Starting a Business as an Immigrant to the U.S.

Published on: 10/10/2019

Many people come to America to fulfill the dream of a better life, including access to education, employment, housing, and, at times, improved health care and a more developed infrastructure.

Often, immigrant entrepreneurs start businesses, work in professional services, retail, restaurants, real estate, technology, healthcare or construction. They sometimes own franchises and small businesses like grocery stores, gas stations and fast food restaurants.

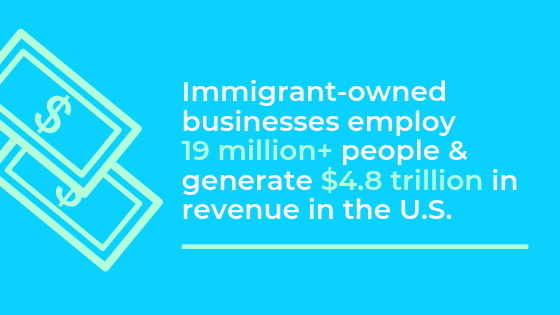

Beyond helping themselves, many have added to our domestic economic growth as immigrant entrepreneurs. In 2016, the National Immigration Forum found that immigrant-owned businesses employ more than 19 million people and generate $4.8 trillion in revenue.

This is an increase from the 2013 report backed by Harvard, which noted that immigrants added $1.6 trillion to the total U.S. gross domestic product (GDP).

A statistical analysis based on the American Community Survey and the Survey of Small Business Owners concluded that immigrants account for approximately 28% of all U.S. small business owners.

Plus, they are two times more likely to become entrepreneurs than native-born people. Even more compelling is research from the National Foundation for American Policy which reported that 55% of the country’s $1 billion startup companies have at least one immigrant founder.

These enormous economic contributions come at a cost for immigrants who struggle to create these types of small business opportunities. Here’s why...

Possible, but with challenges

If you’re wondering if it’s possible for an immigrant (who is not a permanent resident) to start a business in the U.S., the answer is yes. The statistics above prove that many immigrants are accomplishing these business goals. But, it takes time and patience as immigrants do need to overcome considerable challenges.

First, unless you’re a permanent resident, there are no visa categories for immigrant entrepreneurs.

As an immigrant investor, though, it is possible to get an EB-5 visa. But you’ll need more than $1 million to invest with the ability to hire employees. Unfortunately, that only applies to a very small number of immigrants.

Despite many in government working on the Startup Act, the idea of a startup visa is still just that – an idea.

On the other hand, foreign nationals can get a visa as a family, student or visitor, and a work permit as a worker for a certain company or project.

International Entrepreneur Rule and current options

Introduced by President Obama late in his second term, the International Entrepreneur Rule (IER) sought to make entrepreneurship accessible to more immigrant founders.

This rule would have given immigrant founders 2.5 years to scale their companies in the U.S. (and another 2.5 years if companies met growth requirements). The hope was that the IER would help stimulate business opportunity for entrepreneurs wanting to move to the U.S.

However, the Department of Homeland Security under President Trump fought usage of the IER and plans to rescind it.

Until further progress happens or other legislation passes, foreign nationals who want to start a company must use the existing visa system to declare their immigration status. This includes the H-1B, E-2 treaty investor, or EB-5 Investor Program options.

The type of visa you select has certain criteria. If you have an established business outside of the U.S. that is at least a year old and employs four or more people, then the L-1A visa is an option.

If your business is less than 12 months old or has fewer than four employees, then the E-2 visa is an option. This visa would also be ideal for an immigrant who does not have a business outside of the U.S., but is moving here to start one.

There’s also the O-1 visa for an individual or student who can prove they have extraordinary ability or achievement in areas like sciences, arts, education or athletics, which may benefit the U.S.

Starting a business as a non-resident

Immigrant business owners don’t need to have resident status to open a business and file taxes. Like other small business owners, immigrants should first select a company structure, such as a C corporation that can include resident investors, or a limited partnership structure.

The next step is to register in a particular state like Delaware that offers flexible corporate rules. For example, Delaware doesn’t require a bank account or local physical address. After picking a state, select a company name and registered agent as well as fill out a certificate of incorporation.

The process of starting a business also includes getting an Employer Identification Number. You need this for tax purposes, for getting a business license and for opening a bank account.

There are financial advisors who may also specialize in helping immigrant entrepreneurs complete this part of the startup process.

Things to remember

There’s one main thing to consider about starting and managing a business in the U.S. as a non-permanent resident – it does not come with automatic work privileges. That means a foreign entrepreneur can be a corporate officer or director of a startup or established company.

However, immigrants cannot work in the U.S. or receive a salary without first getting a work permit. Examples of this include a green card or a special visa issued by the U.S. government. A foreign citizen can still earn profits from their company, but they must pay the proper taxes on those profits.

Also, they can only receive compensation from a branch of the same company located in their home country. Therefore, an immigrant entrepreneur must make sure they have enough money to support themselves until they get a green card or become a citizen.

Business resources for immigrant entrepreneurs

Starting a business can be a challenge for anyone, especially for someone new to the country who is unfamiliar with processes and laws. Fortunately, there are numerous resources available to help immigrant small business owners succeed.

Sites like the U.S. Small Business Administration focus on helping entrepreneurs grow their businesses, offering education, financial assistance and templates. Other organizations like Immigrant Biz provide a directory of resource options, including micro-lenders that specifically help immigrants, as well as local loan programs by state for immigrants.

Venture capital, funding options and loans for immigrants

If you don’t have full resident status, you cannot get a social security number (SSN), which is a critical number for opening most bank accounts, getting loans and obtaining credit.

While some financial institutions will accept Individual Taxpayer Identification Numbers (ITINs) instead, it’s not a guarantee.

Another option for funding is grants for immigrants. These include business development grants for immigrants who have small businesses but are socially or economically disadvantaged.

The Department of Health and Human Services provides discretionary grants focused on financial literacy. They also offer specialized training like business plan development and marketing for immigrants from Cuba, Haiti and Asia.

The Wilson/Fish Program managed by the U.S. Department of Health and Human Services also provides refugee and entrant help. This is a cooperative-agreement grant limited to immigrants from:

- Cuba

- Haiti

- Iraq

- Afghanistan

- Some Asian countries

The grant includes services, funded projects in immigrant communities and cash assistance for eight months.

Additionally, it’s possible to build credit as a new immigrant, so you can tap into more funding that may help fuel business growth. While it may take some time, this option can help provide additional funding if you can wait to start your business.

It can also help you after you use up any grants, crowdfunding, or other funding.

About the author

John Boitnott is a longtime digital media consultant and journalist who covers technology trends, startups, entrepreneurship and personal finance for Inc, Entrepreneur, Business Insider, USA Today and other major publications.