How to Update Your Credit Report Quickly (Rapid Rescoring)

Published on: 03/26/2023

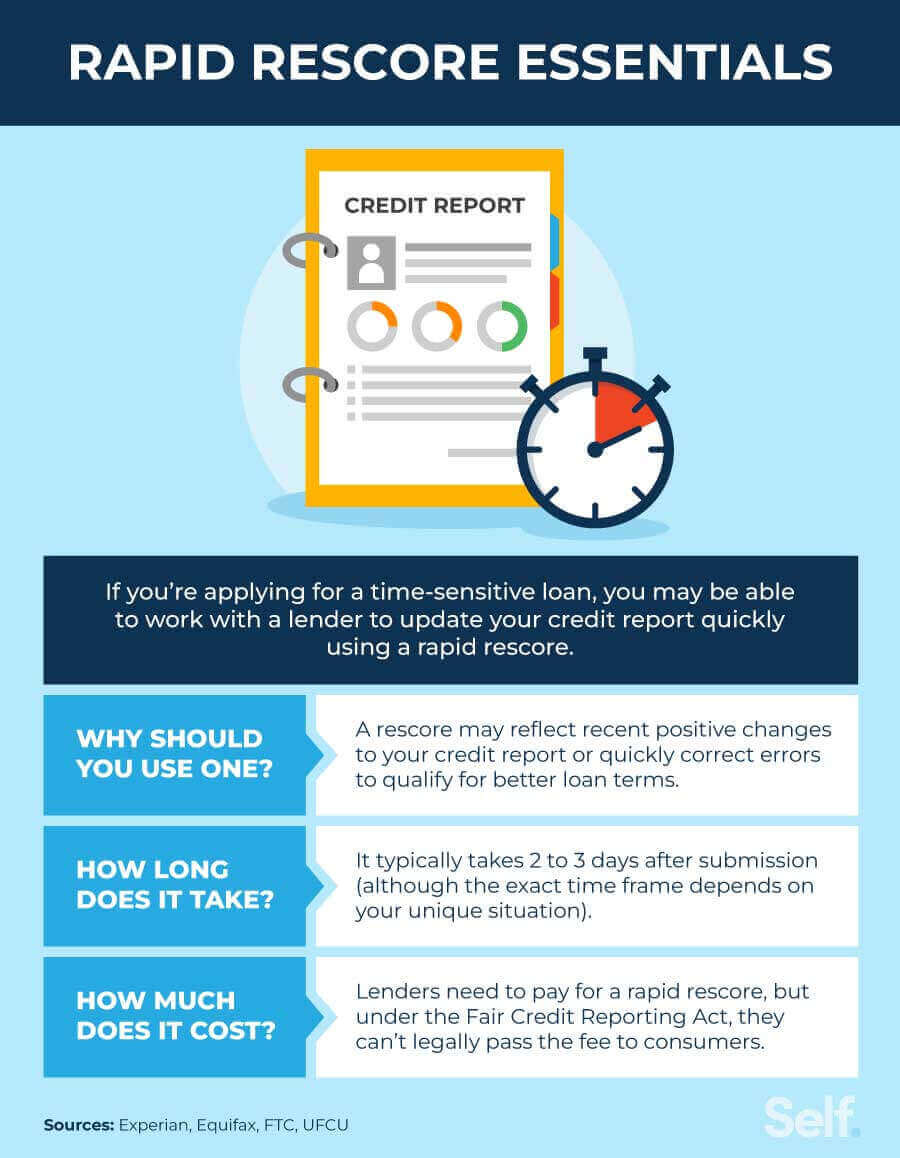

In some instances, when you want your credit report updated quickly, you can speed up the process through rapid rescoring. With rapid rescoring, a lender, typically a mortgage lender, submits proof of recent changes to your credit accounts to the three major credit bureaus. This is something you cannot do yourself.[1]

If you’ve recently made payments that may help you qualify for better terms on a time-sensitive loan, you probably want this factored into your score, but lenders typically update your account information only periodically, anywhere from 30 to up to 45 days. However, with a rapid rescore, they can factor in your updated information slightly faster to get you a new, updated score.[2] A rapid rescore can generally be completed two to three business days after the lender submits the documentation, although the time it takes varies by lender.[1]

If you think recent actions you’ve taken could help elevate your credit score, this post explains how a rapid rescore works and how it may work in your favor.

What is a rapid rescore and how does it work?

With a rapid rescore, you request that your lender submits updated information to one or multiple credit bureaus so that an updated, and hopefully, elevated score can be generated.[2] This may be beneficial if you are applying for a loan and your current credit score is just a few points below what you need to get better loan terms, such as a lower interest rate on a mortgage loan or to simply get approved. If you are facing this situation, your lender may recommend, or initiate for you, a rapid rescore.[1]

It may reflect changes to your credit utilization ratio

Your credit utilization ratio (CUR) factors into your credit score. Your CUR is calculated by taking your total revolving debt and dividing it by your total revolving credit limits. Experts suggest maintaining a CUR below 30% but add that staying under 10% offers the best chance at adding a positive impact to your credit score.[3]

If a high CUR is affecting your credit score, paying down a large credit card balance (and having that change reflected in your credit report using a rapid rescore) may positively impact your credit score.[1]

It may help quickly correct errors on your credit report

You should also consider a rapid rescore to speed up the process of disputing any errors you suspect exist on your credit report. Doing so can save you time and frustration. Rather than trying to resolve the errors yourself,[4] which may take up to 30 days,[5] a rapid rescore may correct mistakes reported by creditors quicker. However, be aware that a rapid rescore is a different process than credit repair.

