How to Remove Closed Accounts from your Credit Report

Published on: 11/03/2022

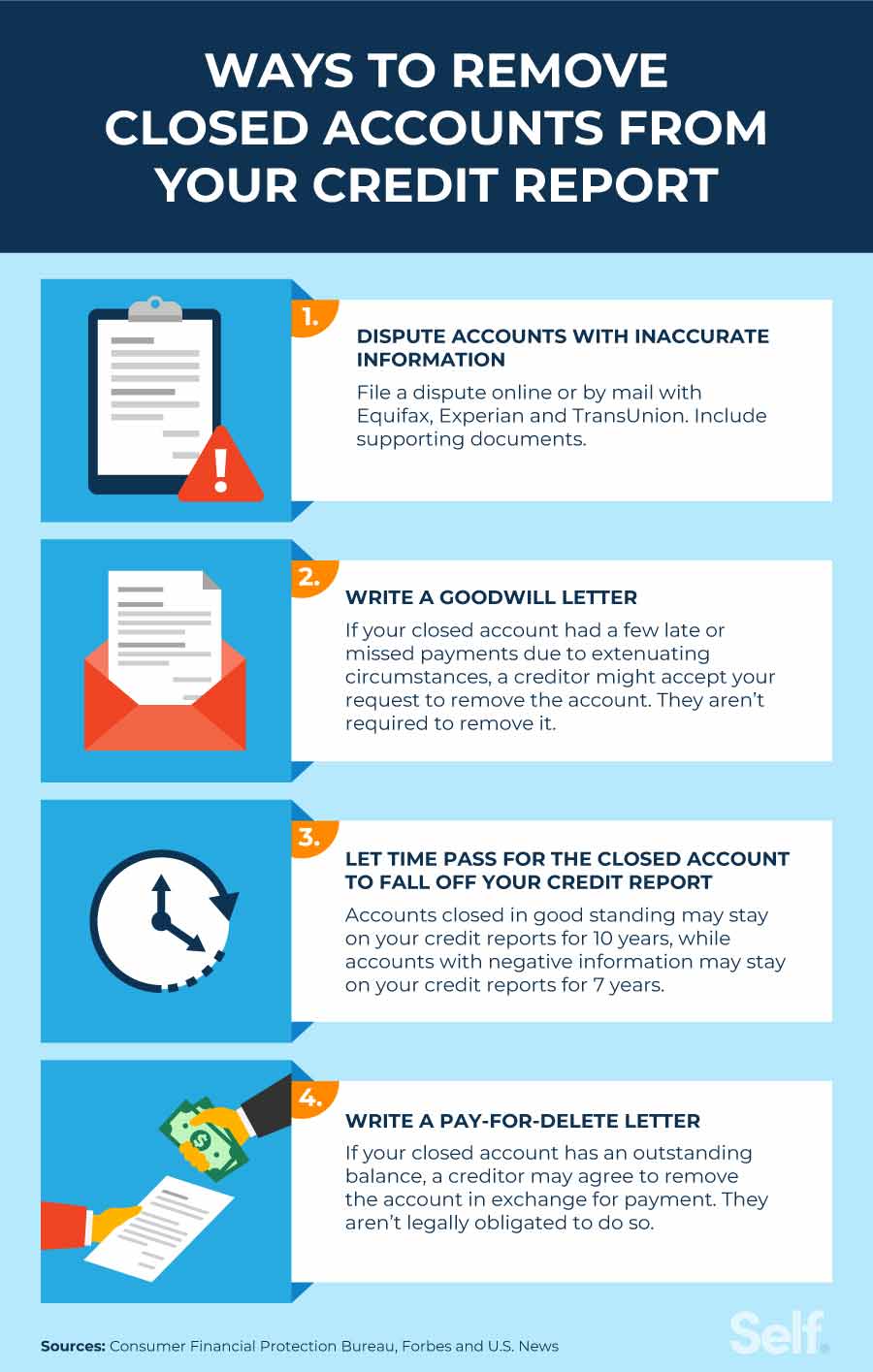

If you want a closed account removed from your credit report, you have a few options: disputing inaccuracies, waiting for it to fall off your report, requesting it by writing a goodwill letter, or writing a pay-for-delete letter. Because closed accounts with negative marks remain part of your credit history for seven years, you may want to remove them from your credit report. Accounts in good standing, however, stay on your report for 10 years, so they may be something positive to keep in your credit history.[1]

If you want to remove closed accounts from your credit report, this article gives you all the details on how to remove them, including which ones you should consider removing.

