What Credit Score Is Needed for an Amazon Card?

Published on: 02/08/2023

If you’re an Amazon shopper, you may be thinking of applying for an Amazon credit card, like the Amazon Prime Rewards VISA Signature Card, the Amazon Rewards VISA Signature Card or the Amazon Prime Store Card, and understanding the eligibility requirements as well as how your credit profile compares to help you decide whether to apply.[1]

A credit score, however, isn’t the only criteria you need to meet. Like any credit card issuer, the bank that issues your Amazon card considers other factors, like your income level and other aspects of your credit profile, in their approvals, too.

If you’re approved, your APR depends on many factors, such as the type of card you’re applying for and factors lenders consider from your application. So you should consider your personal finances first to ensure you’re a good fit for an Amazon credit card.[2]

In this article, we detail what credit score you need for an Amazon card, the approval process, what to do if you’re denied and how the process impacts your credit.

What credit score do you need to be considered for an Amazon card?

To figure out how your credit score compares to Amazon card requirements, Amazon offers some data for illustrative purposes only. According to Amazon, you’re more likely to be approved for an Amazon credit card if your credit score is above 640.[3]

Amazon provides credit score ranges, which it has based on scores that have been commonly used. These ranges — for illustrative purposes only — are different from the ranges used by credit scoring models like FICO®, and specific lenders evaluating your credit may use a different range when assessing your credit profile. So what FICO® considers a “good” score may be different from a lender’s idea of what number represents a “good” score. The ranges provided by Amazon are as follows:[3]

- Fair: 640+

- Good: 680+

- Excellent: 720+

The credit score ranges Amazon provides are based on commonly used scores according to Amazon. They are not traditional FICO® Score ranges. FICO® has its own score ranges, which differ from Amazon’s, and individual lenders may have different cutoffs as well. So you can use Amazon’s ranges to gauge where your score may fall for Amazon cards, but your score may fall in an entirely different FICO® range or range used by the specific lender evaluating your application.

You may be able to check your credit score through your current credit card issuer, loan statements, credit monitoring services or with the credit reporting companies directly.[4] Keep in mind that some of these options are free to use and some are paid. You can also check to see if your financial institution works with FICO® Open Access, which gives you free access to your FICO® credit score, and Experian allows you to obtain a free credit score after creating a free account.[5]

Lenders consider more than just your credit score when you apply. When lenders determine creditworthiness, they’re assessing your ability to pay back what you owe and check your credit for indications that you might be a high-risk borrower.

Limited credit history, late payments, high debt, insufficient income and too many recent inquiries are all reasons a lender might deny an application, even if you have a credit score that falls in the acceptable range.[6]

Another factor for Amazon credit cards specifically is Amazon Prime membership. Some Amazon store cards, like the Amazon Prime Rewards Signature Visa, are only available to Amazon Prime members. So, even though the card doesn’t have an annual fee, you’ll have to purchase an annual Prime membership to qualify.

How long does it take to get approved for an Amazon Rewards card?

The Amazon Rewards card is issued through Chase Bank, and approval for an Amazon Rewards credit card can be very fast. Most online applications receive responses in less than 15 seconds, providing instant decisions.[7]

However, your actual response time may vary, depending on your internet connection and the number of applications being processed. If you aren’t instantly approved, you can expect to hear back in two to four weeks after applying.[8]

Does applying for an Amazon Rewards card hurt your credit?

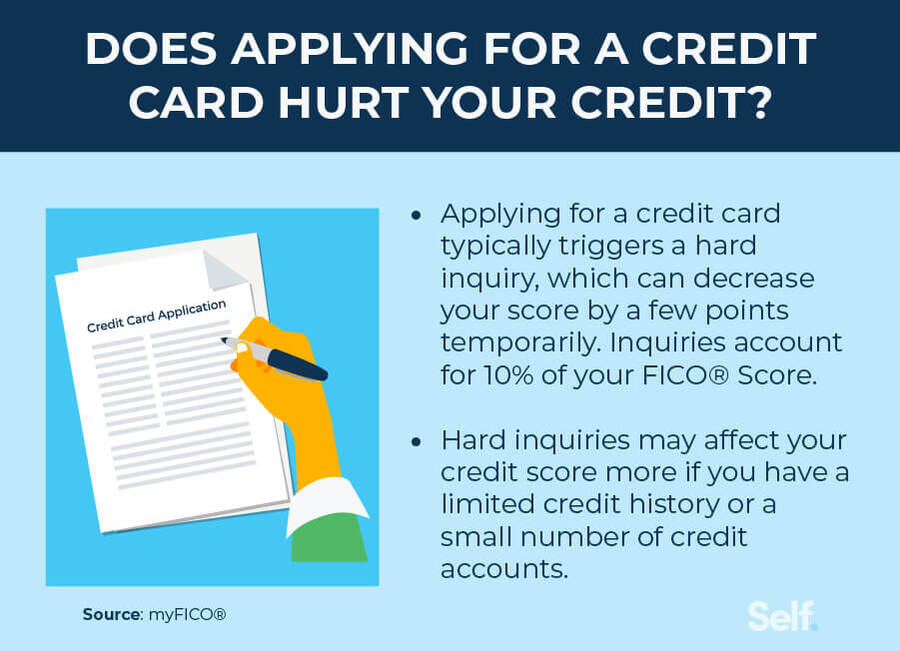

When you apply for an Amazon Rewards card through Chase, the lender conducts a credit check, also known as a hard inquiry. Unlike soft inquiries, such as viewing your own credit report, which doesn’t affect your credit score, hard inquiries usually cause your credit score to drop slightly.[9]

The more hard inquiries you have, the greater the impact on your credit score. Having multiple hard inquiries within a short period on your credit report may reflect negatively on your credit score. In this situation, lenders may see it as a sign that you are having financial difficulties and need credit to make ends meet.

