What Is a Debt Validation Letter? Plus, Debt Verification Template

Published on: 12/27/2021

Have you received a notice or phone call from a debt collection agency that claims you owe money? Maybe you don’t think you owe it.

The good news is that the debt collector has to prove their assertions. Under the Fair Debt Collection Practices Act (FDCPA), those engaged in collection efforts must be able to demonstrate that you owe the debt they’re claiming.

That’s where a debt validation letter comes in.

To be clear: A letter you send seeking information about your debt is called a debt verification letter. By contrast, a debt validation letter comes from the debt collector and provides information to you.

What is a debt validation letter?

A debt validation letter is your way of protecting yourself against false claims.

In some cases, mistakes can be made, and you may be contacted about an you may be asked to pay a credit card debt or other obligation that’s no longer valid. For example, it may be invalid due to the statute of limitations or another reason.

Asking for validation of the debt is important because errors can affect your credit score. Whoever’s seeking to collect the debt — whether it’s the original credit holder or a debt collector — must verify the debt upon request under the FDCPA, which is enforced by the Federal Trade Commission (FTC).

What does a debt validation letter include?

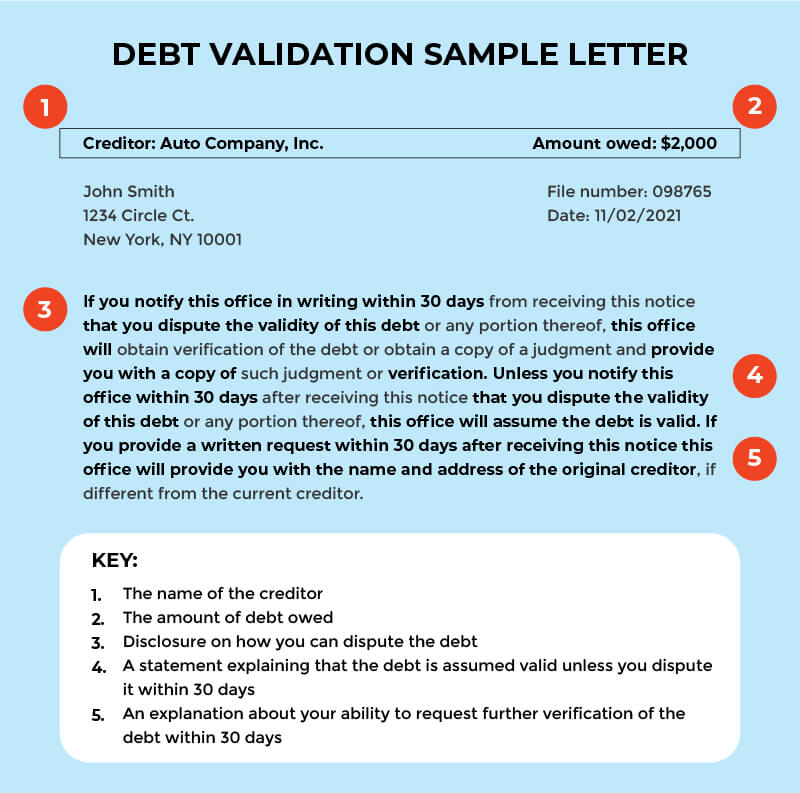

A debt collector is required by law (15 U.S. Code § 1692g) to supply you with the following information in a notice within five days of making the first contact regarding a debt:[1]

- The name of the creditor

- The amount of the debt

In addition, the debt collector must inform you of the following three things:

- Unless the consumer disputes the information in writing within a 30-day timeframe, the collector will consider the debt valid.

- If such a dispute is made, the collector will obtain verification of the debt.

- You will receive, on written request, the name and address of the original creditor.

You have the right to request a debt validation letter if you have not received one. However, it's best to send your request by certified mail with a return receipt to prove it's been delivered.

Once the company receives your letter, it must pause debt collection attempts. However, once it sends you verification (proof) of what you owe, such as a copy of the original bill, it can resume its collection efforts.

