Do Evictions Show Up On Credit Reports?

Published on: 06/11/2022

After an eviction happens, many people wonder whether this shows up on credit reports — and fortunately, they don’t. However, it is important to consider the potential impact an eviction can have on your credit score. Here’s everything you need to know.

Table of contents

- What happens to your credit when you get evicted?

- How to avoid getting evicted

- Your legal rights with eviction

- How to find housing after an eviction

- Financial assistance for housing

What happens to your credit when you get evicted?

The answer can be complicated. Eviction does not show up on your credit report. However, being evicted from a rental property may still impact your credit depending on the reason it happens.

If you owe the property owner rent payments or other fees, the landlord can turn that debt over to a collection agency. The collection agency will almost certainly report any collection accounts to the credit bureaus, which may negatively impact your credit score.

On the other hand, if you don’t have outstanding rent or other financial responsibilities to your landlord, your eviction won’t make your credit score drop, because the eviction itself isn’t reported.

How evictions can affect your credit score

According to myFICO*, having an account reported to collections has a significant impact on your credit score.[1] Exactly how much of an effect it has may depend on the amount that’s reported to collections and the other information included in your credit report.

The three major credit reporting agencies (Experian, Equifax and TransUnion) no longer include an eviction judgment as a part of a consumer’s credit history. This change was made as part of the National Consumer Assistance Plan in 2015.[2]

The only public court records collected routinely by the credit reporting bureaus are bankruptcy reports.[3] If a civil judgment, such as one resulting from eviction, appears on your credit report, you can file a dispute with the credit reporting agencies to have it removed.

*FICO and myFICO are registered trademarks of the Fair Isaac Corporation in the United States and other countries.

How long before an eviction shows up on your credit report?

The eviction itself won’t appear on your credit report, but an unpaid debt related to an eviction can.[4] If you owe back rent and haven’t been evicted for it, it may not show up on your credit report at all: Many property owners and management companies don’t report rent payments to the credit bureaus.

If the debt is sold to collections, however, chances are the collections agency will report your debt to the credit bureaus, at which time it may appear on your credit reports.

How long does an eviction stay on your record?

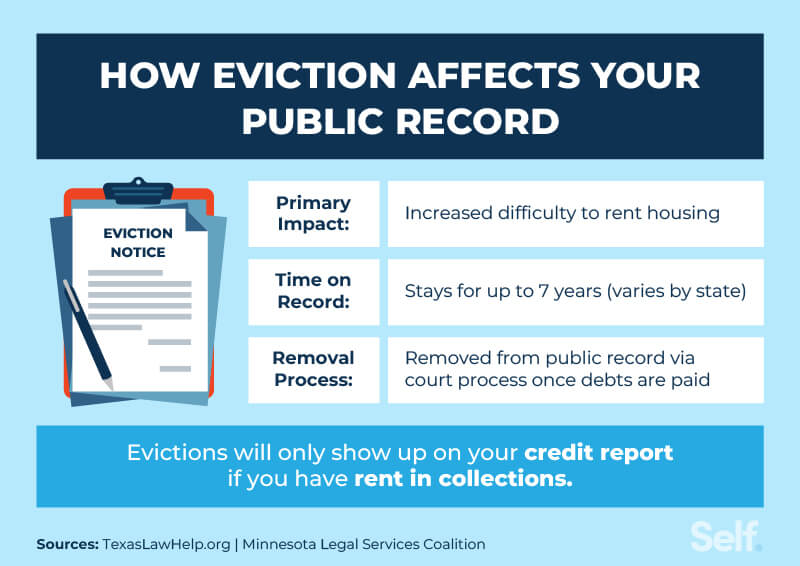

An eviction will stay on your public record for seven years, but it won’t show up on your credit report. However, delinquencies and debt associated with an eviction, if they’re reported to the credit bureaus, will remain part of your credit history for the same amount of time: seven years. This is the same amount of time many negative marks remain on your credit history.

How to get an eviction removed from your public record

You can go to court to get an eviction removed, or expunged, from your public record. This can occur if you prove that the landlord’s case against you was legally baseless or not supported by facts; that it’s in the interest of justice to expunge the case; and that that interest is greater than the public interest in knowing about the case.[5] This is known as a statutory expungement.