Credit models, such as FICO®, however, consider rate shopping as one inquiry if done in a limited time period. Rate shopping refers to when you’re shopping for the best interest rates for a car loan or mortgage.

With FICO®, if you’re rate shopping for a specific financial product, such as auto loans and mortgages, all the hard inquiries for that one type of credit are considered a single inquiry if done between 14 and 45 days, depending on which scoring model is used. Shopping for credit card rates is not included in rate shopping.[9]

If you want to apply for a new Amazon credit card, try not to apply for too many other credit cards in a short timeframe to avoid potential dings to your credit score.

Why was your Amazon Rewards card application denied?

If you applied for an Amazon credit card and your application was denied, there are several possible causes. Lenders look at more than just your credit score. Even if you have a good credit score according to the ranges used by the lender, your application could still be denied for another issue.

Here are some possible factors that can hurt your approval odds:[6]

- Your credit score is too low. If your credit score falls below the range the lender accepts, they’re unlikely to approve your application.

- You don’t meet the credit card application requirements. Credit card applications have more requirements than just having a certain credit score. In addition to having a lower credit score than required, you may be denied if you have insufficient income or aren’t old enough to apply.

- You filled out the application incorrectly. Your application may be denied if you mistakenly provided incorrect personal information. If this happens, you can contact the credit issuer with the correct information and ask them to reconsider.

- You’ve applied for credit too often in a short timeframe. Applying multiple times in a short period means you’ll likely end up with many hard inquiries on your credit report, which can lower your credit score.

- You froze your credit report. If you’ve frozen your credit report, lenders won’t be able to access the information they need to approve your application.

- Your payment history is limited. Having limited credit history makes it less likely that you’ll be approved because lenders don’t have enough information to know how you’ll manage credit.

- You recently filed for bankruptcy. Filing for bankruptcy means you didn’t pay your debt as originally agreed, making you seem like a high-risk borrower for a lender to work with.

Ways to work on your credit score

Though credit scores are only one factor of many that lenders consider in your application, credit scores may be one of the most important because they are calculated from aspects of your credit profile.

While there’s no quick fix for repairing your credit, with time and patience, you can work to elevate your credit score, based on the FICO® score model:

- Check your credit report. By law, you can check your credit report once a year for free from each of the major credit bureaus through AnnualCreditReport.com. Because of the COVID pandemic, the three major credit reporting bureaus, Experian, Equifax and TransUnion, continue to offer free credit reports weekly through the end of 2023.[10] Checking your credit report regularly helps you get a clear sense of where you stand and what lenders see when you apply for credit.

- Set up automatic payments to make on-time payments. Payment history is the most important factor in your credit score calculation, making up 35% of your FICO® score.[11] Making on-time payments goes a long way in maintaining a good credit score. Setting up automatic payments for your monthly balances can prevent you from being late or missing payments.

- Pay down the debt you owe on credit accounts. FICO® considers amounts owed as making up 30% of your credit score.[12] Your credit utilization ratio, or CUR, is factored into your amounts owed. Your CUR takes your total revolving debt and divides it by your total revolving credit limit. Typically, the lower your CUR, the better it is for your credit score, and experts suggest you keep your CUR below 30% but ideally under 10%.[13]

Whether you get a credit card offer for an Amazon credit card or just want to apply, remember that many factors get considered when assessing your application. While the perks, like rewards programs, discounts at retailers like Whole Foods Market, and cash back on Amazon.com purchases and Amazon gift cards may seem enticing, know where you stand with your credit before you apply so that you get the best credit card for your needs.

If you’re looking for ways to build credit, Self’s products may be a good option to help you get started, providing tools and information to help you understand credit and how it affects your ability to secure credit in the future.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- CNBC. “When And Why It’s Worth It To Get The Amazon Prime Credit Card,” https://www.cnbc.com/select/when-and-why-the-amazon-prime-credit-card-is-worth-getting/. Accessed October 6, 2022.

- Chase Bank. “Pricing & Terms,” https://applynow.chase.com/FlexAppWeb/. Accessed October 6, 2022.

- Amazon. “Minimum Credit Quality,” https://www.amazon.com/. Accessed October 6, 2022.

- Consumer Financial Protection Bureau. “Where can I get my credit score?” https://www.consumerfinance.gov/ask-cfpb/where-can-i-get-my-credit-score-en-316/. Accessed October 6, 2022.

- FICO®. “FICO® Score — The Score that Lenders Use,” https://www.ficoscore.com/where-to-get-fico-scores#OpenAccess. Accessed October 20, 2022.

- Experian. “10 Potential Reasons Why Your Credit Card Application Was Denied,” https://www.experian.com/blogs/ask-experian/why-was-my-credit-card-application-denied/. Accessed October 6, 2022.

- Amazon. “Amazon Rewards Visa Signature Card - Offer Details,” https://www.amazon.com/gp/. Accessed October 6, 2022.

- Amazon. “Amazon Rewards Visa Signature Card Approval Process,” https://www.amazon.com/gp/help/customer/. Accessed October 6, 2022.

- FICO®. “How Do Credit Inquiries Affect Your FICO Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed October 6, 2022.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed October 6, 2022.

- FICO®. “How are FICO Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed October 6, 2022.

- FICO®. “How Owing Money Can Impact Your Credit Score,” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed October 6, 2022.

- myFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed October 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).