How Credit Works

What Is a Good Credit Score?

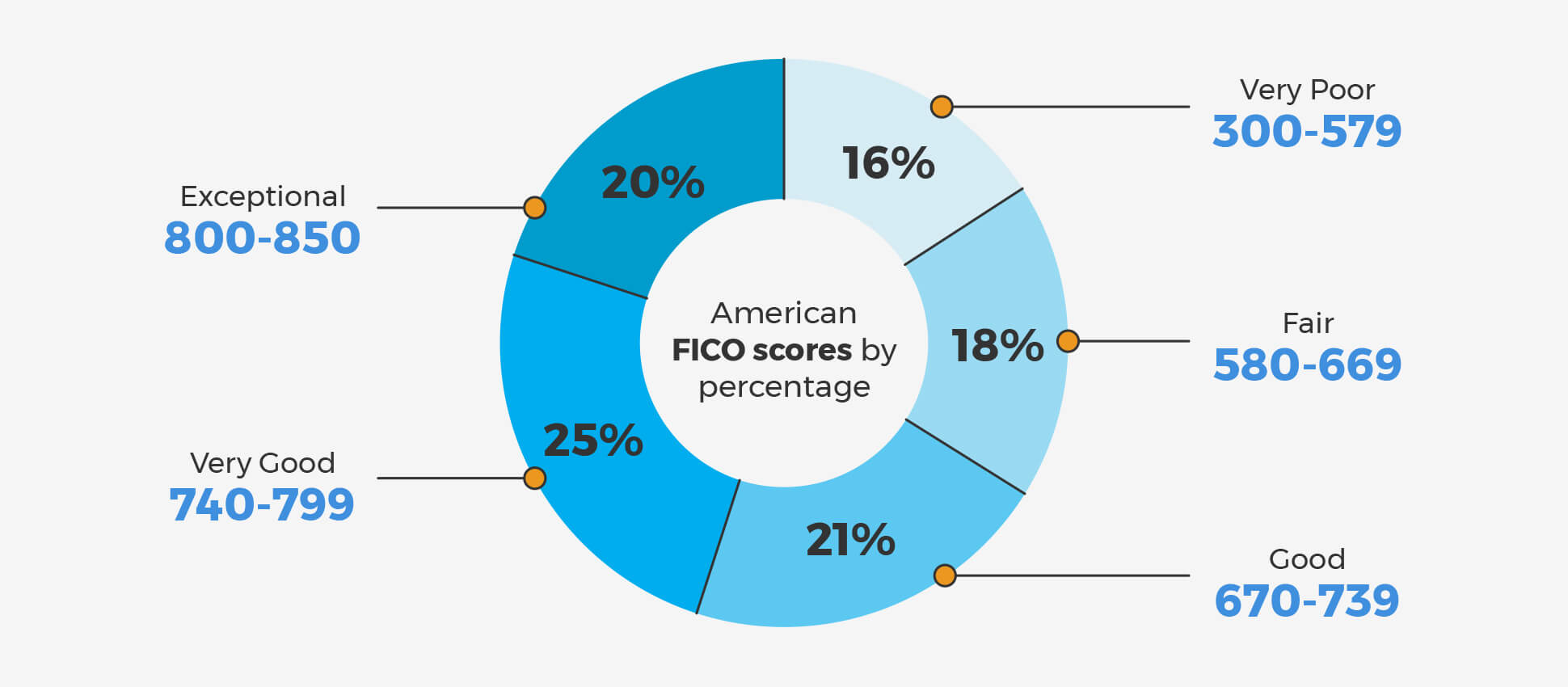

The most common variable used to measure your credit is the credit score, a three digit number from 300-850.

A good credit score can help lenders decide whether or not to approve you for credit and what interest rate to charge you. This can have an effect on whether you get approved for mortgages, auto loans, personal loans, and credit cards.

In the long run, a good credit score could save you thousands of dollars on major purchases and reduce hassle through easier approval of credit cards or loans. While a bad credit score could cost you – big time. It’s important to remember that other factors, like your debt-to-income ratio, can also affect these things and it’s not just down to your credit score.

