FHA vs. Conventional Loans for Mortgages

Whether you’re ready to buy your first house, looking to make a home upgrade, or downsizing for retirement, you have an important decision to make. How will you finance your home? You might not realize it, but when it comes to mortgages you have multiple options.

The home buying process generally begins by meeting with a mortgage loan officer who will help guide your decision. That initial meeting might take place in person, over the phone, or online. You’ll need to submit a mortgage application and satisfy the mortgage lender’s qualification criteria before you’re officially ready to buy a house.

Unless you're eligible for a VA loan or you plan to buy a home in a rural community where USDA loans are available, you'll likely need to choose between two popular mortgage options - an FHA vs conventional mortgage loan.

This guide provides a breakdown of each loan type to help you determine if one of them might be the right fit for your home buying needs. Read on to find out everything you need to know about an FHA vs conventional loan.

What is a conventional mortgage?

Before we can discuss the difference between an FHA loan vs conventional loan, we first have to look at each individually. A conventional mortgage is a type of home loan that is not guaranteed by a government agency, such as the Veterans Administration or the Federal Housing Administration. Instead, the loan is backed by a private lender like a credit union or bank.

Conventional home loans come in two varieties — conforming and non-conforming. Conforming conventional mortgages are the most popular.

Conforming conventional mortgages satisfy Fannie Mae or Freddie Mac requirements. (Fannie Mae and Freddie Mac are known as government-sponsored enterprises or GSEs.)

With a conforming conventional mortgage, a lender can sell the loan to one of the GSEs in the future. This frees up the lender's cash to make new mortgages for other home buyers, rather than having the mortgage on its own books for up to 30 years.

Non-conforming mortgages, by comparison, don’t meet Fannie Mae or Freddie Mac requirements. So, they can’t be sold to a GSE after your loan closing.

This represents more risk for the original lender. As a result, you usually have to meet a higher standard to qualify for non-conforming mortgages.

Conventional mortgage requirements (conforming loans)

To qualify for a conforming conventional loan you’ll need to satisfy a series of Fannie Mae or Freddie Mac requirements. Certain mortgage lenders may also add their own additional stipulations, known as lender overlays, before they will approve your loan application.

