States With the Most Credit Card Debt

Credit card debt in the U.S. had been on the rise for eight straight years until the COVID-19 lockdowns and subsequent relief efforts suddenly reversed the trend. The combination of a severe slowdown in consumer spending, a suspension of student loan payments, moratoriums on evictions and foreclosures, multiple stimulus checks, and advanced payments of child tax credits has filled residents’ pockets with unexpected but much needed cash, and many Americans have used that money to pay down their credit card balances.

The same forces have also reduced credit utilization and late payments. Total U.S. credit card debt dropped from a peak of $930 billion in the final quarter of 2019 to $770 billion in the first quarter of 2021, and the rate of cardholders who transitioned into serious delinquency plummeted even more from 5.32% to 3.78% over the same period, according to the Federal Reserve Bank of New York.

The debt relief measures rolled out by the government and major businesses in response to COVID-19 were most effective at slashing student loan and mortgage delinquency rates, both of which were cut nearly in half between the first quarter of 2020 and 2021. Student loan delinquency fell from 10.75% to 6.16%, and mortgage delinquency shrunk from 1.06% to 0.59%, while other forms of debt generally plateaued or only rose slightly. Even the efforts by credit card companies to lower or defer monthly minimum payments, waive or refund late fees, reduce interest rates, and offer payment plans also made a difference, temporarily halting a sharp rise in severe delinquencies that began in the first quarter of 2020.

By the end of 2020, Experian noted that credit utilization hit a record low, and individuals in the U.S. saw their average credit card balance decrease by $879 since 2019. While that drop is significant, the reality is that people experienced starkly different financial results during the pandemic. For example, Americans cut their credit card debt by as much as 20% in Washington, D.C., or as little as 8% in North Dakota, according to Experian.

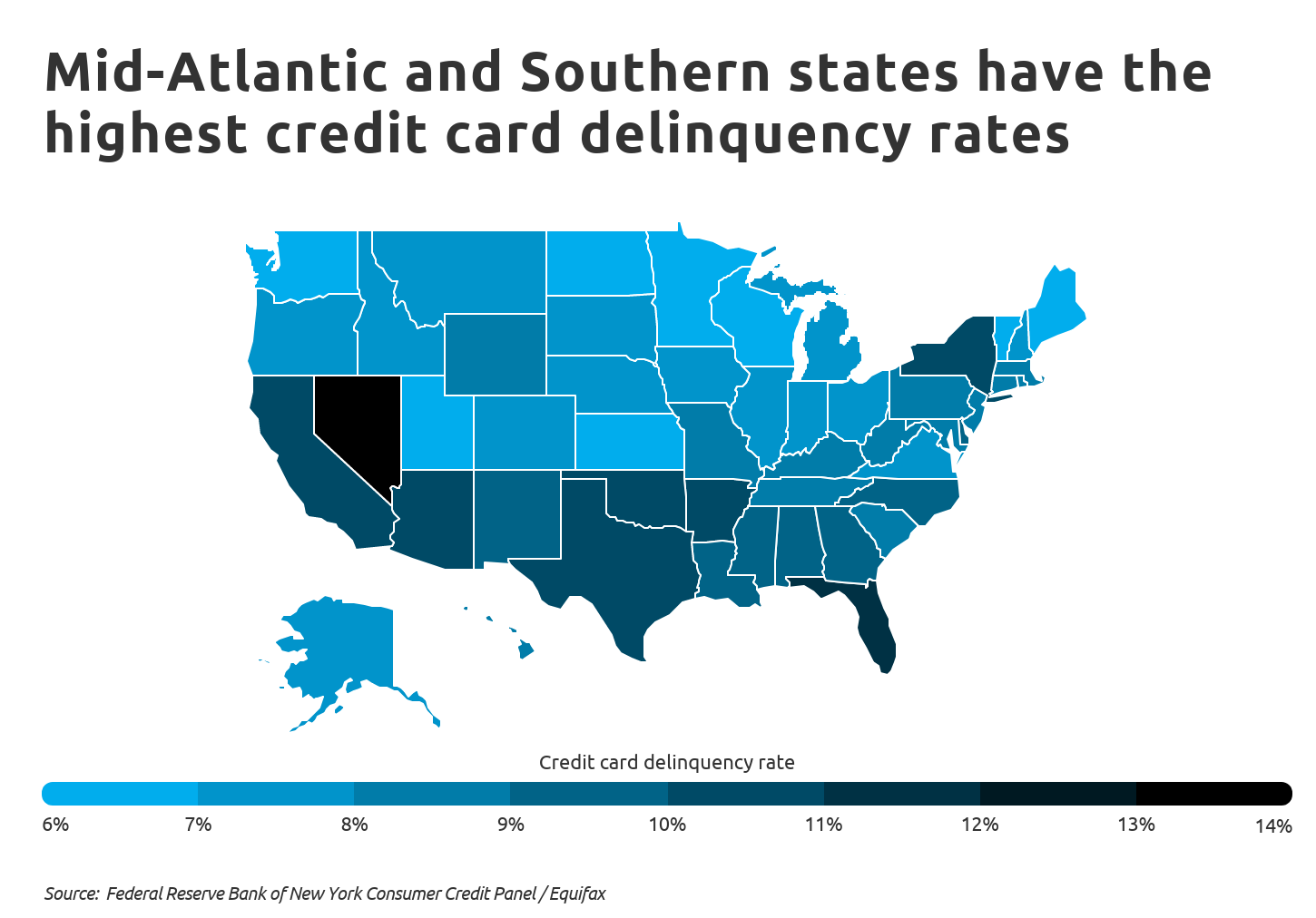

Despite the benefits of the debt relief and stimulus, states in the Mid-Atlantic and across the southern tier of the nation are still burdened with credit card delinquency rates above 10%. Nevada and Florida lead the way with rates of 13.3% and 11.9%, respectively, followed by Arizona, Arkansas, Texas, California, Oklahoma, and New York.