There are two other types of expungement: mandatory and inherent.

- With mandatory expungement, a judge is required to expunge your record if you can prove the property was under foreclosure, you were not evicted due to past due rent or other breach of contract (ie, lease violation), and you had either moved out before foreclosure began or during the foreclosure process.

- Under inherent expungement, your eviction can get expunged from your public record if you can prove to a judge your case is “necessary to the performance of a judicial function” or that benefits of expungement are “equal to or greater than” public interest or the court’s work to pursue the case.[5]

A court decision in a case such as this can affect your credit, too. If the eviction is baseless, your landlord may be relying on or supplying false information concerning what you owe in order to justify your eviction. If this is the case, and the information has been shared with credit bureaus, you can contact them and dispute it by providing them with copies of the expungement judgment.

How to avoid getting evicted

The easiest way to avoid eviction may be to resolve the situation as soon as you receive the first notice from the property owner.

In some cases you simply can’t afford to pay the full amount of rent due, even though you’d like to stay where you are. Here are some steps you can take to try to avoid eviction if you struggle with finances.

- Try to talk to your landlord about a payment plan: If you can’t make rent due to an unforeseen expense, talk to your landlord about whether they will accept a payment arrangement. They may be willing to work with you if you have a positive payment history.

- Consider rental assistance programs: Resources like the National Low Income Housing Coalition can help you find programs in your area.

- Consider getting a roommate: If you’re struggling to make payments, you may want to get a roommate to share the costs. It can be important to clear this with the landlord ahead of time, though, since there may be limits on the number of people allowed under your rental agreement or lease agreement; you may need to modify that agreement, if your landlord is willing to do so.

Your legal rights

If you are wrongfully evicted, you do have legal rights and protections. Each state has different laws when it comes to what constitutes a valid reason for eviction and how much notice a landlord must provide.[6] If your landlord fails to comply with these statutes, you may have grounds to fight an eviction.

Your rights with landlords and eviction notices

Many states require the landlord to send an eviction notice alerting the tenant of the issue that may trigger an eviction. Then the tenant has a short period of time before the eviction process is in full effect — typically anywhere from three days to one month — to resolve it. During this phase of the legal process, the tenant should seek legal advice if there’s an interest in challenging the eviction.

If the tenant can’t catch up on rent payments or otherwise fix the problem, the landlord files the eviction paperwork in housing court. The housing court then provides a hearing date to both the landlord and tenant.

At the eviction lawsuit hearing, the landlord and tenant can present their cases and provide supporting documentation, including the original lease, correspondence between the landlord and tenant, etc.

If the landlord wins the eviction lawsuit, the renter will receive a court order to move out. The deadline to move out varies by state but is usually anywhere from a couple of days to a few weeks.[7]

Federal and state eviction laws

In general, landlords aren’t allowed to carry out a de facto eviction by making a tenant’s living conditions unbearable. They also can’t simply change the locks. And they can’t evict a tenant as retaliation for complaints made against them.[8] While eviction laws vary from state to state, there are also federal laws landlords must follow. For instance, the Fair Housing Act bars landlords from discriminating based on disability, familial status, national origin, race or color, religion or sex.[9]

How to find housing after an eviction

Negative information, including evictions, remains on your tenant screening report for seven years. A tenant screening report draws personal information from your public record.[10] If eviction is unavoidable, you may have a tougher time finding a new place to live. But may not be not impossible.

Here are some options to consider:

- Make amends with your former landlord. If you owe unpaid rent to your former landlord and can pay it off, consider settling the debt. Ask if they would be willing to contact the tenant screening company to remove the eviction in exchange for payment.

- Ask previous landlords for a reference. References can be extremely valuable when trying to persuade a new property owner to rent to you.

- Be honest with potential landlords. Don’t try to hide your eviction record. Property owners may bemore likely to trust you if you are upfront with them about your situation.

- Look for property owners that don’t order tenant screening reports. Private property owners may be less likely to consult screening services or run full background checks than properties with professional management companies or property managers. There are also several suggestions for how to get an apartment with bad credit.

- Offer a larger deposit. A property owner might be willing to take a chance if you can put up a more substantial security deposit initially, even if you have past evictions or a less-than-perfect payment history.

