What Happens If You Don’t Use Your Credit Card?

Published on: 02/22/2023

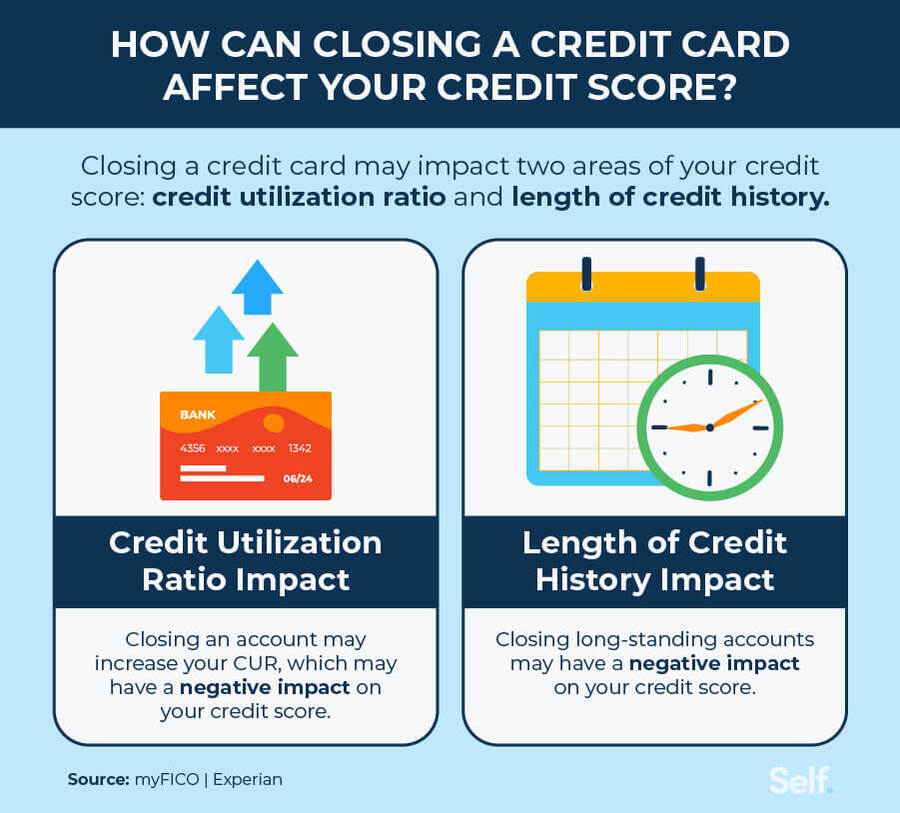

Not using a credit card on its own will have no impact in the short-term, but if a credit card is closed due to inactivity or you voluntarily close it, it may hurt your credit score. Closing a credit card may have a negative impact on your credit utilization ratio (CUR; your total revolving credit balances divided by your total revolving credit limit) and your length of credit history, two important factors that make up your credit score.[1]

This post examines how closed accounts impact your credit, how to keep your credit accounts open and how inactivity impacts your credit accounts.

What happens if you don’t use your credit card?

While you may think that not using your credit card on an ongoing basis means you won’t accumulate debt, you may still be subject to fees during the period of time before your credit card is closed. For example, you can still accrue interest on outstanding balances. You can also be charged annual fees if they apply to your card even if you’re carrying a $0 balance.[2]