Table of contents

- Which closed accounts should you consider removing?

- How do you remove closed accounts from your credit report?

- How do closed accounts impact your credit score?

- Improve your credit moving forward

Which closed accounts should you consider removing?

If you have closed an account in good standing — meaning you’ve made on-time payments and satisfied the terms of the agreement with your creditor — by staying on your credit report it will help your credit.[2] Keeping a positive account open can add additional benefits to your credit because the length of your credit history counts for 15% of your FICO® score. So the longer it is open, the greater the depth of your credit history.[3]

When accounts with missed payments or other derogatory information are removed from your credit report, you can benefit because your payment history makes up 35% of your FICO score.[4]

Your accounts may be closed for a variety of reasons. In some instances, you may choose to close an account yourself. In others, a credit card company may close your account with or without notice. These examples give you an idea of why some accounts may be closed by your lender:

- Missed payments or nonpayments: A creditor may close your account and, after anywhere from 120 to 180 days of nonpayment, refer it to a collections agency, which is known as a charge-off.[5] A charge-off can occur on both installment or revolving accounts, but your lender on an installment loan will not “close” your account for nonpayment. The lender will continue to report your delinquency on the installment loan until that charge-off date at which time they will show your unpaid balance as a charge-off. If you are no longer making payments on your credit card, however, the issuer may close your account to keep you from running up more debt. This revolving account will appear as “closed” on your credit report, and the negative payment history will appear as well.[6], [7]

- Inactivity: If you haven’t used your credit card for a period of time, the credit card issuer may close your account for inactivity. Although the Credit Card Act of 2009 requires creditors to provide you with 45 days’ notice of major changes to your account, closing your account due to inactivity is not included. A creditor can do this without notice. The point at which a card is considered inactive varies according to each individual lender’s policies.[8]

If your lender closes your account for these reasons, your credit score may be negatively impacted. Missed payments and non-payments will hurt your score because your payment history makes up 35% of your FICO® score. A closed credit card account could increase your credit utilization and potentially your credit mix, both of which might have an negative impact on your score.[2] So you may want to try removing them from your credit history. In the coming sections, we provide four ways you may be able to remove a closed account with negative marks from your credit report.

Leave accounts in good standing open

An account in “good standing” refers to accounts for which you made on-time payments and satisfied the terms of your agreement with your creditor.[2] Because the credit bureaus will keep these types of good standing accounts on your credit report that have been closed for 10 years, they should help your credit score. Since payment history impacts your FICO® score the most, having these closed revolving accounts on your report that were paid on time may have a positive impact on your score.[4]

Voluntarily closing your credit card account with a zero balance may sound like a good idea. However, you may want to consider leaving such an account open. Doing so can have a positive impact on your credit score:

- Credit utilization ratio (CUR): Your credit utilization ratio refers to your revolving debt balances divided by your total credit limits. FICO includes this ratio in the second-biggest factor in determining your FICO® score — amounts owed — counting for 30% of your score. Experts recommend keeping your CUR below 30% and ideally below 10%. So if your total revolving balances equaled $1,500, and your total revolving credit limits equaled $7,500, your CUR would be 20%. However, if you removed a closed account with a zero balance that had a credit limit of $2,500, you lower your total revolving credit limit to just $5,000, making your CUR jump to 30%.[9]

- Payment history: Your payment history accounts for 35% of your FICO® score. Leaving an account that has been closed — but that met the terms of the creditor’s agreement and had on-time payments — on your credit report can help your FICO® score because of the positive payment history on that account.[4]

- Credit history length: The longer you keep an account open with positive payment history, the more it contributes to the length of your credit history. The third-biggest factor in determining your FICO® score, your length of credit history, shows potential creditors that you can handle credit responsibly and have done so over an extended period of time. Depending on your unique credit history, closing a credit account, especially one you have had for a long time, may shorten your credit history and negatively impact your score once this account falls off your credit report.[10]

How do you remove closed accounts from your credit report?

