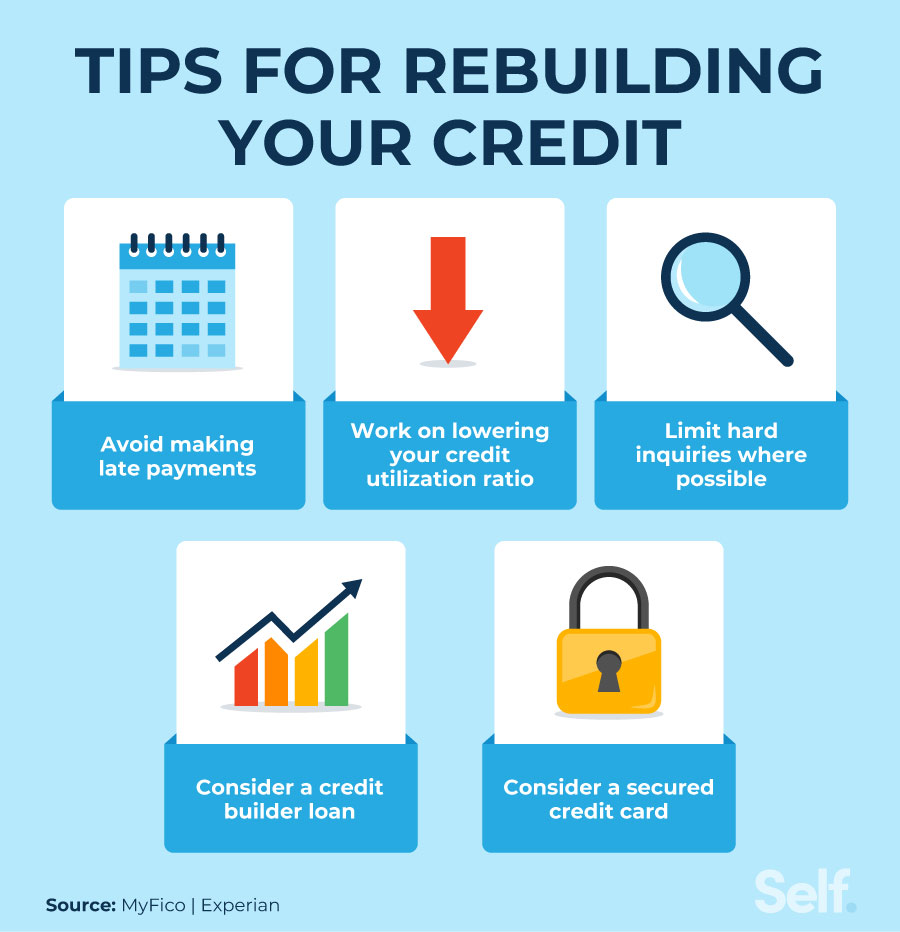

How to rebuild your credit

Rebuilding your credit may help to better your credit score so that you can potentially qualify for the credit you need in the future. While credit repair focuses on removing inaccuracies from your credit report, credit building concentrates on adding positive credit experiences to your report. The next sections explain the steps you can take to rebuild your credit.

Avoid making late payments

Missed payments is one of the biggest negative factors that might cause people to get a bad credit score, so by developing a budget to make sure your payments are on time, you may soon start to see little improvements in your credit month by month. Creditors want to see evidence that your financial troubles are well behind you before they start lending to you. Maintaining positive credit history due to consistent, on-time payments is a great way to rebuild credit.[5]

Work on lowering your credit utilization ratio

Another way to improve your credit is to lower what is known as your credit utilization ratio (CUR) — the amount of available revolving credit you’ve used when compared to your total credit limit. So if you have a $5,000 credit line, and you have a $4,500 balance, that’s a credit utilization ratio of 90%, which may signal to creditors that you have trouble meeting your monthly obligations.[6]