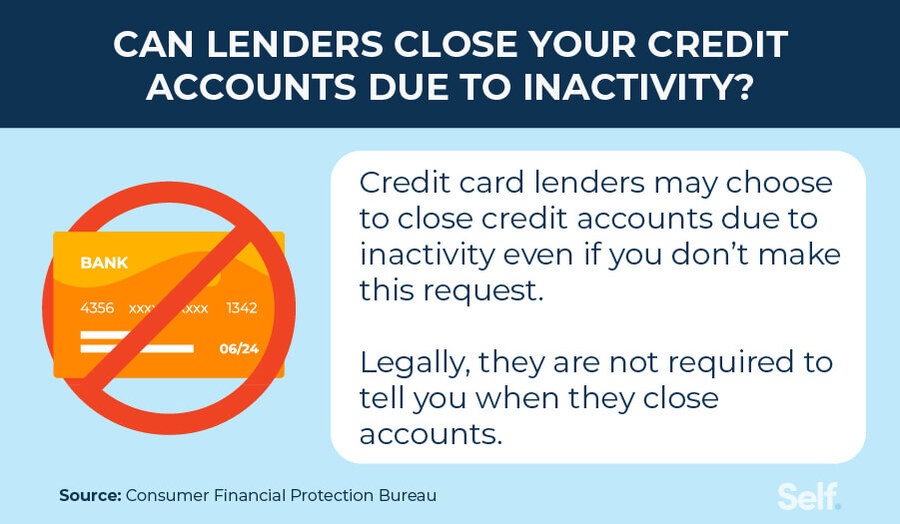

If you rarely use your credit card and have not done so for a specified period of time, your credit card issuer can close your account due to credit card inactivity,[3] even if you wanted to keep the card open or intended to use it in the future. Credit card cancellation due to inactivity varies by lender. If you’re concerned, talk to your credit card issuer about their policy.

How a closed credit card can affect your credit score

The two main areas impacted by closing a credit card — either on your own or through inactivity — are your credit utilization ratio, or CUR, and your length of credit history. The following sections explain the impact these factors have on your credit.

A closed credit card may result in a higher credit utilization ratio

Your CUR measures your credit utilization on revolving credit accounts, like credit cards. The credit utilization ratio is specifically the total amount of revolving debt you owe divided by the total amount of your revolving credit limits. While experts suggest maintaining a credit utilization ratio below 30%, they add that staying close to 10% offers the best chance at adding a positive impact to your credit score.[4]

So closing an unused credit card may increase your CUR by lowering your overall credit limit across all revolving accounts. For example, if you add up your total amount of credit card balances and discover you have $2,000 of debt but a total credit limit of $6,000, you have a CUR of 33% ($2,000 divided by $6,000). However, if you have an inactive card that you decide to close with a $0 balance and a $1,000 credit limit, your CUR increases to 40% ($2,000 divided by $5,000).

Your CUR impacts amounts owed, the second most important factor of your FICO® score, making up 30% of your score, so it’s important to consider this before closing an account.[1] CUR is used in VantageScore® 3.0 and accounts for 20% of your credit score.[5]

Closed credit accounts may stay on your credit score for up to 10 years

The information associated with closed credit accounts, whether positive or negative information, stays on your credit report even after you close the accounts. For some scoring models, your closed account history will continue to impact your credit score as long as it stays on your credit report and is reported to the credit bureaus, for up to 10 years.[6]

The following list gives you an idea of how long different types of information from a closed account can impact your credit score:

- Negative information from closed accounts, such as late payments and delinquencies, can stay on your credit report for seven years, impacting your payment history, which is the most important factor of your credit score.[1], [6]

- Closed accounts with positive information remain on your credit report for up to 10 years, which may positively influence your credit score.[6]

A closed account impacts your length of credit history

Length of credit history is another important factor in your credit score. FICO® states that having a longer credit history always makes a positive impact on your FICO® score. If your closed account helped extend the length of your credit history, closing it may lower the age of your credit. If it was a newer account, it may have less impact.[7]

So closing a credit card, especially if it’s one of your oldest accounts, may negatively impact your credit score, reducing the average age of your credit and limiting the overall period of time you’ve maintained an account history.[1] However, scoring models weigh closed accounts differently. For example, some VantageScore® models don’t include closed accounts in their credit age calculation at all.

When do credit card companies close accounts due to inactivity?

Credit card companies do not have to inform consumers when they are closing an account, and may do so at any time.[8] If you’ve had an inactive credit card for a long period of time, your credit card issuer may decide to close it regardless of whether or not you want that to happen.

How to avoid a credit card company closing your account

The best way to avoid having your credit card company close your account is to simply use the card. You don’t have to go into major debt to keep your card active — even making small purchases on occasion is enough to keep you from having an inactive credit card.

Be sure to use your credit card responsibly, taking into account the debt on other credit accounts you might have and your personal financial situation.

Should you close credit cards you don’t use?