RELATED

How long does it take to build credit? Plan on 6 months if you’re just starting to build credit. If you’re rebuilding, the time frame depends on your situation. A secured credit card is one option that can help speed up the process.

To determine which states have the nation’s most credit card debt, researchers at Self analyzed data from the New York Fed, Experian, the U.S. Census Bureau, and the U.S. Bureau of Labor Statistics. States were then ranked by the percentage of credit card debt that was severely delinquent (90 days or more) in the fourth quarter of 2020. Overall, states with higher credit card delinquency rates were more likely to report higher rates of unemployment and lower average credit scores than states with lower delinquency rates.

Here are the states with the most credit card debt.

States With the Most Credit Card Debt

Photo Credit: Paul Brady Photography / Shutterstock

15. Delaware

- Credit card delinquency rate: 9.06%

- Credit card debt balance per capita: $3,110

- Average credit score: 710

- Median household income: $70,176

- Unemployment rate (2020 average): 7.8%

Photo Credit: Farid Sani / Shutterstock

14. North Carolina

- Credit card delinquency rate: 9.08%

- Credit card debt balance per capita: $2,810

- Average credit score: 703

- Median household income: $57,341

- Unemployment rate (2020 average): 7.3%

Photo Credit: Sean Pavone / Shutterstock

13. Alabama

- Credit card delinquency rate: 9.14%

- Credit card debt balance per capita: $2,330

- Average credit score: 686

- Median household income: $51,734

- Unemployment rate (2020 average): 5.9%

Photo Credit: Felix Mizioznikov / Shutterstock

12. Louisiana

- Credit card delinquency rate: 9.34%

- Credit card debt balance per capita: $2,430

- Average credit score: 684

- Median household income: $51,073

- Unemployment rate (2020 average): 8.3%

Photo Credit: ESB Professional / Shutterstock

11. Georgia

- Credit card delinquency rate: 9.52%

- Credit card debt balance per capita: $3,110

- Average credit score: 689

- Median household income: $61,980

- Unemployment rate (2020 average): 6.5%

Photo Credit: Sean Pavone / Shutterstock

10. Mississippi

- Credit card delinquency rate: 9.66%

- Credit card debt balance per capita: $2,080

- Average credit score: 675

- Median household income: $45,792

- Unemployment rate (2020 average): 8.1%

DID YOU KNOW?

Prospective employers have the right to review your credit profile as part of a hiring process. So, can you get a job with bad credit? The answer depends on the employer.

Photo Credit: Sean Pavone / Shutterstock

9. New Mexico

- Credit card delinquency rate: 9.81%

- Credit card debt balance per capita: $2,510

- Average credit score: 694

- Median household income: $51,945

- Unemployment rate (2020 average): 8.4%

Photo Credit: Sean Pavone / Shutterstock

8. New York

- Credit card delinquency rate: 10.35%

- Credit card debt balance per capita: $3,410

- Average credit score: 718

- Median household income: $72,108

- Unemployment rate (2020 average): 10.0%

Photo Credit: Sean Pavone / Shutterstock

7. Oklahoma

- Credit card delinquency rate: 10.36%

- Credit card debt balance per capita: $2,450

- Average credit score: 690

- Median household income: $54,449

- Unemployment rate (2020 average): 6.1%

Photo Credit: Sean Pavone / Shutterstock

6. California

- Credit card delinquency rate: 10.41%

- Credit card debt balance per capita: $3,230

- Average credit score: 716

- Median household income: $80,440

- Unemployment rate (2020 average): 10.1%

Photo Credit: Sean Pavone / Shutterstock

5. Texas

- Credit card delinquency rate: 10.49%

- Credit card debt balance per capita: $3,080

- Average credit score: 688

- Median household income: $64,034

- Unemployment rate (2020 average): 7.6%

Photo Credit: Sean Pavone / Shutterstock

4. Arkansas

- Credit card delinquency rate: 10.74%

- Credit card debt balance per capita: $2,300

- Average credit score: 690

- Median household income: $48,952

- Unemployment rate (2020 average): 6.1%

Photo Credit: Sean Pavone / Shutterstock

3. Arizona

- Credit card delinquency rate: 10.93%

- Credit card debt balance per capita: $3,030

- Average credit score: 706

- Median household income: $62,055

- Unemployment rate (2020 average): 7.9%

RELATED

During tough economic times, it’s especially important to maintain good credit. For help, check out our comprehensive guide on how to build credit.

Photo Credit: Sean Pavone / Shutterstock

2. Florida

- Credit card delinquency rate: 11.94%

- Credit card debt balance per capita: $3,340

- Average credit score: 701

- Median household income: $59,227

- Unemployment rate (2020 average): 7.7%

Photo Credit: Sean Pavone / Shutterstock

1. Nevada

- Credit card delinquency rate: 13.32%

- Credit card debt balance per capita: $3,220

- Average credit score: 695

- Median household income: $63,276

- Unemployment rate (2020 average): 12.8%

Detailed Findings & Methodology

The data used in this analysis is from the Federal Reserve Bank of New York’s Household Debt and Credit Report, Experian’s 2020 Consumer Credit Review, the U.S. Census Bureau’s 2019 American Community Survey, and the U.S. Bureau of Labor Statistics’ Local Area Unemployment Statistics. To determine the states with the most credit card debt, researchers ranked states based on the percentage of credit card debt balance 90+ days delinquent in Q4 of 2020. In the event of a tie, total credit card debt per capita was considered.