You can calculate your CUR by adding all the balances on your revolving credit, such as all your credit card debt, and then divide that number by the total credit limit of all your revolving credit. According to experts, lenders prefer to see ratios of 30% or lower, and you can get there by gradually paying down your revolving debt and resisting the urge to use that credit when you don’t need it.[7]

Limit hard inquiries where possible

Anytime lenders or companies want to review your credit report, such as when you apply for a personal loan, they make a hard inquiry into your credit. While one hard inquiry won’t impact your FICO® score as much as a late payment would, a lot of hard inquiries can add up and may damage your score. So apply for credit only when you need it. Remember, you don’t have to apply for that card just because a credit card issuer sends you a preapproved offer in the mail.[8]

Consider a credit builder loan

If you have bad credit or no credit, our Credit Builder Account may be a great option. Credit builder loans differ from traditional loans where you get a lump sum upfront and make monthly payments to pay the loan off. The way credit builder loans work is you make monthly payments to the lender until you’ve made all of the payments for the loan, and then that money is returned to you (minus interest and fees). Not only do you have a lump sum of money to use but also you may elevate your credit score.

Consider a secured credit card

The way secured credit cards work is that you put down a security deposit in the form of a certificate of deposit or savings account, typically anywhere from $100 to $300, which is often equal to your credit limit. Your lender reports your monthly payments to the major credit bureaus. So as long as you pay your monthly payment on time and maintain a low CUR, these secured credit cards may help you impact your credit score in a positive way.

Your legal rights in the credit repair process

If you are considering hiring a credit repair firm to help you navigate the process, keep in mind that you have rights during the credit repair process under federal law. These next sections help you understand those rights and why you should be wary of companies offering outside assistance.

The Credit Repair Organizations Act

The Credit Repair Organizations Act (CROA) prohibits "untrue or misleading representations" by companies that offer credit repair services. The act also states that such companies can't demand advance payment, their contracts must be in writing, and consumers have some contract cancellation rights.[9]

Credit repair companies and scams

Nobody needs to hire a credit repair company to repair their credit. You have plenty of things you can do on your own to fix your credit, and these companies don’t have a magic wand that can speed up the process. A credit repair company simply does the same things you would, such as disputing inaccuracies to try to remove late payments on your credit report when they were actually made on time.[1]

If you are already dealing with credit repair companies, be mindful of the following, as they could be signs of a potential scam:[1]

- Requests for upfront payment before any work is done

- Advises you to dispute accurate negative information

- Advises you to falsify information on your report for a better score

- Advises you not to contact credit bureaus for more information

- Offers to hide your negative information

Credit repair is an ongoing journey

Credit repair isn’t a quick process. You have to demonstrate a long track record of financial responsibility to get creditors to lend to you. The time it takes to fix your credit depends on the kinds of marks you have on your credit report and your individual circumstances. By taking some of the steps outlined above, you may slowly but surely build credit and put yourself on the path toward a good credit score.

Sources

- Federal Trade Commission. "Fixing Your Credit FAQs," https://consumer.ftc.gov/articles/fixing-your-credit-faqs. Accessed July 13, 2022.

- Federal Trade Commission. "Disputing Errors On Your Credit Reports," https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed July 13, 2022.

- Consumer Financial Protection Bureau. "How long does negative information remain on my credit report?" https://www.consumerfinance.gov/ask-cfpb/how-long-does-negative-information-remain-on-my-credit-report-en-323. Accessed July 13, 2022.

- Equifax. "How Long Does Information Stay on My Equifax Credit Report?" https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report. Accessed July 13, 2022.

- MyFICO. "What is Payment History?" https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed July 13, 2022.

- MyFICO. "What is Amounts Owed?" https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed July 13, 2022.

- MyFICO. "What Should My Credit Utilization Ratio Be?" https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed July 26, 2022.

- MyFICO. "Credit Checks: What are credit inquiries and how do they affect your FICO® Score?" https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed July 13, 2022.

- Federal Trade Commission. "Credit Repair Organizations Act," https://www.ftc.gov/legal-library/browse/statutes/credit-repair-organizations-act. Accessed July 13, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).