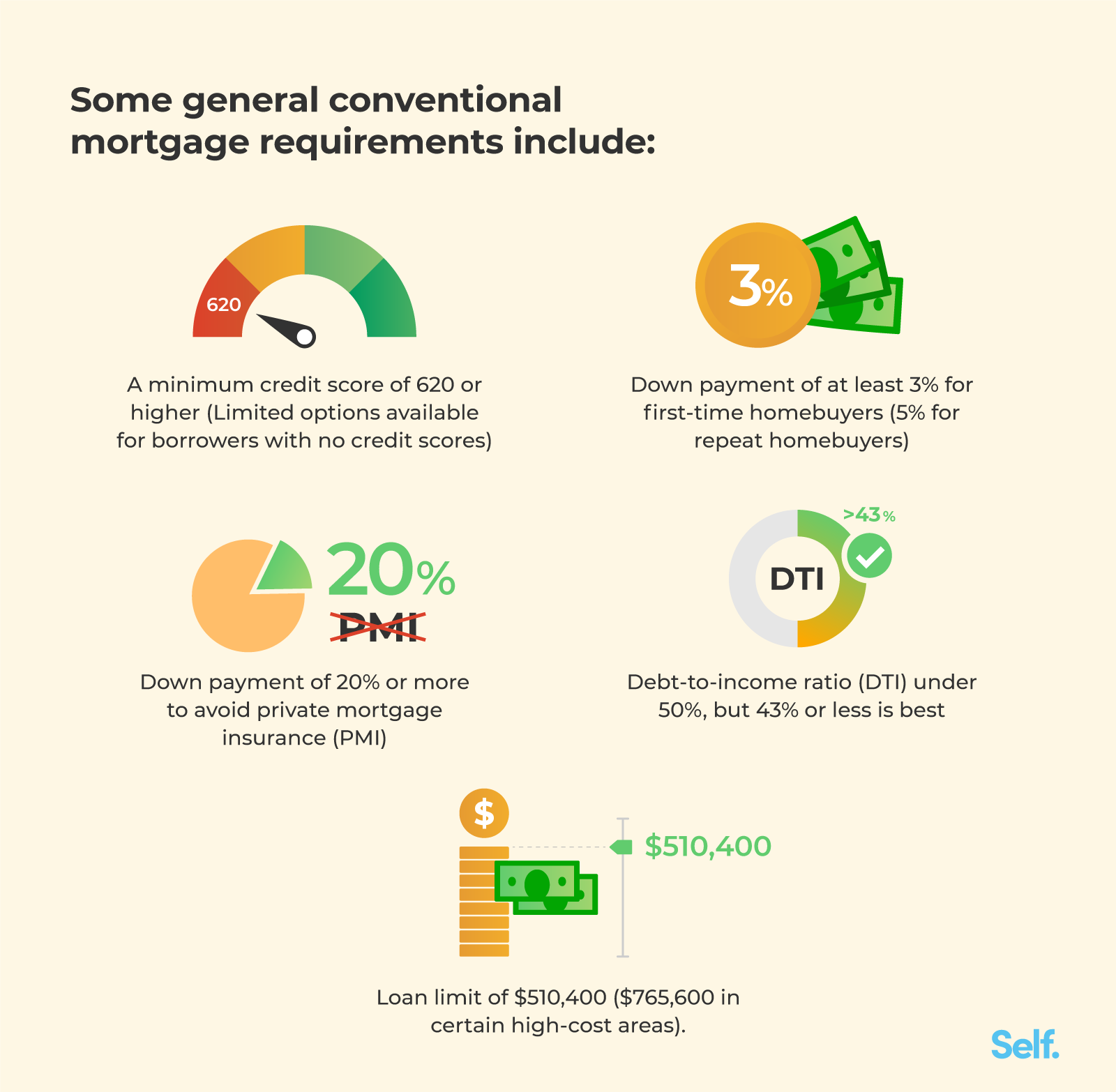

Some general conventional mortgage requirements include:

- A minimum credit score of 620 or higher (Limited options available for borrowers with no credit scores)

- Down payment of at least 3% for first-time home buyers (5% for repeat homebuyers)

- Down payment of 20% or more to avoid private mortgage insurance (PMI)

- Debt-to-income ratio (DTI) under 50%, but 43% or less is best

- Loan limit of $510,400 ($765,600 in certain high-cost areas).

Benefits of conventional mortgages

Reasons you may want to consider a conventional mortgage include:

- You can skip private mortgage insurance and lower your monthly payment if you put down at least 20% of your loan amount.

- Cancel PMI (if you have it on your loan) once you reduce your loan balance to 78% of the purchase price.

- Loan limits are usually higher, helping you purchase a higher-priced property.

- You can potentially avoid some of the closing costs associated with FHA loans and other types of mortgages.

- You may be able to use the loan for investment property purchases or second homes.

What is an FHA mortgage?

An FHA mortgage is a type of home loan that’s backed by the federal government. Specifically, the Federal Housing Administration insures the FHA lender who holds your mortgage in case you stop making your mortgage payment.

If you default on your mortgage, the lender can file an insurance claim for the remaining unpaid balance (principal only) on your loan, according to the Federal Housing Administration.

As a borrower, you pay for an FHA mortgage insurance premium as part of your FHA home loan. Because of mortgage insurance, the lender's risk is lower with FHA financing compared with other types of mortgages, including a conventional home loan. So, the lender may be willing to do business with borrowers who have lower credit scores and smaller down payments than it would typically accept.

FHA loan requirements

To qualify for an FHA loan, you will need to satisfy several requirements (not to mention potential FHA lender overlays).