Examples of such errors include items, such as debts caused by identity theft or accounts that are reported more than once, that create the impression that you have more open lines of credit or more debt than you actually have.

How do you get a rapid rescore?

The process of getting a rapid rescore is not complicated and requires just two simple steps:

- You have to request that your lender initiates a rapid rescore because you can’t initiate one on your own. Your lender may also suggest this to you.

- If the lender agrees or has recommended you pursue it, the lender will pay a fee to the credit reporting company (Experian, TransUnion or Equifax) to have recent account changes updated in an expedited time frame. You will need toneed to provide proof of the account changes for a lender to submit the rapid rescore.[2]

How long does rapid rescoring take?

The main benefit to getting your credit report updated using a rapid rescore is that you can update your credit report when you need to, rather than wait the typical 30 to 45 days for an update to occur. In contrast, after a lender submits the documentation, a rapid rescore is typically completed and your credit report is updated within two to three days (although the exact time frame depends on your unique situation and the lender).[1]

How much does rapid rescoring cost?

A rapid rescore is done at no cost to the person requesting one. Although there is a fee lenders pay the credit bureaus to perform a rapid rescore, the cost can’t be passed to the consumer under the Fair Credit Reporting Act (FCRA), which prohibits the lender from charging their clients to correct or dispute credit report information.[6]

Limitations of rapid rescoring

Although a rapid rescore can be an excellent solution when you need to update your credit report fast, the process does have some limitations. For one thing, a rapid rescore may lead to only a small increase in your credit score, no increase at all, or possibly even a decrease, so you should check your credit report and weigh your options before proceeding with a rapid rescore request through your lender.

It won’t remove legitimate negative information

A rapid rescore also does not have the power to remove legitimate negative information; it can only correct or delete actual errors.[4] A rapid rescore won’t undo the damage of previous financial mistakes such as late payments, high credit card debt or collection accounts.[2]

It might only incrementally improve your credit score

Ensure that your expectations are realistic when considering the rapid rescore option. A rapid rescore is typically only used if your credit score is close to the score you need to qualify for a loan or a better rate, so you shouldn’t expect it to improve your credit score more than incrementally.[1]

It may backfire

You should be aware that, in some cases, a rapid rescore can have the undesirable effect of actually lowering your credit scores.[2] For example, if you recently had a late payment on a credit card or a missed payment on your home loan, this would negatively affect your payment history, the most important factor in your credit score. Instead of an incremental lift, you may see your score drop after your credit file is updated. So when making decisions about your personal finances, make sure you don’t do anything to damage your credit leading up to and while working with loan providers for a rapid rescore.

It’s not the same as rebuilding your credit

While a rapid rescore can benefit you if you are applying for a loan, the process cannot undo or remove months or years of negative items in your credit history. It takes time to rebuild your credit.[2] Negative marks stay on your report for 7 to 10 years, but their impact on your score lessens over time, so as you make good decisions with your credit and finances, you can impact your score positively over time.[3]

Other ways to quickly improve your credit

A rapid rescore is not your only option when you want to improve your credit score. But note that alternatives to getting a rapid rescore take considerably longer — it typically takes 30 to 45 days for lenders to report any changes to the bureaus, so you may not see changes for one to two months.

Proactively monitor your credit report and dispute errors

Credit monitoring helps you not be surprised when applying for personal loans, mortgages, or other types of loans and credit. Proactively monitor your credit report and ensure that your report contains no errors and dispute them if there are. Knowing what’s already contained in your credit report gives you a more informed idea of what potential lenders will see.

By law, you can obtain a free credit report once a year at no cost from each of the major credit bureaus, which you can access at AnnualCreditReport.com. Because of the COVID pandemic, the three major credit reporting bureaus (Experian, Equifax and TransUnion) continue to offer free credit reports weekly until the end of December 2023.[7]

Key takeaways

A rapid rescore is a process that may help you when you are applying for a loan such as a mortgage. Its function is to dispute errors that reflect negatively on your credit score or to update it to include information that can elevate your score. In addition to a rapid rescore, you can work on rebuilding your credit by accessing the tools and products that Self provides to inform your credit-building efforts.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Experian. “What Is a Rapid Rescore?” https://www.experian.com/blogs/ask-experian/what-is-rapid-rescore-should-i-consider/. Accessed January 3, 2023.

- Equifax. “What Is a Rapid Rescore?” https://www.equifax.com/personal/education/credit/score/what-is-a-rapid-rescore/. Accessed January 3, 2023.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed January 3, 2023.

- UFCU. “Rapid Rescoring for Credit Report Errors,” https://www.ufcu.org/personal/learn/tools-advice/financial-advice/conquer-financial-challenges/rapid-rescoring-for-credit-report-errors. Accessed January 3, 2023.

- Federal Trade Commission. “Disputing Errors on Your Credit Reports,”

https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed January 3, 2023. - FTC. “Fair Credit Reporting Act.” https://www.ftc.gov/system/files/ftc_gov/pdf/545A-FCRA-08-2022-508.pdf. Accessed January 3, 2023.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed January 3, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).