Does Opening a Checking Account Affect Your Credit Score?

Published on: 03/22/2023

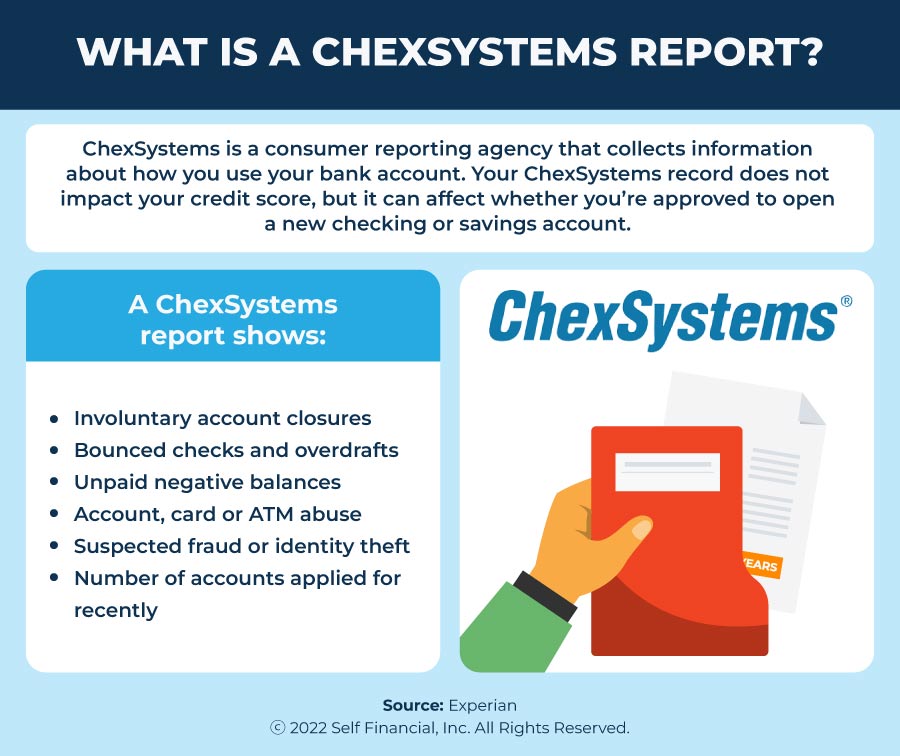

Opening a checking or savings account does not usually affect your credit score. When you apply for a new account, banks and credit unions typically use ChexSystems — a consumer reporting agency — to screen your banking history and decide whether to approve your application. Your ChexSystems report has no direct impact on your credit score.[1]

Because banks do not share your account balances or transactions with credit bureaus, that information will not appear on your credit report. However, if your account has any unpaid account balances, fees or penalties that end up in collections, negative entries may show up on your credit report.[2] In addition, if you open a new account that involves a line of credit, this may impact your credit score because it involves a hard check on your credit.[3]

This post explains that how you manage your checking account may or may not affect your credit score and ChexSystems report. We also explain how you can use your account to build credit.

What checking account activities may impact your credit score?

Although opening a new checking account doesn’t typically affect your credit directly, how you use your account may impact your credit score. As you use your checking account, consider the effect the following activities can potentially have on your credit.

Applying for an overdraft line of credit

Some banks and credit unions offer overdraft protection, a service that allows you to spend more money than you currently have in your checking account. Without overdraft protection, you may have checks bounce or debit card transactions declined.[3]

Most financial institutions allow you to link a savings account, credit card, or line of credit to your checking account to cover any overdrafts you may make.[4] If you open an overdraft line of credit, however, you may undergo a hard credit check to determine your eligibility. A hard inquiry like this can impact your credit score, although it’s typically small and varies depending on what else is contained in your credit report.[3]

Overdraft services often involve a fee, as banks may charge monthly for overdraft protection or each time an overdraft (or account transfer) occurs.[4]

Failing to pay overdraft fees

If you pay off the negative balance and associated fees, overdrafts shouldn’t appear on your credit report. However, if you don’t pay what you owe, the bank may send that debt to a collections agency.[5] This type of negative information can remain on your credit report for up to seven years from the date of delinquency, but the impact usually decreases over time.[6], [7]