Know your rights

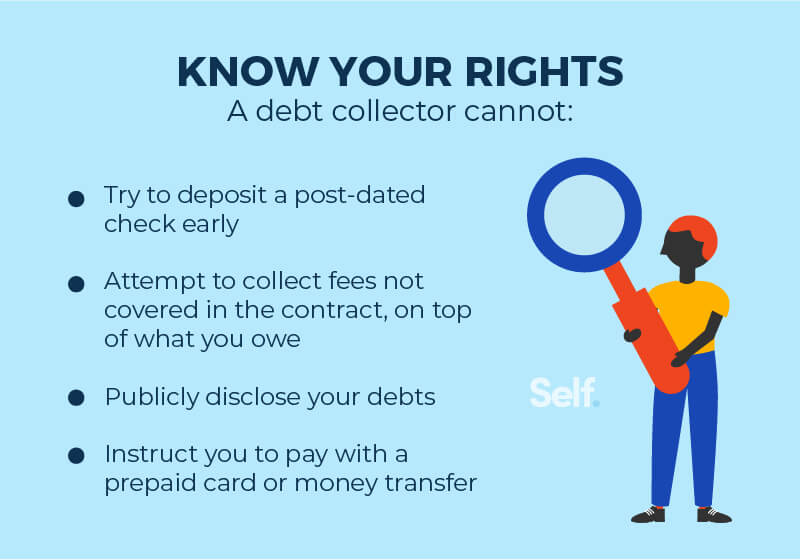

There are limits to what a debt collector can do.

They can’t lie about the amount you owe or pretend to be someone they’re not, such as a government representative or an attorney.

They also can't harass you by repeatedly calling you, threatening you with harm, falsely claiming they'll take legal action, or using obscenities.

They can’t take unethical action against you to harm your finances by:

- Trying to deposit a post-dated check early

- Attempting to collect fees not covered in the contract, on top of what you owe

- Publicly disclosing your debts

- Instructing you to pay with a prepaid card or money transfer (Scammers may ask for this since the money can be untraceable, and you may have difficulty recovering it.)[2]

If you've received a notice from a debt collector about a bill you don't owe, you have 30 days to dispute the debt in writing. Other steps you can take include disputing it with the three major credit bureaus (Experian, Equifax, and TransUnion) and filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state.

You also have the right to hire an attorney and, if you’re sued, you should respond to the lawsuit within the allotted time. If you don’t reply, the collector could receive a judgment against you that may allow the collection agency to garnish your wages or bank accounts.

Debt verification letter templates

If you’re unsure where to start, here are a couple of sample letters you can use as templates for contacting debt collectors.

(These sample letters do not constitute legal advice. If you have any questions, please consult a lawyer.)

Debt verification letter template

A debt verification letter is a letter that a borrower writes to a creditor asking for more information regarding a debt they supposedly owe. Maybe the creditor doesn't even owe the debt in the first place, so ask for verification and further information.

[Your name]

[Your return address]

[Date]

[Debt collector name]

[Debt collector address]

Regarding: [Your account number for the debt]

Dear [Debt collector name],

In response to your recent communication of [insert the date you were contacted], I am writing to identify the debt you referenced. You reached out to me by [insert the type of communication used] on [insert the date you were contacted] and explained the debt as [include information that the debt collector provided during the initial correspondence].

Please provide me with the following information so that I can better understand the situation concerning:

- Why you believe I am responsible for this debt, and to whom I owe it, including the following:

The name and address of the creditor who holds the debt, the account number used by that creditor, and the amount of the debt.

The name and address of the original creditor, if different, along with the following:

- Any other name I may know them by.

- The account number used by that creditor.

- The sum that was owed to that creditor when the debt was transferred.

When and from whom the current creditor obtained the debt.

Documentation, such as a written agreement or receipt signed by the alleged debtor, that establishes a valid basis for any requirement that I pay the debt to the current creditor.

