Can You Reopen a Closed Credit Card Account?

Published on: 01/13/2025

Can you reopen a closed credit card? Sometimes. It’s important to understand who closed your credit card account — you or your creditor — and why it was closed.

We’ll explain the reasons why credit card accounts are commonly closed, and what you can do to try and reopen them.

Table of contents

- Why are credit card accounts closed?

- Can a credit card be closed without notice?

- How can I reopen a closed credit card account?

- Does a closed credit card account impact your credit score?

- How long do closed accounts stay on your credit report?

- Alternatives to reopening a closed credit card

- Final thoughts

Why are credit card accounts closed?

There are a few reasons why your credit card account might be closed. You can ask to have your credit card account closed (maybe you aren’t using it or just don’t want the temptation), or your card provider can decide to close it — sometimes without warning. So, why would a credit card company close your account? There are several possible reasons:

Your credit score dropped

Credit card companies decide whether to issue credit cards, and at what interest rate, based on the level of risk a potential cardholder poses. If the risk is too high, they will decline an application. But they also monitor your credit score once they have issued your card to ensure you remain a good risk. If they see red flags that lead them to believe you may not be able to honor your agreement, they can close your account. These red flags could include sudden drops in your credit score caused by missed payments or delinquencies.

You broke the terms of the card agreement

Your credit card agreement addresses a number of topics, including:

- Annual fees

- Annual percentage rates (interest rate or APR)

- Balance transfer fees

- Cash advance policy

- Late-payment fees

- The expiration date for points and rewards

Breaching any part of the agreement, such as failing to pay your annual fee, can give a credit card issuer a reason to close your account.

Your account was inactive

If you stop using your credit card for a period of months, the issuer could choose to close your account. How long does your card need to be inactive before it is closed? It depends on the issuer. But you can avoid this problem — and the headache of asking the issuer to reopen a closed account — by making a small purchase every month and paying it off when your next statement arrives.[1]

Your credit card was discontinued

Credit card companies typically offer different kinds of cards, such as “gold” or “platinum” cards, business credit cards, rewards cards, cash-back cards, and so forth. If the company chooses to discontinue a specific card, it may offer you a replacement or allow you to keep using your card even though it is not issuing any new ones. It may also, however, simply close your account.[1]

You exceeded your credit limit

Going over your credit limit repeatedly can be a red flag to your lender that you may have trouble meeting your financial obligations. Rather than take that risk, the credit card company may simply close your card as a preventive measure.

Your account was delinquent

Missed payments might cause a credit card issuer to view you as a risk and close your account as a result. If you regularly miss payments or your account goes into default, the issuer may close your account. Missed payments are a violation of your card agreement, which stipulates when payments are due. (If your account is past due for 120 to 180 days, the issuer may charge off your account and sell it to a bill collector.)

Can a credit card be closed without notice?

Yes, a credit card company could close your account without notice if your card is inactive, your account is in default, you’ve consistently exceeded your credit limit, or any of the other reasons listed above.

Credit card companies might notify you that they are planning to close your account, but they are not required to do so. This means some cardholders might find that their account has been closed without any notice.[1]

What can I do to stop my credit card account from being closed?

There are steps you can take to prevent your account from being closed, such as:

- Find out when your card issuer usually closes an account for inactivity

- Use your card every so often to avoid it becoming inactive

- Make sure you pay off your credit card bill on time every month

- Check your credit card agreement and avoid making any breaches

- Keep your credit utilization low and avoid hitting your card’s credit limit[1]

How can I reopen a closed credit card account?

You can attempt to reopen a closed credit card by contacting your lender and asking them to do so. It is the company’s decision as to whether they reopen your credit card. The chances are that they will hinge on two factors: their discretion and why the account was closed in the first place.

If you closed the account yourself, you may have more success in asking the company to reopen it. If the issuer closed the account, they may (or may not) be willing to reopen it depending on why they closed it. If you’re thinking about reopening an account, finding out why it was closed is a good place to start. This could help you avoid the same thing happening with other credit accounts in the future.

1. Determine why your credit card account was closed

Some credit card companies may notify you in advance that they plan to close your account. For instance, you might receive a letter several months before the closure to give you time to contact their customer service. In some cases, they will send you a few notices before closing your account.

If you didn’t close the account yourself and didn’t receive a notice, see if you can determine why it was closed. Was your account inactive for an extended period? Did you miss several payments or go over your credit limit repeatedly? If you’re unsure, obtain a free copy of your credit report, which you are entitled to receive annually under federal law. However, the three major credit reporting companies, Experian, Equifax and Trans Union now offer free online credit reports weekly.[2] This should reveal any credit problems that may have caused your card to be closed.

If you can’t determine why your account was closed based on your credit history, contact the issuer to determine if there is some reason on their end.

2. Collect documentation of your credit card account details

Before you contact the credit card company to reopen your account, you will want to gather relevant paperwork concerning your card. This will help the company identify you quickly and answer any questions you have about your account.

Your documentation should include:

- the account number

- a statement from the closed account

- the actual canceled card (if possible)

Additionally, you will need to have personal information including your name, address, and Social Security number.