Banks may give you a grace period (and multiple notices) to make good on your debt. Once you miss a payment, it typically takes longer than 30 days — usually a few months — for your debt to be sent to collections. At that point, you will likely start hearing from a debt collector and a negative entry will appear on your credit report.[8]

Closing a bank account with a negative balance

Just as opening a checking account doesn’t affect your credit score, closing one doesn’t either — in most circumstances. When you close out an account with a negative balance, however, it could hurt your credit score if it goes to collections. Even if your financial institution doesn’t send your account to a collection agency, they may report it to ChexSystems. This can make it more difficult for you to open a new account in the future.[9]

Understanding your ChexSystems record

A reporting agency called ChexSystems collects information about any issues you may have had with previous deposit accounts (including savings and checking). When you apply for a new account, the bank or credit union will typically review your ChexSystems consumer report to help them decide whether to allow you to open an account.[1]

Although your ChexSystems record has no direct impact on your credit score, it does influence whether you’re approved to open new bank accounts.[1] Information typically remains on your ChexSystems report for five years.[10] ChexSystems generally keeps track of the following types of banking activity:

- Overdrafts and bounced checks

- Unpaid negative balances

- Involuntary account closures

- Suspected fraudulent activity

- Recent applications for other bank accounts

[1]

Because banks don’t typically check your credit score when you open a checking account, you may be able to open a bank account with bad credit. However, if your financial background includes banking problems that show up on ChexSystems — like bounced checks or unpaid overdraft fees — you may find it difficult to open a new account. In that case, you may look into a second chance bank account.

Cleaning up your ChexSystems record

If a bank recently denied your application due to ChexSystems information, you’ll want to get a copy of your report to review. Federal law entitles you to a free copy every 12 months, as well as any time you’ve been denied a checking or savings account in the past 60 days.[1]

If you spot any inaccuracies in your record, you can dispute it with ChexSystems. If you find that you still owe money on any accounts, try to pay off the balance (or settle with the lender) as quickly as possible. After you’ve satisfied the debt, you can ask the financial institution to update the negative item or you can send a copy of your payment receipt directly to the reporting agency.[1]

How opening other accounts may impact your credit score

Although opening a new checking account likely won’t affect your credit score, opening an account involving a line of credit may have an impact because it triggers a hard inquiry.

Hard inquiries vs. soft inquiries

Credit pulls, credit inquiries, and credit checks all refer to the same thing — a request to look at your credit file. Credit inquiries generally fall into two types: hard and soft.

- Hard inquiry: Hard inquiries typically occur when you apply for credit (like a car loan or new credit card). Because most scoring models factor in how recently and frequently you apply for credit accounts, hard pulls generally affect your credit score.

- Soft inquiry: Soft pulls involve reviews of your credit file, such as when you request an annual copy of your credit report or when lenders review existing accounts. These types of soft inquiries typically do not affect your credit score.[11]

Although hard inquiries may affect your credit score for up to 12 months (and stay on your credit report for up to two years), the negative impact depends on your individual credit history. Hard pulls generally don’t affect scores significantly, but they may have a bigger impact if you have a short credit history.[12]

Because too many hard inquiries in a short period of time may indicate that you’re having financial trouble and needing credit to meet your obligations each month, your FICO® scores may drop if you apply for several new lines of credit close together, unless you’re rate shopping for a mortgage, auto or student loan. Depending on the scoring model used by your lender, you have either a 14-day or 45-day window for rate shopping for these loans.[12]

Using your checking account to build your credit

Your credit score typically contains information about your credit accounts — including loans, mortgages, and credit cards — rather than deposit accounts like checking and savings. However, smart use of your checking account can help you build good credit in the following ways.

Opt-in credit models and credit boosters

While everyday banking activity generally does not appear in your credit file, several opt-in services allow you to report certain account information. By signing up for these services, you have the chance to demonstrate positive financial behaviors not typically included in credit scores:

- UltraFICO® allows FICO® to include your checking and savings account data in the calculation of your credit score. If you manage your accounts responsibly, your UltraFICO® score may enhance your traditional FICO® score. While lenders may offer to pull the UltraFICO® Score of people who don’t qualify with their current score, this only works with an Experian credit report. If you don’t qualify with the score the lender pulled, you can check to see if your lender offers the UltraFICO® Score option.[13]

- Rent reporting services like Self allow you to positively impact your credit by having on-time bills, like utility and rent, reported to the credit bureaus. Once you connect your bank account, the services will find qualifying on-time bill payments and add them to your credit file.