If you want to remove a closed account from your credit report, you have four ways you might consider doing so, depending on your situation.

1. Refute inaccurately reported accounts

Credit bureaus must delete inaccurate, incomplete or unverifiable information under the Fair Credit Reporting Act (FCRA).[11] Types of errors that may occur on your credit report include

- Inaccurate payment dates

- Duplicate debt listings

- Closed accounts reported as open

- Balance errors

- Identity errors

For example, if you know you’ve made all your student loan or mortgage payments on-time as agreed, but your credit report shows you’ve missed a payment, you can dispute the inaccurate information with the credit reporting agencies. If you paid your car loan in full, but the lender shows a balance, you can dispute that as well.

First, find out what your credit report shows. You can check your credit report for errors by ordering a free credit report from annualcreditreport.com. Then if you find inaccurate information, you can dispute it by contacting the credit bureaus by mail, phone or online. Each of the three main credit bureaus — Equifax, TransUnion and Experian — has a page online that you can use to file a dispute. You should include your contact information, account number where the error was made, the nature of the error and why you are disputing it and documentation supporting your position.[12]

2. Write a pay-for-delete letter

If you missed a number of payments on a credit card account that was closed and still has a balance on it, this may be a good time to write a pay-for-delete letter. In essence, you are offering to pay your creditor or a debt collector, if the account was charged-off, in exchange for removing the negative mark from your credit report.

Debt collectors are not required to accept a pay-for-delete offer and may even take your money without deleting the negative mark as you requested.[13] If they do accept your offer, you might want to seek confirmation in writing prior to submitting the payment that they have done so and will remove the negative information from your credit reports once you honor your repayment plan.

3. Write a goodwill letter

If you’ve made a late payment but have an otherwise unblemished credit history, a goodwill letter may be an option to consider. In a goodwill letter, you write to a creditor and ask to have a negative mark removed from your credit report.[14]

Your letter should explain that you have a good reason for missing a payment, such as an unexpected illness or temporary loss of employment. It should also point out that the missed payment was not typical in light of your overall payment history. You can then outline the steps you have taken to ensure it won’t happen again.[14]

Creditors may or may not accept your goodwill letter, but a polite letter from someone with a good reason and an otherwise strong payment history may be successful.

4. Let time pass for the closed account to fall off your credit report

If you don’t want to take specific action to have negative items removed from your credit history, you can wait for them to fall off of your credit report. Different negative marks stay on your credit report for 7 to 10 years, depending on the negative mark:[1]

- Delinquencies: Delinquencies remain on your credit report for seven years from the original date of delinquency — the date your account first became delinquent. Even one 30-day late payment can trigger a delinquency and may damage your credit.[15], [16]

- Collection accounts: Accounts referred to collections stay on your credit report for seven years from the date of your first missed payment, not when it was referred to collections.[16]

- Foreclosures: Foreclosures remain on your credit history for seven years.[17]

- Chapter 7 bankruptcy: This type of bankruptcy remains on your credit history for 10 years.[17]

- Chapter 13 bankruptcy: This type of bankruptcy remains on your credit history for seven years.[17]

Fortunately, as the negative accounts age on your credit report, the less impact they’ll have on your credit score over time.[17]

A positive closed account remains on your report longer than a negative one. It can stay there as long as 10 years after the date the account is closed. Experian says it keeps positive accounts on a credit report longer to give people credit for making payments responsibly.[18]