The identity of anyone else who may hold, or have held, the debt, which I am now being asked to repay, and why I am responsible for it.

- The amount and age of the debt, including the following:

- How the amount was calculated

- When the creditor says it was due, and when it became delinquent

- When the last payment was made

- The amount of the debt when it was obtained, and the date when it was

- A copy of the most recent billing statement from the original creditor

- A dated and itemized list, and explanation, of any fees that have been added since the last billing statement from the original creditor

- A dated and itemized list of any payments or other reductions made since the last billing statement from the original creditor

- How any changes are allowable by law or under the original agreement

- The age of the debt, and whether/how you know if this debt falls within the statute of limitations

- Your authority to collect the debt, including the following:

Do you have a license to collect debt in my state or from another state?

If not, why not?

If so, please provide the following:

- The license number

- Name and date on the license

- Name, address, and phone number of state licensing agency

Any judgments the creditor has obtained on this account

I’m making this inquiry because I need the foregoing information in order to make an informed decision concerning your claim. Please let me know if you are willing to accept a figure less than the balance owed to fully resolve the account, and what that figure would be, if it is determined that your claim is valid. I look forward to hearing from you.

In the meantime, please consider the alleged debt disputed until we can come to a resolution.

Thank you in advance for your attention to this matter.

Sincerely,

[Your name]

Disputing a debt letter template

If you do not believe you owe the debt that has been claimed against you, you can submit a letter such as the following:

[Your name]

[Your return address]

[Date]

[Debt collector name]

[Debt collector address]

Regarding: [Your account number for the debt]

Dear [Debt collector name],

I am writing in response to your [form of communication you received by the collector] on [insert the date you were contacted], in which you explained the following debt that you are attempting to collect [include information that the debt collector provided during the initial correspondence].

Please be advised that I am not responsible for this debt.

Please cease all further communication at this address [and/or phone number] with the exception of any documentation that you believe supports your claim.

Please note in your files that I am disputing any obligation for this debt and include this notice of dispute if you forward it to another company or report it to a credit bureau.

Thank you in advance for your attention to this matter.

Sincerely,

[Your name]

What to do if a collector does not verify the debt

Suppose a collector refuses to verify a debt but won't cease in seeking payment. In that case, you can sue under federal law or state laws for $1,000 plus actual damages, court costs, and attorney's fees.[3]

The bottom line

If you have been contacted by a debt collector, there are steps you can take to confirm you owe what’s alleged — or dispute it.

It's important not to accept a collector's allegations without getting validation of the debt. If necessary, make a validation request to be sure you owe what's claimed and that the collector has a legal right to try to collect.

Collections actions can appear on your credit report. And once they do, it can take time to rebuild your credit.

Disputing the claim can save you negative credit reporting if you don't owe what they say. However, if you do, in fact, owe the debt, it's best to establish that so you can pay it to the proper creditor as soon as possible. It takes time to get out of debt and optimize your personal finances, so the sooner you can start to build credit, the better off you’ll be.

Just be sure you’re paying the right lenders or agencies only what you owe and nothing more. Legal protections are in place to ensure that debt collections are done fairly and accurately, and you have the right to those protections. That’s what debt validation letters are all about.

Sources

- Cornell Law School. “15 U.S. Code § 1692g - Validation of debts,” https://www.law.cornell.edu/uscode/text/15/1692g. Accessed July 28, 2021.

- Consumer Financial Protection Bureau. “How to tell the difference between a legitimate debt collector and scammers,” https://www.consumerfinance.gov/about-us/blog/how-tell-difference-between-legitimate-debt-collector-and-scammers. Accessed July 28, 2021.

- Nolo. “Debt Collection Defense: Requiring That the Collector Document the Debt,” https://www.nolo.com/legal-encyclopedia/debt-collection-defense-requiring-that-the-collector-document-the-debt.html. Accessed July 28, 2021.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.