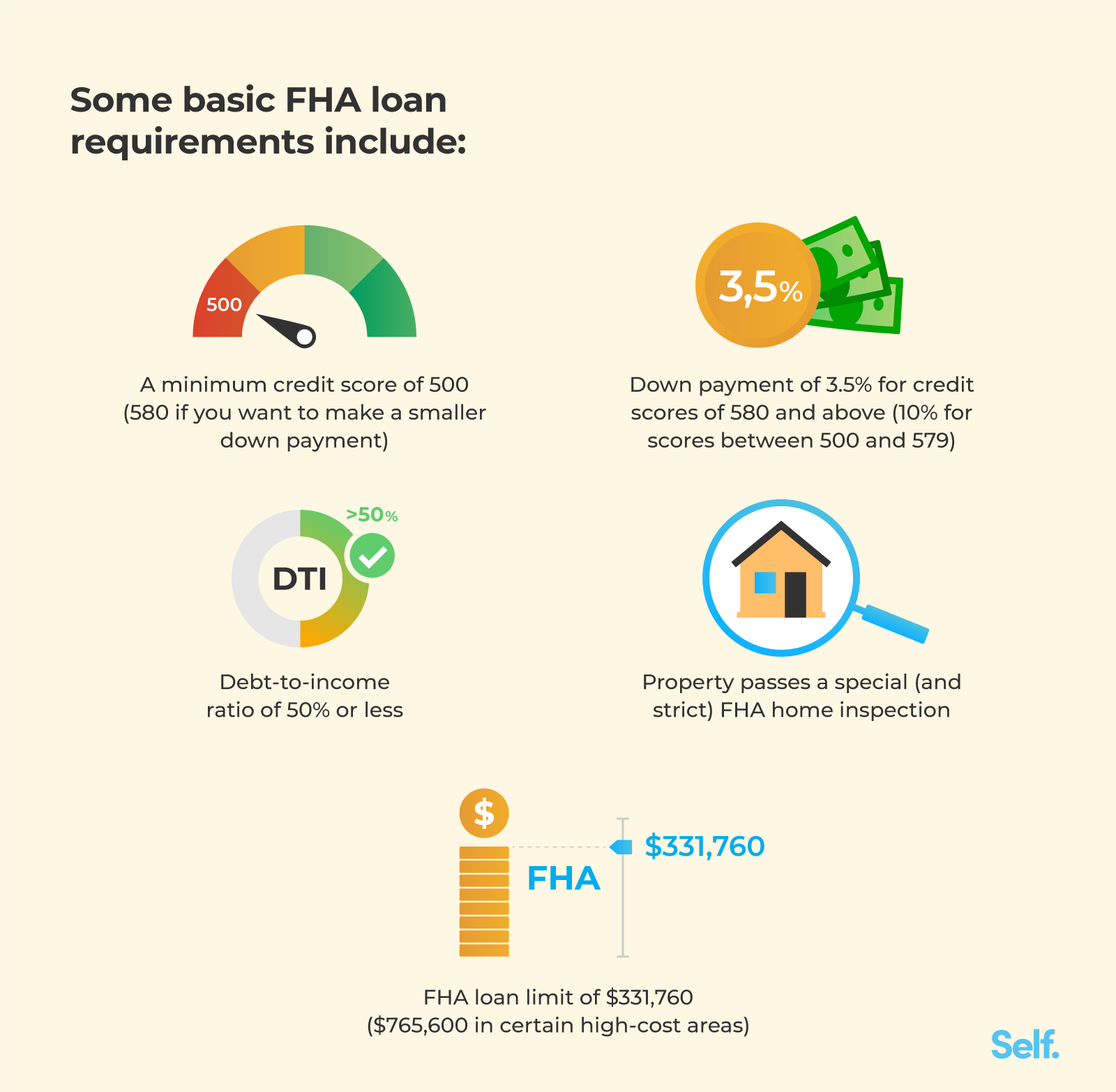

Some basic FHA loan requirements include:

- A minimum credit score of 500 (580 if you want to make a smaller down payment)

- Down payment of 3.5% for credit scores of 580 and above (10% for scores between 500 and 579)

- Debt-to-income ratio of 50% or less

- Property passes a special (and strict) FHA home inspection

- FHA loan limit of $331,760 ($765,600 in certain high-cost areas)

Benefits of FHA mortgages

- Credit requirements are easier to satisfy than those you may face with other types of home loans, so you may qualify even with a lower than average credit score.

- Lenders may accept higher debt-to-income ratios on an FHA mortgage loan than on conventional mortgages.

- You may be able to use documented “gift money” from a loved one toward your down payment.

- Qualify for an FHA loan after bankruptcy or foreclosure sooner than you may qualify for a conventional mortgage after the same type of financial setback.