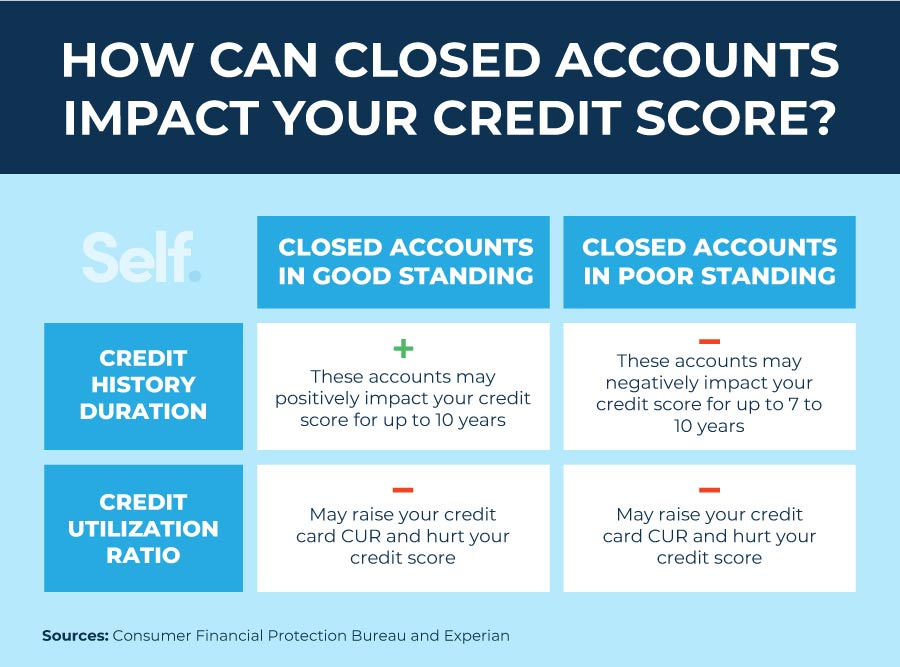

How do closed accounts impact your credit score?

Generally speaking, longer credit histories have a positive effect on your credit score, but the length of your credit history is dependent on more than one account. Credit scores can take factors like the average age of your accounts, the age of your oldest account, and how long ago you opened your newest account into consideration.[19]

Even if you close an account, it can stay on your credit history for as long as 7 or even 10 years. The two factors that a closed account may most impact include:

- Your credit history may increase or decrease since closed accounts can stay on your credit report for 7 to 10 years. In general, closed accounts with on-time payments stay on your credit report longer than negative accounts, and if you’ve had problems in the past, these accounts with positive payment history may help you rebuild your credit.[20] Even if you have closed accounts with on-time payment history their positive marks — the on-time payments — can still help you. Removing them from your credit report may actually hurt your score.

- Your credit utilization rate (CUR) could go up after a revolving credit account, such as a credit card account, is closed. You calculate your CUR by dividing your total balance by your total available credit.[9]

For example, if you have an overall available credit level of $10,000 across three credit cards and have used $2,000 on two of the cards, your CUR amounts to 20%. If you decide to close one of those accounts and it has a $0 balance and a $2,000 credit limit, your level of available credit decreases ($8,000), causing your CUR to increase to 25%.

Experts recommend keeping your CUR below 30% and say people with the best credit have a CUR under 10%. So closing accounts diminishes your available credit and can raise your CUR, and may impact your credit score negatively.[21]

Improve your credit moving forward

Regardless of whether your credit report contains negative marks, you can still improve your credit moving forward. You can use these steps to help you achieve good credit over time and improve your overall personal finances:

- Pay your bills on time. Your payment history counts for more than one-third of your FICO® score, so it makes sense to pay your bills on time.[22]

- Pay off high-balance credit cards. You may accrue more interest on high-balance credit cards, which can make it more difficult to lower your credit utilization. So focus on paying off high-balance credit cards first.[23]

- Pay down debt. Paying down other forms of debt, in addition to credit cards, can make your debt more manageable. When you do so on revolving credit accounts, including credit cards and lines of credit, you can reduce your credit utilization ratio and potentially see an increase in your credit score.[24]

- Limit the number of hard credit inquiries you have. Applying for too many loans and lines of credit in a short period of time can make it appear to lenders that you are having financial difficulty.[25] Too many applications for new credit can also hurt your credit score. Recent activity or new credit counts for 10% of your FICO® score.

- Monitor your credit card spending. Credit monitoring is a key component of ensuring you maintain good credit. Getting too close to your credit limit may leave you without a cushion in case of emergency, cost you more in interest, and hurt your credit utilization ratio. Knowing where you stand can help you keep your credit use manageable and your credit score from dropping.[25]

Removing closed accounts from your credit report is a good idea if they contain negative information and it’s feasible to do so. But this is just one potential step you can take in a comprehensive approach to building and maintaining good credit over the long term.