3. Call customer service

Once you have all the paperwork and information you need, check the back of the card or the issuer’s website to find the customer service line. When you reach a representative, ask to speak to someone about why your account was closed (if you don’t know) and what steps you might take to reopen it.

Does a closed credit card account impact your credit score?

Closing a credit card account might seem like a good idea if you’re worried about taking on too much debt, but it also can hurt your credit score by:

- Increasing your credit utilization rate: Your CUR is your total outstanding balance divided by your total credit limit. If a credit card closes, that means your total credit limit is lower, and your CUR will, in turn, be higher.

- Potentially decreasing your credit history: Your length of credit history accounts for 15% of your FICO score. If you had a credit card for a long time, then the average age of your credit will decrease after the card closes.

If you’re deciding whether to close a credit card, weigh the pros and cons. For example, if you’re paying high fees to keep the card open, it may not be worth it.

How long do closed accounts stay on your credit report?

The answer depends, in part, on the status of your account. If it was in good standing, it can remain on your credit report for as long as 10 years — which will actually help your credit score.

If your account was delinquent, it will stay on your credit history for seven years, starting at the time it first became delinquent.

If you pay off your delinquent account before closing it and are in good standing, the record of any late payments will be removed after seven years, but the rest of your account will remain on your record, showing as a positive account.[3]

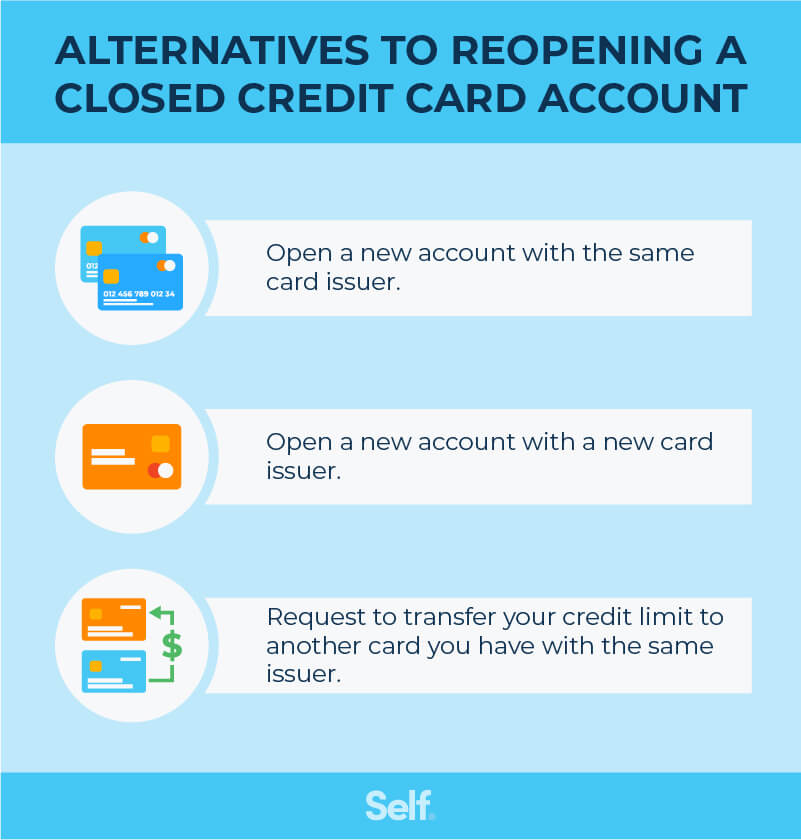

Alternatives to reopening a closed credit card

If your credit card issuer declines to reopen your account, or if you prefer a different alternative to access credit, you can try other avenues instead.

One option is asking to transfer the credit limit from your old card to another card issued by the same company. A company that has discontinued the card you have been using might be particularly willing to grant such a request. You may have to call the company’s customer service number to do so, but some issuers such as American Express may allow transfer requests to be made online.[4]

You can also simply apply for a new account from the same company, or you can shop around and apply for a credit line offered by a different issuer. There are a number of different issuers out there — from Chase to Citi, from Discover to Bank of America to Capital One — and many will be ready with new credit card offers.

You have the opportunity to start over and, if you don’t have bad credit, choose among the best credit cards with the most attractive interest rates. Even if you do have poor credit and need to rebuild it, you can do so using a secured credit card.

Final thoughts

Reopening a credit card that has been closed, either by you or the company, may be worth considering if you want to increase your available credit and/or improve your credit utilization rate.

If you are unsuccessful in reopening a closed credit card, there are, fortunately, other options available to you. You can compare them and choose the one that is best for you and your personal finances.

Sources

- Experian. “Why Credit Card Companies Close Accounts Without Telling You,” https://www.experian.com/blogs/ask-experian/why-would-a-credit-card-be-closed.

- AnnualCreditReport.com. “AnnualCreditReport.com,” https://www.annualcreditreport.com/index.action.

- Experian. “When Are Closed Accounts Deleted?” https://www.experian.com/blogs/ask-experian/when-are-closed-accounts-deleted.

- Experian. “Can You Transfer Credit Limits Between Credit Cards?” https://www.experian.com/blogs/ask-experian/can-you-transfer-credit-limit-between-credit-cards.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).