Other ways to improve your credit

Whether you have bad credit or a limited credit history, you may be wondering about how to build credit. Because credit scores include information about how you manage debt, most credit-building steps involve applying for credit accounts of some sort. You can use these ways to build your credit:

- Make on-time payments each month. Because payment history is the single biggest factor in your credit score, make sure to avoid making any late payments on revolving credit accounts, like credit cards, or installment loans, such as auto loans, mortgages, and any personal loans.

- Keep your credit utilization rate (CUR) low. If you regularly get close to using all of your available credit each month, this could reflect to potential lenders that you have trouble meeting your financial obligations without the use of credit. Experts suggest maintaining a CUR (your total revolving debt divided by your total revolving credit limits) below 30% but add that below10% offers the best chance at adding a positive impact to your credit score.[14]

- Ask someone with good credit to become an authorized user on their credit card account. If you have trouble qualifying for an account on your own, this strategy can help you establish credit and build a positive payment history. When looking for someone to add you as an authorized user, make sure that person pays the account as agreed, has had the account open for a while and maintains a low CUR to give you the best chance of positively impacting your credit score. Otherwise, becoming an authorized user could hurt your credit.

- Take out a credit builder loan. Credit builder loans offer a great way to build credit, especially for those with bad credit or no credit at all. With traditional loans, you receive an amount of money up front and then make monthly payments to pay off what you owe. With the Self Credit Builder Account, however, your loan funds get secured in a bank-held certificate of deposit (CD) each month. Then you make your monthly payments, and each payment is reported to all three credit bureaus. At the end of the period, you receive your money back (minus interest and fees). Not only will you have a lump sum of cash to use as you wish at the end, but you may also elevate your credit score in the process.

If you’re looking for guidance on building better credit or how to build positive habits for your personal finances, Self offers information and tools to get you on the right path.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Experian. “What Is ChexSystems?” https://www.experian.com/blogs/ask-experian/what-is-chexsystems. Accessed on December 23, 2022.

- Experian. “Do Bank Accounts Affect Credit Reports?” https://www.experian.com/blogs/ask-experian/are-bank-accounts-affect-credit-report. Accessed on December 23, 2022.

- Forbes. “Understanding Checking Account Overdraft Protection And Fees,” https://www.forbes.com/advisor/banking/checking/understanding-checking-account-overdraft-protection-and-fees. Accessed on December 23, 2022.

- Consumer Financial Protection Bureau. “My bank/credit union offered to link my checking account to a savings account, a line of credit, or a credit card to cover overdrafts. How does this work?” https://www.consumerfinance.gov/ask-cfpb/my-bankcredit-union-offered-to-link-my-checking-account-to-a-savings-account-a-line-of-credit-or-a-credit-card-to-cover-overdrafts-how-does-this-work-en-1047. Accessed on December 23, 2022.

- Experian. “Does an Overdraft Affect Your Credit Score?” https://www.experian.com/blogs/ask-experian/does-an-overdraft-affect-your-credit-score. Accessed on December 23, 2022.

- Equifax. “How Long Does Information Stay on My Equifax Credit Report?” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report. Accessed on December 23, 2022.

- MyFICO. “Chapter 7 & 13:How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed on December 23, 2022.

- Experian. “Collections on Your Credit Report,” https://www.experian.com/blogs/ask-experian/credit-education/report-basics/how-and-when-collections-are-removed-from-a-credit-report. Accessed on December 23, 2022.

- Experian. “Could Closing a Bank Account Affect My Credit?” https://www.experian.com/blogs/ask-experian/does-closing-a-bank-account-affect-your-credit. Accessed on December 23, 2022.

- MyCreditUnion.gov. “Glossary - C,” https://mycreditunion.gov/financial-resources/glossary/c. Accessed on December 23, 2022.

- Consumer Financial Protection Bureau. “What's a credit inquiry?” https://www.consumerfinance.gov/ask-cfpb/whats-a-credit-inquiry-en-1317. Accessed on December 23, 2022.

- MyFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed on December 23, 2022.

- FICO.com “UltraFICO,” https://www.fico.com/ultrafico. Accessed on December 24, 2022.

- myFICO.com “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed January 3, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).