- For borrowers trying to buy a house with no credit scores, it’s typically easier to qualify for an FHA loan than a conventional mortgage.

Side-by-side comparison: FHA vs Conventional Mortgage

As you can see, there are many differences between conventional mortgages and FHA loans.

Here's a comparsion guide that you can use as a cheat sheet when comparing evaluating the two loan options.

Conventional Mortgage

Minimum credit score: 620 (Some lenders require a higher minimum score)

Down payment requirement: As low as 3% (20% of loan amount to avoid PMI)

Repayment terms: Up to 30 years

Interest rates: Usually lower than FHA mortgages

Mortgage insurance requirements: Avoid PMI with 20% down payment or cancel PMI once you have 22% home equity

2020 loan limits: $510,400 to $765,600, Jumbo loans available for loans that exceed limits

Investment properties and second homes: Financing available

Post-bankruptcy mortgage: 7 year waiting period

Post-foreclosure mortgage: 2-4 year waiting period (based on type of bankruptcy)

FHA Mortgage

Minimum credit score: 580 (or 500 with a 10% down payment)

Down payment requirement: 3.5%

Repayment terms: Up to 30 years

Interest rates: Usually higher than conventional mortgages

Mortgage insurance requirements: FHA mortgage insurance for life of loan if down payment under 10%. Cancel after 11 years with 10% down payment.

2020 loan limits: $331,760 to $765,600, No jumbo loan option available

Investment properties and second homes: No financing available

Post-bankruptcy mortgage: 3 year waiting period

Post-foreclosure mortgage: 0-2 year waiting period (based on type of bankruptcy)

How to choose the best loan option for your situation

There’s no such thing as a universally perfect mortgage loan. Yet there may be a perfect loan for your situation.

If you have some credit challenges or a high debt-to-income ratio, an FHA loan might be the best fit for you. Of course, you’ll need to make sure you’re comfortable with lower FHA loan limits and paying potentially higher interest rates in exchange for the added leniency from the lender.

Borrowers with strong credit scores and lower debt to income ratios, on the other hand, may be able to save money with a conventional mortgage. These loans are also a better choice if you wish to buy a home that costs more than FHA loan limits allow.

Some borrowers may be able to qualify for both an FHA and a conventional mortgage. If you’re in this position, consider yourself lucky. You have more options to choose from and can compare the overall costs of each loan to save money when you buy a home.

Remember, buying a home can be a big financial decision. Saving money ahead of time and being financially stable can help you make these big decisions when it comes time to purchase a home.

Related article: Apps to Help Save Money

Rate shopping

Choosing your preferred loan type is only one of the decisions you’ll need to make when you’re shopping for a new home loan.

You’ll also need to find the lender who offers you the best deal on the type of mortgage you choose. To do this, compare interest rates and fees from multiple lenders.

The CFPB [2] cautions that not shopping for the best interest rate equals money lost for consumers. Rate shopping might save you tens of thousands of dollars in interest over the life of your mortgage.

In fact, studies show [3] that the average American can save nearly $50,000 on a 30-year mortgage by comparing offers from multiple mortgage lenders before they buy a home.

Worried about hurting your credit scores with multiple mortgage applications?

You can rest easy.

Credit scoring models like FICO and VantageScore use logic that doesn’t penalize you for rate shopping (within a limited period of time and for certain types of loans).

Depending on the credit scoring model, several mortgage-related credit inquiries within a 14-45 day window will count only once for credit scoring purposes.

Bottom line

Buying a home can be an exciting adventure at any stage of your life. But in the midst of the excitement, be sure to take your time and review all of your options when it comes to finding the right loan term and insurance.

It's also helpful to check your credit reports for errors and improve your credit as much as possible before you start filling out mortgage applications.

Higher credit scores often leads to lower interest rates and significant savings for you as a home buyer. It’s well worth waiting a few extra months or even a year to start home shopping if you can improve your credit and save thousands of dollars for the effort.

For those who have a bad credit score or no credit score at all, it’s highly recommended to start building good credit so you can qualify for these types of loans in the future. If you find yourself in this situation, consider getting a credit builder loan from Self Financial today.

About the author

Michelle L. Black is a leading credit expert with over 17 years of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting and debt eradication. See Michelle on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.