Sources

- U.S. News. “How to Remove a Closed Account From Your Credit Report.” https://money.usnews.com/credit-cards/articles/how-to-remove-a-closed-account-from-your-credit-report. Accessed October 19, 2022.

- MyFICO. “What's in your credit report?” https://www.myfico.com/credit-education/whats-in-my-credit-report. Accessed October 19, 2022.

- MyFICO. “What is the Length of Your Credit History?” https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed on June 29, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on June 29, 2022.

- Equifax. “What is a Charge-Off?” https://www.equifax.com/personal/education/credit/report/charge-offs-faq/. Accessed October 19, 2022.

- Experian. “The Difference Between ‘Closed’ and ‘Paid-in-Full,’” https://www.experian.com/blogs/ask-experian/the-difference-between-closed-and-paid-in-full/. Accessed on June 29, 2022.

- Experian. “Why Credit Card Companies Close Accounts Without Telling You,” https://www.experian.com/blogs/ask-experian/why-would-a-credit-card-be-closed/. Accessed on June 29, 2022.

- Equifax. “Inactive Credit Card: Use it or Lose it?” https://www.equifax.com/personal/education/credit-cards/inactive-credit-card-account-closed/. Accessed on June 29, 2022.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be/. Accessed on June 29, 2022.

- Equifax. “How Closing a Credit Card Account May Impact Credit Scores,” https://www.equifax.com/personal/education/credit-cards/how-closing-credit-cards-impact-credit-scores/. Accessed on June 29, 2022.

- Federal Trade Commission. “A Summary of Your Rights Under the Fair Credit Reporting Act,” https://www.consumer.ftc.gov/sites/default/files/articles/pdf/pdf-0096-fair-credit-reporting-act.pdf. Accessed on June 29, 2022.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed on June 29, 2022.

- Forbes. “Pay For Delete: Learn About This Collection Removal Strategy,” https://www.forbes.com/advisor/credit-score/pay-for-delete/. Accessed on June 29, 2022.

- U.S. News. “What Is a Goodwill Letter?” https://money.usnews.com/credit-cards/articles/can-a-goodwill-letter-improve-my-credit. Accessed on June 29, 2022.

- Experian. “What Is a Delinquency on a Credit Report?” https://www.experian.com/blogs/ask-experian/what-is-a-delinquency-on-a-credit-report/. Accessed October 19, 2022.

- Equifax. “How Long Does Information Stay on My Equifax Credit Report?” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report/. Accessed October 19, 2022.

- Chapter 7 & 13: How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed on July 5, 2022.

- Experian. “Should Closed Accounts Be Removed From My Credit Report?” https://www.experian.com/blogs/ask-experian/should-closed-accounts-be-removed-credit-report/. Accessed on June 29, 2022.

- Experian. “How Does Length of Credit History Affect Your Credit?” https://www.experian.com/blogs/ask-experian/length-of-credit-history-affect-credit-scores/. Accessed on June 29, 2022.

- Experian. “Closed Accounts and Your Credit History,” https://www.experian.com/blogs/ask-experian/closed-accounts-will-remain-in-credit-history-for-10-years/. Accessed on June 29, 2022.

- Experian. “Does Closing an Account Hurt Your Credit?” https://www.experian.com/blogs/ask-experian/does-closing-an-account-hurt-your-credit/. Accessed on June 29, 2022.

- Experian. “When Do Late Payments Get Reported?” https://www.experian.com/blogs/ask-experian/when-do-late-payments-get-reported/. Accessed on June 29, 2022.

- CNBC. “22% of millennials used their stimulus check to pay off credit card debt—here’s how that could improve your credit score,” https://www.cnbc.com/select/paying-off-credit-card-debt-boosts-credit-score/. Accessed on June 29, 2022.

- Experian. “How to Improve Your Credit Score,” https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/. Accessed on June 29, 2022.

- Consumer Financial Protection Bureau. “How do I get and keep a good credit score?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/. Accessed on June 29, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).