According to FICO®, generally, it’s not recommended to close a credit card account, especially if it’s paid off. It may be tempting to close a credit account to keep yourself from overspending or to make your personal finances seem more manageable, but keeping your total available credit high can actually be very helpful, not only to reduce your CUR and amounts owed but also in case of emergency expenses.[9], [10]

Keep your accounts open with responsible use

Keeping your credit accounts open and adding positive payment history by paying your credit card bill on time offers the best chance at a positive impact to your score. Try some of these strategies to maintain your credit accounts and protect your credit score.

Consider using lower limit credit cards

If you want to keep yourself from overspending, or feel overwhelmed by debt you already owe, using credit cards with lower credit limits may be a good idea. Your credit limit is a cap on how much you can spend, so cards with lower credit limits may help prevent you from overspending.

Keeping accounts with low or no outstanding balance open as part of your credit profile positively contributes to your account history, especially if you make your monthly payments on time. Also, even a small credit limit contributes to your overall total available credit and may help your CUR and amounts owed stay on the lower side.

Prioritize using credit cards with lower interest rates

Putting more of your purchases on cards with lower interest rates can help you accumulate less credit card debt due to interest in the long run. This is especially true if you’re unable to pay off your balance in full each month. If you keep a credit card balance, you’ll accumulate interest.

Cards with lower interest rates result in less interest for you to pay if you have an outstanding balance. That makes it easier for you to not only keep your credit cards open, but also to shift focus to repaying your balances on accounts with higher interest rates first.

Can you reopen a closed credit card?

If your credit card account was closed due to an error or inactivity, you may be able to reopen the account. However, reopening a credit card is at the lender’s discretion, and it may involve changes to your fees, interest rate and credit limit. It may also result in a hard inquiry.[11]

Take these steps to reopen a closed credit card account:

- Determine the reason for the card’s closure. While credit card companies don’t have to inform consumers that they are closing an account, they typically inform you once your account is closed and explain the reasoning.

- Contact the credit card company and make a request. You can speak with your card issuer’s customer service and let them know you’d like to reopen the account. Depending on the reason for the account closure, you may have to address the issues that caused them to close your account before you are allowed to reopen it.

- If reopened, continue using the credit card responsibly. Keep your card active and in good standing by making consistent, on-time monthly payments toward your balance at your due date. It’s important not to slip back into the situation that got your account closed in the first place.[11]

Responsible credit card use can develop healthy financial habits

Used responsibly, credit cards can be an asset to your personal finances. Whether you’re working to build credit or improve your financial situation, making consistent, on-time payments on all credit accounts, including credit cards and loans, is a great step in the right direction. When it comes to building better credit habits, Self has tools and information that can help you understand how your financial decisions impact your credit.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- myFICO. “How are FICO Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed October 20, 2022.

- Experian. “14 Credit Card Terms You Should Know,” https://www.experian.com/blogs/ask-experian/credit-card-terms-you-should-know/. Accessed October 20, 2022.

- NFCC. “How a Creditor Closing Your Account Can Hurt Your Credit,” https://www.nfcc.org/blog/how-a-creditor-closing-your-account-can-hurt-your-credit/. Accessed October 20, 2022.

- myFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed November 2, 2022.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed October 20, 2022.

- Equifax. “How Long Does Information Stay on my Equifax Credit Report,” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report/. Accessed October 20, 2022.

- myFICO. “What is the Length of Your Credit History?” https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed November 2, 2022.

- Consumer Financial Protection Bureau. “I received a notice from my card issuer telling me that they were closing my account and that I cannot use my credit card any more. Can they do that?” https://www.consumerfinance.gov/ask-cfpb/i-received-a-notice-from-my-card-issuer-telling-me-that-they-were-closing-my-account-and-that-i-cannot-use-my-credit-card-any-more-can-they-do-that-en-83/. Accessed October 20, 2022.

- myFICO. “The Relationship between Credit Cards and Credit Scores,” https://www.myfico.com/credit-education/faq/cards/credit-cards-credit-score. Accessed October 20, 2022.

- VantageScore. “Did You Know closing credit card accounts will not improve your credit score?” https://vantagescore.com/newsletter/did-you-know-closing-credit-card-accounts-will-not-improve-your-credit-scores/. Accessed October 20, 2022.

- Experian. “Can I Reopen a Closed Credit Card Account?” https://www.experian.com/blogs/ask-experian/can-i-reopen-closed-credit-card-account/. Accessed October 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).