- Work on rebuilding your credit. A property owner’s biggest concern may be collecting rental payments each month, so they may run a credit check before renting to you. A healthy credit score is one way to potentially ease their mind. There are many ways to try to achieve a good credit score, and Self’s services may be able to help.

Financial assistance for housing

If you’ve been evicted (or even if you haven’t been), you may not have to go looking for housing on your own. You can seek out financial or housing assistance from local, state and federal agencies, depending on your income.

Local Community Action Agencies

The U.S. Department of Health & Human Services provides Community Services Block Grants to community organizations that provide rental assistance and landlord intervention.

You can search for a Community Action Agency in your area at Community Action Partnership.[11]

State Housing Finance Agencies

Housing finance agencies offer individuals and families a wide range of housing support and assistance. The National Council of State Housing Agencies maintains a list of housing finance agencies by state.[12]

State Social Service Agencies

Check with your state social services agency for more information on state benefit programs that may be able to help with rent assistance and other benefits.

USA.gov allows visitors to search for social service agencies by state.[13]

Evictions won't directly hurt your credit

There can be plenty of reasons you might be evicted, but your credit may only be at risk if you’re evicted for nonpayment of rent. Even then, it may not affect your credit directly, because landlords aren’t lenders, and many don’t report rental payments to credit bureaus. The biggest risk to your credit will likely occur if a lender sells your debt to a collection agency, which may typically report your information to the credit bureaus.

If you think this has happened, you can check your credit score and order a free copy of your credit report to investigate. Then, if your credit has suffered, you can begin building better credit from there.

Evictions may not hurt your credit, but they can create other problems, such as landlords who may refuse to rent to you in the future. So it’s best to avoid eviction if at all possible.

Sources

- MyFICO. “Collections - How to Manage Them and What They Do to Your Credit,” https://www.myfico.com/credit-education/faq/negative-reasons/should-i-pay-my-collections. Accessed February 20, 2022.

- Consumer Financial Protection Bureau. “A new retrospective on the removal of public records,” https://www.consumerfinance.gov/about-us/blog/new-retrospective-on-removing-public-records/. Accessed June 6, 2022.

- Experian. “Public Records That Can Appear in Your Credit Report,” https://www.experian.com/blogs/ask-experian/public-records-that-appear-on-your-report/. Accessed June 6, 2022.

- Equifax. “How Does an Eviction Affect Your Credit Score?” https://www.equifax.com/personal/education/credit/score/impact-of-eviction-on-credit-score. Accessed June 6, 2022.

- Education for Justice. “Expunging an Eviction Case,” https://www.wadvocates.org/wp-content/uploads/2019/12/Expunging-Evictions-Fact-Sheet.pdf. Accessed February 20, 2022.

- Legal Services Corporation. “LSC Eviction Laws Database,” https://www.lsc.gov/initiatives/effect-state-local-laws-evictions/lsc-eviction-laws-database. Accessed February 20, 2022.

- NOLO. “How Evictions Work: What Renters Need to Know,” https://www.nolo.com/legal-encyclopedia/evictions-renters-tenants-rights-29824.html. Accessed June 6, 2022.

- The Law Dictionary. “Illegal Eviction – The Consequences & How to Avoid It,” https://thelawdictionary.org/article/illegal-eviction/. Accessed February 20, 2022.

- The United States Department of Justice. “The Fair Housing Act,” https://www.justice.gov/crt/fair-housing-act-1. Accessed February 20, 2022.

- Consumer Financial Protection Bureau. “How long can information, like eviction actions and lawsuits, stay on my tenant screening record?” https://www.consumerfinance.gov/ask-cfpb/how-long-can-information-like-eviction-actions-and-lawsuits-stay-on-my-tenant-screening-record-en-2104/. Accessed June 6, 2022.

- Community Action Partnership. “Find Your CAA,” https://communityactionpartnership.com/find-a-cap/. Accessed February 20, 2022.

- NCSHA. “Find a State Housing Finance Agency,” https://www.ncsha.org/. Accessed February 20, 2022.

- USA.gov. “State Social Service Agencies,” https://www.usa.gov/state-social-services. Accessed February 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).