So what is a good credit score?

Generally speaking, a FICO® credit score of 670-739 is seen as a good score, 740-799 is seen as very good, and a score above 800 can be considered “excellent” or “exceptional.” But different lenders may have different definitions of “good.” A good credit score depends on the creditor, and the type of credit you’re trying to take out.

For example, auto lenders might look for different credit scores than mortgage lenders, and some might be stricter than others when it comes to the interest rate they’ll give you based on your credit score.

Does that mean you will not be approved for a loan if you do not have a specific score? Not at all. It’s often easier to be approved for a loan with a higher credit score, but lenders will still give credit or loans to individuals with lower scores.

What is the benefit of having a good credit score?

Having a good credit score will make it easier for you to get approved for mortgages, loans, credit cards, and other financial services where you’re borrowing money from a lender, although other factors are considered as well as your score. A higher score can also reduce the amount of interest you have to pay, meaning you’ll pay less money back to the lender overall.The drawback to having a lower score is that you will likely have a higher interest rate and may not even get approved. However, if you make on-time payments on all your accounts and don’t run up high balances on credit cards, that score could build over time.

When your score lifts, you could potentially renegotiate interest rates on credit cards or refinance your home. These renegotiations will typically result in lower interest rates and savings for you.

A credit score of 670 may be considered “good” or above average, but that is not a guarantee of receiving a loan or a line of credit.Lower scores are associated with higher risk and lenders are very wary when it comes to lending money and risk levels. Depending on the lender, there are some lenders who are willing to lend money to more risky borrowers, but they may charge more for taking on that risk.

How is a credit score calculated?

Your credit score is calculated using information about you and your financial history. These can include things such as:- How often you apply for credit - Applying for a lot of credit in a short space of time could be a concern for lenders.

- Whether you keep up regular repayments or if you’ve missed any payments as missing payments could make lenders see you as a potential risk.

- Regularly getting too close to your credit limit or going over your credit limit - Another factor that might suggest you are less responsible with your credit.

- Having little or no credit history - A lack of credit history makes it difficult for lenders to determine if you’ll be responsible with your repayments or not.

What is a good credit score to buy a house?

Typically, you’ll need a credit score of at least 620 to qualify for a conventional mortgage. Though this does vary depending on the lender and the type of mortgage you’re applying for.The minimum credit score needed to buy a house with a mortgage can range from 500 to 700 and there is no set minimum, different loans including FHA loans and Jumbo loans will have their own requirements when it comes to credit score. As we have mentioned, other factors such as your down payment, income and debt-to-income ratio all have an effect on how easy it will be for you to get a mortgage.

What is a good credit score to buy a car?

Typically, having a credit score over 600 can give you a better chance of getting a car on a finance loan, but again there’s no set minimum requirement and other factors are still taken into consideration. Like with a mortgage, it depends on the lender and the conditions of the loan you’re applying for.Those with a credit score below 600, classed as subprime, may find it more difficult to get accepted for a car loan. A number of other factors affect whether you’ll be accepted for an auto loan, such as your debt-to-income ratio, the downpayment you pay, and the length of the loan agreement. You can calculate car loan interest rates by your credit score to get an idea of how much you could pay.

How to lift your credit score

If your credit score is fair or poor, there are a few ways you can lift it to a good score over time and give yourself a better chance of being approved for mortgages, loans, and other types of credit.- Open a credit account - You may have to start with a credit builder loan or a secured credit card if your credit score is bad or you don’t have a score at all. This helps you establish a credit history and a way to start building up your credit.

- Make your repayments on time - Late payments can negatively impact your credit score, so ensure payments for credit cards, loans, and other credit-related expenses are all paid on time.

- Keep track of your credit - It’s a good idea to check your personal credit report regularly to make sure there is no inaccurate information that may be damaging your score. Make sure you dispute anything that is incorrect with the credit reporting agency so it can be corrected.

Learn more ways to build your credit here.