What To Do When You Finished Your Self Credit Builder

Published on: 04/03/2019

So you finished your Self loan payments or you’re almost there? First of all, take a moment to do a happy dance and congratulate yourself for putting in the work and making the sacrifice to make it happen!

Done dancing? Cool, now it’s time to refocus. You’ve started building better credit, now you need to make sure you keep it going.

Remember – while Self can allow you get started with credit, if you finish your account and never do anything else, your credit score could drop again!

But there are definitely ways to reduce that risk and keep building, which is why we put this post together. We want to clear up some of that future uncertainty and understand where you could go next.

Here’s what to keep in mind for your credit horizon after you finish your Self Credit Builder Account. ...

What happens after someone finishes their Self loan?

Once you finish your first Self loan, you close your account and get your principal back. That means you get back the money you paid into your loan (minus interest).

While some people use that savings to set up an emergency fund, or apply it as a down payment on a car loan or secured credit card, the choice is yours.

But there are some things you need to know about your credit in the meantime.

First, whenever a line of credit closes – any line of credit – your credit score could drop again. How can you help reduce this risk? Keep building your credit! Make sure you’ve got options on the horizon so you can keep building and improving your credit.

Think of your credit like a living, breathing thing – if you don’t keep nurturing it, it won’t grow. It’s never a one-and-done thing. Anyone who’s ever killed a houseplant after forgetting to water it for weeks on end can probably relate to that.

Basically, don’t let your credit score wither. One way to make sure it's not withering is to keep track of it with an organization that provides a free credit score, such as Experian, or the Annual Credit Report website.

Why you should keep building your credit

Why should someone keep building their credit after they finish their first Self account? A few reasons, such as:

- Getting better car insurance rates or interest rates in general

- To work towards major goals like purchasing a vehicle or buying a home

- To get a better job, get a government job or get a higher military clearance

- To keep growing their credit score

- To rent a better apartment

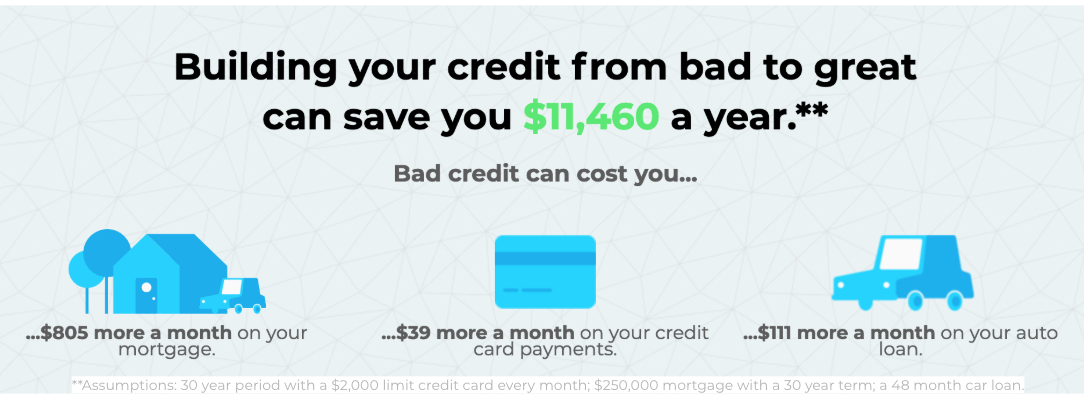

After all, not only could having a higher credit score help open up more of these possibilities, having a better credit score could save you thousands of dollars over the course of your lifetime.

Who might want to consider getting a second Self loan?

If you had a good experience and love saving money while building credit, then a second Self Credit Builder Account could be the right option for you. It could also be a great choice if you don't need a different installment loan (such as a car loan) and want to keep a healthy credit mix on your credit report.

At this time we don’t offer an automatic rollover into a second Self account. Instead, you would need to close your account, get your principal back, and open a new one.

Getting new credit products

Another route many of our customers take is to “graduate” to new credit products once they’ve built their credit enough with Self. That way they can keep building credit and working towards their larger financial goals.

These products could include:

- Secured credit cards

- Unsecured credit cards

- Car loans

- A mortgage

As you graduate to new credit, remember to keep your credit mix and overall credit utilization rate in mind. Using diverse types of credit – both installment loans and revolving credit lines – accounts for 10% of your FICO credit score). Some experts also recommend that you keep the amount of total credit you use to less than 30% of your available credit.

And don’t forget to keep using the same positive financial habits that got you this far with Self! Keep making your payments on time and in full, since payment history accounts for 35% of your FICO credit score.

Ultimately, remember that building your credit is the work of a lifetime ... so keep up the good work!

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to help people build credit and savings.